Earning a $50,000 salary is a significant milestone that places you near the national median for individual earners. For many, reaching this income level sparks a crucial question: Is this enough to buy a home? The answer is a resounding "it depends," but with careful planning and a deep understanding of the factors at play, homeownership can absolutely be within reach.

This guide will break down exactly what a $50,000 salary means for your home-buying power, explore the key variables that will determine your budget, and provide the data-driven insights you need to turn your homeownership dream into a reality.

What Does a $50k Salary Mean for Homeownership?

A $50,000 annual salary breaks down to approximately $4,167 in gross monthly income. Lenders use this figure as the starting point to determine your borrowing capacity. They primarily rely on two core principles:

1. The 28% Rule (Front-End Ratio): This is a widely accepted guideline suggesting that your total monthly housing payment should not exceed 28% of your gross monthly income. This payment, often abbreviated as PITI, includes Principal, Interest, Taxes, and Insurance.

2. The 36% Rule (Back-End Ratio or Debt-to-Income): This rule states that your total monthly debt payments—including your potential mortgage, car loans, student loans, and credit card payments—should not exceed 36% of your gross monthly income.

For a $50k salary, the math looks like this:

- Maximum Monthly Housing Payment (28% Rule): $4,167 x 0.28 = $1,167

- Maximum Total Debt Payment (36% Rule): $4,167 x 0.36 = $1,500

This means that after accounting for all your other debts, your target PITI should ideally be at or below $1,167 per month.

Calculating Your Home-Buying Budget on a $50k Salary

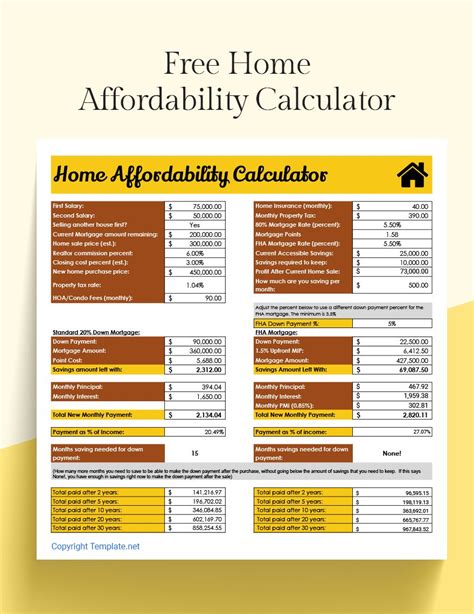

Based on the $1,167 monthly payment guideline, we can estimate a potential home price. Assuming a 30-year fixed-rate mortgage, here’s a sample calculation:

- Monthly PITI: $1,167

- Less Estimated Taxes & Insurance: -$350 (This varies wildly by location, but is a reasonable estimate)

- Remaining for Principal & Interest: $817

With an interest rate of 7.0% (a common rate in 2023-2024), a monthly payment of $817 for principal and interest could support a mortgage of approximately $123,000.

If you have a 20% down payment ($30,750), you could afford a home priced around $154,000. If you use an FHA loan with a 3.5% down payment ($4,450), you could afford a home priced around $127,000, but you would also have to pay Private Mortgage Insurance (PMI), which would increase your monthly cost.

This is a baseline. Now, let's explore the factors that will dramatically shift this number up or down.

Key Factors That Influence Your Home Affordability

### 1. Your Debt-to-Income (DTI) Ratio

This is the single most important factor after your income. Lenders scrutinize your DTI to gauge your ability to manage monthly payments. A $500 monthly car and student loan payment significantly impacts your budget.

- Low Debt Scenario: If your non-housing debt is only $150/month, your DTI is low. You have $1,350 ($1,500 max - $150 debt) available for a housing payment, potentially qualifying you for a larger loan.

- High Debt Scenario: If your non-housing debt is $600/month, you only have $900 ($1,500 max - $600 debt) left for housing. This will reduce your maximum affordable home price significantly.

