Investment banking stands as one of the most prestigious and financially rewarding careers in the modern economy. For ambitious students and professionals drawn to high-stakes finance, the allure is undeniable, driven by the opportunity to shape major corporate deals and, of course, the prospect of an exceptional salary. But what does that compensation package truly look like?

First-year analysts stepping into a top firm can expect a total compensation package well into the six figures, often ranging from $170,000 to over $200,000. For senior professionals, that number can soar into the seven-figure range. This article will break down the components of an investment banker's salary, the key factors that dictate earning potential, and the long-term outlook for this demanding yet lucrative career.

What Does an Investment Banker Do?

Before diving into the numbers, it's essential to understand the role. Investment bankers are financial advisors to corporations, governments, and other large entities. They operate at the highest levels of finance, and their work is typically divided into two main areas: corporate finance and sales & trading.

Key responsibilities include:

- Mergers & Acquisitions (M&A): Advising companies on buying or selling other companies, or on merging their operations.

- Underwriting: Raising capital for clients by issuing and selling securities, such as stocks and bonds, to investors. This includes managing Initial Public Offerings (IPOs).

- Financial Modeling and Valuation: Building complex financial models to analyze companies and determine their value for transactions.

- Creating Pitch Decks: Developing compelling presentations to pitch strategic ideas and transaction opportunities to existing and potential clients.

It's a high-pressure, fast-paced environment that demands exceptional analytical skills, resilience, and a tremendous work ethic, with 80-100 hour work weeks being common, especially at the junior level.

Average Investment Banker Salary

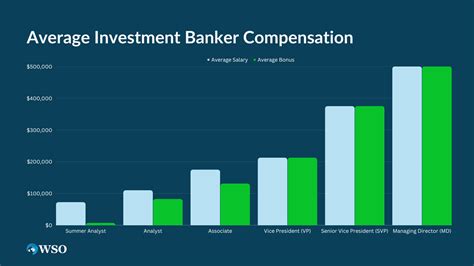

An investment banker's compensation is famously split into two main parts: a base salary and a significant year-end bonus. The bonus is highly variable and tied to both individual and firm performance, often making up 50-100% (or more) of the base salary.

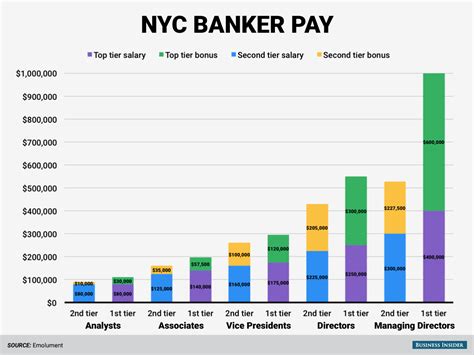

Here’s a breakdown of typical compensation by level in the United States:

- First-Year Analyst:

- Base Salary: $100,000 - $125,000

- Estimated Total Compensation (with bonus): $170,000 - $220,000

- Associate (Post-MBA or promotion):

- Base Salary: $175,000 - $225,000

- Estimated Total Compensation (with bonus): $275,000 - $450,000

- Vice President (VP):

- Base Salary: $250,000 - $300,000

- Estimated Total Compensation (with bonus): $500,000 - $800,000+

- Managing Director (MD) / Partner:

- Base Salary: $400,000 - $600,000+

- Estimated Total Compensation (with bonus): $1,000,000 - $10,000,000+

According to salary aggregator Glassdoor, the estimated total pay for an Investment Banker in the United States is approximately $198,000 per year, with an average base salary of $127,000. Similarly, Payscale reports a median base salary of around $110,000, but notes that bonuses can reach upwards of $100,000, confirming the critical role of variable pay.

Key Factors That Influence Salary

Compensation isn't uniform across the industry. Several key factors dramatically influence an investment banker's earnings.

###

Level of Education

While a bachelor's degree is the minimum requirement, the institution you attend matters immensely. Banks heavily recruit from "target schools"—prestigious universities like the Ivy Leagues, Stanford, MIT, and NYU. Graduating from one of these schools significantly increases your chances of landing a high-paying analyst role.

