Introduction

Have you ever looked at the complex world of business and finance and felt a pull towards making sense of it all? Do you have a knack for numbers, a passion for strategy, and a desire to build a lucrative and impactful career? If so, the role of a Financial Specialist might be your calling. This isn't just a job about crunching numbers in a spreadsheet; it's about being the financial compass for an organization, guiding critical decisions, and shaping the future of a business. It’s a career path that offers not only intellectual stimulation but also significant financial rewards, with the potential for a six-figure income and substantial growth.

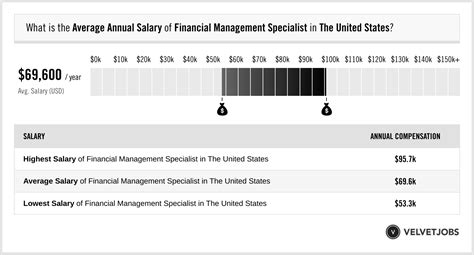

The average financial specialist salary in the United States reflects the critical nature of this role, often ranging from an entry-level starting point of around $60,000 to well over $150,000 for experienced professionals in high-demand sectors. But these numbers are just the beginning. Your earning potential is a dynamic figure, heavily influenced by your education, your location, the skills you master, and the strategic career choices you make along the way.

I once consulted for a mid-sized tech company that was brilliant at innovation but consistently missing its financial targets. They brought in a sharp Financial Specialist who, within six months, didn't just clean up their budget—she built a predictive financial model that identified their most and least profitable service lines, fundamentally changing their business strategy and setting them on a path to sustainable growth. That single hire underscored for me the immense value a skilled financial professional brings to the table; they are not a cost center, but a profit driver.

This guide is designed to be your comprehensive roadmap to understanding and maximizing a financial specialist salary. We will dissect every component that contributes to your paycheck, explore the future of the profession, and provide a clear, step-by-step plan to launch your own successful career.

### Table of Contents

- [What Does a Financial Specialist Do?](#what-does-a-financial-specialist-do)

- [Average Financial Specialist Salary: A Deep Dive](#average-financial-specialist-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

---

What Does a Financial Specialist Do?

The title "Financial Specialist" is a broad term that encompasses a variety of roles centered on the financial health and strategy of an organization. At its core, a Financial Specialist is a professional responsible for collecting, analyzing, and interpreting financial data to provide actionable insights for decision-makers. They are the storytellers of a company's financial narrative, translating raw numbers into clear guidance on budgeting, investing, risk management, and long-term planning.

While specific duties vary depending on the industry and company, the role fundamentally revolves around ensuring financial efficiency, compliance, and profitability. Think of them as internal financial consultants, working closely with department heads, executives, and other stakeholders to align financial activities with overarching business goals.

Core Responsibilities and Daily Tasks:

A Financial Specialist's work can be broken down into several key areas:

- Financial Analysis & Reporting: This is the bedrock of the role. Specialists create and maintain financial models, track key performance indicators (KPIs), and prepare detailed reports (e.g., monthly variance reports, quarterly earnings analyses) that explain *why* the numbers are what they are.

- Budgeting and Forecasting: They are instrumental in the annual budgeting process, working with different departments to allocate funds effectively. Furthermore, they develop financial forecasts (rolling forecasts, long-range plans) to predict future revenues, costs, and profits, helping the company anticipate challenges and opportunities.

- Process Improvement: A key value-add is identifying inefficiencies. This could involve streamlining the expense reporting process, automating data collection, or finding ways to reduce operational costs without sacrificing quality.

- Advising and Decision Support: Specialists don't just present data; they provide recommendations. They might analyze the financial viability of a new project, evaluate a potential acquisition, or advise on pricing strategies.

- Compliance and Risk Management: They ensure the company adheres to financial regulations and internal policies. This can involve monitoring for financial irregularities and helping to assess and mitigate financial risks.

### A Day in the Life of a Financial Specialist

To make this more concrete, let's imagine a typical day for "Alex," a Financial Specialist at a mid-sized software company.

- 9:00 AM - 10:30 AM: Data Reconciliation and Morning Analysis. Alex starts the day by pulling sales and expense data from the company’s Enterprise Resource Planning (ERP) system. They run a routine check to ensure data integrity and then update the monthly financial dashboard in Tableau, checking actual performance against the budget and last month's forecast.

- 10:30 AM - 12:00 PM: Budget Meeting with the Marketing Department. Alex meets with the Head of Marketing to review their spending for the quarter. They discuss the ROI on recent campaigns and work together to reallocate funds from an underperforming channel to a more promising new initiative, ensuring the department stays within its annual budget.

