So, you’re dreaming of being your own boss. You crave the autonomy, the direct link between your effort and your reward, and the satisfaction of building something tangible. Yet, the sheer uncertainty of starting a business from scratch—developing a brand, a product, and a business model all at once—feels overwhelming. This is where franchising enters the picture, offering a tantalizing "business-in-a-box" model that marries entrepreneurial independence with a proven system. But before you leap, the single most pressing question on your mind is likely: what is a typical franchise owner salary?

The answer is complex, but the potential is undeniable. Unlike a traditional salaried employee, a franchise owner's income isn't a fixed number; it's the profit the business generates. While this means greater risk, it also means uncapped potential. Research from industry authorities like Franchise Business Review indicates that the average annual income for franchise owners is around $80,000, with many experienced, multi-unit owners earning well into the six or even seven figures. However, the first few years can be lean, with many owners reinvesting heavily in the business.

I once spoke with a former corporate marketing director who, tired of the endless meetings and bureaucratic red tape, invested her savings into a children's coding education franchise. She told me, "The first two years were the hardest of my life. I paid myself almost nothing. But the moment I saw a shy, 8-year-old girl present a game she built herself with a huge smile on her face, I knew it was worth more than any corporate bonus. Now, five years in, I'm not just financially successful; I'm building a legacy in my community." Her story encapsulates the franchise owner's journey: a path of high-stakes, hard work, and the potential for immense personal and financial reward.

This guide is designed to be your definitive resource, cutting through the hype to provide a data-driven, comprehensive analysis of a franchise owner's potential income. We will dissect every factor that influences your earnings, explore the long-term outlook, and provide a step-by-step roadmap to get you started.

### Table of Contents

- [What Does a Franchise Owner Do?](#what-does-a-franchise-owner-do)

- [Average Franchise Owner Salary: A Deep Dive](#average-franchise-owner-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Franchise Owner Do?

Becoming a franchise owner is fundamentally about stepping into the role of a hands-on business leader. While the franchisor provides the brand, the operating system, and the initial training, the franchisee is the one on the ground executing the vision and driving the business forward day after day. You are not merely a manager; you are the CEO, CFO, and Head of HR for your own small enterprise, all while operating within the framework established by the parent company.

The core responsibilities of a franchise owner are multifaceted, blending strategic oversight with daily operational management. Here’s a breakdown of the primary duties:

- Operations Management: This is the heart of the role. You are responsible for ensuring the business runs smoothly according to the franchisor's standards. This includes managing inventory, maintaining equipment, ensuring the quality of products or services, and overseeing the physical location to meet brand and safety guidelines. For a fast-food franchise, this means ensuring food quality and speed of service; for a cleaning service, it means guaranteeing high standards and efficient scheduling.

- Financial Management: As the owner, you are the ultimate steward of the business's finances. This involves managing payroll, paying suppliers, tracking revenue and expenses, and preparing financial reports. A critical task is managing cash flow, ensuring there's enough capital to cover operational costs while planning for future growth. You are also responsible for all financial obligations to the franchisor, including royalty payments and marketing fund contributions.

- Human Resources & Staff Management: You will hire, train, schedule, and motivate your employees. Creating a positive work culture that reduces turnover and encourages excellent customer service is paramount. This also includes handling payroll, benefits administration (if offered), and ensuring compliance with all local, state, and federal labor laws.

- Marketing and Local Store Marketing (LSM): While the franchisor typically handles national advertising campaigns, the franchisee is responsible for driving business at the local level. This involves executing local marketing plans, engaging with the community through events or sponsorships, managing local social media accounts, and building relationships with other local businesses.

- Customer Service and Reputation Management: You are the face of the brand in your community. Ensuring an exceptional customer experience is non-negotiable. This means training staff on customer service protocols, handling customer complaints and feedback personally, and actively managing the business's online reputation through reviews on platforms like Google, Yelp, and Facebook.

- Franchisor Relations and Compliance: A significant part of the role is maintaining a strong working relationship with the franchisor. This involves regular communication, submitting required reports, attending training and conferences, and adhering strictly to the franchise agreement and operating manual. Compliance is key to protecting your investment and the integrity of the brand.

### A Day in the Life of a Franchise Owner

To make this tangible, let's imagine a day in the life of "David," the owner of a 'PrimeFit Personal Training' studio franchise.

