He’s one of the most recognizable figures in modern advertising: a friendly, reliable professional clad in a red polo and khakis, ready to help at a moment's notice. But beyond the famous catchphrase, "Jake from State Farm" represents a tangible and potentially lucrative career path: the Insurance Agent.

So, what does a real-life "Jake" actually earn? This career offers a significant salary potential that often combines a base pay with performance-based commissions. For those with strong interpersonal skills and a drive to succeed, becoming an insurance agent can be a highly rewarding profession.

This article will break down the salary, influencing factors, and career outlook for insurance professionals like the one Jake represents.

What Does an Insurance Agent Do?

While the commercials show Jake answering a 3 AM phone call, the role of an insurance agent is far more comprehensive. These professionals are the primary point of contact between an insurance carrier (like State Farm) and the customer.

Key responsibilities include:

- Client Consultation: Assessing individuals' and businesses' needs to determine their insurance requirements.

- Policy Sales: Explaining various policy options—such as auto, home, life, or commercial—and helping clients choose the best coverage.

- Relationship Management: Building a "book of business" by fostering long-term relationships with clients, providing ongoing support, and handling policy renewals.

- Claims Assistance: Guiding clients through the initial steps of the claims process when an accident or loss occurs.

- Marketing and Prospecting: Actively seeking out new clients through networking, referrals, and community involvement.

Essentially, an insurance agent is a trusted financial advisor who helps protect clients from life's uncertainties.

Average Insurance Agent Salary

The compensation for an insurance agent is often a mix of a base salary and commission, meaning earnings can vary widely. However, we can establish a strong baseline using data from authoritative sources.

- According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for insurance sales agents was $57,860 in May 2023. The lowest 10 percent earned less than $31,520, and the highest 10 percent earned more than $131,980.

Salary aggregator data provides a similar picture, often showing a slightly higher range due to the inclusion of experienced, high-performing agents:

- Salary.com reports that the typical salary range for an Insurance Sales Agent in the United States falls between $50,003 and $71,159, with significant potential for higher earnings through commissions.

- Glassdoor lists the estimated total pay for a State Farm Agent as ranging from $44,000 to $76,000 per year, factoring in base salary and additional pay like commissions and bonuses.

The key takeaway is that while an entry-level agent might start in the $40,000-$50,000 range, experienced and successful agents can easily earn six-figure incomes.

Key Factors That Influence Salary

What separates a $50,000-a-year agent from one earning over $100,000? Several critical factors come into play.

###

Level of Education

While a bachelor’s degree is not always a strict requirement, it is increasingly preferred by major carriers like State Farm. A degree in business, finance, economics, or marketing can provide a strong foundation and may lead to a higher starting salary or faster advancement into management roles. Regardless of education, all agents must obtain a state-specific license to sell insurance, which requires passing an exam for each type of insurance they plan to sell (e.g., Property & Casualty, Life & Health).

###

Years of Experience

Experience is arguably the most significant factor in an insurance agent's earning potential.

- Entry-Level (0-2 years): New agents are focused on learning the products, passing licensing exams, and building their initial client base. Their income is often more reliant on a base salary during this period.

- Mid-Career (3-10 years): Experienced agents have established a solid "book of business." Their income from renewals and referrals grows steadily, and their commission earnings often surpass their base salary.

- Senior-Level (10+ years): Veteran agents often have a vast network and a large, stable client portfolio. Many transition into owning their own agency, mentoring junior agents, or specializing in high-net-worth clients, leading to top-tier earnings.

###

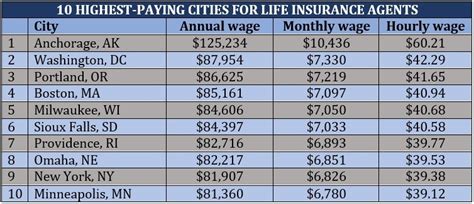

Geographic Location

Where an agent works has a direct impact on their salary. States with a higher cost of living and major metropolitan areas typically offer higher compensation. For example, agents in New York City, San Francisco, or Boston will likely earn more than those in rural parts of the Midwest. Furthermore, states prone to natural disasters (like Florida or California) can have a higher demand for certain types of insurance, creating more opportunities.

###

Company Type

The "Jake from State Farm" character is a captive agent, meaning he works exclusively for one company (State Farm). This is a common and stable career path. However, there is another primary model:

- Captive Agent (e.g., State Farm, Allstate): These agents benefit from strong brand recognition, marketing support, and often a base salary or stipend. The trade-off is that they can only sell products from their parent company.

- Independent Agent (or Broker): These agents work for themselves or an independent agency and represent multiple insurance carriers. This allows them to offer clients a wider range of options and potentially earn higher commission rates, though it comes with less corporate support and more entrepreneurial risk.

###

Area of Specialization

Not all insurance is created equal in terms of earning potential. While auto and home insurance provide a steady stream of business, specializing in more complex and higher-value products can significantly boost an agent's income. Lucrative specializations include:

- Commercial Lines: Insuring businesses against property damage, liability, and other risks.

- Life Insurance: These policies often have large premiums and high commission percentages.

- Health and Benefits: Working with companies to provide group health plans for their employees.

Job Outlook

The future for insurance agents looks bright. According to the BLS, employment of insurance sales agents is projected to grow 6 percent from 2022 to 2032, which is faster than the average for all occupations.

Despite the rise of online insurance tools, many people and businesses still rely on the expert guidance of a human agent to navigate complex policies and make informed decisions. The need for insurance is constant, as people continue to buy homes, start families, and open businesses—all of which require protection.

Conclusion

So, how much does "Jake from State Farm" make? The answer is that it depends entirely on his performance, experience, and specialization. While a median salary hovers around $58,000, the structure of the profession provides a clear path to earning well over $100,000 for those who are dedicated and skilled.

For individuals considering this career, the key takeaways are:

- High Earning Potential: Your income is directly tied to your effort and success.

- Stability and Growth: The demand for insurance agents remains strong and is projected to grow.

- Rewarding Work: You play a crucial role in helping people protect their financial well-being.

The career of an insurance agent is more than just a friendly face in a commercial; it's a dynamic and rewarding profession for driven individuals looking to build a successful future.