- 12:00 PM - 1:00 PM: Lunch & Professional Development. Alex eats lunch while watching a webinar on advanced financial modeling techniques in Excel.

- 1:00 PM - 3:30 PM: Deep Work - Building a New Project Model. The product team is proposing a new software feature. Alex's task is to build a financial model from scratch to project the potential revenue, development costs, and long-term profitability of this feature. This involves deep concentration, using advanced Excel functions, and making informed assumptions based on market research.

- 3:30 PM - 4:30 PM: Ad-Hoc Request from the CFO. The CFO sends an urgent email asking for an analysis of the company's cash flow over the past 18 months. Alex needs to quickly query the financial database using SQL, visualize the data, and write a brief, clear summary of the trends and drivers.

- 4:30 PM - 5:30 PM: Preparing for Tomorrow. Alex reviews the findings from the new project model and prepares a summary presentation for the project kickoff meeting scheduled for the next day. They end the day by organizing their files and creating a to-do list, ensuring a smooth start for tomorrow.

---

Average Financial Specialist Salary: A Deep Dive

Understanding the earning potential is a primary motivator for anyone considering this career path. The good news is that the demand for skilled financial professionals translates into competitive compensation packages. However, the term "Financial Specialist" is broad, so it's most useful to look at data for closely related and more specifically defined roles, such as "Financial Analyst," which the U.S. Bureau of Labor Statistics (BLS) tracks closely.

### National Averages and Salary Ranges

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Financial Analysts was $99,010 as of May 2023. This is a powerful statistic, as the median represents the midpoint—half of the workers in the occupation earned more than that amount, and half earned less.

The BLS data also reveals a wide salary spectrum, underscoring the significant growth potential within the field:

- Lowest 10%: Earned less than $59,380

- Highest 10%: Earned more than $177,930

Data from reputable salary aggregators provides a complementary view, often updated more frequently and incorporating user-reported data.

- Salary.com (as of early 2024) reports the median salary for a Financial Analyst I (entry-level) in the U.S. at around $65,490, while a Financial Analyst IV (senior/lead) has a median salary of $119,390.

- Payscale.com shows a similar trend, with an average base salary for a Financial Analyst reported at approximately $70,000, with a total pay range (including bonuses and profit sharing) spanning from $53,000 to $102,000.

- Glassdoor (as of early 2024) places the total pay for a Financial Specialist in the U.S. at an average of $89,641, with a likely range between $69,000 and $119,000.

These figures paint a clear picture: while a solid starting salary is typical, the real earning power is unlocked through experience, specialization, and continuous skill development.

### Salary by Experience Level

Your compensation will grow in lockstep with your experience and the value you bring to an organization. Here is a breakdown of what you can expect at different stages of your career.

| Experience Level | Typical Years of Experience | Typical Salary Range (Base + Bonus) | Key Responsibilities & Focus |

| :--- | :--- | :--- | :--- |

| Entry-Level Financial Specialist | 0-2 Years | $60,000 - $85,000 | Data gathering, standard report generation, variance analysis, supporting senior analysts, mastering technical tools (Excel, SQL). |

| Mid-Career Financial Specialist | 3-7 Years | $85,000 - $125,000 | Owning the budget for a department/business unit, building complex financial models, presenting findings to management, mentoring junior analysts. |

| Senior/Lead Financial Specialist | 8+ Years | $120,000 - $175,000+ | Leading the strategic financial planning process, advising senior leadership (CFO, VPs), managing a team, driving major cost-saving or revenue-generating initiatives. |

*Source: Synthesized data from BLS, Salary.com, Payscale, and industry observations.*

### Beyond the Base Salary: Understanding Total Compensation

A Financial Specialist's salary is more than just the number on their bi-weekly paycheck. Total compensation is a critical concept to grasp, as it can significantly increase your overall earnings.

- Annual Bonuses: This is the most common form of variable pay. Bonuses are typically tied to a combination of individual performance (meeting your goals) and company performance (hitting revenue or profit targets). A typical bonus for a Financial Specialist can range from 5% to 20% of their base salary, with senior roles in high-performing industries (like investment banking or private equity) seeing bonuses that can equal or even exceed their base salary.

- Profit Sharing: Some companies, particularly private ones, offer a profit-sharing plan where a portion of the company's annual profits is distributed among employees. This directly aligns the employee's financial interests with the company's success.