- 7:00 AM: David arrives at the studio before the first clients. He reviews the appointment schedule, checks the cleanliness of the equipment and locker rooms, and ensures the front desk is ready for check-ins.

- 8:00 AM: He holds a brief morning huddle with his team of trainers, discussing any new member promotions, client progress notes, and operational goals for the day (e.g., upselling nutrition packages).

- 9:00 AM - 12:00 PM: David dedicates this time to "working on the business." He processes payroll, pays the utility bills online, and reviews last week's performance metrics. He sees that morning class attendance is down and brainstorms a "Wake Up and Workout" social media campaign to boost it. He spends an hour calling new members from the previous week to thank them for joining and ask for feedback.

- 12:00 PM: He covers the front desk for an hour to give his receptionist a lunch break, greeting members by name and handling inquiries.

- 1:00 PM - 3:00 PM: David focuses on local marketing. He visits the neighboring corporate office park to drop off flyers for a "Corporate Wellness" discount program he's launching. He then calls the local high school to discuss sponsoring the football team.

- 3:00 PM - 5:00 PM: An applicant for a part-time trainer position comes in for an interview. David conducts the interview, focusing on both technical skills and cultural fit. Afterward, he calls references for another candidate.

- 5:00 PM - 7:00 PM: This is the evening rush. David is on the floor, assisting staff, talking with members, and ensuring the studio's energy is high. He helps a new member learn how to use a specific piece of equipment and resolves a minor billing issue for another.

- 7:30 PM: After the last class, David does a final walkthrough, cashes out the register, and reviews the day's sales report before heading home. He might spend another 30 minutes at home responding to emails and planning for tomorrow.

This example illustrates that being a franchise owner is far from a passive investment; it requires a constant, active presence and the ability to wear multiple hats with skill and dedication.

Average Franchise Owner Salary: A Deep Dive

Analyzing the "salary" of a franchise owner requires a fundamental shift in perspective. Unlike a traditional employee, a franchisee's income is not a predetermined figure. It is the net profit that the business generates after all expenses are paid. These expenses include rent, inventory, employee wages, utilities, insurance, and, crucially, the fees paid to the franchisor (such as royalties and marketing contributions). What's left is the owner's potential income.

An owner can take this income in several ways:

- Owner's Draw: A distribution of profits taken from the business on a regular or as-needed basis.

- Salary: The owner can choose to pay themselves a fixed, regular salary, just like any other employee. This is often recommended for budgeting and financial planning.

- Retained Earnings: Profits that are kept in the business to fund future growth, such as opening a second location, purchasing new equipment, or weathering slow periods.

Therefore, "franchise owner salary" is a fluid concept representing the financial return on their investment of time and capital.

### National Averages and Income Ranges

Because the Bureau of Labor Statistics (BLS) tracks employees, not business owners, we must turn to industry-specific sources for reliable data.

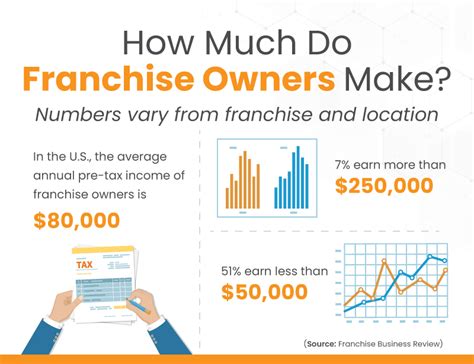

According to a comprehensive 2023 survey by Franchise Business Review, a leading market research firm for the franchise industry, the average pre-tax annual income for franchise owners in the United States is approximately $80,000.

However, this average hides a vast range of outcomes. The same report highlights these critical details:

- Median Income: The median income is closer to $75,000, suggesting that a smaller number of very high-earning owners pull the average up.

- Profitability Timeline: Only 51% of franchise owners report being profitable in their first two years. This underscores the importance of having sufficient personal capital to cover living expenses during the initial ramp-up phase.

- Top Performers: Highly experienced owners, particularly those who own multiple units, report incomes well into the $250,000+ range.

Salary aggregator data, based on self-reported figures, provides another lens:

- Payscale.com reports an average franchise owner salary of $71,514 per year, with a typical range between $31,000 and $184,000.

