For ambitious graduates and aspiring finance professionals, a role at a bulge-bracket investment bank like JPMorgan Chase represents the pinnacle of career achievement. It’s a world of high stakes, immense intellectual challenge, and, famously, extraordinary financial rewards. The question on everyone's mind is often the most direct one: what is a JP Morgan analyst salary? The answer, while seemingly straightforward, is a complex tapestry woven from base pay, significant bonuses, location, and a host of other factors that define a career in this elite tier of global finance.

This guide is designed to be your definitive resource, pulling back the curtain on compensation at one of the world's most prestigious financial institutions. We will move beyond simple numbers to provide a comprehensive analysis of the role, the factors that dictate earnings, the long-term career outlook, and a practical roadmap for how you can pursue this demanding yet incredibly rewarding path. I once mentored a young economics graduate who was fixated on landing a role at a top-tier bank. Her initial focus was purely on the staggering starting salary, but as we delved deeper, she realized the true value was in the unparalleled learning curve and the career options it would unlock a few years down the line. The salary, she discovered, wasn't just payment for long hours; it was an investment in a future of professional excellence.

This article will provide that same depth of understanding, empowering you with the knowledge needed to evaluate and chase a career as an analyst at a firm like JPMorgan Chase.

### Table of Contents

- [What Does a JPMorgan Analyst *Actually* Do?](#what-does-an-analyst-do)

- [Average JP Morgan Analyst Salary: A Deep Dive](#deep-dive)

- [Key Factors That Influence Your Salary](#key-factors)

- [Job Outlook and Career Growth in Investment Banking](#job-outlook)

- [How to Get Started: Your Roadmap to a Career at JPMorgan](#how-to-get-started)

- [Conclusion: Is the Demanding Path Worth the Reward?](#conclusion)

What Does a JPMorgan Analyst *Actually* Do?

Before we can dissect the salary, it's crucial to understand what the title "Analyst" at JPMorgan Chase truly entails, particularly within its most coveted division: the Investment Banking Division (IBD). While JPM employs analysts across various sectors—from technology to risk management to commercial banking—the term "JPMorgan Analyst" in the context of high finance almost always refers to an Investment Banking Analyst. This is an entry-level position, typically held for two to three years by recent university graduates, and it is the bedrock of the entire investment banking structure.

The core function of an investment banking analyst is to provide analytical support for senior bankers on financial transactions. These transactions are typically mergers and acquisitions (M&A), initial public offerings (IPOs), or debt and equity financings for large corporations, governments, and institutional clients. The work is quantitative, detail-oriented, and executed under immense pressure and tight deadlines.

Key Responsibilities and Daily Tasks Include:

- Financial Modeling: This is the analyst's bread and butter. It involves building complex spreadsheets in Excel to project a company's future financial performance. These models are used to value companies, assess the impact of a potential merger, or determine the feasibility of a leveraged buyout (LBO).

- Valuation Analysis: Analysts use various methodologies to determine a company's worth. This includes Discounted Cash Flow (DCF) analysis, Comparable Company Analysis ("Comps"), and Precedent Transaction Analysis.

- Creating Pitch Books and Presentations: A significant portion of an analyst's time is spent in PowerPoint, creating detailed presentations (known as "pitch books") for clients. These books summarize the financial analysis and present strategic recommendations to win new business or update clients on active deals.

- Due Diligence: When a deal is in motion, analysts are responsible for the nitty-gritty work of due diligence. This involves meticulously reviewing a company's financial statements, contracts, customer data, and internal operations to identify potential risks and verify information.

- Market Research: Staying abreast of industry trends, market conditions, and competitor activities is essential. Analysts compile research reports and summaries for senior bankers.

### A "Day in the Life" of a JPMorgan Investment Banking Analyst

To make this tangible, here is a realistic (and intense) glimpse into a typical weekday:

- 9:00 AM: Arrive at the office. Check emails that came in overnight from senior bankers or clients in different time zones. Begin updating a financial model with new data for an upcoming client meeting.

