Financial Planning and Analysis (FP&A) is a cornerstone of modern business, providing the strategic insights that drive critical decisions. For professionals in this field, the role of FP&A Manager represents a significant career milestone, blending deep analytical skills with leadership and business partnership. But what is the earning potential for such a vital role? The answer is compelling: an FP&A Manager's salary is not only competitive but often well into the six-figure range, with significant room for growth based on key factors.

This guide will break down the FP&A Manager salary landscape, explore the factors that dictate your earning power, and provide a clear outlook for this dynamic career path.

What Does an FP&A Manager Do?

Before diving into the numbers, it's essential to understand the value an FP&A Manager brings to an organization. This is not a simple accounting role. An FP&A Manager is a strategic partner to the business, responsible for:

- Budgeting and Forecasting: Leading the annual budget process and creating rolling financial forecasts.

- Performance Analysis: Analyzing financial results, comparing them to budget and forecast, and explaining variances to senior leadership.

- Strategic Planning: Modeling financial scenarios to support long-term strategic initiatives, such as new product launches, market expansions, or M&A activity.

- Management Reporting: Developing and presenting clear, insightful financial reports and dashboards for executives to make informed decisions.

- Team Leadership: Managing a team of financial analysts, mentoring their development, and overseeing their work.

In essence, FP&A managers translate raw data into a strategic narrative that guides the company's future.

Average FP&A Manager Salary

Across the United States, the salary for an FP&A Manager is substantial, reflecting the high level of skill and responsibility required. While figures vary, a clear consensus emerges from leading data sources.

On average, an FP&A Manager in the United States can expect to earn a base salary between $115,000 and $140,000 per year.

Let's break this down further with data from reputable sources (retrieved in May 2024):

- Salary.com: Reports the median base salary for a Financial Planning and Analysis Manager is approximately $138,500, with a typical range falling between $122,800 and $158,300.

- Payscale: Lists the average FP&A Manager salary at around $115,200, with a common range spanning from $89,000 to $146,000.

- Glassdoor: Shows an average base pay of $126,000 and estimates "total pay" (including bonuses and other compensation) to be around $143,000 per year.

It's critical to note that base salary is only part of the equation. Most FP&A Manager roles include a significant bonus component tied to individual and company performance, which can add 10-25% or more to their total compensation.

Key Factors That Influence Salary

Your specific salary as an FP&A Manager isn't determined by a single number. It is a composite of several key factors. Understanding these variables is crucial for maximizing your earning potential.

### Level of Education

A strong educational foundation is the price of entry. A bachelor's degree in finance, accounting, economics, or a related field is a minimum requirement. However, advanced degrees and certifications create a clear path to higher compensation.

- Master's Degree: An MBA or a Master's in Finance can provide a significant salary bump and open doors to leadership roles more quickly. Employers view these credentials as indicators of advanced business acumen and strategic thinking.

- Professional Certifications: Holding a Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designation is highly valued. These certifications validate your expertise in accounting principles and management-level financial strategy, making you a more competitive candidate and justifying a higher salary.

### Years of Experience

Experience is perhaps the most significant driver of salary growth in FP&A. The path to manager typically requires 5-7 years of prior experience as a financial analyst.

- Early-Career Manager (5-8 years total experience): Professionals at this stage typically fall in the lower end of the salary range, from $95,000 to $120,000, as they build their management and strategic leadership skills.

- Mid-Career Manager (8-12 years experience): With a proven track record of successful budgeting cycles and strategic contributions, these managers command salaries in the median range of $120,000 to $150,000.

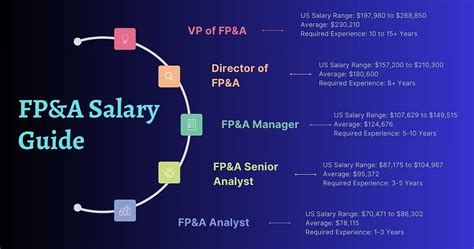

- Senior Manager / Director (12+ years experience): Highly experienced managers, especially those with specialized skills or on a path to a Director or VP of FP&A role, can earn $150,000+, with top earners in large corporations exceeding $200,000.

### Geographic Location

Where you work matters. Salaries are adjusted based on the cost of living and the concentration of corporate headquarters in a given region. Major metropolitan areas with strong finance and tech sectors command the highest salaries.

- Top-Tier Cities: Locations like New York City, the San Francisco Bay Area, Boston, and Seattle consistently offer the highest salaries, often 15-30% above the national average.

- Mid-Tier Cities: Major business hubs like Chicago, Dallas, Atlanta, and Washington D.C. offer very competitive salaries that are at or slightly above the national average.

- Lower-Cost Regions: Salaries in smaller cities and rural areas will typically be lower to reflect the local cost of living.

### Company Type

The size and industry of your employer have a direct impact on your paycheck. Larger, more complex organizations are willing to pay a premium for top talent.

- Company Size: The 2024 Robert Half Salary Guide provides excellent insight here. FP&A Managers at large companies (over $500M in revenue) can expect to earn significantly more than their counterparts at small or midsize companies due to the greater complexity and scope of their roles. For example, a senior manager at a large company might earn $170,000 - $225,000, while the same role at a small company might be closer to $130,000 - $160,000.

- Industry: High-growth, high-margin industries like technology (SaaS), pharmaceuticals, biotechnology, and financial services typically offer the most lucrative compensation packages. In contrast, salaries may be more modest in the non-profit, government, or manufacturing sectors.

### Area of Specialization

Within FP&A, certain specializations are in higher demand and can boost your salary. If you develop expertise in areas like M&A financial modeling, SaaS metrics (ARR, LTV, CAC), capital expenditure planning, or corporate strategy integration, you become a more valuable asset and can command a premium salary.

Job Outlook

The future for finance professionals is exceptionally bright. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial Managers (the category that includes FP&A Managers) is projected to grow 16 percent from 2022 to 2032.

This growth is described as "much faster than the average for all occupations." The driving forces behind this demand include increasing economic complexity, the need for precise financial analysis to navigate global markets, and a growing emphasis on data-driven decision-making across all industries. This strong demand translates into excellent job security and continued upward pressure on salaries for qualified professionals.

Conclusion

A career as an FP&A Manager is both professionally and financially rewarding. With average base salaries comfortably in the six-figure range and strong bonus potential, it is an attractive goal for ambitious finance professionals.

Your journey to a top-tier salary is not a matter of chance; it is a direct result of strategic career decisions. By investing in advanced education and certifications, gaining diverse experience, targeting high-paying locations and industries, and developing specialized skills, you can take control of your career trajectory and position yourself for maximum earning potential in this exciting and influential field.