A career as a financial consultant offers the dual reward of helping clients achieve their most important life goals while building a lucrative and dynamic professional path. But what does that potential look like in concrete numbers? For those with the right skills and dedication, this career path offers significant earning potential, with top performers earning well into the six figures.

The national median salary for financial consultants often hovers around $99,000 per year, but this single figure only tells part of the story. Your actual income can vary dramatically, influenced by a blend of experience, location, specialization, and the type of company you work for.

This guide will break down everything you need to know about a financial consultant's salary, from average compensation to the key factors that can accelerate your earning potential.

What Does a Financial Consultant Do?

Before diving into the numbers, it's essential to understand the role. A financial consultant—a title often used interchangeably with "financial advisor"—is a professional who provides expert advice and guidance to individuals and organizations on how to manage their finances.

Their core responsibilities include:

- Analyzing a client's complete financial picture, including income, assets, debts, and goals.

- Creating personalized financial plans to address objectives like retirement, college savings, investment growth, and estate planning.

- Recommending suitable financial products, such as stocks, bonds, mutual funds, and insurance.

- Monitoring clients' portfolios and making adjustments as market conditions and life circumstances change.

- Educating clients on complex financial topics to empower them to make informed decisions.

Essentially, a financial consultant acts as a trusted partner, navigating the complexities of finance to help clients secure their financial future.

Average Financial Consultant Salary

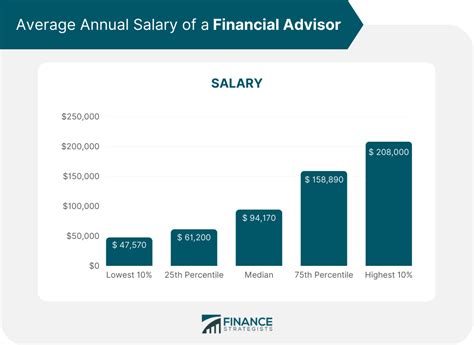

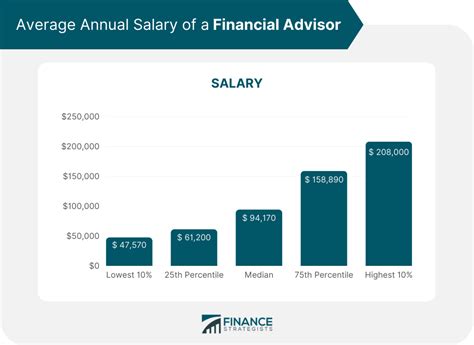

Salary data for financial consultants can vary based on the source and whether it includes base pay only or total compensation (including bonuses and commission). It's crucial to look at multiple sources to get a well-rounded view.

- The U.S. Bureau of Labor Statistics (BLS), which classifies this role as "Personal Financial Advisors," reports a median annual wage of $99,580 as of May 2023. The lowest 10% earned less than $48,310, while the top 10% of earners brought in more than $239,200.

- Salary.com reports a median salary for a Financial Consultant in the United States at $104,138 as of May 2024, with a typical range falling between $91,900 and $122,238.

- Glassdoor lists a total pay average of $111,273 per year in the United States, which includes a base average of $82,429 and an estimated additional pay (bonus, commission, etc.) of $28,844.

This data reveals a wide salary spectrum. An entry-level consultant might start in the $60,000 to $75,000 range, while a senior consultant with a substantial book of clients can easily earn $150,000 to $250,000 or more. The highest earners in the field often run their own successful practices and manage millions in client assets.

Key Factors That Influence Salary

Your specific salary as a financial consultant is not a fixed number. It is a dynamic figure shaped by several critical factors. Understanding these levers is key to maximizing your income.

### Level of Education and Professional Certifications

While a bachelor's degree in finance, economics, accounting, or a related field is the standard entry point, advanced credentials are what truly set top earners apart.

- Master's Degree: An MBA with a finance concentration can open doors to higher-level roles, particularly in corporate financial consulting or wealth management for high-net-worth clients.

