---

Are you analytically minded, fascinated by technology, and driven to make a tangible impact on a national scale? Do you envision a career where you're not just a cog in the machine, but a trusted advisor safeguarding the very systems that power our government? If so, the role of a Federal Technology Assurance Associate at a prestigious firm like KPMG might be your ideal launching point. This career path offers a potent combination of high-stakes problem-solving, rapid professional growth, and a compensation package that reflects the critical nature of the work. For those just starting, the federal technology assurance associate kpmg salary typically ranges from $75,000 to $95,000 in base pay, with significant additional earning potential through bonuses and benefits.

This isn't just another IT job. It's a role that places you at the nexus of technology, security, and public trust. I remember early in my advisory career, working with a team auditing the IT controls of a federal agency responsible for distributing billions in public aid. It wasn't about finding fault; it was about ensuring the technology was robust enough to prevent fraud and guarantee that resources reached the citizens who desperately needed them. That experience solidified for me the profound responsibility and purpose embedded in this profession.

This comprehensive guide is designed to be your definitive resource, whether you're a college student charting your future or a professional considering a pivot. We will dissect the role, demystify the salary structures, explore the career trajectory, and provide a step-by-step plan to help you land this coveted position.

### Table of Contents

- [What Does a Federal Technology Assurance Associate at KPMG Do?](#what-does-a-federal-technology-assurance-associate-at-kpmg-do)

- [Average Federal Technology Assurance Associate KPMG Salary: A Deep Dive](#average-federal-technology-assurance-associate-kpmg-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Federal Technology Assurance Associate at KPMG Do?

At its core, a Federal Technology Assurance Associate at KPMG acts as a professional skeptic and a trusted advisor for technology risk. They don't build the systems, but they ensure the systems that are built are secure, reliable, and compliant with a labyrinth of federal regulations. The "Assurance" part of the title is key—it’s about providing confidence and peace of mind to government agency leaders, inspectors general, and ultimately, the American public, that critical technology and data are properly managed and protected.

The "Federal" distinction is crucial. Unlike their commercial counterparts who might focus on Sarbanes-Oxley (SOX) compliance for public companies, federal associates operate in a unique and high-stakes environment. Their work is governed by specific frameworks like the Federal Information Security Modernization Act (FISMA), standards from the National Institute of Standards and Technology (NIST) (such as the NIST Cybersecurity Framework and the Risk Management Framework - RMF), and various directives from the Office of Management and Budget (OMB).

Their primary responsibility is to perform IT audits and assessments. This involves evaluating the design and operating effectiveness of IT General Controls (ITGCs). These are the foundational controls of an IT environment that cover critical areas such as:

- Access Control: Who can access what systems and data? How are user accounts provisioned, reviewed, and terminated?

- Change Management: How are changes to applications and infrastructure requested, tested, and deployed to prevent system outages or security flaws?

- IT Operations: Are there proper procedures for data backups, disaster recovery, and problem management to ensure system availability and integrity?

- Program Development: How are new systems developed and secured before they go live?

Typical Daily Tasks and Projects:

An associate's work is project-based, typically as part of a larger team led by a senior associate and manager. Their days are a blend of analytical and client-facing activities:

- Evidence Gathering: Requesting and collecting evidence from clients, such as system configurations, user access listings, change management tickets, and policy documents.

- Control Testing (Walkthroughs and Samples): Performing "walkthroughs" to understand a process from end-to-end and testing a sample of transactions (e.g., reviewing 25 user terminations to ensure they were all done in a timely manner).

- Documentation: Meticulously documenting the testing procedures, results, and conclusions in KPMG's workpaper software. This documentation is the bedrock of the audit opinion.

- Client Interviews: Meeting with system administrators, developers, and agency managers to understand their processes and controls.

- Team Meetings: Participating in daily or weekly team syncs to discuss progress, roadblocks, and findings.

- Reporting: Assisting in drafting sections of the final report that details the findings, potential risks, and recommendations for improvement.

### A "Day in the Life" Example

- 8:30 AM: Arrive at the client site (a federal agency in Washington D.C.) or log in from home. Check emails and review the plan for the day with your senior associate.

