For those aspiring to reach the upper echelons of the financial world, a position at a powerhouse like JP Morgan Chase represents a pinnacle of success. The title of "Vice President" (VP) is a significant milestone on this path, signifying expertise, responsibility, and, importantly, a substantial compensation package. While the exact figures can vary, a VP role at JP Morgan Chase offers a highly competitive salary, with total compensation often ranging from $250,000 to over $400,000 annually.

This guide breaks down the components of a JP Morgan Chase VP's salary, the key factors that influence it, and the career outlook for professionals in this demanding yet rewarding field.

What Does a JP Morgan Chase Vice President Do?

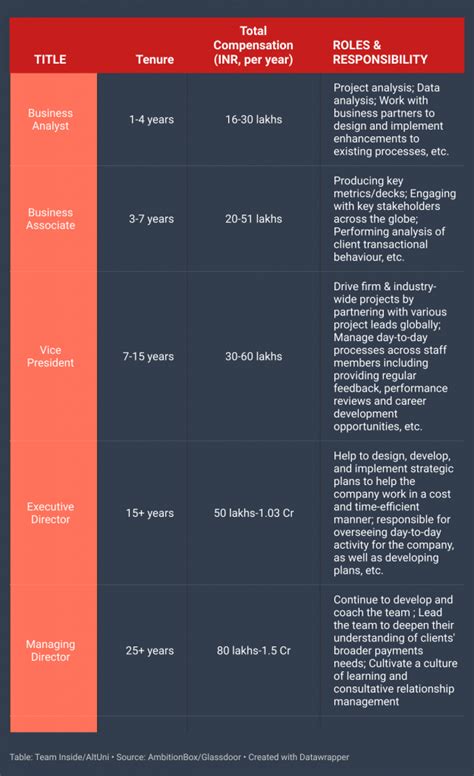

First, it’s crucial to understand the corporate structure at a major investment bank. Unlike a typical corporation where a VP is a high-level executive, the Vice President title at JP Morgan Chase is a mid-level rank. The typical investment banking hierarchy is:

1. Analyst (Entry-level, post-undergraduate)

2. Associate (Post-MBA or promotion from Analyst)

3. Vice President (Mid-level manager)

4. Executive Director (Senior manager)

5. Managing Director (Most senior, client-relationship role)

A VP is the engine of the team. They have moved beyond the analytical "grunt work" of an Analyst and the initial management tasks of an Associate. Key responsibilities include:

- Project Management: Overseeing the day-to-day execution of deals, from M&A transactions to capital raises.

- Team Leadership: Managing and mentoring a team of Associates and Analysts, ensuring the quality and accuracy of their financial models and presentations.

- Client Interaction: Serving as a key point of contact for clients, building relationships, and handling more complex communications.

- Strategic Contribution: Playing a vital role in shaping the strategy and narrative for client pitches and live transactions.

Average JP Morgan Chase VP Salary

The compensation for a VP at JP Morgan Chase is not just a base salary; it's a package composed of a solid base and a significant performance-based bonus.

According to data compiled from reputable sources like Glassdoor and Salary.com, the average total compensation for a Vice President at JP Morgan Chase in a major financial hub like New York City is approximately $280,000 to $325,000 per year.

This compensation is typically structured as follows:

- Average Base Salary: $185,000 to $225,000. This is the guaranteed portion of the salary, paid bi-weekly or monthly.

- Average Bonus: $70,000 to $150,000+. This is the variable, performance-based component paid out annually. It can fluctuate dramatically based on individual performance, team and division results, and the overall firm's profitability for the year.

*(Source: Data synthesized from Glassdoor, Payscale, and industry reports as of early 2024. Figures are approximate and can vary.)*

Key Factors That Influence Salary

While the averages provide a great benchmark, several factors can significantly impact a VP's final take-home pay.

### Area of Specialization / Division

This is arguably the most significant factor. "Vice President" is a title used across the firm's many divisions, and compensation differs drastically between them.

