New York City stands as the undisputed global capital of finance. For aspiring and current financial professionals, it represents the pinnacle of opportunity, ambition, and, of course, earning potential. If you're considering a career as a financial analyst in the Big Apple, your first question is likely: what can I expect to earn?

The answer is both exciting and complex. While the average financial analyst in NYC commands a salary significantly higher than the national average, your final paycheck is influenced by a powerful combination of experience, education, and industry niche. An entry-level analyst might start with a base salary around $85,000, while a seasoned professional at a top-tier firm can easily see total compensation soaring well above $200,000.

This article will break down everything you need to know about a financial analyst's salary in New York City, providing a data-driven roadmap to help you navigate your career path.

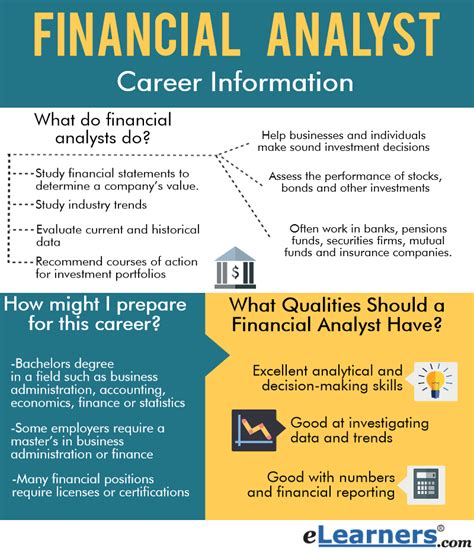

What Does a Financial Analyst Do?

Before diving into the numbers, it's essential to understand the role. A financial analyst is a professional detective for a company's finances. They scrutinize financial data to identify trends, forecast future performance, and guide businesses and investors toward smart, profitable decisions.

Key responsibilities typically include:

- Financial Modeling: Building complex spreadsheets to predict future financial outcomes.

- Forecasting and Budgeting: Projecting revenue and expenses to help departments manage their budgets.

- Variance Analysis: Comparing actual financial results to the forecasted budget to understand performance.

- Reporting: Creating detailed reports and presentations for senior management and stakeholders.

- Investment Recommendations: Analyzing stocks, bonds, and other investments to advise on "buy," "sell," or "hold" strategies.

In essence, their analysis forms the bedrock of strategic planning, investment decisions, and a company’s overall financial health.

Average Financial Analyst Salary in NYC

New York City's status as a high-cost-of-living financial hub means its salaries are among the highest in the world for this profession.

According to data compiled from leading salary aggregators, the average base salary for a financial analyst in New York City typically falls between $95,000 and $115,000.

- Salary.com reports the median base salary for a Financial Analyst II in New York, NY, to be around $103,500.

- Glassdoor lists the average total pay (including bonuses and additional compensation) at approximately $118,000, with the most likely base salary range being $90,000 to $127,000.

However, the base salary is only part of the story. In NYC's competitive landscape, total compensation—which includes annual bonuses, profit sharing, and stock options—is a critical metric. Bonuses can range from 10% of base salary in a corporate role to over 100% in high-stakes environments like investment banking or hedge funds.

Here's a more granular look at typical salary ranges by experience level:

- Entry-Level Financial Analyst (0-2 years): $75,000 - $95,000 base salary.

- Mid-Level Financial Analyst (3-5 years): $95,000 - $125,000 base salary.

- Senior Financial Analyst (5+ years): $125,000 - $160,000+ base salary.

Key Factors That Influence Salary

Your specific salary within these ranges is not random. It's determined by several key factors that you can actively influence throughout your career.

### Level of Education

Your academic and professional credentials are the foundation of your earning potential.

- Bachelor's Degree: A bachelor's in Finance, Economics, Accounting, or a related quantitative field is the standard entry requirement.

- Master's Degree: An MBA or a Master of Science in Finance (MSF) can significantly increase starting salary and accelerate your career trajectory, particularly if obtained from a top-tier university.

- Certifications: The Chartered Financial Analyst (CFA) designation is the gold standard in the investment management industry. Earning a CFA charter is a rigorous process that demonstrates deep expertise and a strong ethical grounding. Professionals with a CFA charter often command salaries that are 15-20% higher than their non-chartered peers. Other valuable certifications include the Certified Public Accountant (CPA) for those in accounting-heavy roles.