- 9:00 AM: Team sync-up meeting. The manager outlines the week's goals and assigns specific controls for you to test. Today, you're focused on logical access controls for a critical financial system.

- 9:30 AM - 12:00 PM: You begin your testing. You use the evidence provided by the client—a list of all users with administrative privileges—and compare it against approved access request forms. You document each step, taking screenshots and noting any discrepancies.

- 12:00 PM - 1:00 PM: Lunch with the project team. This is a great time to build relationships and informally discuss work challenges.

- 1:00 PM - 2:30 PM: You have a scheduled interview with the client's database administrator to walk through the process for granting new user access. You ask prepared questions, listen carefully, and take detailed notes.

- 2:30 PM - 4:30 PM: You return to your desk to formalize your notes from the interview and complete the documentation for the controls you tested in the morning. You identify a potential finding: one administrative account was not terminated within 24 hours of the employee's departure. You flag this for your senior.

- 4:30 PM - 5:00 PM: You sync with your senior to discuss the potential finding. They provide guidance on how to validate it and document it appropriately as a potential exception.

- 5:00 PM - 5:30 PM: You update your workpapers with the senior's feedback and create a to-do list for the next day before logging off.

This structured, methodical work is the foundation of trust in government technology. It's a role that requires immense attention to detail, strong communication skills, and an unwavering commitment to integrity.

---

Average Federal Technology Assurance Associate KPMG Salary: A Deep Dive

Compensation is a significant factor when considering any career path, and the role of a Federal Technology Assurance Associate at KPMG offers a competitive and multi-layered package right from the start. It’s important to look beyond just the base salary and understand the full value proposition, which includes bonuses, benefits, and long-term earning potential.

### Starting Salary for a Federal Technology Assurance Associate at KPMG

For an entry-level associate, typically a new graduate or someone with 0-2 years of experience, the compensation is robust. Based on recent data compiled from various authoritative sources, the salary landscape is as follows:

- Base Salary Range: According to data from Glassdoor and Levels.fyi, the typical base salary for a KPMG Federal Technology Assurance Associate in a major market like Washington D.C. falls between $75,000 and $95,000 per year as of early 2024. This range can fluctuate based on specific location, the candidate's academic background, and any prior internship experience.

- Signing Bonus: It is common practice for Big Four firms like KPMG to offer a signing bonus to new campus hires to make their offers more competitive. These one-time bonuses can range from $2,000 to $10,000, with larger amounts often reserved for candidates with advanced degrees or in high-demand locations.

Therefore, a new associate's first-year total cash compensation could easily approach or exceed $100,000.

### Salary Progression Through the Ranks

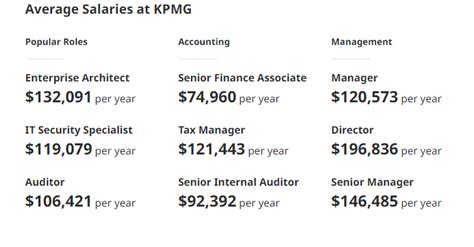

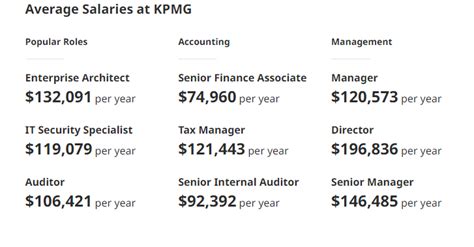

One of the most attractive aspects of a career at KPMG is the clear and relatively rapid career progression. With each promotion comes a significant increase in responsibility and, consequently, compensation.