- Investment Banking Division (IBD): VPs in front-office roles like Mergers & Acquisitions (M&A) or industry coverage groups (e.g., Technology, Healthcare) are typically the highest earners. Their bonuses are directly tied to deal flow and revenue generation, often placing their total compensation at the top end of the range, potentially exceeding $400,000 in a strong year.

- Asset & Wealth Management: VPs in this division also earn substantial salaries, with bonuses tied to assets under management (AUM) and client performance. Compensation is very strong but may be slightly less volatile than in IBD.

- Corporate & Commercial Banking: These roles are still highly compensated but generally have a lower bonus potential compared to IBD.

- Technology, Operations, or HR: VPs in corporate functions or technology roles are vital to the firm but are not in revenue-generating seats. Their compensation is competitive for their respective fields but will have a lower bonus component, bringing their total compensation below that of front-office banking VPs.

### Years of Experience

Within the VP title itself, there is a hierarchy. A newly promoted "VP1" (first-year VP) will earn less than a "VP3" (third-year VP) who is nearing a promotion to Executive Director. With each year of experience, the base salary sees a modest increase, but the target bonus percentage grows more significantly as the individual takes on more responsibility.

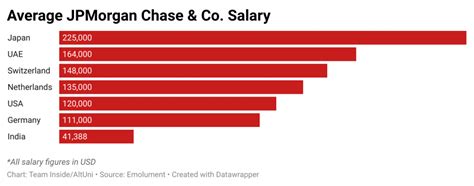

### Geographic Location

Where you work matters. JP Morgan Chase operates globally, but its pay scales are adjusted for local market rates and cost of living.

- Top-Tier Cities: New York City, London, and Hong Kong command the highest salaries and bonuses due to the concentration of deal flow and competition for talent.

- Other Financial Hubs: Locations like Chicago, San Francisco, Houston, and Singapore offer very competitive packages, but the base salary and bonus may be moderately lower than in New York.

- Regional Offices: Offices in lower cost-of-living areas will have salaries adjusted downward accordingly, though they remain highly attractive for those regions.

### Level of Education

While direct promotion from the Analyst ranks is common, many VPs enter the role after completing a Master of Business Administration (MBA), typically from a top-tier program. An MBA from a prestigious school often allows a professional to join the firm as an Associate and can lead to a higher starting salary upon promotion to VP. It serves as a career accelerator and a strong signal of commitment and capability to the firm.

Job Outlook

The career outlook for skilled financial professionals remains robust. While the specific role of "Investment Banking VP" isn't tracked by the U.S. Bureau of Labor Statistics (BLS), the closest proxy is "Financial Managers."

The BLS projects that employment for Financial Managers will grow by 16% from 2022 to 2032, a rate that is much faster than the average for all occupations. This indicates a strong and sustained demand for experts who can manage finances, navigate complex transactions, and guide strategic financial decisions.

While the banking industry is known for its cyclical nature, a top-tier global institution like JP Morgan Chase will always be competing for the best talent to maintain its market leadership.

Conclusion

The role of a Vice President at JP Morgan Chase is a demanding but financially and professionally rewarding career milestone. It represents the intersection of deep expertise, leadership, and significant responsibility within one of the world's most respected financial institutions.

Key Takeaways for Aspiring Professionals:

- Understand the Title: A VP at an investment bank is a respected mid-level manager, not a senior executive.

- Compensation is a Package: Focus on total compensation (base + bonus), as the bonus is a critical part of your annual earnings.

- Your Division Dictates Your Pay: The most lucrative VP roles are in front-office, revenue-generating divisions like Investment Banking.

- Performance is Paramount: Your individual, team, and firm performance will heavily influence your annual bonus.

For those with the ambition, analytical rigor, and resilience to thrive in a high-stakes environment, the path to Vice President at JP Morgan Chase offers an unparalleled opportunity to build a successful and prosperous career in finance.