- Stock Options & Restricted Stock Units (RSUs): Especially common in publicly traded companies and tech startups, equity compensation gives you a stake in the company's future. Stock options give you the right to buy company stock at a predetermined price, while RSUs are grants of company shares that vest over time. This can be an extremely lucrative component of compensation if the company performs well.

- Benefits Package: While not direct cash, a strong benefits package has significant monetary value. This includes:

- Health Insurance: Comprehensive medical, dental, and vision plans.

- Retirement Savings: 401(k) or 403(b) plans, with a generous employer match being a key factor (e.g., a 100% match on the first 5% of your contribution is essentially a 5% raise).

- Paid Time Off (PTO): Vacation days, sick leave, and holidays.

- Professional Development Stipend: Many companies will pay for certifications (like the CFA), advanced training, or even contribute to an MBA.

When evaluating a job offer, it's crucial to look beyond the base salary and calculate the value of the entire compensation package.

---

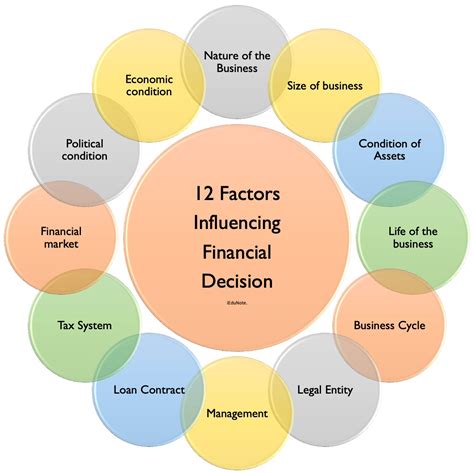

Key Factors That Influence a Financial Specialist Salary

Two Financial Specialists with the same job title can have vastly different salaries. Why? Because compensation is not a monolith; it's a mosaic of factors that reflect your individual qualifications, the context of your employer, and the demand for your specific skills. Mastering these variables is the key to maximizing your lifetime earning potential.

###

1. Level of Education

Your educational background is the foundation upon which your career—and salary—is built.

- Bachelor's Degree (The Entry Ticket): A bachelor's degree is the standard requirement for almost all entry-level financial specialist roles. The most common and effective majors are Finance, Accounting, Economics, and Business Administration. These programs provide the essential theoretical knowledge of financial principles, markets, and analytical methods. While a degree in a quantitative field like Mathematics or Statistics is also highly valued, a candidate with a finance-specific degree often has a slight edge for corporate finance roles.

- Master's Degree (The Accelerator): Pursuing a master's degree can significantly accelerate your career and salary trajectory.

- Master of Business Administration (MBA): An MBA, particularly from a top-tier business school, is a powerful signal to employers. It demonstrates not only advanced financial acumen but also leadership, strategy, and communication skills. An MBA is often a prerequisite for moving into senior management roles like Finance Manager, Director, or CFO. The salary premium can be substantial. According to a 2023 report from the Graduate Management Admission Council (GMAC), the median starting salary for new MBA hires was $125,000, significantly higher than for those with only a bachelor's degree.

- Master of Science in Finance (MSF): An MSF is a more specialized, quantitative-focused degree than an MBA. It's ideal for those who want to dive deep into financial modeling, econometrics, and investment theory. This degree is highly sought after for roles in investment management, risk analysis, and quantitative finance.

- Professional Certifications (The Differentiator): In the world of finance, certifications are a powerful way to validate your expertise and command a higher salary.

- Chartered Financial Analyst (CFA): The CFA charter is the gold standard in the investment management industry. Earning it requires passing three rigorous levels of exams covering topics from portfolio management and wealth planning to equity and fixed-income analysis. Payscale data consistently shows that CFA charterholders earn a significant premium over their non-certified peers, often 15-25% more.

- Certified Public Accountant (CPA): While traditionally associated with accounting roles, the CPA is also highly valuable for corporate Financial Specialists. It demonstrates a deep understanding of financial reporting, regulations (GAAP), and internal controls, which is critical for budgeting and analysis.

- Certified Financial Planner (CFP): This certification is essential for specialists focused on personal finance and wealth management, advising individuals on retirement, insurance, and investment planning.

###

2. Years of Experience

Experience is perhaps the single most significant driver of salary growth. As you progress, you move from executing tasks to driving strategy, and your compensation reflects this increased responsibility and impact.

- Entry-Level (0-2 Years): At this stage, you are learning the ropes. Your value lies in your technical proficiency, attention to detail, and ability to learn quickly. Your focus will be on supporting senior staff, running standard reports, and mastering the company's financial systems. Salary growth is steady as you prove your competence.