Here is a typical salary trajectory within the Technology Assurance practice, citing data trends from Payscale, Salary.com, and industry knowledge for IT Audit and Risk Advisory roles.

| Title | Years of Experience | Typical Base Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Associate | 0 - 2 Years | $75,000 - $100,000 | Performing detailed testing, evidence gathering, documenting workpapers. |

| Senior Associate | 2 - 5 Years | $100,000 - $140,000 | Leading small teams, reviewing associate work, direct client interaction, managing project sections. |

| Manager | 5 - 8 Years | $140,000 - $185,000 | Managing multiple projects, client relationships, staff development, budgeting, business development. |

| Senior Manager | 8 - 12 Years | $185,000 - $250,000+ | Overseeing a portfolio of clients, significant business development, practice leadership, thought leadership. |

| Partner/Managing Director| 12+ Years | $400,000 - $1,000,000+ | Ultimate responsibility for practice growth, profitability, and client relationships. |

*Disclaimer: These are estimates based on publicly available data and industry trends, primarily for HCOL areas like Washington D.C. Actual salaries can vary.*

### A Comprehensive Look at the Compensation Package

The base salary is just one piece of the puzzle. KPMG offers a "Total Rewards" package that significantly enhances the overall value of employment.

- Performance Bonus: After the first year, associates are eligible for an annual performance-based bonus. This is typically a percentage of the base salary (e.g., 5-15%) and is tied to individual performance, engagement success, and the overall firm's profitability.

- Retirement Benefits: KPMG offers a 401(k) plan with a generous company match. Uniquely among many professional services firms, KPMG also offers a pension plan, a defined benefit plan that provides a monthly income stream in retirement based on salary and years of service. This is a powerful and increasingly rare wealth-building tool.

- Health and Wellness: Comprehensive medical, dental, and vision insurance plans are standard. KPMG also invests heavily in wellness programs, including mental health support (e.g., free counseling sessions), fitness subsidies, and flexible work arrangements.

- Paid Time Off (PTO): The firm offers a generous PTO package, which typically increases with tenure, along with a significant number of firm-wide holidays, including a paid week off between Christmas and New Year's.

- Professional Development and Certifications: This is a major financial benefit. KPMG actively encourages and pays for employees to obtain prestigious professional certifications like the Certified Information Systems Auditor (CISA) and Certified Public Accountant (CPA). They cover the costs of study materials (e.g., Becker or Gleim), exam fees, and even provide a cash bonus (often $3,000 - $5,000) upon successful completion. This represents a significant investment in your long-term career value.

- Other Perks: Depending on the office and current policies, other perks can include cell phone reimbursement, commuter benefits, and discounted services.

When you sum up the base salary, potential bonuses, the firm's contribution to your 401(k) and pension, and the monetary value of benefits and professional development, the total compensation package for a Federal Technology Assurance Associate is exceptionally competitive and designed to attract and retain top talent.

---

Key Factors That Influence Salary

While the figures above provide a solid baseline, the exact salary you can command as a Federal Technology Assurance Associate is not static. It is influenced by a dynamic interplay of several key factors. Understanding these levers is crucial for maximizing your earning potential throughout your career. This section provides an exhaustive breakdown of what drives compensation in this field.

### ### Level of Education

Your educational background serves as the entry ticket and can provide an initial salary boost.

- Bachelor's Degree (The Standard): A bachelor's degree is the minimum requirement. The most sought-after majors are Information Systems (or Management Information Systems - MIS), Accounting, Computer Science, and Cybersecurity. A dual major, such as Accounting and Information Systems, is particularly powerful as it directly aligns with the financial and technological aspects of the role. A candidate with a relevant degree from a top-tier, target university may receive an offer at the higher end of the entry-level salary band.

- Master's Degree (The Accelerator): Pursuing a master's degree can provide a distinct advantage.

- Master of Accountancy (MAcc or MAccy) with an IT/Data Analytics focus: This is a popular path, especially for those aiming for the CPA license, as it helps meet the 150-credit-hour requirement.

- Master of Science in Information Systems (MSIS) or Cybersecurity: These specialized degrees signal deep technical expertise.

A candidate entering with a relevant master's degree can often expect a starting base salary that is $5,000 to $15,000 higher than a candidate with only a bachelor's degree. They may also be offered a larger signing bonus and potentially be on a faster track for early promotion.

### ### Years and Quality of Experience

Experience is, without a doubt, the most significant driver of salary growth in this career. The progression is steep, with compensation rising sharply in the first 5-8 years.

