Navigating the world of compensation can be complex. You may have heard the terms "exempt" and "non-exempt" but might be unsure what they mean for your paycheck and work-life balance. Understanding the "minimum salary for exempt" status is not about a specific job title; it's a critical legal classification that determines your eligibility for overtime pay.

For countless professional roles, from marketing managers to financial analysts, meeting the exempt salary threshold is a key part of the compensation structure. Understanding this threshold is crucial for negotiating your salary, knowing your rights, and charting your career path. This guide will break down exactly what it means to be an exempt employee and how it impacts your earnings potential.

What Does It Mean to Be an Exempt Employee?

In the United States, the Fair Labor Standards Act (FLSA) establishes rules for employee pay. The law categorizes employees into two main types: non-exempt and exempt.

- Non-Exempt Employees: These employees are entitled to overtime pay (typically 1.5 times their regular hourly rate) for any hours worked over 40 in a workweek.

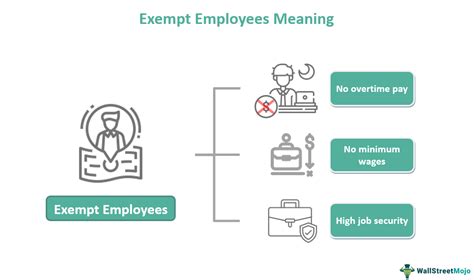

- Exempt Employees: These employees are "exempt" from overtime pay protections. Because of their job duties and level of pay, they receive a fixed salary regardless of whether they work 35 hours or 55 hours in a given week.

To be classified as exempt, an employee must meet three specific tests set by the U.S. Department of Labor (DOL):

1. The Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

2. The Salary Level Test: The employee must be paid a salary that meets a minimum specified amount. This is the core "minimum salary for exempt" threshold.

3. The Duties Test: The employee’s primary job duties must involve executive, administrative, or professional (EAP) tasks. There are also specific exemptions for outside sales employees, computer professionals, and highly compensated employees.

Essentially, being an "exempt" employee means your role is typically salaried, involves a high level of responsibility or specialized knowledge, and pays above a certain government-mandated floor.

The Minimum Salary Threshold for Exempt Employees

The salary level test is the most straightforward factor. If you don't meet this minimum salary, you generally cannot be classified as exempt, even if your job duties are professional or administrative.

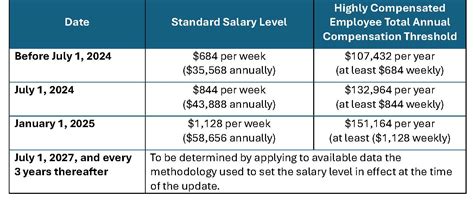

As of the latest federal guidelines, the standard minimum salary threshold for the executive, administrative, and professional exemptions is $684 per week, which translates to $35,568 per year.

Source: U.S. Department of Labor, "Fact Sheet #17A: Exemption for Executive, Administrative, Professional, Computer & Outside Sales Employees Under the Fair Labor Standards Act (FLSA)."

It's crucial to note that this is the *federal minimum*. Many states have their own, often higher, salary thresholds. For example:

- California: As of 2024, the minimum salary for exempt employees is $66,560 per year, which is double the state's minimum wage for a full-time employee.

- New York: The 2024 exempt salary minimum varies by location, reaching as high as $1,200 per week ($62,400 per year) in New York City, Westchester, and Long Island.

- Washington: The state has a phased-in approach, with the 2024 threshold set at twice the state minimum wage, amounting to approximately $67,724.80 per year.

Important Note: The Department of Labor has proposed a new rule to significantly increase the federal exempt salary threshold in 2024. Professionals should stay informed, as these regulations are subject to change.

Key Factors That Influence Your Salary in an Exempt Role

While the FLSA sets the absolute minimum salary for an exempt classification, the actual salary you can earn in an exempt position is influenced by many factors. These roles often have high earning potential, and the federal minimum is merely a floor, not a target.

