A Vice President (VP) role at a global financial powerhouse like JPMorgan Chase represents a significant milestone in a finance professional's career. It signifies expertise, leadership, and a deep commitment to the industry. Naturally, this prestigious title comes with substantial financial rewards. While the exact figure can vary, a VP at JPMorgan can expect a total compensation package that is highly competitive, often ranging from $250,000 to over $400,000 annually.

This guide provides a data-driven look into what a Vice President at JPMorgan earns, the factors that influence this compensation, and the overall career outlook for finance professionals aiming for this level.

What Does a JPMorgan VP Do?

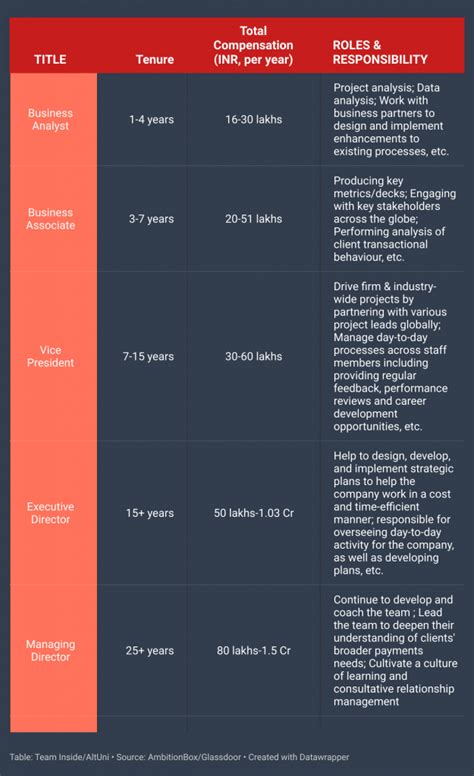

First, it's crucial to understand that the title "Vice President" in investment banking is not equivalent to a C-suite executive role in a typical corporation. In the hierarchical structure of a bank like JPMorgan, the VP is a mid-to-senior level position, sitting above the Analyst and Associate levels and below the Director and Managing Director ranks.

A VP is no longer just an analyst crunching numbers; they are a project manager, a mentor, and a key point of contact for clients. Key responsibilities often include:

- Managing Deal Execution: Overseeing the day-to-day execution of transactions, whether it's a merger, acquisition, or capital raise.

- Leading Junior Teams: Managing and mentoring Analysts and Associates, delegating tasks, and ensuring the quality of their work (e.g., financial models, pitchbooks).

- Client Relationship Management: Building and maintaining relationships with clients, often serving as a primary contact and trusted advisor.

- Strategic Contribution: Playing a more significant role in developing strategies for clients and contributing to the overall direction of a deal.

Average JPMorgan VP Salary

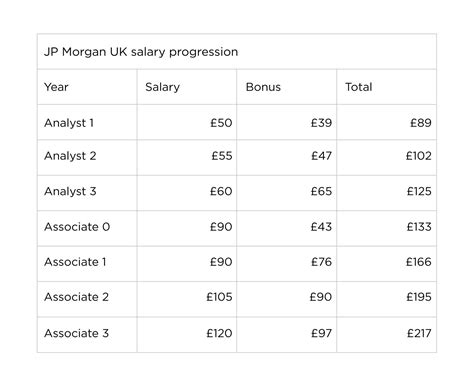

Compensation for a JPMorgan VP is a combination of a strong base salary and a significant performance-based bonus. This bonus component is what drives the substantial year-end earnings and is a critical part of the overall pay structure.

- Average Base Salary: According to extensive data from Salary.com, the typical base salary for a Vice President at JPMorgan Chase falls within the range of $168,190 to $214,990, with an average base of approximately $187,390 as of early 2024.

- Annual Bonus: The bonus is highly variable and depends on individual, group, and firm-wide performance. It can range from 40% to over 100% of the base salary.

- Total Compensation: When combining base salary and annual bonus, the total compensation package sees a significant jump. Glassdoor reports an average total pay of around $288,000 per year for a VP at JPMorgan Chase, with the likely range for total compensation falling between $232,000 and $364,000. More senior VPs in high-performing divisions can easily exceed $400,000 in a strong year.

