Are you driven by a desire to make a tangible, positive impact on people's lives? Do you possess a unique blend of empathy and analytical skill, finding satisfaction in bringing order to chaos? If so, a career as a financial counselor might be your calling. This profession is more than just a job; it's a mission to empower individuals and families, guiding them from financial distress to stability and a secure future. While the intrinsic rewards are immense, it's also a viable, growing profession with respectable earning potential. The typical financial counselor salary in the United States offers a comfortable living, with a national average often cited between $50,000 and $65,000 per year, but this is just the starting point. With experience, specialization, and the right credentials, top earners can command salaries well over $90,000.

I once sat down with a close friend who was drowning in credit card debt, feeling ashamed and hopeless. We spent an afternoon with a spreadsheet, a calculator, and a lot of coffee, mapping out a simple, actionable plan. The look of sheer relief on their face when they saw a clear path out of the red was more rewarding than any spreadsheet could ever quantify. This is the essence of financial counseling: replacing anxiety with action and despair with hope.

This comprehensive guide will illuminate every facet of a financial counselor's career, with a special focus on salary expectations and the factors that drive them. We will explore the day-to-day realities of the role, the levers you can pull to increase your income, the long-term career outlook, and a step-by-step plan to get you started.

### Table of Contents

- [What Does a Financial Counselor Do?](#what-they-do)

- [Average Financial Counselor Salary: A Deep Dive](#salary-deep-dive)

- [Key Factors That Influence Salary](#key-factors)

- [Job Outlook and Career Growth](#job-outlook)

- [How to Get Started in This Career](#get-started)

- [Conclusion](#conclusion)

What Does a Financial Counselor Do?

Before we dive into the numbers, it's crucial to understand the role itself. A common point of confusion is the distinction between a financial *counselor* and a financial *advisor*. While they both work in personal finance, their focus is fundamentally different.

- Financial Advisor: Primarily works with clients who have surplus capital. They focus on wealth management, investments, retirement planning (401(k)s, IRAs), and growing assets. They are often licensed to sell securities and insurance products.

- Financial Counselor: Primarily works with clients who are facing financial challenges or want to build a strong financial foundation. Their focus is on the "blocking and tackling" of personal finance: budgeting, debt management, credit repair, and establishing healthy financial habits. They provide education and guidance, not investment advice.

A financial counselor is a coach, an educator, and a strategist rolled into one. They equip clients with the knowledge and tools to take control of their financial lives. Their work is deeply human-centered, requiring a high degree of emotional intelligence and trust.

### Core Responsibilities and Daily Tasks

The day-to-day work of a financial counselor is varied, blending client interaction, analysis, and administrative tasks. Here’s a breakdown of their core duties:

- Client Assessment: The first step is always a deep-dive interview to understand a client's complete financial picture: income, expenses, assets, and liabilities (debts). This also involves understanding their financial goals, behaviors, and the emotional stressors related to their money situation.

- Budget Creation and Analysis: Counselors help clients create realistic, sustainable budgets. This isn't just about cutting expenses; it's about aligning spending with values and goals. They use tools like spreadsheets or budgeting apps to track cash flow and identify areas for improvement.

- Debt Management Strategy: For clients burdened by debt, this is a critical function. Counselors analyze all debts (credit cards, student loans, medical bills) and develop strategies to tackle them. This might involve creating a "debt snowball" or "debt avalanche" plan, or negotiating with creditors for lower interest rates or settlement amounts.

- Credit Report Review and Repair: Counselors are experts in credit. They help clients pull their credit reports, understand their credit scores, identify errors, and create a plan to build or rebuild their creditworthiness.

- Financial Education: A huge part of the role is teaching. Counselors might run workshops on topics like "First-Time Homebuying," "Understanding Your Credit," or "Saving for Emergencies." They provide clients with resources, articles, and tools to improve their financial literacy.

- Goal Setting and Accountability: They help clients set achievable short-term and long-term financial goals (e.g., building an emergency fund, saving for a down payment) and act as an accountability partner to keep them on track.

### A "Day in the Life" of a Financial Counselor

To make this more concrete, let's imagine a typical Tuesday for a financial counselor working at a non-profit credit counseling agency.

- 9:00 AM - 9:30 AM: Arrive, grab coffee, and review the day's schedule. Respond to urgent client emails and prepare files for the day's appointments, reviewing notes from previous sessions.

