For those with a passion for finance and a drive to help others achieve their goals, a career as a Financial Consultant is a highly rewarding path. At a powerhouse firm like Fidelity Investments, this role offers not only the chance to make a significant impact on clients' lives but also substantial earning potential, with many professionals earning well into the six-figure range.

But what does a Financial Consultant at a major firm like Fidelity actually earn? In this in-depth guide, we will break down the salary expectations, the key factors that drive compensation, and the overall career outlook for this dynamic profession.

What Does a Financial Consultant at Fidelity Do?

A Financial Consultant at Fidelity is a licensed financial professional who works directly with clients to understand their complete financial picture and help them achieve their long-term goals. Unlike a stockbroker focused solely on transactions, a Financial Consultant provides holistic, personalized advice.

Key responsibilities include:

- Financial Planning: Creating comprehensive financial plans covering retirement, college savings, investments, and insurance.

- Client Relationship Management: Building and maintaining a "book of business," serving as the primary point of contact for a portfolio of Fidelity clients.

- Investment Guidance: Educating clients on Fidelity's range of products, including mutual funds, ETFs, stocks, and bonds, and helping them build a portfolio aligned with their risk tolerance.

- Regulatory Compliance: Holding and maintaining essential industry licenses, such as the Series 7 and Series 66, to provide investment advice legally and ethically.

At its core, the role is about building trust and guiding clients through complex financial decisions with clarity and expertise.

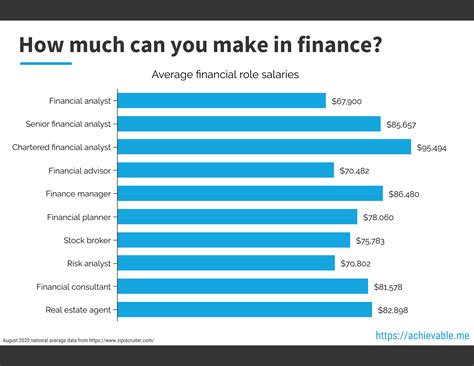

Average Financial Consultant Salary: Fidelity vs. The Industry

Compensation for Financial Consultants is typically a mix of a base salary and variable pay (bonuses, commissions, or profit sharing) tied to performance. This structure means total earnings can vary significantly.

For context, the U.S. Bureau of Labor Statistics (BLS) reports that the median annual wage for Personal Financial Advisors (the closest government classification) was $99,580 in May 2023. The top 10% of earners in this field brought in more than $239,200, highlighting the career's high-income potential.

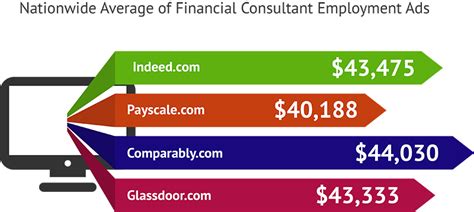

When looking specifically at Fidelity, salary aggregators provide a more focused picture. It's important to note these figures are based on user-submitted data and can fluctuate.

- Glassdoor reports that the estimated total pay for a Financial Consultant at Fidelity ranges from $115,000 to $193,000 per year, with an estimated average total pay of $148,000. This total compensation includes an average base salary of around $85,000 and significant additional pay from bonuses and commissions.

- Payscale corroborates this, showing an average base salary of approximately $74,000, with bonuses potentially adding tens of thousands more, leading to a similar six-figure total compensation package.

These figures show that Fidelity is highly competitive, often paying above the national median, especially when considering the robust benefits and bonus structures they offer.

Key Factors That Influence Salary

Your exact salary as a Financial Consultant at Fidelity isn't a single number—it's influenced by a combination of critical factors. Understanding these will help you maximize your earning potential.

### Level of Education

While a bachelor's degree in finance, economics, business, or a related field is the standard entry requirement, advanced education and certifications can dramatically increase your value and pay.

- Bachelor’s Degree: The foundational requirement for entry-level roles.

- Master’s Degree: An MBA or a Master's in Finance can lead to higher starting salaries and open doors to senior or leadership positions more quickly.