Key Factors That Influence Salary

While the averages provide a solid benchmark, actual earnings for a JPMorgan VP can vary significantly based on several key factors.

###

Division or Line of Business

JPMorgan Chase is a massive, diversified financial institution. The division a VP works in is perhaps the single most important factor determining their compensation structure.

- Investment Banking Division (IBD): This is the most traditional and often most lucrative path. VPs in areas like Mergers & Acquisitions (M&A) or industry coverage groups (e.g., Tech, Healthcare) typically have the highest earning potential due to the high-stakes, deal-driven nature of their work.

- Sales & Trading (S&T): Compensation in this division is heavily tied to market performance and the VP's ability to generate revenue. A strong year in the markets can lead to exceptionally high bonuses.

- Asset & Wealth Management: VPs here manage portfolios and advise high-net-worth clients. Compensation is competitive but may have a slightly lower ceiling than IBD in blockbuster years, though it can offer more stable, recurring revenue-based pay.

- Corporate & Support Functions: VPs in roles like Technology, Risk Management, Compliance, or Human Resources are vital to the bank's operations. While their compensation is excellent and well above market rates for similar corporate roles, their bonuses are generally not as large as those in the front-office, revenue-generating divisions.

###

Years of Experience

Experience plays a critical role. The VP title is a band, not a single level. An employee is typically a VP for three to five years before being considered for a promotion to Director.

- First-Year VP (VP1): A newly promoted VP will be at the lower end of the compensation range.

- Senior VP (VP3+): A VP in their third or fourth year with a proven track record will command a higher base salary and a significantly larger bonus, reflecting their increased expertise and client ownership.

###

Geographic Location

Where a VP is based has a major impact on their salary, primarily driven by the cost of labor and living in major financial hubs.

- Top-Tier Cities (New York, London): These are the epicenters of global finance. VPs working in these locations receive the highest compensation to account for the intense competition and high cost of living.

- Other Financial Hubs (Chicago, Houston, San Francisco): Salaries in these cities are still very strong but may be slightly lower than in New York.

- Regional Offices (e.g., Columbus, Salt Lake City, Plano): JPMorgan has significant operations in these lower-cost-of-living cities. While VPs here are still well-compensated, their base salaries and bonuses will be adjusted downward compared to their New York counterparts.

###

Level of Education

While a bachelor's degree is the minimum requirement, advanced education is common and can influence career trajectory and earning potential. A Master of Business Administration (MBA) from a top-tier business school (e.g., Wharton, Harvard, Booth) is a very common path to entering a bank at the Associate level. Those who successfully navigate the post-MBA track to VP are often positioned for top-tier compensation.

###

Area of Specialization

Within a division like Investment Banking, the specific group a VP belongs to matters. VPs in high-demand, high-revenue groups like Technology, Media & Telecom (TMT), Healthcare, or specialized product groups like Leveraged Finance may see higher bonuses than those in less active sectors, reflecting the deal flow and revenue generated by their team.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track "Investment Banking VP" as a distinct role, we can analyze the outlook for the broader category of "Financial Managers" to understand industry trends. The BLS projects that employment for financial managers will grow by 16% from 2022 to 2032, a rate that is much faster than the average for all occupations.

This robust growth is driven by the increasing complexity of the global financial environment and the need for expert financial guidance. While the overall industry is healthy, it is crucial to note that competition for VP-level roles at elite institutions like JPMorgan Chase remains incredibly fierce. These positions are highly sought after and are awarded to top-performing individuals with a demonstrated history of success.

Conclusion

Securing a Vice President position at JPMorgan Chase is a hallmark of a successful career in finance. It is a demanding role that requires sharp analytical skills, leadership acumen, and unwavering dedication.

For those aspiring to this level, the key takeaways are:

- Total Compensation is Key: Look beyond the base salary; the performance-based bonus constitutes a massive portion of your annual earnings.

- Your Division Dictates Your Potential: A VP role in the Investment Banking Division will have a different—and often higher—pay structure than one in a corporate function.

- Location and Experience Matter: Expect your pay to scale with your years in the role and the city you work in.

The path to becoming a VP at JPMorgan is challenging, but for those who succeed, it offers a professionally and financially rewarding career at the pinnacle of the global finance industry.