### Years of Experience

Experience is one of the most direct drivers of salary growth. As you progress, your responsibilities and value to the firm increase, and your compensation reflects that.

- 0-2 Years (Analyst I): You'll focus on data gathering, basic modeling, and report generation. Your role is primarily about execution and learning the fundamentals.

- 3-5 Years (Analyst II/Senior Analyst): You gain autonomy, handle more complex models, and begin presenting your findings to internal stakeholders. Your analysis starts to carry more weight.

- 5+ Years (Senior Analyst/Manager): You take on a strategic role, mentoring junior analysts, managing entire projects, and often interacting directly with clients or executive leadership.

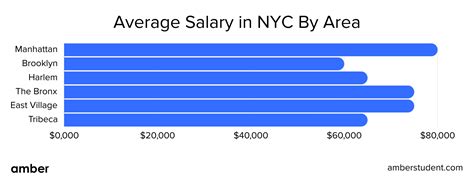

### Geographic Location

While this article focuses on NYC, it's crucial to understand *why* this location pays a premium. The U.S. Bureau of Labor Statistics (BLS) reports the national median pay for Financial Analysts was $99,890 in May 2023. The New York-Newark-Jersey City metropolitan area consistently reports a mean wage significantly above this national figure. This premium is driven by:

- High concentration of top-tier firms.

- Intense competition for elite talent.

- A higher cost of living.

### Company Type

Where you work is arguably the single biggest determinant of your total compensation. The financial world is not monolithic.

- Investment Banking, Private Equity, and Hedge Funds: These are the highest-paying sectors. Analysts work notoriously long hours on high-stakes deals and investment strategies. Bonuses in these fields are substantial and can often exceed the base salary.

- Corporate Finance (FP&A): Working in a Financial Planning & Analysis (FP&A) role for a Fortune 500 company (e.g., PepsiCo, Pfizer) offers a competitive salary and often a better work-life balance. Pay is excellent, but bonuses are typically more modest (10-25% of base).

- Asset Management and Equity Research: These roles involve analyzing securities to make investment decisions for funds or clients. Compensation is strong and highly performance-driven.

- Government and Non-Profit: These sectors offer the lowest direct financial compensation but provide immense job stability, excellent benefits, and a mission-driven work environment.

### Area of Specialization

Within an organization, your specific function also matters.

- Investment Banking Analysts focused on mergers and acquisitions (M&A) are at the top of the pay scale.

- Equity Research Analysts who develop a strong reputation can become highly sought after and well-compensated.

- Corporate FP&A Analysts are vital for internal strategy and are paid well for their business partnership role.

- Credit Analysts and Treasury Analysts perform essential risk management and cash management functions, with solid, stable compensation packages.

Job Outlook

The future looks bright for financial analysts. According to the U.S. Bureau of Labor Statistics (BLS), employment for financial and investment analysts is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

This growth is fueled by an increasingly complex global economy, the rise of big data in financial analysis, and a continuous need for expert guidance in managing money and investments. While the field is growing, competition for top jobs—especially in a premier market like NYC—will remain fierce.

Conclusion

A career as a financial analyst in New York City offers a pathway to exceptional financial rewards and professional growth. While the headline salary figures are high, your actual earnings will be a direct reflection of your dedication and strategic career choices.

Here are the key takeaways for maximizing your earning potential:

1. Build a Strong Foundation: A quantitative degree is essential, but pursuing an MBA or, most importantly, the CFA designation can set you apart.

2. Target High-Growth Industries: Your choice of company—from a global investment bank to a tech giant's corporate finance team—will have the largest impact on your total compensation.

3. Gain Experience and Specialize: The longer you're in the field and the more specialized your knowledge becomes, the more valuable you are.

4. Never Stop Networking: In a city like New York, your professional network can unlock opportunities that data alone cannot.

For those with the analytical mindset, strong work ethic, and ambition to succeed, a career as a financial analyst in NYC isn't just a job—it's an opportunity to be at the center of the financial universe.