- Glassdoor lists a wider range, with a total pay estimate of around $116,155 per year, blending a base salary of ~$73,000 with additional pay (profit sharing, bonuses) of ~$43,000. This higher number likely reflects more established and profitable franchises.

It's crucial to understand that these are national averages. Your actual income will be determined by the specific factors we will explore in the next section.

### Income Progression by Years in Business

A franchise is a long-term investment, and income potential grows significantly over time. The initial years are typically focused on establishing the business and achieving profitability, while later years offer the potential for substantial financial returns.

| Years in Business | Typical Income Range (Annual) | Key Activities & Financial Focus |

| :--- | :--- | :--- |

| Year 1-2 (The Startup Phase) | $0 - $40,000 | Focus is on survival and breaking even. The owner may pay themselves a minimal salary or take no income, reinvesting all cash flow back into the business. Heavy emphasis on marketing, building a customer base, and streamlining operations. |

| Year 3-5 (The Growth Phase) | $45,000 - $90,000 | The business is established and profitable. The owner can now take a regular, stable salary. Focus shifts to optimizing profitability, improving efficiency, and potentially planning for a second location. |

| Year 5+ (The Maturity Phase) | $95,000 - $200,000+ | The franchise is a well-oiled machine with a strong customer base and stable cash flow. The owner may take on a more strategic role, delegating daily tasks. This is where the potential for high six-figure incomes exists, especially for multi-unit owners. |

*(Note: These ranges are illustrative and based on aggregated industry data. Actual results can vary dramatically.)*

### Beyond Salary: A Complete Compensation Picture

A franchise owner's financial reward extends beyond their annual income. A holistic view of compensation must include:

- Profit Sharing/Bonuses: Beyond a base salary, owners can distribute additional profits to themselves at year-end or quarterly, depending on the business's performance.

- Business Equity & Asset Building: The franchise itself is an asset. As you pay down loans and build a profitable business, you are creating equity. A successful franchise can be sold for a significant multiple of its annual profit, providing a substantial payout upon exit. This "exit strategy" is a core part of the long-term financial picture.

- Tax Advantages: Business ownership offers numerous tax deductions not available to traditional employees. Expenses like vehicle use, office supplies, travel for business purposes, and portions of health insurance premiums can often be deducted, lowering the owner's overall tax burden. (Consulting with a qualified accountant is essential here).

- Lifestyle Benefits: While not a direct monetary payment, the autonomy to set your own schedule (once the business is mature), blend work and personal life, and build a legacy for your family are invaluable components of the overall "compensation" package.

In summary, while the headline "average salary" provides a starting point, a prospective franchisee must look deeper. The real financial journey involves surviving the lean early years, growing into stable profitability, and ultimately building a valuable asset that can provide financial security for years to come.

Key Factors That Influence Salary

The wide variance in franchise owner income—from barely breaking even to earning millions—is not random. It is the direct result of a confluence of specific, analyzable factors. A savvy prospective owner must meticulously evaluate each of these variables before investing a single dollar. Think of these factors as levers; understanding how to position and pull them is the key to maximizing your financial return.

###

Franchise Industry & Sector

This is arguably the single most important factor. The profitability ceilings and operational challenges vary dramatically between different business sectors. Choosing the right industry for your skills, financial capacity, and local market is paramount.

- Food and Beverage (QSR, Fast Casual):

- Pros: High brand recognition (e.g., McDonald's, Subway), consistent consumer demand, potential for very high revenue volume.

- Cons: Extremely high initial investment (often $500k to $2M+), high overhead (rent, labor, food costs), intense competition, and relatively low-profit margins (often 5-10% of sales).

- Income Potential: Can be very high for successful, multi-unit operators, but the risk and capital required are substantial. The average single-unit owner might see profits in the $60,000 - $120,000 range after a few years.

- Senior Care and Home Health Services:

- Pros: Booming demand due to an aging population, lower initial investment compared to food service (often office-based), high-profit margins, and a mission-driven business model.

- Cons: Highly regulated industry requiring licensing and compliance, emotionally demanding work, significant challenges in recruiting and retaining qualified caregivers.

- Income Potential: Strong. According to Franchise Business Review's reports, the Senior Care sector is consistently rated as one of the most profitable, with many established owners earning $100,000 - $250,000+.