- 11:00 AM: Join a team call to discuss progress on a live M&A deal. A Managing Director asks for several new analyses and a few slides to be added to the client presentation by the end of the day.

- 1:00 PM: Grab a quick lunch at your desk while reading through industry news and updating a "market watch" summary for your team.

- 3:00 PM: An Associate reviews the slides you created. There are multiple revisions needed—alignment, formatting, and a request to "re-run the numbers" using a different set of assumptions. The attention to detail required is microscopic.

- 6:00 PM: The first draft of the revised presentation is sent up the chain for review. You begin working on a separate project: building a list of potential acquisition targets for another client.

- 8:00 PM: Dinner is ordered and delivered to the office. You eat at your desk while waiting for feedback on the presentation.

- 9:30 PM: Feedback arrives. The Managing Director has made significant changes and added new requests. You and your Associate work together to incorporate the edits and build the new analysis.

- 12:00 AM: The final version of the pitch book is sent out. You begin tidying up your models and files for the next day.

- 1:00 AM (or later): Head home, knowing you need to be back in the office in eight hours to do it all again.

This grueling schedule is the trade-off for the exceptional compensation and unparalleled learning experience offered by a top-tier firm.

Average JP Morgan Analyst Salary: A Deep Dive

The compensation for a JP Morgan analyst salary is famously lucrative, especially for a role straight out of undergrad. However, it's critical to understand that the "salary" is actually a "total compensation" package, composed of a base salary and a significant, variable bonus.

According to data from Glassdoor, a highly reputable salary aggregator, the estimated total pay for an Investment Banking Analyst at JPMorgan Chase in the United States is approximately $197,975 per year, as of late 2023. This figure includes an estimated base salary of around $120,457 and additional pay (primarily the annual bonus) of approximately $77,518.

It is crucial to note that these figures can vary, and top-performing analysts in strong market years can see bonuses that approach or even exceed 100% of their base salary. Let's break down the components.

### Anatomy of an Analyst's Compensation Package

The pay structure in investment banking is designed to attract top talent with a competitive base while heavily incentivizing performance and firm profitability through a year-end bonus.

| Compensation Component | Typical Amount (First-Year Analyst) | Purpose and Notes |

| :--- | :--- | :--- |

| Base Salary | $110,000 - $125,000 | This is the fixed, guaranteed portion of your pay, received in bi-weekly paychecks. In recent years, base salaries for first-year analysts at all major banks have risen to stay competitive, with JPM being among the top payers. |

| Signing Bonus (Sign-On)| $10,000 - $25,000 | A one-time bonus paid upon signing your full-time offer, often months before you start. It's designed to secure your commitment and help with relocation expenses. |

| Performance Bonus (Year-End)| $70,000 - $120,000+ | This is the highly variable component paid out at the end of the year (or in Jan/Feb of the following year). It depends on three main factors: individual performance, your group's performance, and the overall firm's profitability for the year. A great analyst in a bad market year will see a smaller bonus than a mediocre analyst in a fantastic market year. |

| Total Compensation (Year 1)| $190,000 - $270,000+ | The sum of the base salary and performance bonus. This is the number that truly reflects an analyst's annual earnings. |

*Source:* *Data compiled and cross-referenced from recent reports on Glassdoor, Wall Street Oasis, and eFinancialCareers (2023-2024).*

### Salary Progression: From Analyst to Managing Director

The steep learning curve is matched by a steep compensation curve. A career in investment banking offers rapid and substantial salary growth for those who perform well and choose to stay.

Here is a typical salary progression at a bulge-bracket bank like JPMorgan:

- Analyst (Years 1-2):

- Year 1: Total Comp: $190,000 - $270,000

- Year 2: Base salary often increases to ~$125k-$135k. With a larger bonus, total compensation can reach $250,000 - $350,000.