- Professional Certifications: This is a major differentiator. The Certified Financial Planner (CFP®) designation is the gold standard in the industry, signifying a high level of expertise in financial planning. Holding a CFP® can significantly boost credibility and earnings. Other valuable credentials include the Chartered Financial Analyst (CFA) for investment management and the ChFC® (Chartered Financial Consultant).

### Years of Experience

Experience is arguably the most significant factor in financial services. Compensation grows as you build your skills, client base, and track record. A typical career progression at a firm like Fidelity might look like this:

- Entry-Level (0-2 years): Roles like a Financial Representative or Associate focus on supporting senior consultants, client service, and learning the business. Base salaries are modest, but this is a critical training period.

- Financial Consultant (3-8 years): After obtaining licenses and proving your abilities, you begin managing your own book of clients. Your base salary increases, and your variable compensation becomes a much larger portion of your total pay as you gather assets and deepen client relationships.

- Senior/VP Financial Consultant (8+ years): Highly experienced consultants manage larger, more complex portfolios, often focusing on high-net-worth (HNW) clients. Their base salaries are higher, and their performance-based pay can be substantial, often pushing total compensation well above $200,000.

### Geographic Location

Where you work matters. Fidelity has offices and investor centers across the country, and salaries are adjusted based on the local cost of living and market demand. A Financial Consultant working in a major financial hub like Boston or New York City will command a higher base salary than one in a lower-cost-of-living area like Westlake, Texas, or Salt Lake City, Utah—two of Fidelity's major employment centers. However, the higher cost of living in major cities often offsets some of this salary premium.

### Company Type

While this article focuses on Fidelity, it's useful to understand how it compares to other employers. Fidelity is a large, full-service brokerage firm that provides a strong brand, extensive training, and a steady stream of clients.

- Wirehouses (e.g., Morgan Stanley, Merrill): Offer a similar structure to Fidelity with a strong brand and product platform.

- Independent RIAs (Registered Investment Advisors): These firms may offer greater autonomy and a potentially higher payout percentage, but consultants are often responsible for their own business development and marketing.

- Banks (e.g., Chase Private Client): Integrate banking and investment services, offering a different type of client experience and compensation structure.

Fidelity's model is attractive for its stability, resources, and client-centric focus.

### Area of Specialization

As consultants gain experience, they often develop a niche. Specializing in a high-demand area can lead to a more valuable practice and higher pay. Key specializations include:

- Retirement Planning: A core area of expertise for Fidelity and always in high demand.

- High-Net-Worth (HNW) Individuals: Working with affluent clients requires a sophisticated understanding of complex topics like estate planning, tax strategy, and alternative investments. This is one of the most lucrative specializations.

- Financial Planning for Small Business Owners: Advising entrepreneurs on both their personal and business finances is a valuable and complex niche.

Job Outlook

The future for financial consultants and advisors is exceptionally bright. According to the U.S. Bureau of Labor Statistics, employment of Personal Financial Advisors is projected to grow 13 percent from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is driven by several factors:

- The large Baby Boomer generation is entering retirement and needs professional help managing their savings.

- Financial products are becoming increasingly complex, requiring expert guidance.

- Longer lifespans mean retirement funds must last for decades, increasing the need for sophisticated planning.

Conclusion: A Rewarding Career Path

A career as a Financial Consultant at Fidelity offers a clear path to a high-earning, impactful profession. While the national median salary provides a good benchmark, your ultimate compensation will be a direct result of your dedication and strategic career choices.

Key Takeaways:

- Aim for Six Figures: Earning a total compensation package exceeding $100,000 is a realistic goal for a competent Financial Consultant at Fidelity.

- Compensation is Performance-Driven: Your salary is a combination of a stable base and variable pay that rewards building strong client relationships and achieving results.

- Invest in Yourself: Pursuing advanced certifications like the CFP® is one of the surest ways to accelerate your career and earning potential.

- Experience is King: Your value—and your paycheck—will grow as you build a track record of success and move into senior, specialized, or high-net-worth-focused roles.

For those ready to put in the work, the role of a Financial Consultant is not just a job, but a lucrative and professionally fulfilling long-term career.