- Business Services (B2B Coaching, Staffing, Marketing):

- Pros: Lower overhead (often home-based or small office), regular business hours (better work-life balance), high-value client transactions.

- Cons: Requires strong networking and B2B sales skills, success is tied to the health of the local economy, can have long sales cycles.

- Income Potential: Highly variable, but successful owners who can build a strong client roster can earn $75,000 - $175,000.

- Home Services (Cleaning, Painting, Repair, Restoration):

- Pros: Relatively low initial investment, evergreen demand, can often be started from home, scalable model (adding more crews/vans).

- Cons: Labor-intensive, high competition from independent contractors, managing a mobile workforce can be complex.

- Income Potential: Solid. The Top 50 Franchises report by Franchise Business Review often features home services, with owner satisfaction and profitability being high. Average income can be in the $70,000 - $150,000 range.

- Fitness & Recreation:

- Pros: Passion-driven industry, recurring revenue from memberships, community-building aspect.

- Cons: High competition from big-box gyms and boutique studios, trend-driven market, requires high energy and a hands-on presence.

- Income Potential: Can be good, but often requires high member volume to be profitable. A successful studio owner might earn $50,000 - $100,000.

###

Brand Recognition & Reputation

The strength of the franchise brand you buy into directly impacts your ramp-up time and earning potential.

- Established, Tier-1 Brands (e.g., The UPS Store, McDonald's, Great Clips): These brands come with instant consumer trust and a finely-tuned operating system. The marketing is largely done for you. However, this comes at a price: very high initial franchise fees and total investment, stricter operational controls, and often, saturated markets where prime territories are unavailable. Your profit margin might be smaller, but your revenue stream is often more predictable and stable.

- Emerging or Niche Brands: A newer franchise might offer a lower entry cost, more available territory, and greater flexibility to shape the local business. The risk is significantly higher. You will have to work harder to build local brand awareness. The franchisor's support system may be less developed. The potential reward is also higher; if you get in on the ground floor of the "next big thing," your equity can grow exponentially.

###

Geographic Location

"Location, location, location" is a cliché for a reason. Where you open your franchise is critical.

- Market Demographics: Does the local population match the target customer of the franchise? Opening a high-end children's enrichment franchise in a neighborhood with a declining school-age population is a recipe for failure. Conversely, a senior care franchise in a booming retirement community has a built-in advantage.

- Cost of Doing Business: The same franchise will have vastly different profit potential in downtown San Francisco versus suburban Omaha. Factors to analyze include:

- Commercial Real Estate: High rent can be the single biggest drain on profitability.

- Labor Costs: Minimum wage laws and the local talent pool will dictate your payroll expenses.

- Taxes: State and local tax rates vary significantly.

- Market Saturation & Competition: How many other locations of the same franchise are nearby? What about direct competitors (both other franchises and independent businesses)? A detailed competitive analysis is a non-negotiable part of due diligence. High-paying areas are often those with strong economic growth, a favorable business climate, and demographics that align with the chosen franchise model.

###

The Franchise Disclosure Document (FDD) and Item 19

This is the single most important document in your research process. The FDD is a legal document that franchisors are required by the Federal Trade Commission (FTC) to provide to prospective franchisees. Within it, Item 19: The Financial Performance Representation is the section that can provide insight into earning potential.

- What it is: In Item 19, a franchisor may (it is optional) disclose data about the financial performance of existing franchise units. This can include gross sales figures, average costs, and sometimes even gross or net profit data.

- How to Analyze It: Do not just look at the headline average. Look for breakdowns by year of operation, by region, or by top-quartile vs. bottom-quartile performers. This will give you a much more realistic picture of the potential range of outcomes. Your goal should be to build a pro-forma financial statement based on the lower-to-mid-range numbers presented in Item 19.

- Crucial Caveat: The FDD is not a guarantee of your success. It is historical data from other locations. Your performance will depend on your own management and the specific factors of your market. Always have a qualified franchise attorney and an accountant review the FDD with you.

###

Owner's Involvement and In-Demand Skills

Your personal skills and level of effort are a massive variable in the equation.

- Owner-Operator vs. Semi-Absentee: An owner-operator who is in the business daily, managing staff, and engaging with customers will almost always have a more profitable business, especially in the early years, than a semi-absentee owner who hires a manager to run everything. The savings on a general manager's salary alone can be $50,000-$80,000 annually, which goes directly to the owner's bottom line.

