Introduction: Decoding the Value of Your Time

That moment of seeing "$20 per hour" on a job description can spark a wave of calculations and questions. Is it a good wage? What does that translate to annually? Can I build a life and a career on this foundation? For many, this pay rate represents a critical stepping stone—a gateway from entry-level hourly work to the stability and benefits of a full-time salaried position. It’s the starting line for a journey toward professional growth and financial security. But navigating this transition requires more than just a calculator; it demands a strategic understanding of the career landscape.

A $20 per hour wage, which equates to an annual salary of $41,600 before taxes (based on a standard 40-hour work week), is the entry point for a vast number of vital professional roles in our economy. These are the positions that form the backbone of successful organizations, from the administrative professionals who orchestrate daily operations to the customer service experts who are the voice of the company. It’s a salary that provides a solid foundation, but more importantly, it offers immense potential for growth for those who know how to leverage their skills and experience.

I once worked with a young professional who felt stuck in a series of disconnected $18-an-hour contract gigs. By helping them identify the core, transferable skills they'd built—client communication, data entry, and scheduling—we crafted a resume that landed them a full-time, salaried administrative role starting at the equivalent of $21 an hour, but with full benefits, paid time off, and a clear path for advancement. That shift wasn't just about a dollar more per hour; it was about transforming a job into a career. This guide is designed to give you that same strategic roadmap.

We will dissect what it truly means to earn a $20 per hour to salary wage, explore the jobs available at this level, and provide a comprehensive, data-driven blueprint for maximizing your earning potential and charting a course for long-term success.

### Table of Contents

- [What Does a $20-an-Hour Professional Do?](#what-does-a-20-an-hour-professional-do)

- [Average $20 per hour to salary Salary: A Deep Dive](#average-20-per-hour-to-salary-salary-a-deep-dive)

- [Key Factors That Influence Your Salary](#key-factors-that-influence-your-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career Path](#how-to-get-started-in-this-career-path)

- [Conclusion: Building Your Career from a Solid Foundation](#conclusion-building-your-career-from-a-solid-foundation)

What Does a $20-an-Hour Professional Do?

While "$20 an hour" isn't a job title, it's a compensation benchmark that encompasses a wide array of crucial, skilled roles across nearly every industry. Professionals earning at this level are often the operational engine of a company. They are the organizers, the communicators, the problem-solvers, and the frontline support who ensure that business runs smoothly and efficiently. Their work is characterized by reliability, attention to detail, and a strong service orientation.

These roles typically require a high school diploma or an associate's degree, along with specific software competencies and excellent interpersonal skills. The work is often a mix of routine tasks and unexpected challenges, demanding adaptability and a proactive mindset. Let's explore some of the most common professions that fall within this pay grade.

### Common Roles and Core Responsibilities:

1. Administrative Assistant / Executive Assistant: This is perhaps the most classic example. These professionals manage schedules, organize meetings, handle correspondence, prepare reports and presentations, and maintain filing systems. They are the central nervous system of an office or an executive's work life.

2. Customer Service Representative (Tier 2 or Specialized): While entry-level call center jobs may pay less, skilled customer service professionals who handle more complex inquiries, manage escalations, or work in specialized industries (like tech support or finance) often earn in the $20/hour range. They are masters of conflict resolution, product knowledge, and client relationship management.

3. Bookkeeping or Accounting Clerk: Responsible for maintaining a company's financial records. Daily tasks include recording transactions, processing accounts payable and receivable, managing payroll, and reconciling bank statements. This role requires meticulous accuracy and proficiency with accounting software like QuickBooks or SAP.

4. Medical Assistant or Administrative Medical Secretary: Working in a healthcare setting, these individuals perform administrative and sometimes clinical duties. They schedule appointments, manage patient records (often using EHR systems), handle billing and insurance claims, and act as a liaison between patients and medical staff.

5. Human Resources (HR) Assistant: An entry point into the world of HR, these assistants support the HR department with tasks like posting job openings, screening resumes, scheduling interviews, onboarding new hires, and maintaining employee records. They must be trustworthy and handle confidential information with discretion.

### A "Day in the Life" Composite Example

To make this more concrete, let's imagine a "Day in the Life" of a skilled professional earning a $41,600 salary. This composite pulls tasks from several of the roles mentioned above to illustrate the dynamic nature of the work.

