In the world of finance, few roles are as critical to a company's strategic future as the Financial Planning & Analysis (FP&A) Analyst. This high-impact career offers not only significant influence but also a compelling compensation package, with average salaries often approaching the six-figure mark and senior roles commanding substantially more.

If you're a detail-oriented professional with a passion for using data to tell a story and shape business decisions, a career in FP&A could be your ideal path. This guide will break down everything you need to know about an FP&A Analyst's salary, from national averages to the key factors that can maximize your earning potential.

What Does an FP&A Analyst Do?

Before we dive into the numbers, it's essential to understand the role. Unlike traditional accountants who focus on historical data and compliance, FP&A analysts are forward-looking. Think of them as the financial strategists and storytellers of a business. They bridge the gap between raw financial data and actionable business intelligence.

Key responsibilities typically include:

- Budgeting and Forecasting: Creating annual budgets and continuously updating financial forecasts based on performance and market conditions.

- Variance Analysis: Analyzing the difference between actual financial results and the budget or forecast, explaining *why* those variances occurred.

- Financial Modeling: Building complex models to predict the financial impact of potential business decisions, such as launching a new product or entering a new market.

- Management Reporting: Preparing and presenting clear, concise reports and dashboards for senior leadership to aid in strategic decision-making.

- Ad-hoc Analysis: Supporting executive leaders with on-demand financial analysis to answer pressing business questions.

Average FP&A Analyst Salary

Now, let's get to the figures. The salary for an FP&A Analyst is competitive and reflects the high level of skill and responsibility the role demands.

According to data from Salary.com updated for 2024, the median salary for an FP&A Analyst in the United States is approximately $95,800. However, this is just a midpoint. The typical salary range for the majority of FP&A Analysts falls between $85,000 and $108,000.

Reputable salary aggregator Glassdoor reports similar figures, with an average base pay of around $90,000 and a total average pay (including potential bonuses and profit sharing) of $102,000. This highlights an important aspect of FP&A compensation: performance-based bonuses can significantly increase total earnings.

The full spectrum of pay can range from around $75,000 for an entry-level position to well over $150,000 for a senior or FP&A manager role.

Key Factors That Influence Salary

Your personal earning potential is not a single number but a range influenced by several critical factors. Understanding these drivers is the key to maximizing your compensation throughout your career.

###

Level of Education

Your educational background provides the foundation for your analytical skills.

- Bachelor's Degree: A bachelor's degree in Finance, Accounting, Economics, or a related field is the standard entry requirement.

- Master's Degree: An advanced degree, such as a Master of Business Administration (MBA) or a Master's in Finance, can provide a significant salary boost and open doors to leadership positions. It equips you with advanced modeling skills and a broader strategic perspective.

- Professional Certifications: Earning prestigious certifications signals a high level of expertise and commitment. The Certified Public Accountant (CPA) is highly respected. Even more specific to the field are the Certified Corporate FP&A Professional (FPAC) and the Chartered Financial Analyst (CFA), which can substantially increase your marketability and salary.

###

Years of Experience

Experience is arguably the most significant factor in salary progression. As you gain expertise, your value to an organization increases dramatically.

- Entry-Level (0-2 years): Analysts at this stage typically earn between $70,000 and $85,000. Their work focuses on data gathering, maintaining financial models, and assisting with report preparation.

- Mid-Career (3-7 years): With several years of experience, analysts can expect to earn between $85,000 and $115,000. They take ownership of more complex models, present findings to management, and begin to act as business partners to different departments.

- Senior / Manager (8+ years): Senior FP&A Analysts and FP&A Managers command salaries from $120,000 to $160,000+. At this level, they are leading teams, driving the overall financial strategy, and working directly with C-suite executives to influence major company decisions.

###

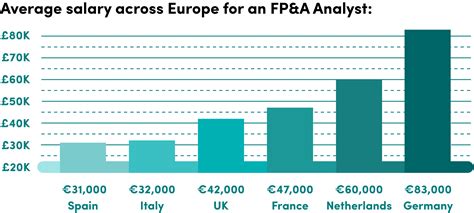

Geographic Location

Where you work matters. Salaries are adjusted based on the cost of living and the demand for financial talent in a specific market. Major metropolitan areas with large corporate headquarters tend to offer the highest salaries.

High-paying locations include:

- San Francisco, CA

- New York, NY

- Boston, MA

- Seattle, WA

- Washington, D.C.

An analyst in the San Francisco Bay Area might earn 25-35% above the national average to compensate for the high cost of living, while an analyst in a smaller midwestern city may earn a salary closer to the national median.

###

Company Type

The size and industry of your employer play a crucial role in your compensation.

- Large Corporations (Fortune 500): These companies generally offer higher base salaries, well-structured bonus programs, and comprehensive benefits packages. The complexity and scale of their operations demand top-tier talent.

- Tech Startups & High-Growth Companies: While base salaries might be competitive, a significant portion of the compensation package may come in the form of stock options or equity. This offers the potential for a very high financial reward if the company succeeds.

- Industry: Industries with high margins and complex financial operations, like technology, pharmaceuticals, and financial services, often pay more than industries like non-profit or retail.

###

Area of Specialization

Within FP&A, you can develop specialized expertise that can make you more valuable. Some high-demand specializations include:

- Sales FP&A: Focusing on revenue forecasting, sales team performance, and commission structures.

- Supply Chain FP&A: Analyzing manufacturing costs, logistics, and inventory management.

- Marketing FP&A: Analyzing the return on investment (ROI) of marketing campaigns and customer acquisition costs.

Developing a niche in a business-critical area can lead to a salary premium over a more generalist corporate FP&A role.

Job Outlook

The future for FP&A professionals is exceptionally bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for Financial Analysts (the category that includes FP&A) will grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

This robust growth is driven by the ever-increasing need for businesses to use data to guide strategy, manage risk, and navigate a complex global economy. Companies rely on FP&A professionals to provide the financial intelligence they need to thrive, making this a secure and in-demand career path.

Conclusion

A career as an FP&A Analyst offers a powerful combination of professional fulfillment and financial reward. While the national average salary is strong, your earning potential is truly in your hands. By focusing on continuous learning, gaining valuable experience, pursuing certifications, and positioning yourself in a high-growth industry or location, you can build a lucrative and impactful career.

For those with a knack for numbers, a strategic mindset, and a desire to influence business outcomes from the inside, the path of an FP&A Analyst is one of the most promising in the modern financial landscape.