Understanding your financial growth trajectory is one of the most empowering skills a professional can possess. While a bigger paycheck is always welcome, knowing how to analyze your salary increase in percentage terms provides crucial context. It tells you whether you're outpacing inflation, being rewarded for your contributions, or simply keeping up with the market. This guide will not only teach you the simple math behind the calculation but also delve into the critical factors that determine the size of your raise, helping you advocate for the compensation you deserve.

Why Calculating Your Salary Increase Percentage Matters

At its core, calculating your salary increase percentage is a way of measuring your financial progress. It's not just a number; it's a key performance indicator (KPI) for your career. This simple calculation allows you to:

- Benchmark Against Averages: Understand how your raise compares to national and industry averages.

- Assess Real-Term Growth: Determine if your raise outpaces inflation, meaning your purchasing power is actually increasing.

- Evaluate Your Value: A percentage provides a standardized measure of how your employer is valuing your increased skills and contributions year-over-year.

- Negotiate Effectively: Walking into a performance review armed with data is far more effective than simply asking for "more money."

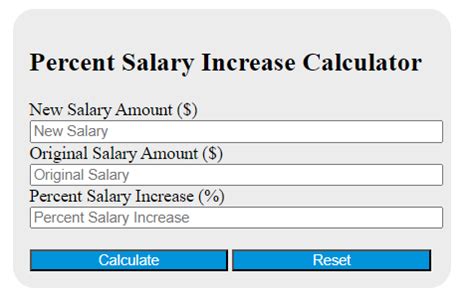

Before you can analyze your raise, you need to calculate it. The formula is straightforward:

The Salary Increase Percentage Formula:

`((New Salary - Old Salary) / Old Salary) * 100 = Salary Increase Percentage`

Example:

- Your old salary was $70,000.

- You received a raise, and your new salary is $73,500.

Calculation:

1. Subtract the old salary from the new salary: `$73,500 - $70,000 = $3,500`

2. Divide the difference by the old salary: `$3,500 / $70,000 = 0.05`

3. Multiply by 100 to get the percentage: `0.05 * 100 = 5%`

In this scenario, you received a 5% salary increase.

Understanding Average Salary Increases: The National Landscape

Now that you have your percentage, you need context. Is a 5% raise good? The answer depends on the economic climate and industry standards.

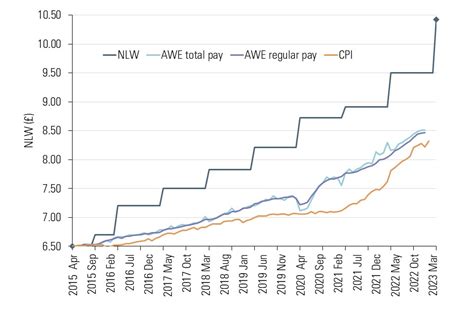

According to projections from the consulting firm Willis Towers Watson (WTW), U.S. employers are budgeting for an average salary increase of 4.0% in 2024. This figure has remained relatively high compared to pre-pandemic years, driven by a competitive labor market and inflation.

It's important to distinguish between different types of raises:

- Cost-of-Living Adjustments (COLA): These are not merit-based. They are given to help employees' purchasing power keep up with inflation, as measured by the Consumer Price Index (CPI) from the U.S. Bureau of Labor Statistics (BLS). If your raise only matches inflation, you haven't received a "real" raise in terms of increased earning power.

- Merit Increases: This is the most common type of raise, tied directly to your performance and contributions over the past year. High-performing employees typically receive a significantly higher percentage than average or low performers.

- Promotional Increases: When you are promoted to a role with greater responsibility, the accompanying salary increase is typically much larger, often in the 10-20% range, according to data from sources like Salary.com.

Key Factors That Influence Your Salary Increase

Your raise percentage isn't random. It's determined by a combination of factors related to your performance, your company's health, and the broader market.

### Performance and Contributions

This is the single most important factor you can control. Companies explicitly budget to reward their top talent. According to WTW data, companies consistently allocate a larger share of their budget to top performers. An employee rated as "high-performing" might receive an increase of 5.5% or more, while an average-performing employee might receive 3.5%, and a low-performer may receive little to nothing. To maximize this, diligently document your achievements, quantify your impact on projects, and be prepared to discuss how you have exceeded expectations.

### Experience and Tenure

Seniority plays a dual role. More experienced professionals command higher base salaries and are often seen as more critical to the business, justifying larger merit increases. However, external market data often shows that employees who switch companies every few years see larger overall salary jumps than those who stay with one employer for a long time. This is because external hires are brought in at the current, often inflated, market rate. If you've been with a company for a long time, it's crucial to ensure your raises are keeping you competitive with the external market.

### Geographic Location

Where you live and work has a major impact on your pay and the size of your raise. A role in a high-cost-of-living (HCOL) area like San Francisco or New York City will have a higher salary base than the same role in a low-cost-of-living (LCOL) area. Salary aggregators like Payscale and Glassdoor provide detailed location-based salary calculators. Companies often adjust their salary increase budgets based on local market conditions and competition for talent. A hot tech hub may see higher average raises than a region with a less dynamic job market.

### Company and Industry Performance

Your company can't give what it doesn't have. The financial health of your employer and the growth of your industry are huge determining factors. A tech or biotech company that just had a record-breaking year is in a much better position to offer generous raises than a manufacturing company facing declining sales. Research your company's public financial reports (if applicable) and stay informed about your industry's overall health through trade publications and market reports.

### Market Rate and Specialization

Is your role in high demand? Niche specializations with a limited talent pool (like AI/machine learning, cybersecurity, or specialized healthcare roles) have significant leverage. To justify a raise that exceeds the company average, you must benchmark your salary against the current market rate for your specific job title, experience level, and location. Use the salary tools on Salary.com, Glassdoor, and Payscale to gather this data. If you can demonstrate that you are being paid below the market median, you have a powerful, data-driven case for a significant adjustment.

Job Outlook and Salary Negotiation

The overall job market provides the backdrop for all salary negotiations. The BLS projects that total employment will grow by 3% from 2022 to 2032, adding 4.7 million new jobs. However, growth is not uniform across all professions. Occupations in healthcare, renewable energy, and data science are projected to grow much faster than average.

A strong job market with low unemployment puts upward pressure on wages and gives employees more leverage. When companies are competing for talent, they are more willing to offer larger raises to retain their best people. Use this to your advantage by being prepared, professional, and confident in your negotiation.

Conclusion: Take Control of Your Earning Potential

Working out your salary increase percentage is the first step toward taking strategic control of your career finances. It transforms a subjective feeling about your pay into an objective data point you can use to measure your progress and advocate for your worth.

Key Takeaways:

- Do the Math: Use the simple formula to calculate your percentage increase.

- Know the Averages: Benchmark your raise against national data (~4.0% for 2024) to understand where you stand.

- Build Your Case: Your strongest arguments for a significant raise are rooted in your quantifiable performance, the external market rate for your role, and your company's ability to pay.

- Negotiate with Data: Replace emotion with evidence from sources like the BLS, Payscale, and Glassdoor to build a compelling case.

By understanding these dynamics, you shift from being a passive recipient of a yearly raise to an active participant in shaping your financial future.