8:45 AM: Arrive at the office (or log into the remote system). Grab a coffee and review your calendar and to-do list for the day. You see an urgent flag on an email from your manager asking for the latest sales figures for a 10:00 AM meeting.

9:00 AM: You access the company's CRM (like Salesforce), export the relevant data into Excel, format it into a clean, easy-to-read table, and email it to your manager. You also handle two urgent appointment rescheduling requests for senior team members.

10:00 AM - 11:30 AM: Time for focused work. You begin processing last week's invoices, carefully cross-referencing purchase orders and ensuring all codes are correct in the accounting software. During this time, you take a call from a key client who is having trouble with a recent order. You patiently listen, document their issue in the ticketing system, and successfully resolve their problem by coordinating with the logistics department.

11:30 AM - 12:30 PM: You help the HR department by prescreening a dozen resumes for a new coordinator position, flagging the top five candidates who meet the core criteria. You then send out templated emails to schedule initial phone screens.

12:30 PM - 1:30 PM: Lunch break.

1:30 PM - 3:00 PM: You are tasked with organizing the logistics for a quarterly team offsite event. This involves researching and getting quotes from venues, creating a budget spreadsheet, and drafting a survey to send to the team for activity preferences.

3:00 PM - 4:30 PM: You dedicate this time to "deep work" on a recurring task: compiling and formatting the monthly departmental newsletter. You gather content from various team leads, edit it for clarity and tone, and lay it out in a marketing template (like Mailchimp or HubSpot).

4:30 PM - 5:00 PM: You do a final sweep of your inbox, responding to any remaining quick questions. You update your to-do list for tomorrow, ensuring that high-priority tasks are at the top. You send a brief end-of-day summary to your manager if required, then log off, having successfully managed a blend of financial, administrative, and client-facing responsibilities.

This day illustrates the essential nature of the role: it's about being a reliable, proactive, and versatile hub of activity that enables others in the organization to do their jobs more effectively.

Average $20 per hour to salary Salary: A Deep Dive

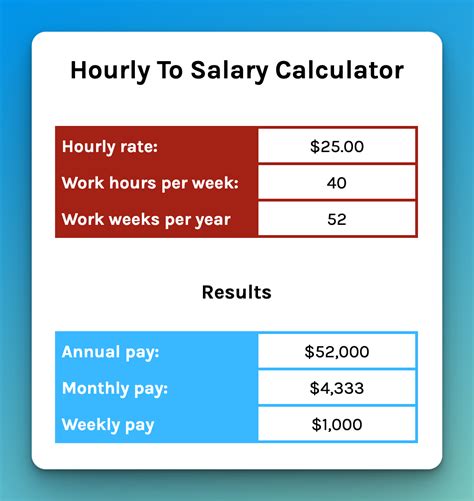

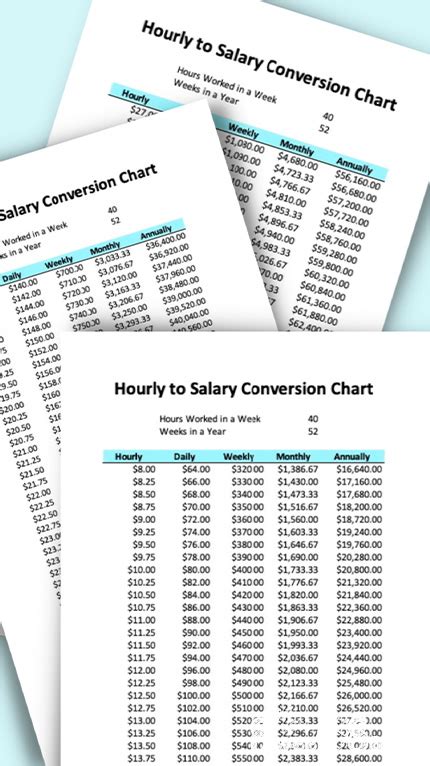

The starting point for our analysis is the direct conversion: a $20 per hour wage translates to an annual gross salary of $41,600. This is calculated as follows:

`$20/hour × 40 hours/week × 52 weeks/year = $41,600/year`

This figure serves as a crucial national benchmark, but it is by no means a static number. It represents the *starting salary* or the pay for a professional with a foundational skill set in many parts of the United States. To truly understand the earning potential, we must look at the typical salary range, from entry-level to senior positions, and consider the complete compensation package.

