For many ambitious professionals, the pinnacle of the corporate world is not just a job title but a symbol of profound impact, strategic leadership, and, undeniably, extraordinary financial reward. When people search for a "Julie Sweet salary," they are looking for more than a number; they are trying to comprehend the career trajectory that leads to becoming the Chair and CEO of a global powerhouse like Accenture. This is a quest to understand the ultimate destination on a long and demanding professional journey. Reaching this level of success is reserved for a select few, but the path itself is paved with lessons in leadership, strategy, and relentless value creation that can elevate any career.

The compensation for a top-tier C-suite executive is a complex tapestry woven from base salary, performance bonuses, and substantial equity awards, often culminating in eight-figure annual packages. According to a 2023 analysis by Equilar, the median total compensation for an S&P 500 CEO soared to a record $14.8 million. However, the broader category of "Top Executives," as defined by the U.S. Bureau of Labor Statistics, shows a median pay of $191,340 per year, highlighting the vast spectrum of leadership roles across companies of all sizes. The journey to the top is not a sprint; it's a marathon of strategic career moves, continuous learning, and unwavering dedication.

I recall a moment early in my consulting career when I was in a boardroom with the CEO of a Fortune 500 client. The sheer weight of the decisions being made—impacting tens of thousands of employees and billions in revenue—was palpable. It wasn't the authority that was most impressive, but the clarity of thought and deep sense of responsibility. That experience crystallized for me that a "Julie Sweet" role is less about the title and more about becoming the person who can capably bear that responsibility. This guide is designed to demystify that path, providing a comprehensive, data-driven roadmap for anyone who aspires to lead at the highest level. We will dissect the role, the salary, the influencing factors, and the concrete steps you can take to embark on this ultimate career journey.

### Table of Contents

- [What Does a C-Suite Executive Do?](#what-does-a-c-suite-executive-do)

- [Average C-Suite Executive Salary: A Deep Dive](#average-c-suite-executive-salary-a-deep-dive)

- [Key Factors That Influence Executive Salary](#key-factors-that-influence-executive-salary)

- [Job Outlook and Career Growth for Executives](#job-outlook-and-career-growth-for-executives)

- [How to Get Started on the C-Suite Path](#how-to-get-started-on-the-c-suite-path)

- [Conclusion: Is the Executive Path Right for You?](#conclusion-is-the-executive-path-right-for-you)

What Does a C-Suite Executive Do?

While the title of Chief Executive Officer (CEO) or another C-suite role (COO, CFO, CIO, etc.) is the most visible, the work itself is a multi-faceted and relentless exercise in high-stakes leadership. A top executive is, at their core, the chief steward of an organization's vision, health, and future. Their responsibilities transcend the day-to-day management tasks that occupy other levels of the organization; they operate on a strategic plane where decisions can have decade-long consequences.

The core mandate of a C-suite executive can be broken down into several key domains:

- Strategic Vision and Direction: The executive team, led by the CEO, is responsible for defining the company's "North Star." This involves answering fundamental questions: Where is the market going? What is our unique value proposition? Where should we invest our capital and talent for the next five to ten years? They set the overarching goals and strategy that the rest of the organization will execute.

- Financial Stewardship and Performance: The executive is ultimately accountable for the company's financial health. This includes overseeing budgets, managing profitability (P&L), ensuring a strong balance sheet, and delivering returns to shareholders or owners. They are the primary interface with investors, analysts, and the financial community.

- Stakeholder Management: A CEO's world is a complex web of stakeholders, each with different interests. This includes the Board of Directors (to whom they report), investors (who provide capital), employees (who create value), customers (who drive revenue), and regulators (who set the rules). A huge portion of their time is spent communicating with, negotiating with, and balancing the needs of these diverse groups.

- Organizational Leadership and Culture: A top executive is the ultimate culture-setter. Their behavior, communication style, and priorities signal what is valued within the organization. They are responsible for building and leading a high-performing senior leadership team, nurturing top talent, and ensuring the company is a place where people can do their best work.

- Crisis Management and Final Decision-Making: When a major crisis hits—a cyber-attack, a product recall, a PR disaster, or a global pandemic—the buck stops with the CEO. They must lead the response, make the toughest calls under immense pressure, and project calm and confidence to steer the organization through the storm.

### A "Day in the Life" of a Big-Tech CEO

To make this tangible, consider a hypothetical "Day in the Life" for a CEO of a large, publicly traded technology services firm, akin to Accenture:

- 5:30 AM: Wake up, physical workout, review overnight market news from Asia and Europe.

- 7:00 AM: Breakfast meeting with the Chief Financial Officer (CFO) to prepare for the quarterly earnings call with Wall Street analysts. They role-play difficult questions about growth forecasts and competitive pressures.

- 8:30 AM: Weekly Executive Leadership Team (ELT) meeting. The agenda includes a review of key performance indicators (KPIs), a deep dive into a potential multi-billion dollar acquisition target, and a debate on the company's new AI investment strategy.