- Professional Certifications: These are paramount in the finance industry. The Certified Financial Planner (CFP) designation is the gold standard for personal financial planning. It signifies proven expertise and adherence to a strict ethical code, making CFP professionals highly sought after and better compensated. Similarly, the Chartered Financial Analyst (CFA) charter is a globally respected designation focused on investment analysis and portfolio management, often leading to lucrative roles in asset management firms.

### Years of Experience

Experience is arguably the most significant driver of income in this field. A financial consultant's career and salary typically follow a clear progression:

- Entry-Level (0-3 years): In the early years, consultants focus on learning the trade, passing licensing exams (like the Series 7 and Series 66), and supporting senior advisors. Compensation is often a modest base salary.

- Mid-Career (4-10 years): At this stage, consultants have begun building their own book of clients. Their income becomes a mix of salary and commissions or fees based on the assets they manage (AUM). Earning potential grows significantly.

- Senior/Veteran (10+ years): Experienced consultants have established deep client relationships and a substantial AUM. Their income is largely performance-driven and can be exceptionally high. They may also take on mentorship or management roles within their firm.

### Geographic Location

Where you work matters. Salaries for financial consultants are highest in major financial hubs and areas with a high concentration of wealth. According to the BLS, the top-paying states for personal financial advisors are:

1. New York: Average annual salary of $178,390

2. Illinois: Average annual salary of $159,310

3. Massachusetts: Average annual salary of $154,230

4. California: Average annual salary of $143,890

5. Maine: Average annual salary of $142,650

Metropolitan areas like New York City, Chicago, and San Francisco offer the highest salaries, though this is often balanced by a higher cost of living.

### Company Type

The structure of your employer directly impacts how you are paid.

- Large Wirehouses (e.g., Morgan Stanley, Merrill Lynch): These firms often offer strong training programs and a recognized brand name. Compensation is typically a mix of salary and commission, with high earning potential but also high-pressure sales targets.

- Independent Firms (Registered Investment Advisors - RIAs): Many experienced advisors move to or start their own RIAs. They often operate on a "fee-only" model, charging a percentage of the assets they manage. This model aligns the advisor's interest with the client's and can be very profitable for those with a large client base.

- Banks and Credit Unions: These institutions provide a steady stream of client referrals and often offer a more stable, salary-focused compensation structure, though the ceiling for top-end earnings may be lower than at a wirehouse or independent RIA.

- Insurance Companies: Consultants here may focus heavily on insurance-based financial products, with compensation tied to policy sales and commissions.

### Area of Specialization

General financial planning is valuable, but specializing in a complex or high-demand niche can dramatically increase your worth. Lucrative specializations include:

- High-Net-Worth (HNW) Individuals: Managing the complex financial lives of wealthy clients.

- Retirement Planning: Specializing in retirement income strategies, 401(k) rollovers, and pension plans.

- Estate Planning: Working with clients and attorneys to create tax-efficient plans for wealth transfer.

- Corporate Financial Planning: Advising businesses on benefits packages, retirement plans, and investment strategies.

Job Outlook

The future for financial consultants is bright. The BLS projects employment for personal financial advisors to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is driven by several factors: an aging population nearing retirement (the Baby Boomer generation), the increasing complexity of financial products, and a growing recognition of the need for professional financial advice. As more individuals take control of their own retirement and investment planning, the demand for qualified consultants will continue to rise.

Conclusion

A career as a financial consultant is not just a job; it's a long-term professional journey with exceptional earning potential. While the national median salary provides a solid benchmark, your individual success is firmly in your hands.

For those considering this path, the key takeaways are clear:

- The earning potential is high, with top professionals commanding significant incomes.

- Income is performance-based, directly tied to your ability to build trust and deliver results for clients.

- Continuous learning is non-negotiable. Pursuing advanced certifications like the CFP or CFA is a proven strategy for boosting credibility and salary.

- Strategic choices matter. Your earnings will be shaped by your experience, your choice of employer, your geographic location, and whether you develop a valuable specialization.

If you are driven, analytical, and passionate about helping people achieve financial wellness, a career as a financial consultant offers a clear and rewarding path to both professional and financial success.