### National Averages and Salary Ranges

Authoritative sources provide a clearer picture of where this salary fits within the broader market. It's important to look at data for the *types* of jobs that typically pay in this range.

- U.S. Bureau of Labor Statistics (BLS): The BLS provides some of the most reliable data. For example, in its May 2023 Occupational Outlook Handbook update:

- The median pay for Administrative Assistants and Executive Assistants was $44,550 per year, or $21.42 per hour. This indicates that $41,600 is very much in line with the national average, likely representing a professional in the earlier stages of their career.

- The median pay for Customer Service Representatives was $37,790 per year, or $18.17 per hour. A $20/hour wage in this field suggests a more experienced or specialized role, placing you above the median.

- The median pay for Bookkeeping, Accounting, and Auditing Clerks was $47,430 per year, or $22.80 per hour. Here, a $41,600 salary would be typical for an entry-level or junior position.

- The median pay for Medical Assistants was $42,000 per year, or $20.19 per hour, placing a $20/hour wage squarely at the national median.

- Salary Aggregators: Websites like Payscale and Salary.com provide real-time, aggregated data that often shows a wider range.

- Payscale.com reports the average salary for an Administrative Assistant is around $46,000 per year, with a typical range of $35,000 to $62,000.

- Salary.com shows the median salary for an Administrative Assistant I (entry-level) in the U.S. is approximately $45,391, with the salary range typically falling between $40,600 and $51,190.

This data confirms that a salary of $41,600 is a very realistic and common salary for individuals in these foundational professional roles, especially for those with 0-3 years of experience.

### Salary Progression by Experience Level

Your salary will not remain at $41,600 forever. Experience is one of the most significant drivers of income growth. Here is a typical progression for a professional role starting in this range, based on aggregated data from Payscale and Salary.com.

| Experience Level | Typical Years of Experience | Typical Salary Range | Key Characteristics |

| :--- | :--- | :--- | :--- |

| Entry-Level | 0-2 Years | $38,000 - $48,000 | Learning core job functions, requires direct supervision, focused on task execution. |

| Mid-Career | 3-7 Years | $49,000 - $65,000 | Works independently, handles more complex projects, may mentor junior staff, proficient in multiple software systems. |

| Senior/Specialist | 8-15+ Years | $66,000 - $85,000+ | Manages projects or small teams, acts as a subject matter expert (e.g., Executive Assistant to C-Suite, Senior Bookkeeper, Legal Assistant), involved in process improvement. |

As you can see, a career path that starts at $41,600 can realistically double in salary over a decade or more with consistent performance, skill development, and strategic career moves. An Executive Assistant supporting a C-level executive in a major corporation, for example, can often earn a salary exceeding $100,000.

### Beyond the Paycheck: The Total Compensation Package

One of the most significant advantages of moving from an hourly role to a salaried position is the access to a comprehensive benefits package. This "total compensation" is often worth an additional 20-40% of your base salary. When evaluating a job offer, you must look beyond the $41,600 figure and consider the full value.

Common Components of a Total Compensation Package:

- Health Insurance: This is a major benefit. Employer contributions towards medical, dental, and vision insurance premiums can be worth thousands of dollars per year. A company with a generous plan that has low deductibles and co-pays is far more valuable than one with a high-deductible plan.

- Retirement Savings Plan: Access to a 401(k) or 403(b) plan is critical for long-term financial health. The most important feature is the employer match. A common match is 50% of your contributions up to 6% of your salary. For a $41,600 salary, if you contribute 6% ($2,496), your employer adds another $1,248 to your retirement account for free.

- Paid Time Off (PTO): This includes vacation days, sick leave, and personal days. A standard package might offer 10-15 vacation days, 5-7 sick days, and several public holidays. This paid leave is a direct financial benefit compared to hourly work where time off is often unpaid.

- Bonuses and Profit Sharing: While not always guaranteed, many companies offer annual performance-based bonuses. These can range from a few hundred dollars to several thousand, depending on individual and company performance.