- Associate (Years 3-6; typically post-MBA or a direct promotion):

- Base Salary: $175,000 - $225,000

- Total Compensation: $350,000 - $550,000

- Vice President (VP) (Years 7-10):

- Base Salary: $250,000 - $300,000

- Total Compensation: $500,000 - $800,000+

- Director / Managing Director (MD):

- At these senior levels, compensation becomes highly variable and dependent on the amount of business brought into the firm. Total compensation regularly exceeds $1,000,000, with a significant portion delivered in deferred stock and other long-term incentives.

This trajectory illustrates why the analyst program is so competitive. It's not just a job; it's the entry point to a career with one of the highest earning potentials in the corporate world.

Key Factors That Influence Your Salary

While the numbers above provide a strong baseline, actual compensation for a JP Morgan analyst salary can be influenced by a powerful combination of factors. Understanding these levers is key to maximizing your earning potential, whether you are negotiating an offer or planning your career path. This section is the most critical for a nuanced understanding of compensation.

###

Level of Education

In investment banking, your educational background serves as a primary filtering mechanism. While it's not impossible to break in from a non-target school, the path is significantly easier for graduates of elite universities.

- Undergraduate Degree & University Prestige: The vast majority of investment banking analysts at firms like JPMorgan, Goldman Sachs, and Morgan Stanley are hired from "target" schools. These are typically Ivy League universities (Harvard, Yale, Princeton), other top-tier private schools (Stanford, MIT, Duke), and top public universities (UVA, Michigan, UC Berkeley). A high GPA (typically 3.7+) in a quantitative field like Finance, Economics, or Accounting is the standard expectation. While your choice of school won't necessarily result in a higher starting base salary (banks have standardized pay bands for first-years), it drastically increases your chances of securing an interview and, subsequently, an offer.

- Master's Degrees (Pre-Experience): For analyst roles, a specialized Master's in Finance (MFin) from a top program can be an alternative entry point, especially for candidates from European universities or those looking to pivot from a different undergraduate field. The starting salary is generally identical to that of an undergraduate hire.

- The MBA (for Associate Roles): The Master of Business Administration (MBA) is the primary vehicle for entering investment banking at the post-analyst, or "Associate," level. Hiring for these roles is heavily concentrated at top-5 business schools (Harvard, Stanford, Wharton, Booth, Kellogg). An MBA hire will enter with a significantly higher base salary (around $175,000) and total compensation package, reflecting their prior work experience and advanced degree.

- Certifications (CFA, etc.): While not required for an entry-level analyst role, pursuing the Chartered Financial Analyst (CFA) designation can be valuable. It demonstrates a high level of commitment and technical knowledge. While it may not directly increase your first-year bonus, it strengthens your resume and can be a significant asset for promotions or when moving to the "buy-side" (e.g., private equity or hedge funds) after your analyst stint.

###

Years of Experience

Experience is the single most powerful driver of salary growth within the investment banking track. The industry operates on a fairly rigid, lock-step promotion and compensation cycle for junior bankers.

| Career Stage | Typical Experience | Base Salary Range | Total Comp. Range | Key Responsibilities |

| :--- | :--- | :--- | :--- | :--- |

| Analyst - Year 1 | 0-1 years | $110k - $125k | $190k - $270k | Financial modeling, pitch book creation, grunt work |

| Analyst - Year 2 | 1-2 years | $125k - $135k | $250k - $350k | More complex modeling, training first-years, more client exposure |

| Analyst - Year 3 | 2-3 years | $135k - $150k | $280k - $400k | Often a "top bucket" analyst; takes on Associate-level tasks |

| Associate - Year 1| 3-4 years (or 0 post-MBA) | $175k - $200k | $350k - $500k | Managing analysts, checking work, primary modeling, client contact|

| Senior Associate | 5-6 years | $200k - $225k | $450k - $600k | Leading deal execution, significant client interaction |

| Vice President (VP)| 7+ years | $250k - $300k+ | $500k - $800k+ | Sourcing deals, managing client relationships, leading teams |

As you can see, each year of experience brings a substantial, non-linear jump in total compensation, driven largely by the increasing size of the performance bonus.

