Navigating your career path involves more than just finding the right role; it requires understanding the laws that govern your compensation and rights as a professional. One of the most critical concepts is your classification as an "exempt" or "non-exempt" employee. This classification, determined by both your job duties and your salary, dictates your eligibility for overtime pay.

In 2024, the U.S. Department of Labor (DOL) announced a significant new rule, drastically increasing the federal minimum salary threshold for exempt employees in 2024 and 2025. This change will impact millions of workers and the companies that employ them. Understanding these thresholds is essential for negotiating your salary, ensuring fair pay, and planning your financial future.

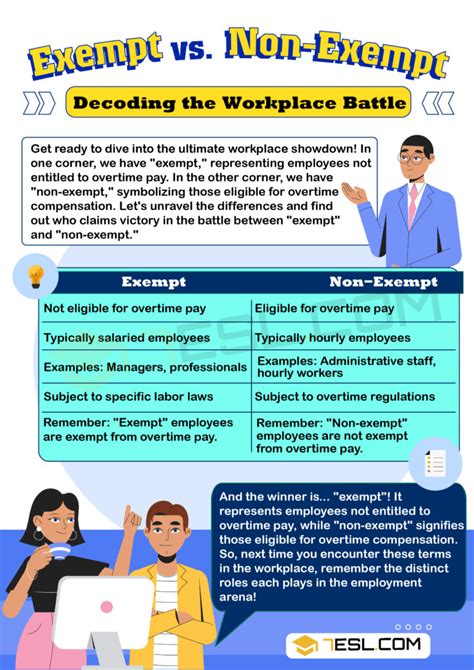

What Does "Exempt" vs. "Non-Exempt" Mean?

Before diving into the numbers, it's crucial to understand the terminology. The Fair Labor Standards Act (FLSA) is the federal law that establishes minimum wage, overtime pay, recordkeeping, and youth employment standards.

- Non-Exempt Employees: Are entitled to overtime pay (typically 1.5 times their regular rate of pay) for any hours worked over 40 in a workweek. Most paid-by-the-hour workers fall into this category.

- Exempt Employees: Are *not* entitled to overtime pay. To be classified as exempt, an employee must meet three tests:

1. Salary Basis Test: Be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. Salary Threshold Test: Earn a salary that meets a minimum specified amount. This is the primary focus of this article.

3. Duties Test: Primarily perform job duties that are considered executive, administrative, or professional (EAP) in nature.

Simply being paid a salary does not make an employee exempt. All three tests must be met. The new federal rule and various state laws are making the "Salary Threshold Test" a much higher bar to clear.

Average Exempt Salary Thresholds for 2025

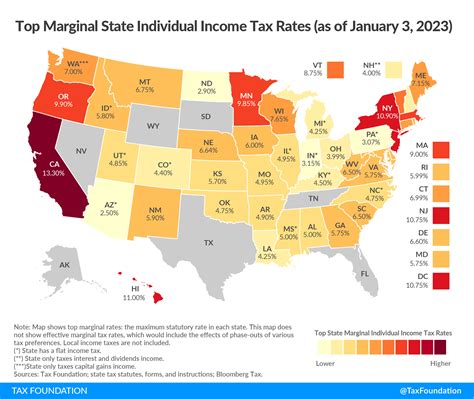

The exempt salary threshold is not a single, nationwide number. While there is a federal minimum, many states have enacted their own, higher thresholds to account for a higher cost of living. Employers must comply with whichever law—federal or state—provides greater protection to the employee.

### Federal Exempt Salary Threshold

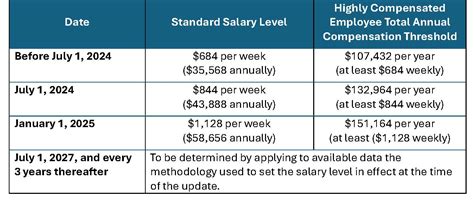

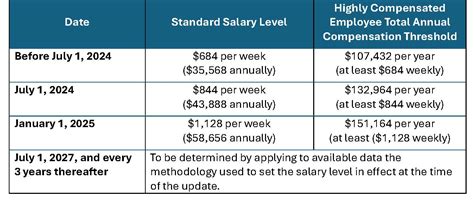

The U.S. Department of Labor's 2024 Final Rule established a two-step increase to the federal minimum salary for EAP-exempt employees:

- Effective July 1, 2024: The threshold increases to $844 per week (equivalent to an annual salary of $43,888).

- Effective January 1, 2025: The threshold increases again to $1,128 per week (equivalent to an annual salary of $58,656).

Additionally, the threshold for Highly Compensated Employees (HCE), who are subject to a more lenient duties test, also increases:

- Effective July 1, 2024: $132,964 per year.

- Effective January 1, 2025: $151,164 per year.