- Professional Development: Many employers will pay for certifications, online courses, or attendance at industry conferences. This is a direct investment in your future earning potential.

- Other Perks: These can include life insurance, short-term and long-term disability insurance, wellness stipends, commuter benefits, and employee assistance programs (EAPs).

When comparing a $20/hour contract role with no benefits to a $41,600 salaried role with a solid benefits package, the salaried position is almost always the more lucrative and secure option.

Key Factors That Influence Your Salary

Your starting salary and long-term earning potential are not set in stone. They are influenced by a dynamic interplay of several key factors. Understanding and strategically navigating these elements is the secret to accelerating your journey from $41,600 to $60,000, $80,000, and beyond. This section provides a granular analysis of each factor, offering actionable insights to maximize your value in the job market.

### Level of Education

While many jobs in the $20/hour range are accessible with a high school diploma, your educational background creates a clear ceiling—or ladder—for your potential earnings.

- High School Diploma or GED: This is the baseline for most administrative, customer service, and clerical roles. At this level, employers will heavily weigh your practical experience and demonstrated skills. Your starting pay will likely be right around the $38,000-$42,000 mark.

- Associate's Degree: An A.A. or A.S. degree, particularly in a relevant field like Business Administration, Accounting, or Paralegal Studies, immediately makes you a more competitive candidate. It signals a higher level of commitment and foundational knowledge. Employers are often willing to pay a premium of 5-10% for candidates with a relevant two-year degree, potentially starting you closer to $45,000.

- Bachelor's Degree: A four-year degree (B.A. or B.S.) significantly broadens your career path. Even if the degree is in an unrelated field like English or History, it demonstrates critical thinking, research, and communication skills. For a role like an Executive Assistant or a Junior Financial Analyst, a bachelor's degree is often a prerequisite and can command a starting salary in the $50,000 - $55,000 range, even with limited direct experience. It is the key that unlocks higher-level management and specialist tracks later in your career.

- Certifications: This is one of the most powerful tools for salary negotiation and career advancement. Industry-recognized certifications validate your expertise in a specific domain.

- Microsoft Office Specialist (MOS) Expert: Proves mastery of Excel, Word, and PowerPoint. Essential for any administrative or data-heavy role.

- Certified Administrative Professional (CAP): Offered by the International Association of Administrative Professionals (IAAP), this is a highly respected credential that can significantly boost your credibility and pay.

- QuickBooks Certified User: A must-have for bookkeeping and accounting clerk roles, immediately signaling your value.

- Project Management Certifications (e.g., CAPM): The Certified Associate in Project Management is an entry-level credential that shows you understand the principles of managing projects, a skill valuable in any role.

Actionable Advice: If you have a high school diploma, prioritize getting a valuable certification. If you have an unrelated bachelor's degree, supplement it with certifications relevant to your target role.

### Years of Experience

Experience is the currency of the professional world. As you accumulate years of relevant work, your value shifts from your potential to your proven track record.

- 0-2 Years (The Learner): At this stage, your salary hovers around the baseline ($38k-$48k). Your primary goal is to absorb as much as possible. Focus on mastering your core duties, being reliable, and building a reputation as a quick learner. Say "yes" to new tasks and projects.

- 3-5 Years (The Contributor): You now have a solid grasp of your role and the industry. You work more independently and may begin to informally mentor new hires. Your salary should see a significant jump into the $49k-$60k range. This is the time to start asking for more complex projects and taking initiative to improve processes.

- 6-10 Years (The Specialist/Leader): With this level of experience, you are a subject matter expert. You can transition into more specialized, higher-paying roles like an Executive Assistant to a senior VP, a Senior Bookkeeper managing the books for a small business, or a Team Lead in a customer service department. Salaries in this bracket often reach $60k-$75k.

- 10+ Years (The Strategist): Professionals with over a decade of experience are strategic assets. They may be an Executive Assistant to a C-Suite officer, a full-charge Bookkeeper, an Office Manager, or a Paralegal. Their institutional knowledge is invaluable. At this stage, salaries can push well into the $75k-$95k+ range, especially when combined with other factors like location and specialization.