- Mid-Career (3-7 Years): You are now a fully functional and independent contributor. You can own complex processes like the budget for an entire business unit, build sophisticated financial models from scratch, and begin presenting your analysis to managers and directors. You start to develop a deeper understanding of the business itself, not just the numbers. This is where you'll see significant salary jumps as you take on more ownership. According to Salary.com, a Financial Analyst I (entry-level) earns a median of ~$65k, while a Financial Analyst III (mid-career) earns a median of ~$91k, a nearly 40% increase.

- Senior/Lead/Manager (8+ Years): At this level, your value shifts from "doing" to "leading and strategizing." You are no longer just analyzing the data; you are interpreting its strategic implications for the entire company. You might manage a team of analysts, serve as the primary financial advisor to a VP or C-level executive, and lead high-stakes projects like M&A due diligence or long-range strategic planning. Your compensation structure shifts to include a larger performance bonus and potentially equity, reflecting your direct impact on the company's bottom line. Senior roles regularly command salaries well into the six figures, often $130,000 to $180,000 or more.

###

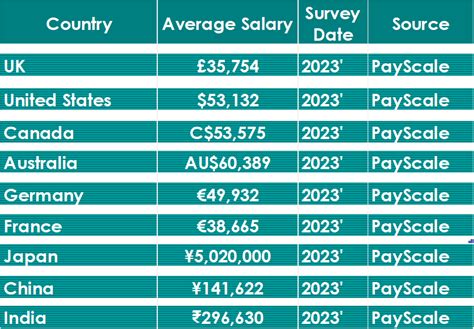

3. Geographic Location

Where you work matters—a lot. Salaries for Financial Specialists can vary dramatically based on the cost of living and the concentration of high-paying industries in a particular city or state.

Companies in major financial hubs and tech centers must offer higher salaries to attract top talent and compensate for a higher cost of living.

Top-Paying Metropolitan Areas for Financial Analysts (BLS, May 2023 Data):

1. New York-Newark-Jersey City, NY-NJ-PA: Annual Mean Wage: $138,560

2. San Francisco-Oakland-Hayward, CA: Annual Mean Wage: $135,760

3. San Jose-Sunnyvale-Santa Clara, CA: Annual Mean Wage: $133,020

4. Boston-Cambridge-Nashua, MA-NH: Annual Mean Wage: $124,310

5. Bridgeport-Stamford-Norwalk, CT: Annual Mean Wage: $123,800

In contrast, salaries in smaller metropolitan areas or states with a lower cost of living will generally be lower, even for the same job. However, the purchasing power in these locations might be comparable. A $90,000 salary in Des Moines, Iowa, might afford a similar or better lifestyle than a $125,000 salary in New York City. The rise of remote work has slightly blurred these lines, but location-based pay adjustments are still standard practice for most companies.

###

4. Company Type, Size, and Industry

The type of organization you work for is a massive determinant of your salary.

- Industry: The industry has the largest impact. A Financial Specialist in the Securities, Commodity Contracts, and Other Financial Investments industry earns a median salary of $139,780, according to the BLS. This includes roles in investment banking, private equity, and hedge funds, which are known for their grueling hours but astronomical compensation potential (especially bonuses). Compare this to a specialist in Government ($97,050 median) or Educational Services ($82,920 median).

- Company Size:

- Large Corporations (Fortune 500): These companies typically offer higher base salaries, structured career paths, and excellent benefits. They have the resources to invest in top talent and sophisticated financial systems. The work is often specialized within a large FP&A (Financial Planning & Analysis) team.

- Startups & Small/Mid-Sized Businesses (SMBs): Base salaries might be lower than at large corporations. However, the compensation package may include significant equity (stock options), which can have a massive payoff if the company succeeds. The roles are often broader, giving you more exposure to different aspects of the business.

- Company Type:

- Public vs. Private: Publicly traded companies often offer RSU-based compensation, which can be very valuable. Private companies may offer profit-sharing or a more direct line of sight to the impact of your work.

- For-Profit vs. Non-Profit: Non-profit organizations and government agencies generally offer lower salaries than their for-profit counterparts. However, they often compensate with excellent job security, better work-life balance, and strong benefits packages (like pensions in government roles).

###

5. Area of Specialization

Within the "Financial Specialist" umbrella, various specializations command different salary levels.

- Corporate Finance (FP&A): This is the most common path, focusing on budgeting, forecasting, and analysis to support a company's internal operations. It offers strong, stable career growth and a path to CFO.