### State-Level Exempt Salary Thresholds for 2025

Several states have set their own salary thresholds that are already higher than the new federal level. The table below outlines the states with specific, higher thresholds for 2025. If a state is not listed, employers must adhere to the new federal threshold of $58,656 per year as of January 1, 2025.

| State | 2025 Minimum Salary for Exempt Status (Annual) | Weekly Amount | Notes & Sources |

| :--- | :--- | :--- | :--- |

| Federal | $58,656 | $1,128 | *(Source: U.S. Department of Labor)* |

| California | $66,560 | $1,280 | Based on 2x the state minimum wage of $16.00/hr. This rate is effective as of Jan 1, 2024, and applies for 2025 unless the minimum wage changes. *(Source: CA Dept. of Industrial Relations)* |

| New York | $65,000 (NYC, Long Island, Westchester)

$62,400 (Rest of State) | $1,250

$1,200 | These rates are scheduled for 2025, increasing to $67,600 and $64,480 in 2026. *(Source: NYS Department of Labor)* |

| Washington | ~$73,730 (Estimated) | ~$1,418 | The 2025 rate is 2x the state minimum wage. The exact 2025 wage will be announced in late 2024; this is an estimate based on inflation projections. The 2024 threshold is $67,724.80. *(Source: WA State Dept. of Labor & Industries)* |

| Alaska | $58,240 (Current) | $1,120 | Must be at least 2x the state's minimum wage. The current rate is below the new 2025 federal threshold, so the federal rate of $58,656 will apply. *(Source: Alaska Dept. of Labor)* |

| Colorado | $55,000 (Current) | $1,057.69 | The 2024 rate is $55,000. The 2025 rate will be announced in late 2024. If it is not higher than the new federal level, the federal rate of $58,656 will apply. *(Source: Colorado Dept. of Labor)* |

| Maine | $58,500 (Estimated) | ~$1,125 | Calculated at 3000x the state minimum wage, divided by 52. The 2025 rate is an estimate based on inflation. The federal rate of $58,656 will likely apply unless the state minimum wage increases significantly. *(Source: Maine Dept. of Labor)* |

*Disclaimer: The data above is based on currently available information and projections for 2025. State minimum wages and, consequently, salary thresholds, can change. Always consult official state Department of Labor websites for the most current figures.*

Key Factors That Influence Your Salary (Above the Threshold)

The exempt salary threshold is the legal *floor*, not the ceiling. Your actual earnings as a professional will be determined by several factors that reflect your value in the marketplace.

Geographic Location

Beyond the state-mandated thresholds, the cost of living and labor market competition in a specific metropolitan area heavily influence salaries. According to data from salary aggregators like [Salary.com](https://www.salary.com), an exempt-level Marketing Manager in San Francisco can expect to earn a market salary far exceeding one in a smaller midwestern city, even though both would be well above the legal threshold. Companies in high-cost-of-living areas must offer higher salaries to attract and retain talent.

Years of Experience

Experience is a primary driver of compensation. An entry-level professional who just meets the exempt criteria will earn a salary close to the legal threshold. However, a senior or principal-level professional with 10-15 years of experience will command a salary significantly higher. A senior software engineer, for example, is an exempt role, but their salary is dictated by market demand and expertise, not the legal minimum. Payscale data consistently shows a strong positive correlation between years of experience and salary across all exempt professions.

Level of Education

While a bachelor's degree is often a baseline for many exempt professional roles, advanced degrees like a Master's, MBA, or Ph.D. can significantly increase earning potential. For example, in fields like biotechnology or data science, a Ph.D. is often required for senior research roles, and the compensation reflects that high level of educational attainment, placing it far above the minimum exempt threshold.

Company Type and Industry

The company you work for plays a huge role. A large, multinational tech or finance corporation will generally have a much higher salary structure than a local non-profit or a small startup. According to Glassdoor reviews and salary reports, exempt roles in industries like investment banking, management consulting, and big tech consistently rank as the highest-paying.

Area of Specialization

Within any given field, specialization matters. An exempt-level HR professional specializing in high-demand areas like Compensation & Benefits or HRIS (Human Resources Information Systems) will typically earn more than a generalist. Likewise, an attorney specializing in patent law will command a higher salary than one in a less lucrative field. Your niche expertise directly translates to higher earning potential.

Job Outlook

The concept of an "exempt professional" isn't a single job, but a category that spans nearly every high-skilled industry, from healthcare to technology to management. The U.S. Bureau of Labor Statistics (BLS) projects strong growth for many of these roles.

For example, Management occupations are projected to grow 8 percent from 2022 to 2032, much faster than the average for all occupations, resulting in about 836,000 new jobs. Similarly, roles in Computer and Information Technology are projected to grow 15 percent. This robust growth indicates a strong and sustained demand for skilled, salaried professionals, which will continue to push market-rate salaries well above the legally mandated thresholds.

Conclusion

The landscape of professional compensation is undergoing a significant shift with the new federal and state exempt salary thresholds for 2025. For professionals and those aspiring to these roles, the key takeaways are:

- Know Your Rights: Understand the criteria for being "exempt" and ensure your employer is compliant. If your salary is below the new 2025 threshold for your state, you may be reclassified and become eligible for overtime.

- Aim Above the Floor: The exempt salary threshold is a legal minimum, not a target for your career. Use it as a baseline, but focus on building the skills, experience, and specializations that command a true market-rate salary.

- Negotiate with Data: When entering salary negotiations, be armed with data not only on the legal requirements but also on the market rates for your role, experience level, and geographic location.

- Stay Informed: These regulations are dynamic. The new federal rule includes a provision for automatic updates every three years, meaning these thresholds will continue to rise.

By understanding these legal foundations and the market factors that truly drive value, you can strategically navigate your career and ensure you are compensated fairly for your professional expertise.