Actionable Advice: Don't just "do your time." Actively document your accomplishments at each stage. At your annual review, come prepared with a list of projects completed, processes improved, and money saved. This is how you justify a raise that outpaces the standard cost-of-living adjustment.

### Geographic Location

Where you work is one of the most significant—and least flexible—determinants of your salary. Companies adjust pay scales based on the local cost of living and the competitiveness of the talent market. The same job can pay dramatically different amounts in different cities.

- High Cost of Living (HCOL) Areas: Major metropolitan centers like San Francisco, San Jose, New York City, and Boston have the highest salaries to compensate for exorbitant housing and living costs. An administrative role that pays $42,000 in a smaller city could easily command $60,000 - $70,000 in an HCOL city. For example, according to Salary.com, the median salary for an Administrative Assistant I in New York, NY is around $51,700, significantly higher than the national median.

- Medium Cost of Living (MCOL) Areas: Cities like Austin, Denver, Chicago, and Atlanta offer a balance. Salaries are strong, but the cost of living is more manageable than in HCOL hubs. You might expect salaries to be 5-15% above the national average here.

- Low Cost of Living (LCOL) Areas: Smaller cities and rural regions in the Midwest and South will generally offer lower salaries. The $41,600 salary might be the median or even slightly above-average pay for a skilled professional in these locations. However, the purchasing power of that salary can be much greater.

Here's a sample comparison for a "Bookkeeping Clerk" role using 2024 data from salary aggregators to illustrate the point:

| Location | Typical Salary Range | Cost of Living Index (US Avg = 100) |

| :--- | :--- | :--- |

| San Francisco, CA | $55,000 - $75,000 | 179 |

| Denver, CO | $48,000 - $65,000 | 114 |

| Kansas City, MO | $42,000 - $58,000 | 89 |

| National Average | $47,000 | 100 |

Actionable Advice: If you have the flexibility to relocate, target MCOL cities with growing job markets. If you are in an HCOL area, ensure your salary expectations reflect the local market rate; do not accept a national average salary. For remote workers, be aware that some companies are now adjusting salaries based on employee location, a policy known as "geo-arbitrage."

### Company Type & Size

The type of organization you work for has a profound impact on your compensation and career experience.

- Startups: Often offer lower base salaries but may compensate with stock options or equity. Benefits can be less comprehensive. The environment is fast-paced and offers incredible opportunities to learn and take on responsibility quickly. A role here is a bet on the company's future growth.

- Large Corporations (Fortune 500): Typically offer competitive, market-rate salaries with highly structured pay bands. The real advantage is the robust benefits package: excellent health insurance, generous 401(k) matches, and ample professional development funds. Career paths are well-defined, but advancement can be slower and more political.

- Small to Medium-Sized Businesses (SMBs): Salaries can vary widely. Some SMBs pay very well to attract top talent, while others are more budget-constrained. You often have a broader role and more direct impact than in a large corporation. Benefits are usually good but may not be as rich as a corporate giant's.

- Non-Profits: These organizations are mission-driven. Salaries are notoriously lower than in the for-profit sector, often by 10-20%. However, they can offer excellent work-life balance and a deep sense of purpose. Benefits can be surprisingly good, especially in larger, well-established non-profits.

- Government (Local, State, Federal): Government jobs are known for stability and exceptional benefits, particularly pensions and healthcare. The base salary may start slightly lower than in the private sector, but the total compensation over a lifetime can be superior. The hiring process is often long and bureaucratic.

### Area of Specialization

This is where you can truly take control of your career trajectory. Generalists are valuable, but specialists are paid a premium. Starting in a general administrative role at $42,000 and then specializing is a proven path to a six-figure salary.

- General Administrative vs. Legal Assistant/Paralegal: A general admin assistant might top out around $60,000. A skilled Legal Assistant in a top law firm can earn $70,000 - $90,000+. Paralegals, who have specialized training and can perform substantive legal work, often earn even more.

- General Bookkeeper vs. Full-Charge Bookkeeper: A clerk handling accounts payable is valuable. A full-charge bookkeeper who manages the entire financial cycle for a small business—including payroll, financial statements, and month-end closing—is indispensable and can command a salary of $65,000 - $85,000.

- Administrative Assistant vs. Executive Assistant to a C-Suite Executive: The leap from supporting a mid