- 11:00 AM: Virtual call with the Prime Minister of a European country to discuss a major public-sector digital transformation project and the company's commitment to creating jobs in the region.

- 12:30 PM: Lunch with the CEO of a top client (a Fortune 100 bank) to solidify the strategic partnership and discuss future collaborative innovation.

- 2:00 PM: Company-wide virtual Town Hall. The CEO presents the vision for the upcoming year, celebrates major wins, and answers live, unscripted questions from employees around the globe.

- 3:30 PM: Meeting with the Chief Human Resources Officer (CHRO) and top legal counsel to review the succession plan for a critical senior executive role.

- 5:00 PM: One-on-one call with a board member to provide a confidential update on the M&A pipeline and get their perspective on a looming regulatory challenge.

- 7:00 PM: Attend a high-profile industry awards dinner, serving as a keynote speaker on the topic of "Leading Through Technological Disruption."

- 9:30 PM: In the car home, reviewing and responding to the most urgent emails flagged by their executive assistant before disconnecting for family time.

This schedule illustrates a role dominated not by operational tasks, but by strategic communication, relationship building, and high-consequence decision-making.

Average C-Suite Executive Salary: A Deep Dive

The compensation for a top executive is one of the most widely discussed yet often misunderstood aspects of the corporate world. It is rarely a simple annual salary. Instead, it's a carefully structured package designed to align the executive's financial interests with the long-term success of the company. A "Julie Sweet" level salary is a constellation of base pay, short-term incentives, and, most significantly, long-term equity awards.

### Understanding the Spectrum of Executive Pay

It's crucial to differentiate between the compensation for executives at the world's largest public companies and those leading small or mid-sized businesses (SMBs).

- Top Executives (Broadly Defined): The U.S. Bureau of Labor Statistics (BLS) Occupational Outlook Handbook provides a grounded perspective on the broader category. As of May 2022, the median annual wage for top executives was $191,340. The lowest 10 percent earned less than $76,170, while the highest 10 percent earned more than $239,200. This data point is heavily weighted towards executives at the millions of SMBs across the country and is a far cry from the multi-million dollar packages of S&P 500 leaders.

- S&P 500 CEOs (The "Julie Sweet" Level): This is where compensation enters a different stratosphere. According to a comprehensive 2023 report from Equilar, which analyzes executive pay at the 500 largest U.S. public companies, the median total compensation for CEOs reached a record $14.8 million in 2022. For context, Julie Sweet's own reported total compensation for fiscal year 2023 was over $30 million, a figure that perfectly illustrates the pay scale at the very top of global business.

### Salary and Compensation by Career Stage (The Path to the Top)

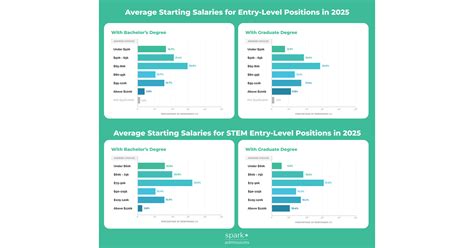

The journey to the C-suite is long, with compensation growing significantly at each major inflection point. While there is no "entry-level" CEO, we can map the salary progression through the leadership pipeline.

| Career Stage | Typical Experience | Average Base Salary Range | Total Compensation Potential (with Bonuses/Equity) |

| :--- | :--- | :--- | :--- |

| Director | 7-12+ years | $150,000 - $250,000 | $200,000 - $400,000+ |

| Vice President (VP) | 10-15+ years | $220,000 - $350,000 | $350,000 - $700,000+ |

| C-Suite (Non-CEO) at a Large Corp. | 15-20+ years | $400,000 - $750,000 | $1,000,000 - $5,000,000+ |

| CEO of a Mid-Sized Company | 15-25+ years | $300,000 - $600,000 | $750,000 - $2,500,000+ |

| CEO of an S&P 500 Company | 20-30+ years | $900,000 - $2,000,000 | $10,000,000 - $50,000,000+ |

*Sources: Salary data synthesized from recent reports on Glassdoor, Payscale, Salary.com, and industry compensation surveys by firms like Korn Ferry and Willis Towers Watson (2023-2024).*

### Deconstructing the Executive Compensation Package

The multi-million dollar figures are not typically cash in a bank account each year. They are composed of several key elements:

1. Base Salary: This is the fixed, guaranteed portion of cash compensation. For a top CEO like Julie Sweet, this might be between $1.5 million and $2 million. It's a significant amount but often represents only 10-15% of their total target compensation.

2. Annual Bonus / Short-Term Incentive Plan (STIP): This is a variable cash payment based on the company's (and sometimes the individual's) performance over the past fiscal year. Performance metrics are typically tied to revenue growth, profitability, cash flow, or other key strategic goals. The target bonus is often 100-200% of the base salary, but can pay out higher or lower depending on results.