- Entry-Level (0-2 Years): At this stage (Associate), you are learning the fundamentals of auditing, control testing, and client interaction. Your value is in your ability to learn quickly and execute tasks accurately under supervision. The salary range is typically $75k - $100k.

- Mid-Career (2-5 Years): As a Senior Associate, you are no longer just an executor. You begin to manage small teams of associates, review their work, take ownership of significant portions of an engagement, and serve as a primary day-to-day contact for the client. This leap in responsibility is met with a substantial salary increase, moving into the $100k - $140k range. Your experience in specific industries or with complex systems starts to build your market value.

- Experienced (5-10 Years): As a Manager and then Senior Manager, your role shifts dramatically from "doing" to "managing and selling." You are responsible for project profitability, client relationships, staff development, and contributing to business development proposals. Your deep technical and industry expertise is now a strategic asset. Salaries at this level jump to $140k - $250k+, supplemented by much larger performance bonuses tied to managed revenue and practice growth.

- Expert/Leadership (10+ Years): At the Partner/Managing Director level, compensation is a different equation entirely, often tied directly to the revenue you generate and manage for the firm. Total compensation can soar well into the high six or even seven figures.

The *quality* of experience matters as much as the quantity. Experience on high-profile, complex federal engagements (e.g., at the Department of Defense or a major civilian agency) is more valuable than experience on smaller, less complex audits.

### ### Geographic Location

Where you work has a massive impact on your paycheck, primarily driven by cost of living and market demand. For the *Federal* practice, one location stands above all others.

- Tier 1 / High Cost of Living (HCOL): Washington, D.C. Metro Area (including Northern Virginia and Maryland): This is the undisputed epicenter of the federal government and, therefore, KPMG's Federal Practice. The highest concentration of clients, projects, and talent is here. Consequently, this region offers the highest salaries to attract and retain professionals. The salary ranges discussed throughout this article are most accurate for this specific market.

- Tier 2 / Other Major Federal Hubs: Cities with a significant federal presence, such as San Antonio, TX (military), Huntsville, AL (NASA/military), Denver, CO, and St. Louis, MO, will also offer competitive salaries, though they may be slightly lower (perhaps 5-10% less) than the D.C. market to adjust for a lower cost of living.

- Tier 3 / Lower Cost of Living (LCOL): In areas with a minimal federal footprint, the opportunities and salaries for this specific role will be much lower and less frequent. A role in a LCOL city might pay 15-25% less than the same role in Washington, D.C. However, the purchasing power of that salary might be comparable or even greater.

KPMG, like other major firms, uses geographic pay differentials to standardize compensation based on location. Always research the cost of living in conjunction with the salary offered.

### ### Company Type & Size

While this article focuses on KPMG, understanding the broader market provides context for your career choices.

- Big Four (KPMG, Deloitte, PwC, EY): These firms are the market leaders. They land the largest and most complex federal contracts, offer the most structured training and career progression, and generally pay at the top of the market for audit and advisory talent. The trade-off is often a demanding work environment with long hours, especially during busy seasons.

- Mid-Tier Firms (e.g., Grant Thornton, BDO, RSM): These firms also have robust federal practices and offer similar services. Their compensation is very competitive, sometimes matching the Big Four for top talent, but may be slightly lower on average. The perceived benefit can be a better work-life balance and a more intimate firm culture.

- Boutique Consulting Firms: Smaller, specialized firms that focus on a specific niche (e.g., cybersecurity for the intelligence community) can offer very high salaries for individuals with specific, in-demand expertise. However, career paths may be less structured.

- Direct Government Employment (e.g., Government Accountability Office - GAO, Agency Inspectors General - OIG): Working directly for a federal agency as an IT Auditor (e.g., a GS-12 or GS-13 on the General Schedule pay scale) offers unparalleled job security and work-life balance. While the base salary may initially be lower than at KPMG, the federal benefits package, including a pension and generous leave, is excellent. The salary ceiling is generally lower than in the private sector's executive ranks.

### ### Area of Specialization

Within the broad field of Technology Assurance, developing a deep specialization is a powerful way to accelerate your career and salary. Generalists are valuable, but specialists are rare and command a premium.

