Considering a career as a claim adjuster? You're exploring a field known for its stability, engaging challenges, and significant earning potential. For those with a keen eye for detail and strong negotiation skills, this path offers a rewarding financial future. But what can you actually expect to earn?

This comprehensive guide will break down the typical claim adjuster salary, exploring the key factors that can increase your pay and providing a clear look at the future of the profession. On average, you can expect a median salary of over $76,000 per year, with top earners bringing in well over six figures. Let's dive into the details.

What Does a Claim Adjuster Do?

Before we talk numbers, it’s important to understand the role. A claim adjuster, sometimes called a claims examiner or investigator, is a critical link between an insurance company and a policyholder who has filed a claim. Their primary job is to investigate insurance claims to determine the extent of the insurance company's liability.

Key responsibilities include:

- Inspecting property damage (homes, vehicles, etc.)

- Interviewing claimants and witnesses

- Reviewing police reports, medical records, and other documents

- Evaluating the validity and value of a claim

- Negotiating settlements with policyholders or their lawyers

- Authorizing payments

In short, they ensure that claims are processed fairly, ethically, and in accordance with the policyholder's contract.

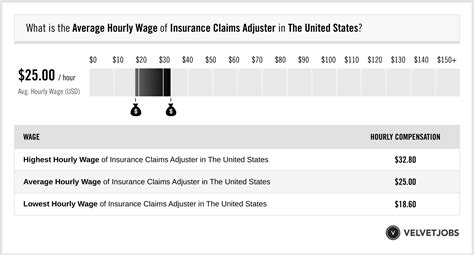

Average Claim Adjuster Salary

The salary for a claim adjuster is competitive and varies based on several factors. To provide the most accurate picture, we've compiled data from several authoritative sources.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Claims Adjusters, Appraisers, Examiners, and Investigators was $76,170 as of May 2023. This is a strong median that sits comfortably above the national average for all occupations.

However, a single number doesn't tell the whole story. The salary range is quite broad:

- The lowest 10 percent earned less than $48,970. This typically represents entry-level or trainee positions.

- The highest 10 percent earned more than $111,040. This reflects senior-level adjusters, specialists, and managers.

Reputable salary aggregators provide similar data, offering a real-time pulse on the market.

- Salary.com reports a median salary for a Claims Adjuster I (entry-level) at around $62,778, while a Claims Adjuster III (senior) has a median of $81,591, with many earning closer to $100,000.

- Glassdoor lists a total pay average of $73,618 per year for claims adjusters in the United States, which includes base salary and potential additional compensation like bonuses.

Key Factors That Influence Salary

Your specific salary will be determined by a combination of factors. Understanding these variables is the key to maximizing your earning potential throughout your career.

### Level of Education

While a bachelor’s degree is not always a strict requirement, it is increasingly preferred by major insurance companies and can directly impact your starting salary and long-term career trajectory. The BLS notes that a high school diploma is the typical entry-level education, but employers often hire candidates with a degree in business, finance, or a related field.

More importantly, licensing and certifications are crucial. Most states require adjusters to be licensed, which involves completing pre-licensing courses and passing a state exam. Holding multiple state licenses or advanced certifications, such as the Chartered Property Casualty Underwriter (CPCU) designation, can significantly boost your value and salary.

### Years of Experience

Experience is one of the most significant drivers of salary growth in this profession. As you gain expertise in evaluating complex claims and negotiating settlements, your value to an employer skyrockets.

- Entry-Level (0-2 years): Expect to start in the $50,000 to $65,000 range. You'll likely work under close supervision as a trainee, learning the fundamentals of claim investigation and company procedures.

- Mid-Career (3-9 years): With a solid track record, your salary can climb into the $65,000 to $85,000 range. At this stage, you'll handle more complex claims with greater autonomy.

- Senior/Experienced (10+ years): Highly experienced adjusters, especially those in management or specialized roles, regularly earn $85,000+, with many exceeding $100,000 per year.

