A Vice President role at a financial powerhouse like JPMorgan Chase & Co. represents a significant milestone in a finance professional's career. It signifies expertise, leadership, and the potential for substantial financial reward. For those aspiring to climb the corporate ladder in banking, the question isn't just *if* they can reach this level, but what the compensation looks like when they do. With total compensation packages often soaring well beyond $300,000, the role is as lucrative as it is prestigious.

This article provides a data-driven, in-depth analysis of a JPMorgan Vice President's salary, exploring the key factors that influence earnings and the career outlook for this demanding yet rewarding profession.

What Does a JPMorgan Vice President Do?

First, it's crucial to understand that the "Vice President" (VP) title in investment banking is not an executive C-suite position. Instead, it is a mid-to-senior level rank within the firm's hierarchy, typically sitting above the Associate level and below the Director or Executive Director level.

A VP at JPMorgan Chase is an experienced professional who takes on significant responsibility. Their duties often include:

- Project and Deal Management: Leading the day-to-day execution of deals, such as mergers and acquisitions (M&A), initial public offerings (IPOs), or other financing transactions.

- Client Relationship Management: Serving as a key point of contact for clients, building relationships, and understanding their financial needs.

- Mentorship and Team Leadership: Managing and mentoring junior team members, including Analysts and Associates, and overseeing the quality of their financial models and presentations.

- Strategic Contribution: Contributing to the strategic direction of their group and actively participating in business development efforts.

Average JPMorgan Vice President Salary

Compensation for a VP at JPMorgan Chase is multifaceted, comprising a strong base salary and a significant, often larger, performance-based bonus. This structure is designed to reward high performance and successful deal execution.

Based on aggregated data from multiple reputable sources, here is a typical breakdown:

- Average Base Salary: According to figures from Salary.com and Glassdoor, the average base salary for a Vice President at JPMorgan Chase in the United States typically falls between $175,000 and $220,000 per year as of late 2023 and early 2024.

- Total Compensation (Base + Bonus): The base salary is only part of the equation. The annual bonus is where compensation escalates significantly. When including performance-based bonuses and any potential stock awards, the total compensation for a J.P. Morgan VP can range from $250,000 to over $400,000.

- Median Figures: The tech and finance salary aggregator Levels.fyi reports a median total compensation for a J.P. Morgan VP (level 603) at approximately $330,000, with a median base of $200,000 and a median bonus of $100,000, supplemented by stock awards.

It's important to note that these figures are estimates and can vary widely based on the factors discussed below.

Key Factors That Influence Salary

Compensation is not a one-size-fits-all number. Several critical factors determine where a specific VP's salary will fall within the expected range.

### Years of Experience

Experience is a primary driver of salary progression. A newly promoted VP (often with 5-7 years of total industry experience) will be at the lower end of the compensation band. A senior VP with several years at the title, who has proven their ability to lead deals and manage client relationships effectively, will command a higher base salary and a significantly larger bonus.

### Area of Specialization (Division)

JPMorgan Chase is a massive, diversified financial institution. The division a VP works in has one of the most significant impacts on their earning potential.

- Investment Banking Division (IBD): This is traditionally one of the highest-paying areas. VPs in M&A or industry coverage groups (like Technology, Media, and Telecom or Healthcare) who close large, profitable deals can expect some of the highest bonuses.

- Markets (Sales & Trading): Compensation here is closely tied to the performance of the trading desk and the individual's P&L (Profit & Loss). Successful trading VPs can earn bonuses that rival or even exceed those in IBD.

- Asset & Wealth Management: VPs in this division manage portfolios for high-net-worth individuals and institutions. While bonuses can be substantial, total compensation is generally considered more stable and slightly lower than in front-office IBD or Markets roles.

- Corporate & Commercial Banking: These roles focus on providing banking services to large corporations. Compensation is very competitive but typically more conservative than in the investment bank.

- Technology: A VP in a technology role at J.P. Morgan is also a highly compensated position, competitive with Big Tech. The compensation structure may lean more towards base salary and restricted stock units (RSUs) rather than a single, massive annual bonus.

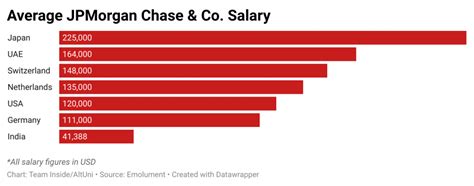

### Geographic Location

Where you work matters. Major financial hubs with a high cost of living and a high concentration of talent command the highest salaries.

- New York City: As JPMorgan's headquarters and the financial capital of the world, NYC sets the benchmark for top-tier salaries.

- Other Major Hubs: Locations like London, Hong Kong, San Francisco, and Chicago also offer highly competitive compensation packages, though they may differ slightly from New York.

- Regional Offices: Offices in cities like Houston, Charlotte, or Dallas will still offer lucrative salaries but may have slightly lower bands to reflect the regional market and cost of living.

### Level of Education

While direct promotion through the ranks is common, educational background can play a role, particularly in career acceleration. An MBA from a top-tier business school (e.g., Wharton, Harvard, Stanford) is a traditional and powerful entry point to the post-MBA Associate level. Professionals with this background are often on an accelerated path to VP and may command higher compensation due to their advanced training and network.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track data for "Investment Banking Vice President" specifically, we can look at the broader category of Financial Managers for an industry-level perspective.

The BLS projects that employment for financial managers will grow 16% from 2022 to 2032, a rate considered "much faster than the average for all occupations." The median pay for this broad category was $139,790 per year in May 2022.

It's critical to contextualize this data: a VP role at an elite firm like JPMorgan Chase represents the top-tier of this profession, earning well above the median. While the industry outlook is strong, competition for these coveted roles remains exceptionally fierce. The demand for skilled financial professionals who can navigate complex markets, manage risk, and drive growth for clients is perennial.

Conclusion

A Vice President position at JPMorgan Chase is a testament to years of hard work, financial acumen, and dedication. The role offers a highly rewarding career path with a compensation package to match.

For aspiring professionals, the key takeaways are:

- Total Compensation is Key: Look beyond the base salary; the performance-based bonus is where the majority of earning potential lies.

- Specialization Matters: Your choice of division—from Investment Banking to Asset Management—will be a primary driver of your compensation.

- Performance is Paramount: Ultimately, salary progression and bonus size are tied directly to your performance, your ability to lead teams, and your success in serving the firm's clients.

For those willing to embrace the challenges of a fast-paced, high-stakes environment, the journey to becoming a Vice President at a firm like JPMorgan Chase offers an unparalleled opportunity for professional growth and financial success.