Reaching the level of Partner at a prestigious "Big Four" accounting firm like Ernst & Young (EY) represents a pinnacle of achievement in the world of finance, accounting, and consulting. It's a role associated with strategic leadership, immense responsibility, and, consequently, significant financial reward. While the path is demanding, the compensation can be extraordinary, often reaching well into the six-figure, and frequently seven-figure, territory.

This article provides a data-driven analysis of what an EY Partner earns, the factors that influence their compensation, and the career outlook for professionals aspiring to this elite position.

What Does an EY Partner Do?

An EY Partner is far more than a senior accountant or consultant; they are a co-owner of the firm. Their responsibilities shift from direct project execution to high-level strategy, business development, and firm leadership.

Key responsibilities include:

- Strategic Leadership: Setting the direction for their practice area, service line, or geographic region.

- Business Development: Sourcing and winning new clients, which is a primary driver of their value to the firm.

- Client Relationship Management: Acting as the ultimate point of contact and trusted advisor for the firm's most important clients.

- Quality and Risk Management: Holding final accountability for the quality of work and managing the inherent risks on client engagements.

- Mentorship and People Development: Leading and mentoring teams of managers, seniors, and staff, and identifying future leaders within the firm.

In essence, a Partner operates as a business owner within the larger EY network, responsible for generating revenue, managing profitability, and upholding the firm's brand and reputation.

Average EY Partner Salary

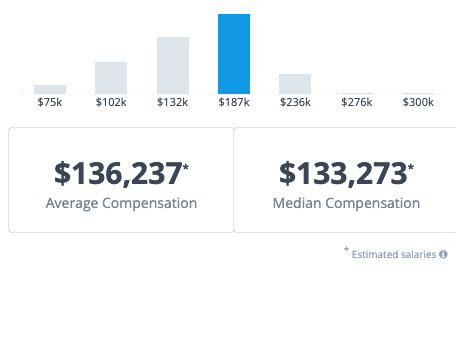

Determining a single "average" salary for an EY Partner is complex because their compensation is multifaceted. It's crucial to distinguish between a base salary and total compensation, which includes profit sharing and bonuses.

- Base Salary: The fixed portion of a Partner's income. This component is substantial but represents only a part of their total earnings.

- Total Compensation: This is the more accurate measure of a Partner's income. It includes the base salary plus a significant variable component tied to the firm's overall profitability, the performance of their specific service line, and their individual contributions to business development.

According to data from salary aggregator Glassdoor, the estimated total pay for a Partner at EY in the United States ranges from $502,000 to over $1,100,000 per year, with an estimated average total pay of around $655,000. It's widely reported in the industry that senior equity partners in high-performing service lines can earn significantly more, often exceeding $2 million to $3 million annually.

These figures are a reflection of the immense value and revenue that Partners are expected to generate for the firm.

Key Factors That Influence Salary

A Partner's compensation is not a flat figure. It's influenced by a combination of performance-based, geographic, and role-specific factors.

### Years of Experience

Experience plays a pivotal role in two ways. First is the long journey *to* partnership, which typically takes 12 to 18 years of high performance. Second, once an individual makes Partner, their seniority continues to affect their earnings.

A first-year Partner will earn on the lower end of the partnership compensation scale. A seasoned Partner with a decade of experience in the role, a strong book of business, and significant leadership responsibilities within the firm will command a much higher share of the firm's profits.

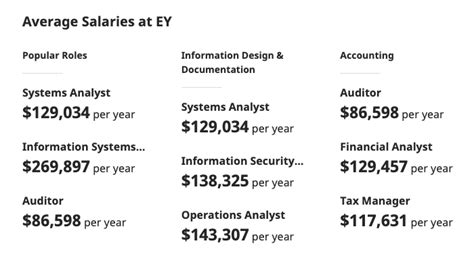

### Area of Specialization

The service line in which a Partner operates is one of the most significant drivers of compensation. While all are lucrative, some are tied to higher-margin services.

- Consulting and Strategy: Partners in technology, strategy, and management consulting often have the highest earning potential. Their work is tied to high-stakes corporate transformations and advisory services that command premium fees.

- Strategy and Transactions (SaT): Formerly known as Transaction Advisory Services (TAS), these partners advise on mergers, acquisitions, and divestitures. Their compensation is often linked to the success and size of these large-scale deals, leading to very high potential earnings.

- Tax: Partners in specialized areas of tax, such as international tax or M&A tax, can be extremely well-compensated for their highly technical and valuable expertise.

- Assurance (Audit): While auditing is the bedrock of the firm, it is often a lower-margin business compared to consulting. As a result, assurance partners, while earning exceptional incomes, may be on the lower end of the overall partner compensation spectrum.

### Geographic Location

As with any profession, location matters. Partners working in major financial hubs with a higher cost of living and a greater concentration of Fortune 500 clients will earn more than those in smaller, regional offices. According to Salary.com, professionals in financial services can expect to earn significantly more in cities like New York, San Francisco, and Boston compared to national averages. An EY Partner in New York City will almost certainly have a higher compensation target than a Partner in Omaha, Nebraska.

### The "Big Four" Factor (Company Type)

While this article focuses on EY, it's important to understand *why* their partner compensation is so high. EY is one of the "Big Four" global professional services firms. The scale, brand recognition, and breadth of clients these firms attract allow them to generate massive revenues that smaller national or regional firms simply cannot match. This financial strength directly translates into higher compensation potential for their partners compared to partners at mid-tier or boutique firms.

### Level of Education

By the time a professional reaches the Partner level, their educational background is foundational. A Bachelor's degree in Accounting, Finance, Economics, or a related field is a minimum requirement. More importantly, professional certifications are virtually mandatory.

- CPA (Certified Public Accountant): Essential for partners in the Assurance and Tax service lines.

- MBA, CFA, or other certifications: Can be highly valuable, particularly for those in the Consulting and Strategy and Transactions service lines.

While a specific degree doesn't add a direct dollar amount, these qualifications are the gatekeepers to the career path that ultimately leads to partnership.

Job Outlook

There is no specific U.S. Bureau of Labor Statistics (BLS) category for "EY Partner." However, we can look at the outlook for the professions that feed into this role to understand the health of the industry.

- Accountants and Auditors: The BLS projects a 4% growth for this profession from 2022 to 2032, which is about as fast as the average for all occupations. This indicates stable, consistent demand for core accounting services.

- Management Analysts (Consultants): The outlook here is even stronger, with the BLS projecting a 10% growth from 2022 to 2032, much faster than the average. This reflects the growing need for companies to improve efficiency and navigate complex business challenges.

While the underlying industry is healthy, the path to Partner is exceptionally competitive. The structure of firms like EY is a pyramid, with thousands of junior staff at the bottom and a very small number of partners at the top. The "up-or-out" promotion culture means that only a tiny fraction of those who start their careers at EY will ever reach the Partner level.

Conclusion

Becoming a Partner at EY is the culmination of a long, challenging, and highly competitive career journey. It is a role reserved for top performers who demonstrate not only technical mastery but also exceptional leadership, business acumen, and salesmanship.

The financial rewards reflect this exclusivity and responsibility. With total compensation packages regularly ranging from $500,000 to well over $1,000,000 annually, it stands as one of the most lucrative positions in the professional services industry. For ambitious students and professionals in finance and accounting, the role of an EY Partner represents a powerful and inspiring career goal—a testament to what dedication, expertise, and strategic leadership can achieve.