Considering a career as an insurance claim adjuster? You're exploring a dynamic, challenging, and essential profession that serves as the backbone of the insurance industry. It’s a role that demands a unique blend of investigation, negotiation, and empathy. But beyond the job description, a crucial question arises: What is the earning potential?

The good news is that a career as an insurance claim adjuster offers a stable and often lucrative path. With a median salary well above the national average for all occupations, and significant room for growth, this profession can provide a rewarding financial future. In this comprehensive guide, we'll break down everything you need to know about insurance claim adjuster salaries, from national averages to the key factors that can significantly increase your income.

What Does an Insurance Claim Adjuster Do?

Before we dive into the numbers, it's important to understand the role. Insurance claim adjusters—also known as claims examiners or investigators—are the professionals who evaluate insurance claims to determine the liability and value of a loss for the insuring company.

In essence, they are investigators, analysts, and customer-facing negotiators all in one. Their daily responsibilities can include:

- Inspecting property damage (homes, vehicles, commercial buildings).

- Interviewing claimants and witnesses.

- Consulting with experts like mechanics, contractors, or medical professionals.

- Reviewing police or hospital records.

- Analyzing the details of an insurance policy to determine coverage.

- Negotiating settlements and authorizing payments.

Their work is critical in helping individuals and businesses recover from unexpected events, making it a career with a tangible impact.

Average Insurance Claim Adjuster Salary

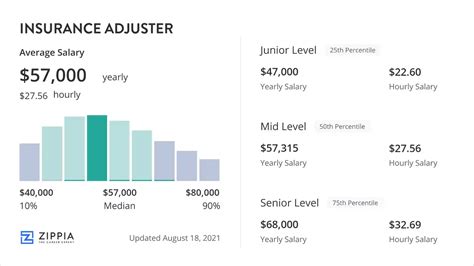

The salary for an insurance claim adjuster is competitive, reflecting the skill and responsibility required for the role.

According to the most recent data from the U.S. Bureau of Labor Statistics (BLS), the median annual wage for "Claims Adjusters, Appraisers, Examiners, and Investigators" was $76,170 in May 2023. This figure represents the midpoint—half of all adjusters earned more than this, and half earned less.

To provide a fuller picture, the BLS also reports a wide salary range:

- Lowest 10%: Earned less than $49,480

- Median (50%): $76,170

- Highest 10%: Earned more than $112,870

Data from reputable salary aggregators reinforces this, offering slightly different perspectives:

- Salary.com places the average U.S. salary for a Claims Adjuster I (entry-level) around $65,110, while a Claims Adjuster III (senior) averages $83,235, with top earners exceeding $95,000.

- Glassdoor reports a total pay average of around $74,000 per year, which includes an estimated base pay and additional compensation like bonuses or profit sharing.

- Payscale notes an average base salary of approximately $62,000, with significant salary growth based on experience.

This data clearly shows that while entry-level positions offer a solid starting wage, there is substantial potential for six-figure earnings as you advance in your career.

Key Factors That Influence Salary

Your salary isn't set in stone. Several key factors can dramatically impact your earning potential. Understanding these variables is crucial for anyone looking to maximize their income in this field.

### Level of Education

While a bachelor's degree is not always a strict requirement for entry-level positions, it is increasingly becoming the standard, especially at major insurance carriers. A degree in business, finance, or a related field can give you a competitive edge and potentially a higher starting salary. For highly complex roles, such as commercial liability or litigation adjustment, some employers may prefer candidates with a legal background, such as a Juris Doctor (J.D.) degree, which commands a significant salary premium.

### Years of Experience

Experience is arguably the most significant driver of salary growth for a claims adjuster. The profession relies on a deep well of practical knowledge that can only be built over time.

- Entry-Level (0-2 years): In this stage, you're learning the fundamentals of policy interpretation, investigation techniques, and estimation software. Salaries typically fall in the $55,000 to $68,000 range.

- Mid-Career (3-9 years): With several years of experience, adjusters can handle more complex claims with greater autonomy. Their salaries often climb into the $68,000 to $85,000 range. They may also begin to specialize.