- 9:30 AM - 11:00 AM: Client Meeting #1 (Intake). Meet with a new couple overwhelmed by student loan and credit card debt. The session is focused on active listening, gathering all their financial documents, and building rapport. The goal is to make them feel heard and understood, not judged. They leave with a "homework" assignment: to track all their spending for one week.

- 11:00 AM - 12:00 PM: Case Notes and Follow-Up. Document the intake session in the CRM system. Draft a follow-up email to the couple summarizing the meeting and confirming their next appointment. Start building a preliminary budget framework for them based on the initial numbers.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 2:00 PM: Client Meeting #2 (Progress Check). Meet with a long-term client who has been on a debt management plan for six months. Review their progress, celebrate their success in paying off one credit card, and discuss an upcoming large expense (car repairs) to adjust the budget accordingly.

- 2:00 PM - 3:30 PM: Creditor Negotiation. Spend time on the phone on behalf of a different client. Call two credit card companies to negotiate a hardship plan, aiming for a reduced interest rate and waived late fees. This requires patience, persistence, and strong negotiation skills.

- 3:30 PM - 4:30 PM: Workshop Preparation. Work on a PowerPoint presentation for an upcoming community workshop on "How to Improve Your FICO Score." Research the latest credit scoring trends and create engaging, easy-to-understand visuals.

- 4:30 PM - 5:00 PM: Final administrative tasks. Respond to non-urgent emails, plan for tomorrow's appointments, and tidy up the office.

This example illustrates the dynamic nature of the role—a constant shift between empathetic client coaching, detailed analytical work, and proactive outreach.

Average Financial Counselor Salary: A Deep Dive

Understanding your potential earnings is a critical part of career planning. The salary for a financial counselor is not a single, fixed number but a range influenced by a multitude of factors, which we will explore in the next section. However, by looking at data from authoritative sources, we can establish a reliable baseline.

It's important to note that the U.S. Bureau of Labor Statistics (BLS), the gold standard for employment data, groups financial counselors under the broader category of "Credit Counselors" (SOC Code 13-2071). This is the most accurate classification for the role as described, distinct from "Personal Financial Advisors" who focus on investments.

### National Averages and Salary Ranges

According to the most recent data, here is a snapshot of the national salary landscape for financial and credit counselors:

- U.S. Bureau of Labor Statistics (BLS): The BLS reported the median annual wage for credit counselors was $46,950 in May 2023. The lowest 10 percent earned less than $34,310, and the highest 10 percent earned more than $77,880. This data often forms the most conservative baseline, as it includes part-time workers and those in lower-paying non-profit roles.

- Salary.com: This aggregator provides a more granular view, reporting the median salary for a "Financial Counselor" in the U.S. to be around $61,311 as of late 2023. Their typical range falls between $54,845 and $68,898. They also note that top earners with significant experience and specialized skills can reach higher figures.

- Payscale: Payscale reports a similar average base salary of approximately $52,058 per year. Their data shows a broad range from $38,000 for entry-level positions to over $79,000 for experienced professionals, highlighting the significant impact of experience.

- Glassdoor: Based on user-submitted data, Glassdoor estimates the total pay (including base and additional compensation) for a financial counselor in the United States is around $64,482 per year, with a likely range between $51,000 and $82,000.

Synthesized View: Taking these sources together, a realistic expectation for a financial counselor salary is a median around $55,000 to $65,000. Entry-level professionals should expect to start in the $40,000s, while experienced, certified counselors in high-demand areas can push into the $80,000s and even low $90,000s.

### Salary by Experience Level

Your earnings will grow predictably as you accumulate experience, build a track record of success, and take on more complex cases or leadership responsibilities. Here’s a typical salary progression:

| Experience Level | Typical Annual Salary Range | Key Characteristics & Responsibilities |

| :--- | :--- | :--- |

| Entry-Level (0-2 years) | $40,000 - $52,000 | Learning the ropes, handling basic client cases (budgeting, credit reports), often under direct supervision. Focus on gaining foundational skills and pursuing initial certifications. |

| Mid-Career (3-8 years) | $53,000 - $75,000 | Working with greater autonomy on more complex client situations (significant debt, bankruptcy considerations, housing issues). May begin to specialize, mentor junior counselors, or lead workshops. Holds key certifications like the AFC®. |

| Senior / Lead (8+ years) | $76,000 - $90,000+ | Manages a portfolio of the most challenging cases. Often holds a leadership or supervisory role, responsible for program management, training staff, and strategic planning. May be a recognized expert in a specific niche (e.g., student loans, military finance). |

*Source: Synthesized from Payscale, Salary.com, and industry observations.*

### A Closer Look at Compensation: Beyond the Base Salary

Your total compensation is more than just your annual salary. It's important to consider the entire package when evaluating a job offer.