- Key Skills that Boost Income:

- Sales and Networking: The ability to be the lead salesperson for your business is invaluable, especially in B2B or service-based franchises.

- Financial Acumen: Owners who understand their P&L statement, manage cash flow effectively, and control costs will be more profitable.

- Leadership and People Management: The ability to hire well, train effectively, and motivate a team leads to better customer service, lower employee turnover, and a healthier bottom line.

- Marketing Savvy: Understanding how to leverage social media, build community partnerships, and execute local marketing campaigns can dramatically increase revenue.

###

Capitalization and Ongoing Fees

How well-funded your business is from the start can dictate its long-term health.

- Initial Investment: Under-capitalization is a primary reason for franchise failure. If you borrow the absolute maximum and have no working capital reserves, any unexpected expense or slower-than-projected ramp-up can be fatal. Having at least 6-12 months of operating expenses plus personal living expenses in reserve is a common recommendation.

- Ongoing Fees: These directly reduce your net profit.

- Royalty Fee: Typically 4-8% of gross sales, paid to the franchisor weekly or monthly.

- Marketing/Ad Fund Fee: Typically 1-4% of gross sales, contributed to the national advertising fund.

- Other Fees: Technology fees, software fees, training fees, etc.

A franchise with a 5% royalty and 2% ad fund means 7% of every dollar of revenue immediately goes to the franchisor before you pay rent, labor, or any other cost. Understanding and modeling this impact is essential for projecting your true income.

Job Outlook and Career Growth

While "franchise owner" isn't a traditional job tracked by the BLS, the health and growth of the franchising industry as a whole serve as a strong proxy for the outlook and opportunities available to entrepreneurs on this path. The data paints a picture of a resilient and expanding sector, poised for continued growth.

According to the International Franchise Association (IFA) 2024 Franchising Economic Outlook report, the industry is projected to experience robust growth. Key projections include:

- Growth in Establishments: The total number of franchise establishments in the U.S. is expected to increase by over 15,000 units, or 1.9%, reaching a total of over 821,000.

- Job Creation: Franchises are expected to add nearly 221,000 jobs in 2024, growing their total employment to 8.9 million workers.

- Economic Output: The total economic output of franchising is projected to grow by 4.2% to $893.9 billion.

This data signifies a healthy and dynamic environment for prospective franchise owners. The continued growth indicates that the franchise model is a durable and appealing path to business ownership for many, suggesting a stable long-term outlook.

### Emerging Trends Shaping the Future of Franchising

Staying ahead of emerging trends is crucial for long-term success and profitability. An astute owner will not just operate their business today but will actively prepare for the challenges and opportunities of tomorrow.

1. Technology Integration: Technology is no longer an add-on; it's a core component of success. This includes everything from sophisticated Point-of-Sale (POS) systems that provide deep data analytics to customer-facing mobile apps for ordering and loyalty programs. Franchises that effectively leverage technology to improve customer experience and operational efficiency will have a significant competitive advantage.

2. Multi-Unit and Multi-Brand Ownership: The most common path for career growth and significant wealth creation in franchising is becoming a multi-unit owner. Experienced operators leverage their proven success and operational expertise to open second, third, or even dozens of locations. A growing trend is multi-brand ownership, where a franchisee diversifies their portfolio by owning units from different, non-competing franchise systems (e.g., owning both a fast-casual restaurant and a home services franchise).

3. Focus on Niche and Service-Based Models: While food and retail remain large segments, much of the recent growth is in service-based franchises. This includes sectors like senior care, pet care (grooming, daycare), health and wellness (boutique fitness, med-spas), and home services (restoration, junk removal). These businesses often require lower initial investment and can be more resilient to e-commerce disruption than traditional retail.

4. Increased Emphasis on ESG (Environmental, Social, and Governance): Modern consumers, particularly Millennials and Gen Z, increasingly prefer to support businesses that align with their values. Franchises are responding by focusing on sustainable practices, community involvement, and ethical governance. Owners who authentically embrace these principles can build stronger brand loyalty and attract both customers and employees.

5. The Rise of "Co-Branding": Savvy franchisors are partnering to place two complementary brands within a single physical location. Think of a gas station that also contains a Dunkin' or a