A career as a Finance Director is not only strategically vital to an organization's success but also one of the most financially rewarding paths in the business world. Tasked with overseeing the financial health and long-term strategy of a company, these leaders command impressive compensation packages. But what does a Finance Director salary actually look like?

The answer is complex, with salaries often ranging from a solid $120,000 to well over $250,000 annually, depending on a host of factors. In this comprehensive guide, we will break down the numbers, explore the key variables that influence your earning potential, and provide a clear outlook on this demanding yet lucrative career.

What Does a Finance Director Do?

Before diving into the numbers, it's essential to understand the role. A Finance Director is a senior-level executive who acts as the financial steward of an organization. They are less focused on the day-to-day accounting (the job of a Controller) and more on high-level strategy and long-term planning.

Key responsibilities typically include:

- Developing and implementing financial strategies, plans, and goals.

- Overseeing budgeting, forecasting, and financial reporting.

- Leading and mentoring the finance and accounting teams.

- Analyzing financial data to provide strategic recommendations to the CFO and executive team.

- Managing cash flow, investments, and risk management.

- Ensuring compliance with all legal and regulatory requirements.

- Often playing a key role in fundraising, mergers, and acquisitions (M&A).

In short, a Finance Director combines financial acumen with leadership and strategic foresight to guide a company toward sustainable growth.

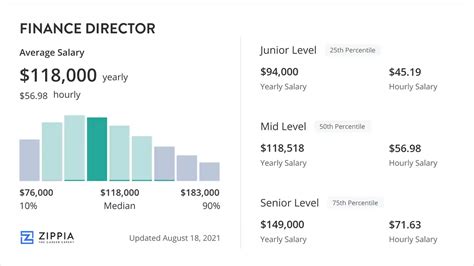

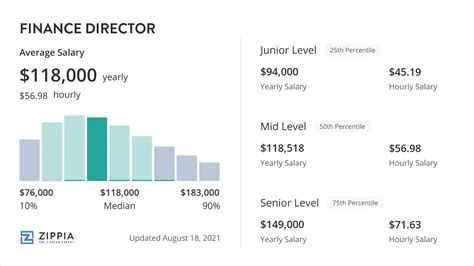

Average Finance Director Salary

The compensation for a Finance Director is significant, reflecting the high level of responsibility the role entails. However, salary figures can vary widely between different data sources, largely due to methodology—some include bonuses and other compensation, while others focus on base salary.

Here’s a look at what leading sources report for Finance Directors in the United States:

| Source | Average Base Salary (Approx.) | Typical Salary Range | Note |

| :--- | :--- | :--- | :--- |

| Salary.com | $183,990 | $153,090 - $221,490 | Specific to "Finance Director" title. |

| Glassdoor | $166,500 | $127,000 - $225,000 | Reflects base pay; "Total Pay" with bonuses is often significantly higher (~$215,000). |

| Payscale | $128,700 | $88,000 - $184,000+ | Includes a wide range of company sizes and experience levels. |

| BLS (Financial Mgrs) | $139,790 (Median) | $77,540 - >$208,000 | Broader "Financial Manager" category, which includes directors but also other management roles. |

*(Data retrieved in late 2023/early 2024. Figures are subject to change.)*

The key takeaway is that a six-figure salary is standard. The U.S. Bureau of Labor Statistics (BLS) reports a median annual wage of $139,790 for the broader "Financial Managers" category in May 2022. However, the top 10% of earners in this category made more than $208,000. More specific platforms like Salary.com show an even higher median for the "Finance Director" title, placing it closer to $184,000. This discrepancy highlights that "Director" level roles typically sit in the upper half of the pay scale for financial managers.

Key Factors That Influence Salary

Your salary as a Finance Director is not a fixed number. It's a dynamic figure influenced by your unique qualifications, where you work, and the company you work for. Understanding these factors is key to maximizing your earning potential.

###

Level of Education

A strong educational foundation is non-negotiable for this role.

- Bachelor's Degree: A bachelor's in finance, accounting, economics, or a related business field is the minimum requirement.

