Decoding the Paycheck: What is a JP Morgan Managing Director's Salary?

For those aspiring to reach the pinnacle of the finance world, the title "Managing Director" at a bulge-bracket investment bank like JP Morgan represents a career zenith. It’s a role synonymous with prestige, strategic influence, and, of course, significant financial reward. While the path is demanding, the compensation can be extraordinary, often reaching well into the seven figures.

This article will break down the components of a JP Morgan Managing Director's salary, explore the factors that influence it, and provide a realistic view of what it takes to reach this elite level.

What Does a JP Morgan Managing Director Do?

A Managing Director (MD) at JP Morgan is a senior leader, far removed from the entry-level analyst roles focused on Excel models and pitchbook creation. The responsibilities of an MD are primarily strategic and client-facing. They are the firm's primary rainmakers.

Key responsibilities include:

- Deal Origination: Leveraging their extensive network to source and secure large, complex deals, such as mergers and acquisitions (M&A), initial public offerings (IPOs), or major debt financing.

- Client Relationship Management: Acting as the trusted senior advisor to C-suite executives at major corporations, private equity firms, and government entities.

- Team Leadership: Managing large teams of Vice Presidents, Associates, and Analysts, providing mentorship and guiding the overall strategy for their group or division.

- P&L Responsibility: Overseeing the profitability of their specific business line or sector, ensuring revenue targets are met and exceeded.

In short, an MD is a business generator and a leader who drives the firm's revenue and reputation.

Average JP Morgan Managing Director Salary

Understanding an MD's compensation requires looking beyond a simple base salary. The total compensation package is a combination of three key elements:

1. Base Salary: A fixed annual salary.

2. Bonus: A highly variable, performance-based cash payment that often constitutes the largest portion of their earnings.

3. Stock/Equity: Deferred compensation in the form of restricted stock units (RSUs) or other equity awards, designed to retain top talent.

Based on the most current data, here is a typical breakdown:

- Average Base Salary: According to data from sites like Salary.com and Glassdoor, the base salary for a Managing Director at JP Morgan typically falls between $450,000 and $650,000 per year. Top performers in high-revenue divisions can command even higher base salaries.

- Total Average Compensation (Base + Bonus): This is where the numbers become truly significant. The annual bonus is directly tied to individual, team, and firm performance. For a typical year, total compensation often ranges from $800,000 to over $2,500,000. Data from industry reports suggests that top-performing MDs in strong market years can easily surpass this range. It is the variable bonus that creates this wide spectrum of earnings.

Key Factors That Influence Salary

Not all Managing Directors earn the same amount. Several critical factors influence the final compensation package, making it a highly nuanced calculation.

Level of Education

At the Managing Director level, a specific degree is less of a direct salary determinant than overall performance. However, education is the critical gateway to entering the investment banking track in the first place. The most common path includes a bachelor's degree from a top-tier university, followed by an MBA from an elite business school (like Wharton, Harvard, or Stanford). While an MBA is not strictly required, it is a traditional and highly effective way to accelerate one's career from an Associate to a Vice President role, putting you on the path to MD.

Years of Experience

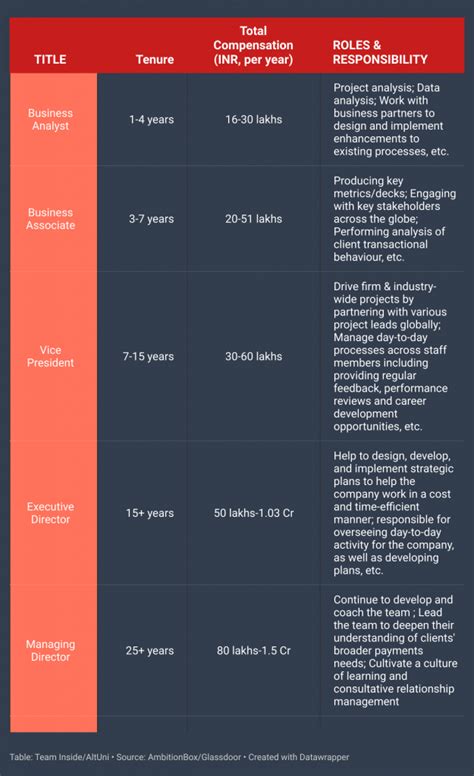

This is arguably the most significant factor. The title of Managing Director is not awarded lightly. It is the culmination of a long and successful career, typically requiring 15 to 20+ years of experience within the industry. The career ladder is steep:

- Analyst (2-3 years)

- Associate (3-4 years)

- Vice President (VP) (5-7 years)

- Executive Director (ED) / Director (Varies, a senior VP-level role)

- Managing Director (MD)

Each promotion comes with a substantial increase in both base salary and bonus potential. A newly promoted MD will be at the lower end of the pay scale, while a veteran MD with a 25-year track record of major deals will be at the absolute top.

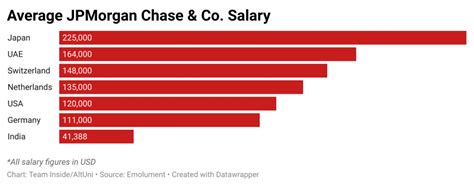

Geographic Location

Finance is a global industry, but its key hubs command the highest salaries due to a higher cost of living and a greater concentration of deal flow.

- Top Tier: New York City is the epicenter of finance in the U.S., and salaries there set the benchmark. Other top-tier global hubs like London and Hong Kong offer comparable, highly competitive compensation packages.

- Second Tier: Major financial centers like Chicago, San Francisco, and Boston also offer robust salaries, though they may be slightly lower than in New York.

According to Payscale, financial professionals in New York can earn significantly more than the national average, a trend that is most pronounced at senior levels.

Company Type

JP Morgan is a "bulge bracket" investment bank—the largest and most profitable type of bank in the world. These firms (which also include Goldman Sachs, Morgan Stanley, etc.) generally pay the highest compensation due to the size and complexity of the deals they handle. Compensation structures may differ at other types of firms, such as elite boutique banks (which may offer a higher "eat-what-you-kill" bonus potential) or middle-market banks, where total compensation might be lower.

Area of Specialization

Within JP Morgan, an MD's division plays a huge role in their earnings. The closer a role is to direct revenue generation, the higher the bonus potential.

- High-Earning Groups: Divisions like Mergers & Acquisitions (M&A), Leveraged Finance, and Capital Markets focusing on hot sectors like technology or healthcare are often the most lucrative. These groups generate massive fees for the firm.

- Other Groups: MDs in areas like Equity Research, Sales & Trading, or Asset Management also have extremely high earning potential, but their bonus structures are tied to different performance metrics (e.g., trading P&L, assets under management).

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking Managing Director" as a specific role, the outlook for the broader category of Financial Managers provides excellent insight.

According to the BLS Occupational Outlook Handbook, employment for financial managers is projected to grow 16 percent from 2022 to 2032, which is "much faster than the average for all occupations." The BLS cites the increasing complexity of global commerce and the need for expert financial guidance as key drivers of this growth.

However, it's crucial to note that while the demand for financial expertise is high, the number of MD positions is extremely limited and fiercely competitive. These are top-level leadership roles reserved for a very small percentage of professionals in the industry.

Conclusion

A career as a Managing Director at JP Morgan is one of the most financially rewarding paths in the professional world. While the base salary is substantial, the true earning potential lies in the performance-based bonus, which can elevate total compensation to well over $1 million annually.

For aspiring professionals, the key takeaways are:

- It’s a Marathon, Not a Sprint: Reaching the MD level is the result of 15+ years of high performance, resilience, and strategic career moves.

- Performance is Paramount: Your value is tied directly to the business you can generate and the clients you manage.

- Location and Specialization Matter: Working in a major financial hub and in a high-revenue division will maximize your earning potential.

While the journey is incredibly demanding, for those with the ambition and ability to navigate the competitive landscape of investment banking, the role of Managing Director at a firm like JP Morgan remains the ultimate prize.