For ambitious students and young professionals in finance, a career in investment banking represents a pinnacle of achievement. It's a world defined by high-stakes deals, immense responsibility, and, most notably, extraordinary financial rewards. But what does that compensation truly look like? The query "investment banking analyst salary" reveals a complex and lucrative picture far beyond a simple annual figure.

This article will break down the components of an investment banking analyst's compensation, explore the key factors that dictate their earnings, and provide a realistic outlook on this demanding yet rewarding career path. In your first year alone, total compensation can often range from $180,000 to over $225,000, making it one of the highest-paying entry-level professions in the world.

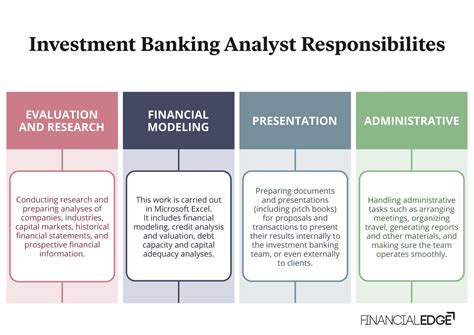

What Does an Investment Banking Analyst Do?

Before diving into the numbers, it's essential to understand the role. Investment banking analysts are the workhorses of the banking world. They are typically recent university graduates who join a bank for a two-to-three-year program. Their primary function is to support senior bankers in providing advisory services to corporations, governments, and other institutions.

Key responsibilities include:

- Financial Modeling: Building complex spreadsheets to forecast a company's financial performance and value it for potential mergers, acquisitions, or IPOs.

- Valuation Analysis: Using various methodologies like Discounted Cash Flow (DCF), Comparable Company Analysis (CCA), and Precedent Transactions to determine a company's worth.

- Creating Pitchbooks: Developing extensive presentations and marketing materials to pitch deal ideas to current and prospective clients.

- Performing Due Diligence: Meticulously researching a company's financial health, operational stability, and market position ahead of a transaction.

Analysts are at the epicenter of major corporate decisions, requiring intense analytical rigor, attention to detail, and a famously demanding work ethic.

Average Investment Banking Analyst Salary

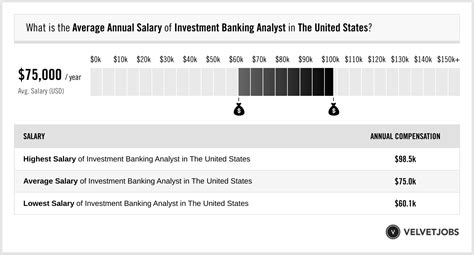

An investment banking analyst's compensation is not a single number but a combination of two key components: a base salary and a performance-based bonus. This distinction is critical to understanding their total earnings.

- Base Salary: For a first-year analyst in a major financial hub like New York City, the base salary has steadily climbed in recent years. According to data from Glassdoor and industry reports from sources like Wall Street Oasis, a first-year analyst can expect a base salary between $100,000 and $125,000.

- Performance Bonus: The bonus is the variable component that makes investment banking so lucrative. It is paid out at the end of the year and is based on both individual and firm-wide performance. For a first-year analyst, this bonus can range from $70,000 to over $100,000.

- Total Compensation: When combined, the total first-year compensation package typically falls in the $180,000 to $225,000+ range. As noted by Salary.com, the median total cash compensation for a Level I Investment Banking Analyst is around $196,590, though this can vary significantly based on the factors below.

This figure grows with each year in the analyst program. A second-year analyst might see their base rise to $125,000-$150,000, with a bonus that pushes their total compensation well over $250,000.

Key Factors That Influence Salary

Not all investment banking analyst roles are created equal. Several factors can significantly impact earning potential, from where you work to the type of deals you work on.