- Master's Degree (MBA): A Master of Business Administration (MBA), particularly from a top-tier business school, can provide a significant salary boost and open doors to leadership positions at larger corporations. Employers view an MBA as a sign of advanced business acumen and strategic thinking.

- Certifications: Professional certifications are highly valued and can directly impact compensation. The most common and respected include:

- CPA (Certified Public Accountant): Demonstrates deep expertise in accounting, reporting, and compliance.

- CFA (Chartered Financial Analyst): Signals mastery in investment analysis, portfolio management, and corporate finance.

###

Years of Experience

Experience is perhaps the most significant driver of a Finance Director's salary. The career path is a ladder, and compensation grows with each rung.

- Early Career (5-10 years): Professionals typically work their way up from roles like Financial Analyst or Senior Accountant to a Financial Manager position. In these stages, you build foundational skills.

- Mid-Career (10-15 years): With a decade of experience and a proven track record of managing teams and projects, you become a strong candidate for a Finance Director role, often starting at the lower end of the salary range ($120k - $150k).

- Senior/Experienced (15+ years): Finance Directors with extensive experience, especially those who have guided companies through significant growth, IPOs, or M&A activity, can command salaries at the very top of the scale ($200k+), often supplemented by substantial bonuses and equity.

###

Geographic Location

Where you work matters. Salaries are often adjusted to the cost of living and the demand for talent in a specific metropolitan area. Major financial hubs naturally offer the highest pay.

High-paying metropolitan areas for finance professionals include:

- New York, NY

- San Francisco, CA

- San Jose, CA

- Boston, MA

- Washington, D.C.

A Finance Director in New York or San Francisco can expect to earn 20-30% more than the national average, though this is offset by a much higher cost of living. Conversely, salaries in smaller cities and rural areas will likely be closer to the lower end of the national range.

###

Company Type

The size, industry, and structure of your employer have a profound impact on your compensation package.

- Large Corporations (Fortune 500): These companies offer the highest base salaries and the most lucrative bonus structures, stock options, and benefits packages. The roles are often more specialized and part of a larger, hierarchical finance team.

- Startups and Tech Companies: Base salaries might be slightly lower than at large corporations, but they are often supplemented with significant equity (stock options). This offers the potential for a massive payout if the company is successful or acquired.

- Mid-Sized Businesses: These roles often provide a competitive salary with a good work-life balance. The Finance Director here may wear more hats than at a larger company, offering broader experience.

- Non-Profit Organizations: While incredibly rewarding, non-profits typically offer lower salaries than for-profit entities due to budget constraints.

###

Area of Specialization

Within finance, certain specializations are in higher demand and command higher pay. A Finance Director with expertise in a high-growth or complex area can negotiate a premium salary. Valuable specializations include:

- Financial Planning & Analysis (FP&A): The strategic heart of modern finance, focusing on forecasting and data-driven decision-making.

- Mergers & Acquisitions (M&A): Highly specialized and lucrative, especially in industries with frequent consolidation.

- Treasury and Capital Markets: Expertise in managing cash, raising capital, and handling investments is critical for large, publicly traded companies.

- International Finance: In a globalized economy, experience managing finances across multiple currencies and regulatory environments is a major asset.

Job Outlook

The future is bright for aspiring financial leaders. According to the U.S. Bureau of Labor Statistics, employment for financial managers is projected to grow 16 percent from 2022 to 2032, a rate that is much faster than the average for all occupations.

This strong growth is driven by several factors, including the increasing complexity of financial products, the need for robust risk management, and the growing importance of data analysis in corporate strategy. As companies continue to expand globally and navigate a complex economic landscape, the demand for skilled, strategic Finance Directors will remain high.

Conclusion

A Finance Director role represents a pinnacle of achievement in the finance profession. The journey requires a robust education, years of dedicated experience, and a commitment to continuous learning.

The reward for this effort is a substantial salary and a central role in shaping a company's future. While the average salary provides a strong baseline, remember that your ultimate earning potential is not static. It is a dynamic figure you can actively influence through strategic choices in your education, the experience you gain, the industry you choose, and the specialized skills you develop. For those with the ambition and drive, a career as a Finance Director offers a path to exceptional professional and financial success.