### Geographic Location

Where you work matters. Salaries for claim adjusters vary widely by state and even by metropolitan area, often due to differences in the cost of living, demand for adjusters, and the frequency of claims (e.g., in areas prone to natural disasters).

According to BLS data, the top-paying states for claim adjusters include:

- New Jersey: $94,420 (annual mean wage)

- Connecticut: $92,020

- District of Columbia: $91,660

- Maryland: $89,390

- New York: $86,470

Conversely, salaries tend to be lower in states with a lower cost of living and less claim activity.

### Company Type

The type of adjuster you are also plays a major role in your compensation structure.

- Staff Adjusters: These professionals work directly for a single insurance company (e.g., State Farm, Allstate, Progressive). They receive a set salary, have a predictable workflow, and typically get excellent benefits, including health insurance, retirement plans, and paid time off.

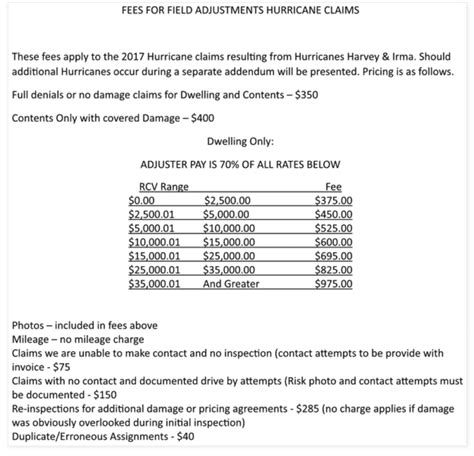

- Independent Adjusters: These adjusters work as contractors for multiple insurance companies or third-party administration (TPA) firms. Their income is often based on a fee schedule, typically a percentage of the claim settlement. While this can lead to less predictable income, it also offers significantly higher earning potential. Experienced independent adjusters who are willing to travel can earn well over $100,000, especially when working on major catastrophic events.

### Area of Specialization

Not all claims are created equal. Specializing in complex or high-stakes areas can lead to a more lucrative career.

- Property Claims: Adjusters handling claims for homes and commercial buildings often earn more due to the complexity and high value of the properties.

- Casualty/Liability Claims: These involve investigating claims of injury or negligence and can be very complex, often commanding higher salaries.

- Workers' Compensation: This is a highly specialized field requiring deep knowledge of state laws and medical issues.

- Catastrophe (CAT) Adjusting: This is arguably the most high-paying specialization. CAT adjusters are deployed to areas hit by natural disasters like hurricanes, tornadoes, or wildfires. They work long hours under intense pressure, but their compensation reflects this. It's not uncommon for a dedicated CAT adjuster to earn a six-figure income in just 6-9 months of work.

Job Outlook

The career outlook for claim adjusters is stable. According to the U.S. Bureau of Labor Statistics, employment for claims adjusters is projected to decline 4 percent from 2022 to 2032.

However, it's crucial to interpret this statistic with context. While automation and software are making the claims process more efficient, the need for human oversight, investigation, and negotiation—especially on complex claims—remains essential. The BLS still projects about 23,600 openings for claims adjusters each year, on average, over the decade. Most of these openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

This means that while the overall number of jobs may slightly decrease, there will continue to be consistent demand for skilled, licensed, and dedicated professionals.

Conclusion

A career as a claim adjuster offers a clear path to a comfortable and rewarding financial future. With a median salary well above the national average and significant room for growth, it's an excellent choice for detail-oriented problem-solvers.

Key Takeaways:

- The median national salary is strong, around $76,170, with top earners exceeding $111,000.

- Your salary is not fixed; it is directly influenced by your experience, location, education, and specializations.

- Pursuing certifications (like the CPCU) and gaining experience in high-demand areas like catastrophe or property claims can dramatically increase your earnings.

- Whether you prefer the stability of a staff adjuster or the high earning potential of an independent adjuster, there is a path for you.

For anyone looking for a stable career where expertise is financially rewarded, becoming a claim adjuster is a path well worth investigating.