JPMorgan Chase & Co. stands as a titan in the global financial landscape. For ambitious students and seasoned professionals alike, a career at this prestigious firm represents a pinnacle of achievement. But beyond the reputation, what are the real numbers? A role at JPMorgan Chase offers the potential for significant financial rewards, with compensation packages that can range from competitive starting salaries for operational staff to seven-figure totals for senior, revenue-generating leaders.

This guide will break down the complex world of JPMorgan salaries. We will explore the compensation structure for various roles, analyze the key factors that dictate your earning potential, and provide a data-driven look at what you can expect from a career at this financial powerhouse.

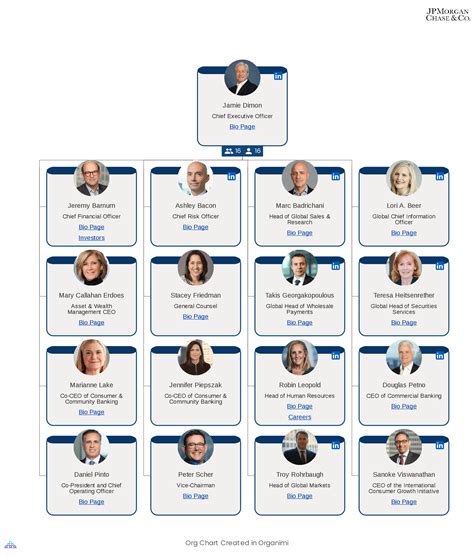

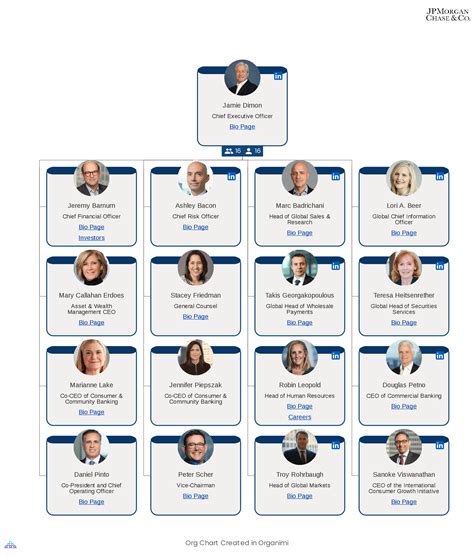

Understanding Roles and Responsibilities at JPMorgan Chase

It's crucial to understand that there is no single "JPMorgan job." The firm is a massive, diversified financial institution with several distinct business lines, each containing hundreds of different roles. Your responsibilities—and consequently, your salary—are determined by where you fit within the organization.

The main divisions include:

- Corporate & Investment Bank (CIB): This is the division most people associate with Wall Street. It includes high-stakes roles in Investment Banking (Mergers & Acquisitions, Capital Markets), Markets (Sales & Trading), and Global Corporate Banking.

- Asset & Wealth Management (AWM): This division manages investments for institutions and high-net-worth individuals. Roles include portfolio managers, private bankers, and investment specialists.

- Commercial Banking (CB): This group provides services to mid-sized businesses, including lending, treasury solutions, and credit.

- Consumer & Community Banking (CCB): This is the Chase brand that serves millions of customers through retail banking, credit cards, mortgages, and auto finance.

- Technology & Corporate Functions: The backbone of the firm, this includes thousands of employees in roles like Software Engineering, Data Science, Risk Management, Compliance, HR, and Marketing.

Average Salaries at JPMorgan Chase

Given the vast array of roles, a single "average salary" can be misleading. It's more instructive to look at compensation by role and level. A significant portion of pay, especially in front-office roles, comes from an annual performance-based bonus, which can often exceed the base salary.

Here is a look at typical compensation ranges for several key positions within the firm.

| Role/Title | Typical Base Salary Range | Estimated Total Compensation (Base + Bonus) |

| :--- | :--- | :--- |

| Investment Banking Analyst (1st Year) | $110,000 - $125,000 | $175,000 - $225,000+ |

| Investment Banking Associate (Post-MBA) | $175,000 - $225,000 | $275,000 - $400,000+ |

| Vice President (Investment Banking) | $250,000 - $300,000 | $450,000 - $700,000+ |

| Software Engineer (Entry-Level) | $90,000 - $120,000 | $105,000 - $140,000+ |

| Senior Software Engineer (VP Level) | $150,000 - $190,000 | $180,000 - $250,000+ |

| Wealth Management Advisor | $80,000 - $150,000 | Varies widely based on assets under management (AUM) |

| Operations Analyst | $65,000 - $85,000 | $70,000 - $95,000+ |

| Bank Teller (Chase) | $35,000 - $45,000 | Hourly, with some bonus potential |

*Source: Data compiled and synthesized from recent reports on Glassdoor, Levels.fyi, Salary.com, and Wall Street Oasis as of late 2023 and early 2024. Ranges are estimates and can vary.*

Key Factors That Influence Salary

Your specific compensation package at JPMorgan is not arbitrary. It is calculated based on a combination of well-defined factors.