- Base Salary: This is the fixed, predictable amount you earn, paid bi-weekly or monthly. It forms the bulk of your compensation.

- Bonuses: While less common in non-profit settings, for-profit counseling firms or financial wellness companies may offer performance-based bonuses. These could be tied to client satisfaction scores, the number of clients served, or overall company profitability. These can range from a few thousand dollars to 10-15% of your base salary.

- Profit Sharing: Some private firms offer profit sharing, where a portion of the company's annual profits is distributed among employees. This directly ties your success to the company's performance.

- Health and Wellness Benefits: This is a significant part of your compensation. Look for comprehensive medical, dental, and vision insurance. Many employers in this field also offer generous Employee Assistance Programs (EAPs) and mental health support, recognizing the emotional demands of the job.

- Retirement Savings: A strong retirement plan, such as a 401(k) or 403(b) (for non-profits), is crucial. Pay close attention to the employer match. A common offering is a 100% match on the first 3-6% of your salary contribution—this is essentially free money and a key part of your total earnings.

- Paid Time Off (PTO): Generous PTO, including vacation days, sick leave, and holidays, contributes to work-life balance and is a valuable part of the compensation package.

- Professional Development Fund: A forward-thinking employer will invest in your growth. Look for companies that offer a stipend for continuing education, professional association memberships (like AFCPE), and certification maintenance fees. This is a direct investment in your future earning potential.

When comparing job offers, don't just look at the base salary. Calculate the total value of the compensation package to make a truly informed decision.

Key Factors That Influence Financial Counselor Salary

Your starting salary and long-term earning potential are not set in stone. They are the result of a complex interplay of your background, choices, and market forces. By strategically focusing on the factors below, you can actively steer your career towards higher compensation. This is the most critical section for understanding how to maximize your income in this profession.

### 1. Level of Education and Professional Certifications

Your formal education and, more importantly, your professional credentials are the bedrock of your career and salary.

Educational Background:

A bachelor's degree is typically the minimum requirement for a professional financial counseling role. While some entry-level positions in call centers or non-profits might accept an associate's degree with relevant experience, a four-year degree significantly broadens your opportunities.

- Relevant Degrees: Degrees in finance, accounting, economics, business administration, or human services/social work are highly valued. A finance or business degree provides the hard analytical skills, while a social work degree provides the crucial counseling and human behavior component. A candidate with a blend of both (e.g., a finance degree with a minor in psychology) is exceptionally well-positioned.

- Master's Degree: While not required for most counseling roles, a master's degree (e.g., an MBA with a finance concentration or a Master's in Personal Financial Planning) can accelerate your path to leadership and higher-level roles, particularly in program management or director-level positions. It can command a salary premium of 10-20% over a bachelor's degree alone.

Professional Certifications (The Real Game-Changer):

In financial counseling, certifications are arguably more impactful on salary than the specific type of bachelor's degree you hold. They are a clear signal to employers and clients that you have met rigorous standards of excellence and ethics.

- Accredited Financial Counselor (AFC®): This is the gold standard certification in the field, administered by the Association for Financial Counseling and Planning Education (AFCPE®). Earning the AFC® demonstrates proven expertise in the core competencies of financial counseling. It requires passing a comprehensive exam, completing a significant number of experience hours, and adhering to a strict code of ethics. Holding an AFC® is one of the single most effective ways to boost your salary and marketability. Many employers list it as a preferred or even required qualification, and it can easily add $5,000-$15,000 to your annual salary potential compared to a non-certified peer.

- Certified Credit Union Financial Counselor (CCUFC): Offered by the Credit Union National Association (CUNA), this certification is highly respected within the credit union industry. If you plan to build a career in this sector, the CCUFC designation is invaluable.

- HUD-Certified Housing Counselor: For those specializing in housing and mortgage counseling, becoming certified by the U.S. Department of Housing and Urban Development (HUD) is essential. It's often a requirement for jobs at housing finance agencies and non-profits that receive federal funding.

- Certified Personal Finance Counselor (CPFC): Another reputable certification that validates skills in counseling and personal finance.

### 2. Years of Experience

As shown in the table above, experience is a primary driver of salary growth. This progression isn't just about time served; it's about the depth and breadth of skills acquired.

- Entry-Level (0-2 Years): At this stage, you are building credibility. Your focus is on mastering the fundamentals: conducting effective client interviews, building accurate budgets, and understanding the nuances of credit reports. Your value is in your potential and willingness to learn.