###

Level of Education

A bachelor's degree in finance, economics, accounting, or a related quantitative field is the standard entry requirement. The prestige of your university plays a significant role. Banks heavily recruit from "target schools"—top-tier universities like Ivy League institutions, MIT, Stanford, and NYU—and graduates from these programs often secure the highest-paying offers. While an MBA is the standard path to the post-analyst "Associate" level, a stellar undergraduate record from a top school is the key that unlocks the initial analyst opportunity and its corresponding high salary.

###

Years of Experience

Experience is a direct and powerful driver of salary growth within the analyst program. The progression is structured and predictable, assuming strong performance.

- First-Year Analyst: Total Compensation: $180,000 - $225,000

- Second-Year Analyst: Total Compensation: $225,000 - $275,000

- Third-Year Analyst: Total Compensation: $275,000 - $350,000+

After completing the two or three-year analyst stint, top performers are often promoted to the Associate level (with a significant pay increase) or leverage their experience to move into other high-paying fields like private equity or hedge funds.

###

Geographic Location

Where you work matters immensely. Compensation is highest in major global financial centers to account for the concentration of deal flow and the higher cost of living.

- New York City: As the epicenter of global finance, NYC sets the standard for salaries and is generally the highest-paying location.

- San Francisco / Bay Area: Driven by the tech industry, salaries here are highly competitive with New York, especially for analysts in Technology, Media, & Telecom (TMT) groups.

- Other Major Hubs: Cities like Chicago, London, and Hong Kong also offer very high salaries, though they may trail New York slightly.

###

Company Type

The type of bank you work for is one of the most significant factors. The industry is generally tiered:

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These are the largest, most globally recognized banks. They handle massive deals and typically offer top-tier, highly competitive compensation packages.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller, specialized firms often focus exclusively on advisory services like Mergers & Acquisitions (M&A). To attract top talent away from the bulge brackets, they frequently offer bonuses that meet or even exceed those of their larger competitors, leading to some of the highest total compensation packages on Wall Street.

- Middle-Market Banks (e.g., Baird, Houlihan Lokey, William Blair): These firms work on smaller deals than the bulge brackets. While still offering excellent compensation that is well above a typical corporate finance role, their total pay for analysts is usually a step below the top-tier banks.

###

Area of Specialization

Within a bank, analysts work in specific industry or product groups. The groups that generate the most revenue and work on the largest deals often yield the highest bonuses.

- Product Groups: Mergers & Acquisitions (M&A) is consistently one of the most prestigious and lucrative groups.

- Industry Groups: Groups like Technology, Media, & Telecom (TMT), Financial Institutions Group (FIG), and Healthcare are often flush with deal flow, leading to strong bonus potential.

While all analyst roles are well-compensated, being in a top-performing group at a top-tier bank is the formula for maximizing earnings.

Job Outlook

According to the U.S. Bureau of Labor Statistics (BLS), the overall employment of "Financial and Investment Analysts" is projected to grow 4 percent from 2022 to 2032, which is about as fast as the average for all occupations.

However, it is crucial to add context to this figure. The BLS data covers a broad range of financial analyst roles. The competition for coveted *investment banking analyst* positions at top-tier firms is exceptionally fierce. While the field itself is stable, securing a place at a bulge bracket or elite boutique bank requires a top-tier academic background, extensive networking, and a grueling interview process. The number of applicants far exceeds the number of available positions each year.

Conclusion

A career as an investment banking analyst offers a path to financial success that is nearly unparalleled for a recent graduate. The journey is demanding, defined by long hours and high pressure, but the rewards are substantial.

For those considering this path, here are the key takeaways:

- Focus on Total Compensation: Remember that salary is a combination of a strong base and an even larger year-end bonus.

- Aim for the Top: Your earnings are directly influenced by the prestige of your university, the tier of the bank you join (bulge bracket vs. boutique vs. middle-market), and your location.

- Expect Growth: Compensation grows rapidly with just a few years of experience, providing a powerful launchpad for a long-term career in finance.

While the path is challenging, the combination of world-class training, unparalleled exit opportunities, and significant earning potential ensures that investment banking will continue to be a top destination for the brightest and most ambitious minds in finance.