###

Geographic Location

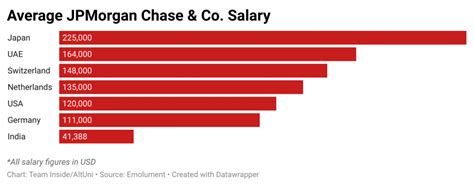

Investment banking is a highly concentrated industry, and where you work has a direct impact on your salary, though perhaps not in the way you might expect.

- Top-Tier Financial Hubs (New York, London, Hong Kong): These cities are the epicenters of global finance. For U.S. analysts, New York City is the benchmark. Bulge-bracket banks like JPMorgan have standardized base salaries across all their U.S. offices for junior bankers. This means a first-year analyst in New York will have the same base salary as an analyst in Chicago or San Francisco.

- The Cost of Living (CoL) Factor: While the base salary is standardized, the *value* of that salary changes dramatically. A $125,000 base salary provides a much higher quality of life in a city like Charlotte or Dallas than it does in New York City or San Francisco, where housing costs are astronomical.

- Bonus Differentials: While base pay is often flat, bonuses can sometimes have slight regional variations. Deal flow and group performance in major hubs like NYC (especially for top groups like M&A) might lead to slightly higher bonus pools compared to regional offices.

- International Offices: Compensation in London is broadly comparable to New York, though often slightly lower when currency is converted, and bonus structures can differ. Offices in other regions like Zurich, Frankfurt, or Singapore will have their own competitive salary bands benchmarked to local market rates.

Here's a simplified comparison of the "real" value of a standardized salary:

| Location | Sample 1st Year Base | Estimated Rent (1BR) | Base Salary After Rent |

| :--- | :--- | :--- | :--- |

| New York, NY | $125,000 | $54,000 ($4,500/mo) | $71,000 |

| San Francisco, CA | $125,000 | $42,000 ($3,500/mo) | $83,000 |

| Chicago, IL | $125,000 | $26,400 ($2,200/mo) | $98,600 |

| Charlotte, NC | $125,000 | $19,200 ($1,600/mo) | $105,800 |

This illustrates that while the nominal JP Morgan analyst salary is consistent, the financial reality on the ground varies significantly by location.

###

Company Type & Size

While this article focuses on JPMorgan, it's enlightening to see how its compensation stacks up against other types of firms where financial analysts work.

- Bulge-Bracket Banks (JPMorgan, Goldman Sachs, Morgan Stanley): These are the largest, full-service global banks. They offer standardized, top-tier pay. The brand prestige and deal exposure are unparalleled, but they are also vast, sometimes bureaucratic organizations.

- Elite Boutique Banks (Evercore, Lazard, Centerview): These firms specialize purely in advisory (mainly M&A) and often compete directly with bulge-bracket banks for the biggest deals. They are known for having leaner deal teams, which can mean more responsibility for analysts. Their compensation is often *higher* than that of bulge-bracket banks, particularly the bonus component, as they have lower overhead. Total compensation for top performers at these firms can sometimes exceed JPM's.

- Middle-Market Banks (Baird, Houlihan Lokey, William Blair): These firms focus on deals for mid-sized companies (typically valued under $1 billion). The base salaries are very competitive with bulge-bracket banks, but the bonuses may be slightly lower on average. The work-life balance can sometimes be marginally better.

- Corporate Finance (e.g., Analyst at Apple, Google, P&G): An analyst in a corporate finance or corporate development role at a Fortune 500 company has a very different compensation structure. The base salary might be strong (e.g., $80,000 - $110,000), but the bonus is significantly smaller (e.g., 10-20% of base). The total compensation is much lower than in banking, but the trade-off is a vastly superior work-life balance (e.g., 40-50 hours per week vs. 80-100).