- Mid-Career (3-8 Years): You have moved from theory to practice. You have a portfolio of successful client outcomes you can point to. You can handle complex cases independently, such as clients with multiple income sources, small business issues, or severe debt loads requiring intricate negotiations. Your salary increases because you are a reliable, proven asset who requires less supervision and delivers consistent results. This is often when counselors earn their AFC® and see a significant pay bump.

- Senior-Level (8+ Years): Your value transcends one-on-one counseling. You are now a strategic thinker. You might be developing new counseling programs, training and mentoring a team of junior counselors, representing your organization at industry events, or specializing in a highly complex niche like forensic financial analysis or high-net-worth debt management. Your salary reflects your leadership, expertise, and the broader impact you have on the organization.

### 3. Geographic Location

Where you work matters—a lot. Salaries for financial counselors vary significantly based on state, city, and the local cost of living. A high salary in a low-cost area can provide a better quality of life than a slightly higher salary in an expensive metropolitan center.

High-Paying States and Cities:

Metropolitan areas with strong financial sectors, high population density, and a higher cost of living tend to offer the highest salaries. According to data from Salary.com and BLS regional reports, top-paying locations often include:

- States: California, New York, Massachusetts, Washington, New Jersey, and the District of Columbia.

- Cities: San Francisco, San Jose, New York City, Boston, Seattle, and Washington, D.C.

For example, a financial counselor in San Francisco might earn $75,000 for a role that pays $55,000 in a smaller midwestern city like Omaha. However, the cost of living in San Francisco is substantially higher, which must be factored in.

Lower-Paying Areas:

Conversely, salaries tend to be lower in rural areas and states with a lower cost of living, such as Mississippi, Arkansas, West Virginia, and parts of the South and Midwest.

The Rise of Remote Work:

The pandemic has accelerated the trend of remote work in this field. This presents a unique opportunity. A counselor living in a low-cost-of-living area who can secure a remote position with a company based in a high-paying city like New York could significantly maximize their real income. Employers are still navigating how to adjust salaries for remote workers, but this remains a powerful strategy for savvy professionals.

### 4. Company Type & Size

The type of organization you work for has a profound impact on both your salary and your day-to-day work environment.

- Non-Profit Organizations (Credit Counseling Agencies, Community Centers): This is the largest employer of financial counselors. Examples include members of the National Foundation for Credit Counseling (NFCC).

- Salary: Tends to be on the lower end of the national average.

- Culture: Mission-driven, focused on client outcomes above all else. The work is incredibly rewarding. Benefits, especially retirement plans (403b) and PTO, can be quite good.

- Credit Unions: A major employer in this space, as financial wellness is core to their member-focused mission.

- Salary: Generally competitive, often slightly higher than non-profits.

- Culture: Strong focus on member education and community. Excellent benefits are a hallmark of the credit union industry. Roles often come with the CCUFC certification path.

- For-Profit Companies (Financial Wellness Providers, FinTech): This is a growing sector. Companies contract with large employers to provide financial wellness as an employee benefit.

- Salary: Can be significantly higher than non-profits, often including performance bonuses.

- Culture: More corporate and fast-paced. Focus on technology, scale, and delivering measurable ROI to their corporate clients. Might feel less "hands-on" than traditional counseling.

- Government (Federal, State, and Local): Counselors work on military bases (a huge area of need), for university financial aid offices, and within social service agencies.

- Salary: Generally solid and predictable, with defined pay scales (like the GS scale for federal jobs).

- Culture: Bureaucratic but stable. Government roles are known for exceptional job security and outstanding benefits, including pensions, which are rare elsewhere.

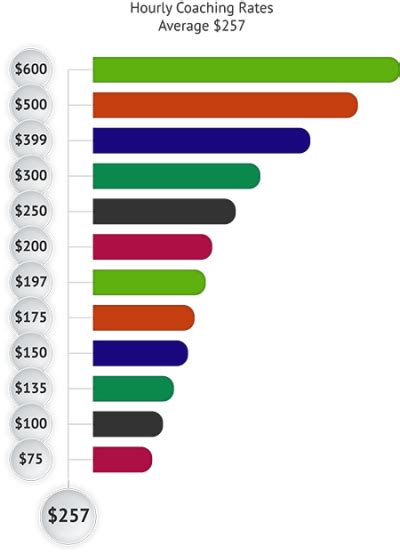

- Private Practice / Self-Employed: Experienced, certified, and entrepreneurial counselors can start their own practice.

