Reaching the rank of Managing Director (MD) at a prestigious institution like Goldman Sachs represents the pinnacle of a career in finance. It’s a role synonymous with leadership, influence, and, of course, significant financial reward. For those aspiring to climb the corporate ladder on Wall Street, the question isn't just *if* the compensation is high, but *how* high it can go.

While the path is demanding, the financial outcomes are exceptional, with total compensation packages for Goldman Sachs MDs frequently entering the seven-figure range. This article provides a data-driven deep dive into what a Managing Director earns, the factors that shape their pay, and the career outlook for these elite financial professionals.

What Does a Goldman Sachs Managing Director Do?

A Managing Director at Goldman Sachs is far more than a senior employee; they are a leader responsible for driving business and shaping the firm's strategic direction. This is a high-stakes, high-impact role that typically requires 15-20 years of dedicated industry experience to achieve.

Key responsibilities include:

- Deal Origination and Execution: MDs are the primary "rainmakers." They leverage their extensive networks to source and secure major deals, such as mergers and acquisitions (M&A), initial public offerings (IPOs), or large-scale financing for corporations.

- Client Relationship Management: They are the senior point of contact for the firm’s most important clients, including C-suite executives, institutional investors, and government entities.

- Team Leadership: An MD manages and mentors a team of Vice Presidents, Associates, and Analysts, guiding their professional development and ensuring the flawless execution of projects.

- P&L Responsibility: They are accountable for the profitability of their specific business unit or division, making strategic decisions to maximize revenue and manage risk.

Average Goldman Sachs Managing Director Salary

Understanding compensation for a Goldman Sachs MD requires looking beyond a simple base salary. The total package is a combination of a substantial base salary and a highly variable—and often much larger—annual bonus.

Base Salary:

According to data from salary aggregators, the base salary for a Managing Director at Goldman Sachs typically falls within a specific range.

- Typical Base Salary Range: $400,000 to $750,000 per year.

- Average Base Salary: Data from Glassdoor indicates an average base pay of approximately $498,000 per year for this role, based on user-submitted data.

Annual Bonus and Total Compensation:

The annual bonus is where the compensation package becomes truly significant. This component is directly tied to both individual and firm-wide performance, as well as the overall economic climate. In a strong year, an MD's bonus can be multiple times their base salary.

- Total Compensation Range: When combining base salary and the annual bonus, the total compensation for a Goldman Sachs MD typically ranges from $800,000 to over $2.5 million. Some top performers in highly profitable divisions can earn substantially more.

- Industry reports from sources like eFinancialCareers consistently place average MD-level compensation in the seven figures, highlighting that the bonus makes up the vast majority of the annual take-home pay.

Key Factors That Influence Salary

Compensation for an MD is not one-size-fits-all. Several key factors determine where an individual will fall on the earnings spectrum.

### Level of Education

By the time a professional reaches the MD level, their performance and track record far outweigh their initial educational credentials. However, a top-tier education is often a prerequisite to enter and advance in the competitive world of investment banking. Most MDs hold a bachelor's degree in finance, economics, or a related field. Furthermore, an MBA from an elite business school (such as Wharton, Harvard, or Stanford) is a very common stepping stone, particularly for those transitioning into an Associate role earlier in their career. Certifications like the Chartered Financial Analyst (CFA) are also highly regarded.

### Years of Experience

Experience is arguably the most critical factor. The journey to MD is a marathon, not a sprint, typically following a well-defined path:

1. Analyst (2-3 years)

2. Associate (3-4 years)

3. Vice President (VP) (5-7 years)

4. Managing Director

This progression means an individual promoted to MD already has at least 10-15 years of experience. A newly promoted MD will earn on the lower end of the compensation scale, while a seasoned MD with over 20 years of experience and a powerful client book will command the highest figures.

### Geographic Location

Where you work matters immensely in finance. Compensation is highest in the world’s major financial centers to account for the concentration of deal flow and the high cost of living.

- Top Tier: New York City and London are the epicenters of investment banking, offering the highest compensation packages.

- Other Major Hubs: Locations like Hong Kong, San Francisco (driven by the tech industry), and Tokyo also offer highly competitive pay.

- Regional Offices: MDs in regional offices like Chicago, Houston, or Zurich will still earn substantial salaries, but their total compensation may be slightly lower than that of their counterparts in New York or London. Salary.com data often reflects these geographic pay differentials for senior financial roles.

### Company Type

This article focuses on Goldman Sachs, a "Bulge Bracket" investment bank. This category of bank (which also includes firms like J.P. Morgan and Morgan Stanley) is known for its size, global reach, and wide range of services. Within the high-finance ecosystem, compensation can vary. An MD at an "Elite Boutique" firm (e.g., Evercore, Lazard) may have a lower base salary but could potentially earn a higher bonus in a good year, as these firms often have a different compensation structure. The pay at Goldman Sachs is consistently at the top of the market.

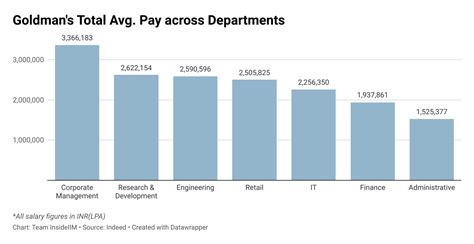

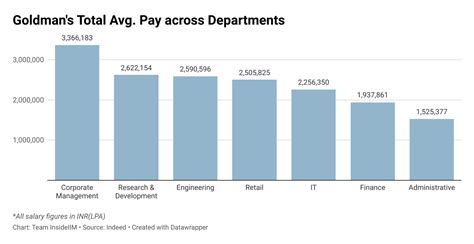

### Area of Specialization

Not all divisions within an investment bank are equally profitable, and this directly impacts MD compensation.

- Mergers & Acquisitions (M&A): This is traditionally one of the most lucrative areas. MDs who lead multi-billion dollar M&A deals generate immense revenue for the firm and are compensated accordingly.

- Sales & Trading: Compensation in this division can be highly volatile. A trader who has an exceptionally profitable year can earn one of the highest bonuses at the firm.

- Capital Markets: MDs in debt or equity capital markets (DCM/ECM) who lead major IPOs or debt issuances are also top earners.

- Wealth Management & Asset Management: While still highly compensated, MDs in these divisions may have a more stable but slightly lower compensation ceiling compared to their M&A or trading counterparts.

Job Outlook

The specific role of a Goldman Sachs MD is not tracked by the U.S. Bureau of Labor Statistics (BLS). However, we can look at the broader category of Financial Managers for a general industry outlook.

According to the BLS Occupational Outlook Handbook, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations. This growth is driven by the need for strategic financial planning and analysis in an increasingly complex global economy.

However, it is crucial to temper this optimistic outlook with realism. The number of MD positions at elite firms like Goldman Sachs is extremely limited, and competition is ferocious. While the industry is growing, securing one of these top-tier roles remains one of the most challenging feats in the professional world.

Conclusion

Pursuing a career path culminating in a Managing Director role at Goldman Sachs is an ambition reserved for the most dedicated, resilient, and talented finance professionals. The journey requires immense personal sacrifice and a sustained high level of performance over decades.

For those who succeed, the rewards are multifaceted. Beyond the extraordinary seven-figure compensation, the role offers the chance to operate at the highest levels of global business and influence market-moving decisions. For any student or professional with their sights set on Wall Street, the Goldman Sachs MD role serves as a powerful reminder of what is possible at the peak of the finance industry.