### 2. Your Down Payment and Savings

Your down payment directly impacts your loan size and monthly payment. While 20% is the traditional goal to avoid PMI, many loan programs require less.

- Conventional Loans: Can be secured with as little as 3% down.

- FHA Loans: Require a minimum of 3.5% down.

- VA and USDA Loans: May require 0% down for eligible borrowers.

A larger down payment not only reduces your monthly mortgage payment but also demonstrates financial stability to lenders, potentially securing you a better interest rate. Don't forget to budget for closing costs, which typically run 2-5% of the home's purchase price.

### 3. Geographic Location

Location is perhaps the most powerful variable. A $50,000 salary provides vastly different purchasing power across the United States.

- High Cost-of-Living (HCOL) Areas: In states like California, Hawaii, or Massachusetts, where the median home price can exceed $700,000, affording a home on a $50k salary alone is extremely challenging, if not impossible.

- Low Cost-of-Living (LCOL) Areas: According to the National Association of Realtors (NAR), the median sales price of existing homes in the Midwest and South was $304,600 and $392,300, respectively, in the first quarter of 2024. In states like West Virginia, Mississippi, or Arkansas, the median prices are even lower, making a home in the $125,000 - $175,000 range a realistic goal.

### 4. Interest Rates and Loan Type

The interest rate you secure has a massive impact on your monthly payment. A single percentage point can change your purchasing power by tens of thousands of dollars over the life of a loan. Your credit score is the primary driver of your interest rate. A higher score (740+) typically qualifies you for the best rates.

The type of loan (e.g., FHA, Conventional, VA) will also influence your costs, down payment requirements, and insurance obligations.

### 5. Taxes, Insurance, and HOA Fees

Your housing payment isn't just principal and interest. Property taxes and homeowners' insurance (the "TI" in PITI) are significant recurring costs that vary by state, county, and even neighborhood. Furthermore, if you buy a condominium or a home in a planned community, you may have to pay a Homeowners' Association (HOA) fee, which can range from under $100 to over $500 per month and counts toward your DTI.

Job Outlook for Careers Earning Around $50k

To sustain a mortgage, you need stable employment. Fortunately, many stable and growing professions have median salaries in the $50,000 range. According to the U.S. Bureau of Labor Statistics (BLS), here are a few examples:

- Bookkeeping, Accounting, and Auditing Clerks: The 2023 median pay was $47,490 per year. While the field is projected to decline slightly, the large number of positions ensures consistent openings.

- Administrative Assistants and Executive Assistants: The 2023 median pay was $45,550 per year, with a projected decline of 6% through 2032. However, this remains a massive occupational field with high turnover creating opportunities.

- Skilled Trades: Many skilled trades like painters, flooring installers, and certain types of technicians have median salaries in the $45k-$60k range, with many projected to see stable or growing demand.

Earning a $50k salary places you in a solid position within many of these essential, in-demand career fields across the country.

Conclusion

So, how much house can you afford with a $50k salary? The answer is likely a home in the $125,000 to $180,000 range, but this is highly dependent on the key factors discussed.

Here are your key takeaways:

1. Know Your Numbers: Your DTI ratio and credit score are paramount. Work on paying down high-interest debt and improving your credit score before you apply.

2. Saving is Power: A larger down payment significantly increases your affordability and reduces long-term costs.

3. Location is Everything: Be realistic about where you can afford to buy. Your $50k salary goes much further in the Midwest or parts of the South than on the coasts.

4. Look Beyond the Sticker Price: Always factor in PITI and potential HOA fees to understand your true monthly housing cost.

5. Get Pre-Approved: The best way to get a definitive answer is to talk to a lender. A mortgage pre-approval will give you a concrete budget based on your specific financial profile, empowering you to shop with confidence.

With a strategic approach and a clear understanding of your finances, a $50,000 salary can be the foundation upon which you build your dream of homeownership.