- Senior/Expert (10+ years): Senior adjusters, team leads, and managers have extensive experience and often handle the largest, most complex claims (e.g., major commercial property fires, multi-million dollar liability cases). Their earnings can easily push into the $90,000 to $115,000+ range.

### Geographic Location

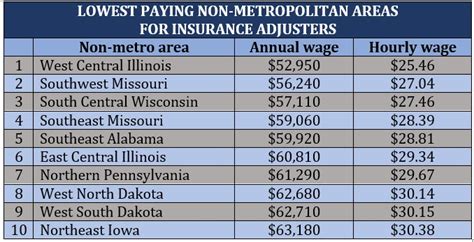

Where you work matters. Salaries for claims adjusters vary significantly based on state and metropolitan area, primarily due to differences in the cost of living and market demand. According to BLS data, the top-paying states for claims adjusters include:

- District of Columbia: $97,520 (annual mean wage)

- New Jersey: $94,000

- Connecticut: $90,740

- Washington: $88,710

- New York: $88,510

Conversely, states with a lower cost of living may offer salaries below the national median. It's always wise to research the specific market you plan to work in.

### Company Type

The type of adjuster you are also plays a massive role in your compensation structure and potential.

- Staff Adjuster: These professionals are salaried employees who work for a single insurance company (e.g., Allstate, Progressive, State Farm). They receive a steady paycheck, benefits, and company resources. Their salary falls within the traditional ranges mentioned above.

- Independent Adjuster: These are freelancers or contractors who work for multiple insurance companies or third-party administration (TPA) firms. They are often paid a fee based on a percentage of the claim's value. This model offers tremendous earning potential, especially for Catastrophe (CAT) Adjusters who travel to disaster zones (hurricanes, floods, wildfires). A successful independent CAT adjuster can earn well into six figures in a single busy season, though their income is less stable and they are responsible for their own benefits, licensing, and business expenses.

### Area of Specialization

Not all claims are created equal. Specializing in complex or high-value areas is a direct path to a higher salary.

- Auto Claims: Often the entry point for many adjusters. These are typically lower-complexity and higher-volume, with salaries aligning with the lower-to-mid end of the national average.

- Property Claims (Residential & Commercial): Adjusting claims for homes and especially large commercial buildings requires more technical expertise and can command higher pay.

- Workers' Compensation: This specialty involves navigating medical treatment plans, disability regulations, and return-to-work programs, offering strong salary potential.

- General Liability & Bodily Injury: These complex claims involve investigating accidents and injuries, assessing liability, and can lead to very high-value settlements. Adjusters with expertise in this area are highly compensated.

Job Outlook

The career outlook for claims adjusters is nuanced. The BLS projects a 3 percent decline in employment for this profession from 2022 to 2032. However, this statistic requires context.

The projected decline is largely driven by the increasing use of technology and AI to automate the processing of simple, low-value claims (e.g., minor auto-glass damage). At the same time, the need for skilled, experienced human adjusters will remain strong. Complex claims involving major property damage, severe bodily injury, or intricate business interruptions will always require the critical thinking, negotiation, and judgment of a professional. Therefore, while the total number of jobs may slightly decrease, the demand for high-quality, specialized talent is expected to remain robust.

Conclusion

A career as an insurance claim adjuster offers a stable and financially rewarding path for individuals with strong analytical, investigative, and interpersonal skills. While the national median salary of $76,170 is an attractive starting point, your true earning potential is in your hands.

To build a lucrative career, prospective and current adjusters should focus on:

- Gaining Experience: Patiently build your skills and take on increasingly complex claims.

- Pursuing Specialization: Target high-value areas like commercial property, general liability, or catastrophe claims.

- Understanding Your Market: Be aware of the salary norms in your geographic location and the different pay structures between staff and independent roles.

- Committing to Lifelong Learning: Stay current with industry regulations, estimation software, and investigation techniques.

By strategically navigating these factors, you can transform a solid job into an exceptionally successful and well-compensated career.