###

Level of Education

The "duties test" often correlates with advanced education. The "learned professional" exemption applies to roles requiring knowledge acquired through prolonged, specialized intellectual instruction (e.g., doctors, lawyers, accountants, engineers). A higher degree, like a Master's, MBA, or Ph.D., not only qualifies you for these exempt roles but also significantly boosts your earning potential. For example, a Financial Analyst with a bachelor's degree might earn an average of $72,000, while one with an MBA could command a salary closer to $95,000 or more, according to data from Payscale.

###

Years of Experience

Experience is a primary driver of salary growth in exempt positions. An entry-level exempt role like an HR Generalist might start near $60,000. However, after 5-10 years of experience and a promotion to HR Manager, that salary can easily surpass six figures. According to Salary.com, the median salary for an HR Manager in the United States is approximately $122,000, with senior managers earning upwards of $150,000. Your career progression from a junior to a senior-level exempt employee is where you will see the most substantial salary increases.

###

Geographic Location

As shown by the state-level minimums, location is a critical factor. Salaries for exempt roles are significantly higher in major metropolitan areas with a high cost of living, such as San Francisco, New York City, and Boston. An IT Project Manager in Des Moines, Iowa, might earn an average salary of $105,000, while the same role in San Francisco could command an average of $145,000 or more, as reported by Glassdoor. Always research the local market rate for your profession, not just the national average.

###

Company Type and Industry

The company you work for plays a huge role. A large, multinational tech or finance corporation will typically offer much higher salaries and more robust benefits packages than a small non-profit or a local startup. For instance, a Marketing Manager at a Fortune 500 company will almost certainly earn more than one at a small community organization. Lucrative industries like technology, pharmaceuticals, and financial services consistently pay higher salaries for exempt professional roles compared to retail or education.

###

Area of Specialization

Within any given professional field, specialization drives value. A general Accountant may earn a solid exempt salary, but an accountant specializing in forensic accounting or international tax law can command a much higher premium. Similarly, a Software Developer is an exempt role, but one specializing in high-demand fields like Artificial Intelligence or Cybersecurity can expect a salary well into the upper six figures. The more specialized and in-demand your skills are, the greater your leverage for a higher salary.

Job Outlook for Exempt Professions

Because "exempt" is a classification, not a single job, its outlook is tied to the growth of professional, administrative, and executive roles as a whole. The U.S. Bureau of Labor Statistics (BLS) projects strong growth for many careers that are typically classified as exempt.

For example, the BLS projects that Management Occupations will grow by 8% from 2022 to 2032, much faster than the average for all occupations, adding about 882,000 new jobs. Similarly, Computer and Information Technology Occupations are projected to grow by 15%, reflecting the high demand for skilled tech professionals.

This data suggests that the demand for skilled, salaried professionals who qualify for exempt status is robust and expected to continue growing, offering strong career stability and opportunities for advancement.

Conclusion: Key Takeaways for Your Career

Understanding the "minimum salary for exempt" is less about a single number and more about understanding your rights and value as a professional.

Here are the key takeaways:

1. Know Your Classification: Determine if you are correctly classified as exempt by looking at your salary (meeting the federal and your state's minimum) and your job duties (executive, administrative, or professional).

2. The Threshold is a Floor, Not a Ceiling: The legal minimum salary is just the starting point. Your actual salary should be determined by your experience, education, location, and the value you bring to your employer.

3. Use It for Negotiation: If a job offer for a professional role is near the federal or state minimum, use the data on industry and location averages from sites like the BLS, Salary.com, and Glassdoor to negotiate for a more competitive rate.

4. Stay Informed: Regulations around exempt status and salary thresholds can change. Keeping up-to-date on federal and state labor laws empowers you to advocate for yourself throughout your career.

By understanding these principles, you can better navigate job offers, ensure you are being paid fairly, and strategically plan your professional growth for maximum earning potential.