- Salary: The potential is highest here, as you set your own rates. Top practitioners can earn well over $100,000. However, income is not guaranteed.

- Culture: You are the boss. This comes with complete autonomy but also the responsibility of marketing, billing, compliance, and covering all your own business expenses and benefits.

### 5. Area of Specialization

Developing a deep expertise in a specific niche can make you a highly sought-after professional and boost your earning potential. Generalists are valuable, but specialists often command a premium.

- Student Loan Counseling: With over $1.7 trillion in student debt in the U.S., experts who can navigate complex repayment plans (IBR, PAYE, REPAYE), consolidation options, and forgiveness programs (like PSLF) are in high demand.

- Housing Counseling (HUD-Certified): Specializing in pre-purchase education, mortgage delinquency, and foreclosure prevention is a critical, regulated field. HUD certification is the key to unlocking higher-paying roles in this area.

- Military/Veteran Financial Counseling: Active-duty service members and veterans face unique financial challenges (PCS moves, deployments, VA benefits). Counselors with expertise in the military lifestyle and benefits (like the GI Bill and TSP) are invaluable on military installations and at veteran service organizations.

- Medical Debt Counseling: As healthcare costs rise, specialists who can negotiate with hospitals and insurance companies and navigate medical billing are becoming increasingly important.

- Employee Financial Wellness: This specialization focuses on delivering counseling and education within a corporate EAP framework, requiring an understanding of benefits like 401(k)s, HSAs, and stock options.

### 6. In-Demand Skills

Beyond your formal credentials, a specific set of hard and soft skills can directly translate to a higher salary. Employers will pay more for professionals who can demonstrate proficiency in these areas.

High-Value Hard Skills:

- Financial Planning Software Proficiency: Expertise in tools like eMoney Advisor, MoneyGuidePro, or specialized counseling CRM systems.

- Advanced Microsoft Excel/Google Sheets: The ability to create complex budget models, amortization schedules, and data visualizations.

- Data Analysis: The ability to analyze client data and broader trends to inform counseling strategies and program development.

- Bilingualism: The ability to serve clients in more than one language (especially Spanish) is a massive asset in many parts of the country and can command a significant salary premium.

Crucial Soft Skills (Power Skills):

- Empathy and Active Listening: You cannot be a successful counselor without the ability to connect with clients on a human level and make them feel safe and understood.

- Behavioral Coaching: Understanding the psychology behind money decisions is key. The best counselors are coaches who can help clients change their long-term habits, not just their spreadsheets.

- Complex Problem-Solving: The ability to look at a tangled financial situation and devise a clear, logical, and actionable plan.

- Communication and Education: The skill of breaking down complex financial topics into simple, digestible information that empowers clients to act.

- Resilience and Professional Detachment: The ability to handle emotionally charged situations daily without taking on the client's stress yourself is vital for long-term success and avoiding burnout.

Job Outlook and Career Growth

When considering a long-term career, salary is only one part of the equation. Job security and opportunities for advancement are equally important. For financial counselors, the future looks bright and stable. The societal need for financial guidance is persistent and growing, ensuring a steady demand for qualified professionals.

### Official Projections: A Growing Field

The U.S. Bureau of Labor Statistics (BLS) provides the most reliable long-term forecast. In its latest Occupational Outlook Handbook, the BLS projects the employment of Credit Counselors to grow, although at a more modest pace than some other financial professions.

The BLS projects that about 3,400 openings for credit counselors are expected each year, on average, over the decade from 2022 to 2032. This demand stems from two primary sources:

1. New Job Creation: As the population grows and financial products become more complex, the need for counselors increases.

2. Replacement Needs: Many openings will arise from the need to replace workers who retire or transition to different occupations.

This steady demand provides a strong foundation of job security for those entering and advancing in the field. Unlike trendy tech jobs that can be subject to boom-and-bust cycles, the need for sound financial advice is evergreen.

### Emerging Trends Shaping the Future

The profession is not static. Several powerful trends are reshaping the landscape of financial counseling, creating both challenges and exciting opportunities for those who are prepared to adapt.

- The Rise of Financial Wellness as an Employee Benefit: This is perhaps the most significant trend. More and more companies recognize that employee financial stress impacts productivity, engagement, and retention. They are increasingly partnering with financial wellness firms to offer services like one-on-one financial counseling, educational webinars, and budgeting tools as part of their benefits packages. This is creating a new, lucrative employment channel for counselors outside of the