Furthermore, a Master of Business Administration (MBA) is a traditional entry point for the "Associate" role. Professionals often use an MBA from a top-tier business school (like Wharton, Harvard, or Booth) to pivot into investment banking or to accelerate their career from the Analyst to Associate level, which comes with a substantial jump in both base salary and bonus potential.

###

Years of Experience

Investment banking has a rigid, hierarchical structure, and compensation grows exponentially as you climb the ladder.

- Analyst (2-3 years): The entry-level position. Analysts perform the bulk of the financial modeling and presentation work.

- Associate (3-4 years): Often filled by promoted analysts or new MBA graduates. Associates manage analysts and take on more client-facing responsibilities.

- Vice President (VP): VPs are primary project managers and client relationship leaders.

- Managing Director (MD): The most senior level, focused on originating new business and maintaining high-level client relationships. Their compensation is heavily tied to the revenue they generate for the firm.

###

Geographic Location

Where you work has a major impact on your salary. The world of high finance is concentrated in a few global hubs, with New York City being the undisputed center in the United States.

- New York, NY: Offers the highest salaries due to the concentration of bulge-bracket banks and intense competition for talent.

- San Francisco, CA: A major hub, especially for technology-focused banking, with salaries that are competitive with New York.

- Chicago, IL & Los Angeles, CA: Other major financial centers with strong compensation packages, though often slightly below those in New York.

According to Salary.com, an Investment Banking Associate I in New York City earns a median base salary that is approximately 15% higher than the national average, reflecting the premium placed on talent in this key market.

###

Company Type

The type and size of the bank you work for is a critical determinant of your pay. The industry is generally tiered:

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan, Morgan Stanley): These are the largest global banks that handle multi-billion dollar deals. They typically offer the highest base salaries and have massive bonus pools.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These smaller, specialized firms focus almost exclusively on advisory services (like M&A). While base salaries are competitive, their bonuses can sometimes exceed those at bulge bracket firms, especially in good years for M&A.

- Middle Market Banks (e.g., Baird, Jefferies, William Blair): These firms focus on deals for smaller companies. Compensation is still excellent but generally trails behind the bulge bracket and elite boutique firms.

###

Area of Specialization

Within a bank, different groups can have varying levels of prestige and bonus potential. The most lucrative groups are often those most closely tied to generating revenue.

- Mergers & Acquisitions (M&A): Often considered the most prestigious group, M&A bankers who close major deals can command some of the highest bonuses.

- Leveraged Finance (LevFin): This group helps fund transactions using significant amounts of debt and is also a highly compensated specialty.

- Equity Capital Markets (ECM) & Debt Capital Markets (DCM): These groups help companies raise money by issuing stock or debt, respectively. Compensation is strong but can be more market-dependent than in M&A.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banker" as a distinct profession, it provides data for the closely related and broader category of "Financial Analysts." The outlook is very positive.

The BLS projects employment for financial analysts to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations. The median annual wage for financial analysts was $96,220 in May 2022. It is crucial to note that investment banking represents the highest-paying niche within this broader category, with salaries far exceeding this median figure.

Despite this growth, the field remains incredibly competitive. The number of front-office investment banking positions is limited, and hiring is often cyclical, heavily influenced by the health of the economy and global M&A activity.

Conclusion

A career in investment banking offers a path to extraordinary financial success, but it is not without its demands. The trade-off for a salary that can reach seven figures is a grueling work schedule and an intensely high-pressure environment.

For prospective professionals, the key takeaways are clear:

- Compensation is a Package: Focus on total compensation (base + bonus), as the bonus is a massive part of your earnings.

- Experience Pays: Your salary will grow exponentially as you gain experience and seniority.

- Prestige Matters: The firm you work for, the school you attended, and your area of specialization all significantly impact your earning potential.

If you are a driven, analytically-minded individual with a passion for finance and the resilience to thrive under pressure, investment banking remains one of the most challenging and financially rewarding careers you can pursue.