A career in technology at a prestigious firm like Goldman Sachs represents a powerful intersection of finance and innovation. For aspiring IT professionals, it offers a path to work on complex, high-impact systems that power the global economy. But beyond the challenge and prestige, a key question for many is: what is the earning potential?

A role as a technology analyst at Goldman Sachs is not only a significant resume builder but also a financially lucrative one. For entry-level positions, total compensation can readily surpass the six-figure mark, with substantial growth opportunities as you gain experience and specialize.

This article will provide a data-driven breakdown of the Goldman Sachs IT Analyst salary, explore the key factors that influence your pay, and discuss the overall career outlook for this exciting profession.

What Does a Goldman Sachs IT Analyst Do?

First, it's important to clarify the terminology. While the query is for an "IT Analyst," Goldman Sachs typically uses titles like "Technology Analyst," "Engineering Analyst," or "Strats" (Strategists) for its technology-focused roles. These positions go far beyond traditional corporate IT support.

A Technology Analyst at Goldman Sachs is an engineer, a problem-solver, and a core part of the firm's machinery. Their responsibilities are integral to the bank's operations and profitability. Key duties often include:

- Software Development: Building and maintaining proprietary trading platforms, risk management systems, and client-facing applications using languages like Java, Python, and C++.

- Infrastructure & Cloud Engineering: Managing the massive, secure, and resilient global infrastructure that the firm relies on, increasingly leveraging cloud platforms like AWS and Azure.

- Cybersecurity: Protecting the firm's sensitive data and systems from sophisticated cyber threats by developing and implementing robust security protocols.

- Data Analytics and Machine Learning: Analyzing vast datasets to identify market trends, optimize trading strategies, and improve operational efficiency.

- Systems Reliability Engineering (SRE): Ensuring the high-performance, low-latency operation of critical applications that handle billions of dollars in transactions daily.

In essence, you are not just supporting the business; you are building the technology that *is* the business.

Average Goldman Sachs IT Analyst Salary

Compensation at Goldman Sachs, particularly in technology roles, is highly competitive and is composed of two primary parts: a base salary and an annual performance bonus.

Based on recent data from several authoritative sources, here is a typical breakdown for an entry-level Technology Analyst:

- Average Base Salary: According to data from Glassdoor and Levels.fyi, the average base salary for an entry-level Technology Analyst at Goldman Sachs in the U.S. typically ranges from $100,000 to $120,000 per year.

- Average Total Compensation: When including the annual bonus, which is heavily dependent on both individual and firm performance, total compensation sees a significant jump. Levels.fyi, a highly trusted source for tech and finance compensation, reports that total compensation for new analysts often falls between $130,000 and $160,000. This figure includes base salary, a projected bonus, and sometimes stock grants.

Here’s a general progression you can expect:

| Level | Years of Experience | Typical Base Salary Range | Typical Total Compensation Range |

| :--- | :--- | :--- | :--- |

| Analyst | 0 - 3 | $100,000 - $130,000 | $130,000 - $180,000 |

| Associate | 3 - 6 | $140,000 - $175,000 | $190,000 - $250,000+ |

| Vice President (VP) | 6+ | $180,000 - $250,000+ | $275,000 - $400,000+ |

*Source: Synthesized data from Glassdoor, Levels.fyi, and other industry reports as of early 2024. Ranges are estimates and can vary.*

Key Factors That Influence Salary

The figures above are averages; your actual compensation can vary significantly based on several key factors.

### Level of Education

A Bachelor's degree in a relevant field like Computer Science, Software Engineering, Information Systems, or a related STEM discipline is the standard requirement. However, advanced degrees can provide a competitive edge. A Master's degree in a specialized field like Financial Engineering, Cybersecurity, or Machine Learning can lead to a higher starting salary and qualify you for more advanced roles from the outset.

### Years of Experience

Experience is arguably the most significant driver of salary growth at Goldman Sachs. The firm has a well-defined career progression track, moving from Analyst to Associate, then to Vice President (VP), and beyond. Each promotion comes with a substantial increase in both base salary and, more dramatically, bonus potential. An Associate with four years of experience will earn significantly more than a new Analyst, and a VP's compensation can be multiples of an entry-level role due to the larger leadership responsibilities and performance-based incentives.

