Decoding the Paycheck: A Deep Dive into the Goldman Sachs Securities Analyst Salary

A career as a securities analyst at a prestigious firm like Goldman Sachs is one of the most sought-after paths in finance. It promises intellectual challenge, high-stakes decision-making, and, of course, significant financial rewards. For those aspiring to enter this elite world, the most pressing question is often: what can you actually expect to earn?

While compensation packages are complex, a first-year analyst at Goldman Sachs can often expect a total compensation package well into the six-figure range, with earnings potential growing exponentially with experience. This article provides a data-driven look into the salary of a Goldman Sachs securities analyst, the key factors that influence your pay, and the long-term outlook for this demanding and rewarding career.

What Does a Goldman Sachs Securities Analyst Do?

Before diving into the numbers, it’s essential to understand the role. A securities analyst, whether on the "buy-side" (managing investments for the firm or its clients) or "sell-side" (providing research and recommendations to external clients), is a financial detective.

Their core responsibilities include:

- Financial Modeling: Building complex spreadsheets to forecast a company's future earnings and valuation.

- In-depth Research: Analyzing industry trends, market conditions, and specific company fundamentals (financial statements, competitive advantages, management quality).

- Generating Insights: Distilling vast amounts of information into a clear investment thesis—a recommendation to buy, sell, or hold a particular security (like a stock or bond).

- Communication: Writing detailed research reports and presenting findings to portfolio managers, traders, or clients to guide their investment strategies.

At a firm like Goldman Sachs, the work is fast-paced, the standards are exceptionally high, and the analysis directly influences transactions worth millions or even billions of dollars.

Average Goldman Sachs Securities Analyst Salary

It is crucial to distinguish between base salary and total compensation. In investment banking and finance, a significant portion of an analyst's earnings comes from an annual performance-based bonus.

- Entry-Level Analyst (First Year): An undergraduate joining Goldman Sachs as an analyst in a major financial hub like New York City can typically expect a base salary between $110,000 and $125,000.

- Performance Bonus: The year-end bonus is highly variable and depends on both individual and firm performance. For a first-year analyst, this can range from $30,000 to over $70,000.

- Total Compensation (First Year): Combining base and bonus, a first-year securities analyst's total compensation often falls in the $140,000 to $200,000+ range.

As analysts gain experience and move up the ladder to roles like Associate and Vice President (VP), both base salaries and, more dramatically, bonuses increase significantly. An experienced VP in the Securities Division can earn a total compensation package that approaches or exceeds seven figures.

*(Salary data is aggregated and synthesized from recent reports on Glassdoor, Salary.com, and Levels.fyi, reflecting 2023-2024 figures.)*

Key Factors That Influence Salary

While the firm's prestige sets a high benchmark, several key factors will determine your specific compensation package.

Level of Education

A bachelor’s degree in finance, economics, accounting, or a STEM field is the standard entry requirement. However, advanced education can provide a direct pathway to a higher-level role. An analyst who pursues a Master of Business Administration (MBA) from a top-tier business school can typically re-enter the firm at the "Associate" level. Associates start with a higher base salary (often $175,000+) and a significantly larger bonus potential than an entry-level analyst. Furthermore, holding a professional designation like the Chartered Financial Analyst (CFA) charter is highly respected and can enhance credibility and long-term earning potential.

Years of Experience

Experience is the single most powerful driver of salary growth in finance. The career ladder at Goldman Sachs is clearly defined, with compensation rising at each rung.

- Analyst (0-3 years): This is the entry-level position post-undergrad. The focus is on learning technical skills and supporting the team.

- Associate (3-6+ years): Typically hired after an MBA or promoted internally. Associates have more responsibility, manage analysts, and have greater client interaction. Their compensation reflects this leap in duties.

- Vice President (VP) and beyond: At this level, you are a senior leader responsible for driving business, managing major client relationships, and developing broad strategies. Compensation becomes heavily weighted towards performance bonuses and long-term incentives.

Geographic Location

Where you work matters immensely. Goldman Sachs has offices globally, but compensation is highest in major financial centers with high costs of living.

- Top-Tier Hubs (New York, London, Hong Kong): These cities command the highest salaries and serve as the benchmark for global compensation.

- Secondary Hubs (Salt Lake City, Dallas): Goldman Sachs has built a significant presence in other domestic cities. While salaries in these locations are lower than in New York, they remain highly competitive for the local market and often provide a better cost-of-living-adjusted income.

Company Type and Division

While this article focuses on Goldman Sachs—a top "bulge bracket" investment bank—it's helpful to know how it compares. Goldman consistently pays at the very top of the market, often exceeding the compensation offered by smaller boutique or regional firms.

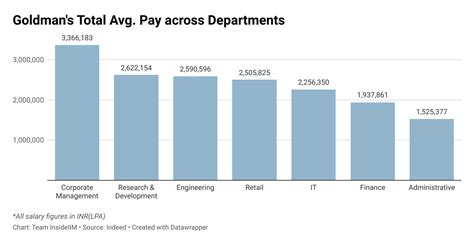

Within Goldman, the specific division also matters. An analyst in the Securities Division (focused on sales, trading, and research) may have a slightly different compensation structure than an analyst in the Investment Banking Division or Asset Management. However, at the junior levels, pay is largely standardized across these front-office roles to attract the best talent.

Area of Specialization

The specific industry or asset class an analyst covers can impact their value and, consequently, their bonus. An analyst specializing in a "hot" and transaction-heavy sector like Technology, Media, & Telecom (TMT) or Healthcare may see higher bonus potential in a given year due to increased deal flow. Likewise, analysts who cover complex financial products like derivatives or structured credit command specialized knowledge that can be highly rewarded.

Job Outlook

The demand for sharp financial minds remains strong. According to the U.S. Bureau of Labor Statistics (BLS), employment for Financial and Investment Analysts is projected to grow 8% from 2022 to 2032, which is much faster than the average for all occupations. The BLS notes that the median annual wage for this category was $96,220 in May 2022.

It's important to note that this BLS figure represents the median for the entire profession across all company types and locations. For a top-tier firm like Goldman Sachs in a major financial hub, the compensation is significantly higher, as detailed above. While the overall field is growing, the competition for roles at elite firms will remain exceptionally fierce.

Conclusion

For ambitious individuals with a passion for the markets and a strong analytical mindset, a career as a securities analyst at Goldman Sachs offers an unparalleled opportunity. While the path is demanding, the rewards are substantial.

Here are the key takeaways:

- Think Total Compensation: Your salary is more than just your base pay; the annual bonus is a major component of your earnings.

- Expect Six Figures Early: Entry-level analysts can realistically expect a total compensation package in the $140,000 to $200,000+ range.

- Growth is Driven by Experience: Your earnings will grow significantly as you climb the ladder from Analyst to Associate to VP.

- Location and Specialization Matter: Working in a top financial hub and covering a high-demand sector can further boost your earning potential.

A role at Goldman Sachs is more than a job; it's an investment in your career. The skills, network, and financial foundation you build can set you up for long-term success, both within the firm and beyond.