Considering a career as an insurance adjuster? You're likely drawn to a profession that is stable, challenging, and essential to the economy. But beyond the day-to-day responsibilities, a key question for any prospective professional is: What is the earning potential?

The answer is promising. A career as an insurance adjuster offers a competitive salary that can grow substantially with experience, specialization, and strategic career moves. While the national average hovers around a very respectable $76,000 per year, it's not uncommon for seasoned, specialized professionals to earn well into the six figures.

This article will break down everything you need to know about an insurance adjuster's salary, from the national averages to the key factors you can leverage to maximize your income.

What Does an Insurance Adjuster Do?

Before we dive into the numbers, it's important to understand the role. An insurance adjuster, often called a claims adjuster, is essentially a professional investigator for the insurance industry. When a customer files a claim for a loss (like a car accident, property damage from a storm, or a workplace injury), the adjuster steps in to manage the process.

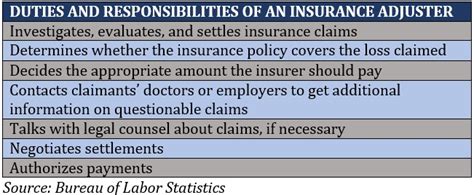

Their core responsibilities include:

- Investigating the circumstances surrounding a claim.

- Evaluating the damage and determining the extent of the insurance company's liability.

- Negotiating with the policyholder, contractors, and legal representatives.

- Settling the claim and authorizing payment.

It's a role that requires a unique blend of analytical thinking, empathy, attention to detail, and strong negotiation skills.

Average Insurance Adjuster Salary

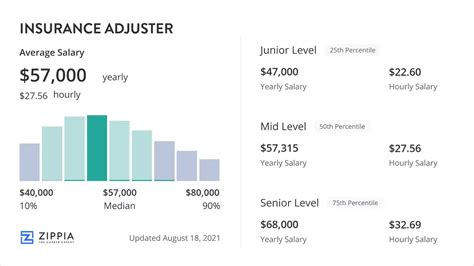

When looking at salary data, it's best to consult multiple sources to get a complete picture. Here’s how the numbers break down for claims adjusters, appraisers, examiners, and investigators.

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS), the median annual wage for claims adjusters was $76,170 in May 2023. This "median" figure means that half of all adjusters earned more than this amount and half earned less.

The BLS also provides a look at the broader salary spectrum:

- Lowest 10% earned: Less than $49,490

- Highest 10% earned: More than $110,630

Salary aggregator websites, which collect user-reported data, provide similar insights and often reflect total compensation, including bonuses:

- Salary.com reports that the typical salary range for an insurance adjuster in the U.S. falls between $67,951 and $86,306.

- Payscale shows a clear progression with experience, indicating an average base salary of around $62,000, with significant growth potential over a professional's career.

- Glassdoor places the average base pay at $68,000, with total pay rising to approximately $75,000 when additional compensation like bonuses and profit-sharing is included.

Key Factors That Influence Salary

Your salary isn't just one static number. It's a dynamic figure influenced by several critical factors. Understanding these can help you chart a path toward higher earnings.

### Level of Education

While a bachelor's degree is not a strict requirement to enter the field—the BLS notes that a high school diploma is the typical entry-level education—it is often preferred by major insurance carriers and can lead to a higher starting salary. Degrees in business, finance, or a related field are particularly valuable.

More important than a degree, however, are licensing and certifications. Most states require adjusters to be licensed, which involves completing a pre-licensing course and passing an exam. Earning professional designations, such as the Associate in Claims (AIC) or the prestigious Chartered Property Casualty Underwriter (CPCU), demonstrates a high level of expertise and can significantly boost your earning potential and career opportunities.

### Years of Experience

Experience is one of the most significant drivers of an adjuster's salary. As you gain expertise in evaluating complex claims, navigating policy language, and negotiating settlements, your value to an employer skyrockets.

Here's a typical career progression, based on data from Payscale and industry observations:

- Entry-Level (0-2 years): In this stage, you're learning the ropes. Expect a salary in the range of $50,000 to $60,000 as you handle simpler, lower-value claims.

- Mid-Career (3-9 years): With solid experience, you'll be trusted with more complex cases. Your salary can grow into the $65,000 to $85,000 range.

- Senior/Experienced (10+ years): Senior adjusters, team leads, and managers who handle large, complex, or litigated claims often earn $90,000+, with top performers easily surpassing the $100,000 mark.

### Geographic Location

Where you work matters. Salaries for insurance adjusters vary significantly by state and even by metropolitan area due to differences in the cost of living, demand, and the frequency of claims (e.g., in areas prone to natural disasters).

According to BLS data, the top-paying states for claims adjusters include:

1. District of Columbia: $97,950 (Annual Mean Wage)

2. Connecticut: $93,310

3. New Jersey: $92,020

4. Maryland: $90,120

5. Washington: $88,290

Conversely, states with a lower cost of living may offer salaries below the national average, but your purchasing power could still be very strong.

### Company Type

The type of adjuster you are also plays a massive role in your compensation structure.

- Staff Adjusters: These professionals are salaried employees who work directly for a single insurance company (e.g., State Farm, Allstate, Progressive). They receive a steady paycheck, benefits, and a predictable work schedule. This path offers stability and is great for long-term career growth within a corporate structure.

- Independent Adjusters: These adjusters work for independent firms that are hired by insurance carriers on a contract basis, often to handle catastrophic events or during periods of high claim volume. While their income can be less predictable, their earning potential is often much higher. During a busy hurricane season, for example, an independent "CAT" (catastrophe) adjuster can earn a six-figure income in just a few months.

- Public Adjusters: A smaller group, public adjusters are hired by policyholders (the public) to help them navigate their claim and negotiate with the insurance company. They work on a fee basis, typically a percentage of the final settlement, which can be very lucrative on large claims.

### Area of Specialization

Not all claims are created equal. Specializing in high-value or complex fields is a direct path to a higher salary.

- Standard Claims (Auto, Homeowners): These are the most common roles and tend to follow the standard salary ranges.

- Catastrophe (CAT) Adjusting: As mentioned, CAT adjusters who travel to disaster zones command very high day rates and have immense earning potential due to the high demand and difficult working conditions.

- Large Loss / Commercial Claims: Adjusters who handle claims for businesses, such as fire damage to a factory or major liability cases, require deep expertise. These roles are among the highest-paid in the industry.

- Niche Specialties: Fields like marine insurance (cargo ships), aviation insurance, and cyber insurance are highly specialized and well-compensated due to the unique knowledge required.

Job Outlook

The career outlook for insurance adjusters is stable. The BLS projects a decline of 3 percent in employment from 2022 to 2032. However, this figure needs context. Much of this slight decline is attributed to automation and AI, which are beginning to handle very simple, low-value claims.

The need for skilled human adjusters to investigate complex scenarios, evaluate nuanced damage, and negotiate face-to-face is not going away. Furthermore, with a significant portion of the current workforce nearing retirement, there will be consistent demand for new talent to fill these essential roles.

Conclusion

A career as an insurance adjuster offers a clear and attainable path to a strong, upper-middle-class income and beyond. While the national median salary of $76,170 is an attractive starting point, it is far from the ceiling.

Your ultimate earning potential is in your hands. By pursuing continuous education and certifications, gaining valuable experience, and strategically choosing your location and area of specialization, you can build a financially rewarding career. For individuals who are analytical, detail-oriented, and thrive on solving complex problems, becoming an insurance adjuster is a professional path well worth investigating.