### Geographic Location

Where you work matters. Goldman Sachs has major technology hubs in various cities, and compensation is adjusted based on the local cost of living and talent market.

- High-Cost Locations: Offices in New York City, Jersey City, and London will offer the highest salaries to offset the steep cost of living and to compete for top-tier talent in major financial centers.

- Lower-Cost Hubs: The firm has expanded its presence in cities like Salt Lake City, Dallas, and Bengaluru (India). While salaries in these locations are still highly competitive and well above the local market average, they will generally be lower than in New York to reflect the different economic environments.

### Company Type

While this article focuses on Goldman Sachs, it's helpful to understand how its pay structure compares to other firms.

- vs. Big Tech (e.g., Google, Meta): Compensation can be competitive. Big Tech firms often offer higher initial stock grants (RSUs), leading to very high total compensation in the first few years. Investment banks like Goldman Sachs have historically relied more on large annual cash bonuses, though they have increasingly incorporated stock into their compensation packages.

- vs. Other Investment Banks: As a top-tier "bulge bracket" bank, Goldman Sachs's compensation is at the very top of the market, generally on par with or exceeding that of its direct competitors like Morgan Stanley and J.P. Morgan.

- vs. Non-Finance Companies: A technology role at Goldman Sachs will almost always pay significantly more than a comparable IT role at a company in a non-tech, non-finance industry (e.g., retail, manufacturing). This is because technology at an investment bank is a direct revenue-enabling function.

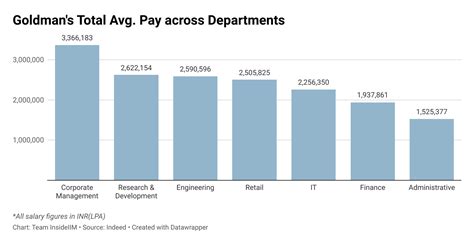

### Area of Specialization

Not all technology roles are compensated equally. Your area of expertise within the firm's engineering division can have a major impact on your earnings.

- High-Demand Specializations: Roles that are closest to revenue generation or require highly niche skills command the highest salaries. These include Quantitative Analysts ("Quants"), engineers working on low-latency or high-frequency trading systems, and experts in AI/Machine Learning and Cybersecurity.

- Core Technology Roles: Professionals in general software development, cloud engineering, and data infrastructure are also very well-compensated, but the salary premium may be highest in the specialized fields listed above.

Job Outlook

The career outlook for technology professionals in the finance industry is exceptionally strong. The financial sector is undergoing a massive digital transformation, increasing its reliance on technology for everything from automated trading to regulatory compliance and client service.

According to the U.S. Bureau of Labor Statistics (BLS), employment in computer and information technology occupations is projected to grow 15% from 2022 to 2032, much faster than the average for all occupations. This will result in about 377,500 new jobs over the decade.

This industry-wide growth is amplified at firms like Goldman Sachs, which view technology not as a cost center but as a competitive advantage. The continuous need for faster, smarter, and more secure financial systems ensures that demand for skilled technology analysts will remain robust for the foreseeable future.

Conclusion

A career as a Technology Analyst at Goldman Sachs offers a rewarding path for ambitious and skilled professionals. The role promises intellectually stimulating work, a direct impact on global finance, and a compensation package that is among the best in any industry.

Key Takeaways:

- High Earning Potential: Expect a starting total compensation package in the $130,000 to $160,000 range, with significant room for growth.

- Compensation is More Than Just Salary: Your annual bonus will be a major component of your total earnings.

- Experience and Specialization are Drivers: Your salary will climb steeply as you progress from Analyst to Associate and VP, with specialized skills in areas like AI, cybersecurity, and quantitative analysis commanding a premium.

- Strong Career Outlook: The financial industry's deep reliance on technology ensures a bright and stable future for tech professionals.

For those with the drive to excel in a fast-paced, high-stakes environment, a technology career at Goldman Sachs is an unparalleled opportunity for both professional development and financial success.