- Investment Analysis (Buy-Side/Sell-Side): These analysts research stocks, bonds, and other securities to make investment recommendations. Sell-side analysts work for brokerages, while buy-side analysts work for asset management firms like mutual funds and hedge funds. This is one of the most lucrative specializations, with high pressure and very high compensation potential.

- Treasury: Treasury specialists manage a company's cash, debt, and investment activities. They focus on liquidity, capital structure, and managing financial risks like interest rate and currency fluctuations.

- Risk Management: These specialists identify, measure, and mitigate financial risks. This field is growing in importance, especially in banking and insurance, and requires strong quantitative skills.

- Wealth Management / Personal Financial Advisor: These specialists work with individuals to manage their finances. Compensation is often tied to assets under management (AUM) and can be very high for successful advisors.

###

6. In-Demand Skills

In today's data-driven world, having the right combination of technical and soft skills can directly translate into a higher salary. Employers are willing to pay a premium for specialists who can do more than just build a spreadsheet.

High-Value Technical Skills:

- Advanced Excel: This is non-negotiable. Mastery goes beyond SUM and VLOOKUP. You need to be an expert in Pivot Tables, Power Query, Macros (VBA), and building complex, three-statement financial models.

- SQL (Structured Query Language): The ability to pull and manipulate data directly from company databases is a huge differentiator. It makes you self-sufficient and allows for more sophisticated analysis than relying on pre-packaged reports.

- Business Intelligence (BI) & Data Visualization Tools: Proficiency in tools like Tableau or Microsoft Power BI is increasingly expected. The ability to create interactive, intuitive dashboards that allow leaders to explore data is far more valuable than a static PowerPoint slide.

- Financial Software & ERP Systems: Experience with enterprise-level systems like SAP, Oracle NetSuite, or Anaplan is highly valued, as these are the systems that run large businesses.

- Python/R: While not required for all roles, programming skills for data analysis and automation are becoming a major advantage, particularly in tech-finance (FinTech) and quantitative roles.

Essential Soft Skills:

- Communication & Presentation: You can have the best analysis in the world, but if you can't explain it clearly and persuasively to a non-financial audience (like a marketing or engineering leader), its value is lost.

- Strategic & Critical Thinking: Top-earning specialists don't just report the numbers; they ask "why?" and "what's next?" They connect financial data to the company's competitive landscape and strategic goals.

- Attention to Detail: In finance, small errors can have massive consequences. A reputation for accuracy and precision is paramount.

- Business Acumen: Understanding the operational realities of the business you are analyzing is crucial. The best analysts get out of their chairs and talk to people in sales, operations, and marketing to understand the story behind the numbers.

---

Job Outlook and Career Growth

Choosing a career is a long-term investment, so understanding its future trajectory is just as important as knowing the current salary. For Financial Specialists, the outlook is bright, characterized by strong growth, evolving responsibilities, and ample opportunities for advancement.

### Job Growth Projections

The U.S. Bureau of Labor Statistics provides a very encouraging forecast for this profession. Employment of Financial and Investment Analysts, Management Analysts, and Financial Specialists is projected to grow much faster than the average for all occupations.

Specifically for Financial Analysts, the BLS projects 8 percent growth from 2022 to 2032. This is significantly faster than the 3 percent average for all occupations. This growth is expected to result in about 35,700 new jobs over the decade. Additionally, the BLS anticipates around 42,400 openings for financial analysts each year, on average, primarily from the need to replace workers who transfer to different occupations or exit the labor force.

What's Driving This Growth?

- Increasingly Complex Financial Products and Markets: As the global economy becomes more interconnected and financial instruments more sophisticated, the need for experts who can navigate this complexity grows.

- The Rise of Big Data: Companies are collecting more data than ever before. They need skilled specialists who can turn this deluge of information into profitable insights. The role is shifting from data compilation to data interpretation.

- Emphasis on Risk Management: Following various economic crises and increasing regulatory scrutiny, companies across all sectors are investing heavily in professionals who can identify, monitor, and mitigate financial risks.

### Emerging Trends and Future Challenges

The role of a Financial Specialist is not static; it is evolving rapidly. Staying ahead of these trends is key to remaining relevant and valuable.

Key Trends Shaping the Future:

1. Automation and Artificial Intelligence (AI): AI and machine learning are automating many of the routine, data-gathering tasks that once consumed a junior analyst's time. This is a positive development for the profession. It frees up specialists to focus on higher-value activities: strategy, advising, communication, and complex problem-solving. The future Financial Specialist will be less of a data cruncher and more of a strategic partner.

2. ESG (Environmental, Social, and Governance): Companies are under increasing pressure from investors and consumers to perform well on non