Level of Education

A bachelor’s degree is the standard requirement for almost all professional roles at the firm. The prestige of your undergraduate institution and your academic performance can influence your desirability as a candidate, especially for competitive front-office positions.

For many, an advanced degree is a powerful accelerator. A Master of Business Administration (MBA) from a top-tier program is the traditional pathway to entering the Investment Banking division at the "Associate" level, which comes with a significant jump in both base salary and bonus potential compared to an undergraduate Analyst. For highly technical and lucrative roles in quantitative finance ("quants"), a Ph.D. or a master's degree in a field like Financial Engineering, Computer Science, or Mathematics is often required.

Years of Experience

Experience is perhaps the single most significant driver of compensation. JPMorgan, like other investment banks, has a very structured career progression, especially in its front-office divisions. The typical path is Analyst, Associate, Vice President (VP), Executive Director (ED), and Managing Director (MD). Each promotion brings a substantial increase in base salary and, more importantly, a geometric rise in bonus potential. An MD’s bonus can be many multiples of their base salary, often reaching seven figures in a good year.

According to Payscale, an employee with less than one year of experience might start around $80,000 on average (across all roles), while an employee with over 20 years of experience can command an average base salary well over $180,000, with total compensation being much higher.

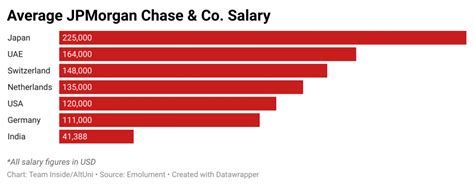

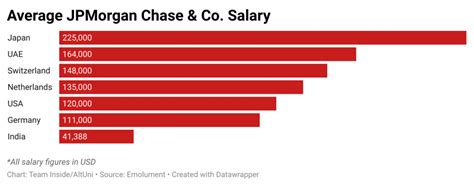

Geographic Location

Where you work matters immensely. JPMorgan has a global presence, but its major hubs in high cost-of-living (HCOL) financial centers command the highest salaries. New York City is the epicenter and generally sets the top of the pay scale, with London and Hong Kong also offering premium compensation.

Other U.S. hubs like San Francisco and Chicago also offer high salaries, though they may be slightly below New York levels. The firm also has large operational and technology centers in locations like Plano, Texas; Columbus, Ohio; and Wilmington, Delaware. While salaries in these locations are lower than in New York, they are still highly competitive for their respective regions and offer a lower cost of living.

Business Division and Role

As the salary table illustrates, your division dictates your pay ceiling. This is often framed as "Front Office vs. Middle/Back Office."

- Front Office: These are the revenue-generating roles (Investment Banking, Sales & Trading, Private Banking). They have the highest earning potential due to their direct impact on the firm's bottom line. Their compensation is heavily weighted towards performance bonuses.

- Middle & Back Office: These roles support the front office and include functions like Risk Management, Compliance, Technology, and Operations. While they are critical to the firm's success, they are viewed as "cost centers" rather than "profit centers." Salaries are strong and stable but lack the exponential bonus potential of the front office.

Area of Specialization

Even within a division, specialization can impact pay. For example, within the Investment Bank, analysts working in highly active and complex groups like Mergers & Acquisitions (M&A) or specialized technology or healthcare teams may see higher bonuses than those in less active sectors.

In technology, this is even more pronounced. A quantitative developer working on complex trading algorithms or a data scientist specializing in AI/Machine Learning will earn significantly more than a software engineer working on internal HR applications.

Job Outlook

JPMorgan Chase is a bellwether for the financial services industry. While the company does not release specific hiring growth targets, we can look to the U.S. Bureau of Labor Statistics (BLS) for the outlook of the broader industry.

- Financial Analysts: The BLS projects employment for financial analysts to grow 8% from 2022 to 2032, faster than the average for all occupations.

- Securities, Commodities, and Financial Services Sales Agents: This category, which includes investment bankers and traders, is projected to grow 10% from 2022 to 2032, also much faster than average.

- Software Developers: With finance becoming increasingly tech-driven, the outlook for developers is exceptionally strong, with a projected growth rate of 25% from 2022 to 2032.

Competition for roles at premier firms like JPMorgan will always be intense. However, the overall industry growth suggests a sustained demand for talented finance and technology professionals.

Conclusion

A career at JPMorgan Chase offers a pathway to exceptional financial success, but it is not a monolithic experience. Your salary is a dynamic figure determined by your education, your experience, your location, and, most importantly, the specific role you play within this global institution.

Key Takeaways:

- Pay is Role-Dependent: Front-office, revenue-generating roles in the Investment Bank offer the highest compensation, heavily weighted by performance bonuses.

- Experience is King: Structured career progression from Analyst to Managing Director leads to exponential growth in earning potential.

- Location Matters: Major financial hubs like New York City pay a significant premium.

- Tech is Booming: Specialized technology roles in areas like quantitative finance and AI are becoming some of the most lucrative and in-demand positions within the bank.

For those willing to meet the high demands of the industry, a career at JPMorgan Chase is not just a job—it's an opportunity to build a highly rewarding professional and financial future.