- Cybersecurity & Privacy: This is arguably the hottest specialization. Associates who build skills in vulnerability assessments, penetration testing frameworks, FedRAMP (for cloud security), and privacy regulations (like the Privacy Act) are in extremely high demand and can command higher salaries.

- Cloud Assurance (AWS, Azure, GCP): As federal agencies aggressively migrate to the cloud, auditors who deeply understand cloud-native security controls, identity and access management (IAM) in the cloud, and container security are indispensable.

- Data Analytics & Forensic Technology: Associates who can use tools like Alteryx, Power BI, or even Python to analyze large datasets for anomalies, fraud, or control weaknesses bring a quantitative edge to audits. This skill set is highly valued and can lead to higher pay and more interesting projects.

- Enterprise Resource Planning (ERP) Systems (e.g., SAP, Oracle): Federal agencies run on massive, complex ERP systems. Specialists who understand the intricate security and control configurations within these systems are critical for financial statement audits and are compensated accordingly.

### ### In-Demand Skills

Beyond broad specializations, specific, demonstrable skills on your resume will make you a more attractive candidate and give you leverage in salary negotiations.

- Technical/Hard Skills:

- Regulatory Framework Mastery: Deep knowledge of NIST SP 800-53, FISMA, and the Risk Management Framework (RMF) is non-negotiable for federal work.

- Cloud Security Certifications: Holding an AWS Certified Security – Specialty or Microsoft Certified: Azure Security Engineer Associate is a huge differentiator.

- Data Analysis Tools: Proficiency in Alteryx, Tableau, Power BI, or SQL.

- Scripting: Basic knowledge of Python or PowerShell for automating simple data analysis or evidence-gathering tasks.

- GRC Tools: Experience with Governance, Risk, and Compliance (GRC) software like Archer or ServiceNow.

- Professional/Soft Skills:

- Client Presence and Communication: The ability to clearly and confidently interview senior clients, explain complex technical issues in simple terms, and build rapport is paramount.

- Project Management: Even at the associate level, demonstrating strong organizational skills, time management, and the ability to track your work against a budget is key.

- Critical Thinking and Professional Skepticism: The core of auditing. The ability to look at a process and ask "What could go wrong here?" is the most valuable skill you can possess.

- Report Writing: The ability to write clearly, concisely, and persuasively is essential for creating reports that drive action.

By strategically developing these skills and specializations, you can actively steer your career towards higher-impact roles and, in turn, a more lucrative salary.

---

Job Outlook and Career Growth

Choosing a career is an investment, and the return on that investment depends heavily on future demand. For those pursuing a path in Federal Technology Assurance, the long-term outlook is exceptionally bright and stable, driven by powerful, non-cyclical trends. This field is not just growing; it's becoming more integral to the function of government every year.

### A Profession at a High-Growth Intersection

The role of a Technology Assurance Associate sits at the crossroads of two professional fields with strong growth projections, according to the U.S. Bureau of Labor Statistics (BLS):

1. Information Security Analysts: The BLS Occupational Outlook Handbook projects that employment for Information Security Analysts will grow by a staggering 32 percent from 2022 to 2032. This is described as "much faster than the average for all occupations." The BLS attributes this explosive growth to the increasing frequency and sophistication of cyberattacks. Federal Technology Assurance is a direct response to this threat, focused on building defensive and compliant systems.

2. Accountants and Auditors: The BLS projects a 4 percent growth rate for Accountants and Auditors over the same period, which is about as fast as the average. While the overall growth is more modest, the demand for auditors with specialized IT skills is growing at a much faster pace than the headline number suggests. The financial integrity of every federal agency now depends on the security of its underlying IT systems, making IT auditors essential to the financial statement audit process.

By combining the cybersecurity focus with the auditor's mandate, the Federal Technology Assurance profession captures the high growth of the former and the stability of the latter, creating a powerful career proposition.

### Key Trends Driving Future Demand

The strong job outlook is not based on speculation. It is fueled by several undeniable, long-term trends:

- Persistent and Evolving Cyber Threats: Malicious actors, including nation-states, are constantly targeting U