###

Area of Specialization

Even within JPMorgan's Investment Banking Division, the group you join can impact your experience and bonus potential.

- Industry Groups (e.g., Technology, Media & Telecom (TMT), Healthcare, Financial Institutions Group (FIG), Industrials): These groups cover companies within a specific sector. Your bonus will be tied to how active your sector was during the year. A TMT banker in a tech boom year will likely see a larger bonus than an industrials banker in a quiet year.

- Product Groups (e.g., Mergers & Acquisitions (M&A), Leveraged Finance (LevFin), Equity Capital Markets (ECM), Debt Capital Markets (DCM)): These groups specialize in a type of transaction.

- M&A and LevFin are often considered the most prestigious and technically demanding. They typically have high deal flow and, as a result, often have some of the highest bonus potentials.

- ECM and DCM are more market-facing and can be more cyclical. Bonuses are highly dependent on the health of the stock and bond markets.

###

In-Demand Skills

Certain skills can make you a more effective analyst, leading to a better performance rating and, consequently, a higher "bucket" for your bonus.

- Hard Skills (The Essentials):

- Advanced Excel: You must be a wizard. This means knowing shortcuts, building complex, three-statement financial models from scratch, and creating dynamic charts and tables.

- PowerPoint Mastery: The ability to create clean, aesthetically pleasing, and impactful presentations quickly is non-negotiable.

- Valuation Techniques: Deep, practical knowledge of DCF, LBO, comparable company analysis, and precedent transactions is the core technical skill set.

- Hard Skills (The Differentiators):

- Data Science & Programming: Increasingly, analysts who know Python or R for data analysis and automating tasks are highly valued. The ability to work with large datasets is a growing need.

- Financial Software: Proficiency with platforms like a Bloomberg Terminal, Capital IQ, and FactSet is expected.

- Soft Skills (What Separates Good from Great):

- Attention to Detail: A single typo in a pitch book can damage credibility. Meticulousness is paramount.

- Resilience and Positive Attitude: The long hours and high-pressure environment are draining. The ability to stay positive, composed, and driven is a huge asset.

- Communication Skills: Being able to clearly articulate the results of your analysis to your associate or VP is crucial.

- Proactiveness: The best analysts anticipate the next question and do the work before being asked.

Mastering these skills not only ensures a higher bonus but also positions you for a successful career, whether you stay in banking or move to another high-finance role.

Job Outlook and Career Growth

A career as an investment banking analyst at a firm like JPMorgan is not just about the first few years of high pay; it's about the long-term career trajectory it enables. The skills, network, and brand prestige gained are immensely valuable and create a wide array of future opportunities.

### Industry Job Outlook for Financial Analysts

The U.S. Bureau of Labor Statistics (BLS) provides a broad outlook for the "Financial and Investment Analysts" category. According to the BLS's Occupational Outlook Handbook, employment for this group is projected to grow 8 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS projects about 34,200 openings for financial and investment analysts each year, on average, over the decade. This growth is driven by several factors:

- Growing Complexity of Financial Products: As investments and financial instruments become more complex, demand for knowledgeable analysts to evaluate them will increase.

- Globalization: Increasing global trade and investment requires analysts who can navigate international markets.

- Big Data and Technology: A growing need for analysts who can use technology and data analytics to inform investment decisions.

Crucially, it must be noted that these statistics apply to the *entire* financial analyst profession. The subset of jobs at elite investment banks like JPMorgan is far smaller and infinitely more competitive. While the overall field is growing, securing a spot at a bulge-bracket bank will remain exceptionally challenging, with thousands of top students competing for a few hundred spots each year.

### Emerging Trends and Future Challenges

The world of investment banking is not static. Analysts entering the field today face a different landscape than those who started a decade ago.

- The Impact of AI and Automation: Mundane tasks like data gathering and basic chart creation are increasingly being automated. This doesn't mean analysts will be replaced, but that their role will evolve. The focus will shift even more towards higher-level thinking: interpreting data, strategic thinking, and client