3. Long-Term Incentive Plan (LTIP): This is the largest and most important component of executive pay. It's designed to align the executive's fortunes with those of the shareholders over a multi-year period. It typically consists of equity awards that vest over three to five years.

- Restricted Stock Units (RSUs): Grants of company stock that vest (i.e., become fully owned by the executive) over a set period of time, provided the executive remains with the company.

- Performance Stock Units (PSUs): These are the holy grail of executive pay. They are grants of company stock that only vest if specific, rigorous, long-term performance goals are met. These goals are often based on Total Shareholder Return (TSR) relative to a peer group of companies. For example, a CEO might only receive 100% of their PSU grant if the company's stock performance is in the top 50% of the S&P 500 over a three-year period. This directly ties their pay to creating shareholder value.

4. Perquisites ("Perks") and Other Benefits: While less significant financially, these are still part of the package. They can include a car allowance or driver, personal use of the company aircraft (for security and efficiency reasons), enhanced security services, financial planning services, and premium health and life insurance policies.

This complex structure means that a CEO's actual take-home pay can fluctuate dramatically from year to year based on the company's stock performance, making them the ultimate "owner-operator" with immense skin in the game.

Key Factors That Influence Executive Salary

An executive's salary is not a one-size-fits-all number. It is a highly calibrated figure influenced by a confluence of factors. The board's compensation committee, often with the help of external consultants, weighs these variables meticulously to arrive at a package they believe is competitive enough to attract and retain top talent, while also being defensible to shareholders and the public. Understanding these levers is key to understanding the landscape of executive pay.

###

Level of Education

While grit and experience are paramount, education provides the foundational knowledge and, critically, the network and pedigree that open doors to elite corporate circles.

- The MBA Premium: The Master of Business Administration (MBA), particularly from a top-tier ("M7" or "Top 20") program like Harvard Business School, Stanford Graduate School of Business, or Wharton, remains the gold standard for aspiring C-suite executives. According to a study by U.S. News, graduates from top-15 business schools reported an average salary and bonus of over $177,000 within three months of graduation, setting them on an accelerated path. More importantly, these programs provide a deep understanding of finance, strategy, and operations, and cultivate a powerful alumni network that is invaluable for career advancement. A significant percentage of Fortune 500 CEOs hold an MBA.

- Juris Doctor (JD) and Other Advanced Degrees: A law degree, as in the case of Julie Sweet (a graduate of Columbia Law School), is another powerful pathway, especially for roles in highly regulated industries or for leaders who will navigate complex M&A and governance issues. Other relevant advanced degrees include PhDs for leaders in R&D-intensive industries like biotech or advanced engineering degrees for technology firms.

- Executive Education & Certifications: While traditional certifications are less important at this level, participation in elite executive leadership programs at institutions like INSEAD, Harvard, or Wharton can further burnish a leader's credentials, expand their network, and signal a commitment to continuous learning, which can be a factor in promotions and compensation negotiations.

###

Years of Experience

Experience is arguably the single most important factor. The journey to the C-suite is a process of accumulating a portfolio of progressively more complex leadership challenges and successes.

- The 20-Year Climb: It typically takes two to three decades of demonstrated success to reach the CEO role at a major corporation. The salary trajectory mirrors this climb.

- Early Career (0-7 years): As an individual contributor or junior manager, the focus is on mastering a functional skill (e.g., finance, marketing, engineering) and proving reliability. Compensation is primarily base salary with a small bonus.

- Mid-Career / Director (7-15 years): This is the crucial leap into significant management and budget responsibility. The professional must prove they can lead teams, manage projects, and think strategically. Compensation begins to include more meaningful bonuses and potentially small equity grants. Salary.com data shows a Corporate Director in the U.S. has a median base salary around $201,000, with total compensation reaching $250,000+.

- Vice President / Senior Leadership (15-20+ years): At this stage, leaders often have P&L responsibility for a major business unit or function. They are part of the senior leadership team and are being evaluated for C-suite potential. Equity becomes a major component of their pay package, and total compensation can easily move into the high six-figures or low seven-figures.

- C-Suite (20+ years): Upon reaching the executive suite, the compensation structure transforms, as detailed previously, with long-term equity making up the vast majority of the potential earnings. Each year of successful C-suite experience, especially as a CEO, further increases a leader's market value for their next role or for lucrative board memberships.

###

Geographic Location

Where a company is headquartered has a significant impact on executive compensation, primarily due to the cost of living and the concentration of corporate headquarters and talent.

- Major Metropolitan Hubs: Cities like New York City, the San Francisco Bay Area (including Silicon Valley), Boston, and Los Angeles command the highest executive salaries. The concentration of Fortune 500 companies, major financial institutions, and a highly competitive talent market drives pay scales upward. According to Salary.com's analysis, an executive in New York City can expect to earn roughly 20-25% more than the national average.

- Secondary and Tertiary Markets: While still offering strong compensation, cities in the Midwest and Southeast may have lower pay scales that are reflective of a lower cost of living. However, as companies increasingly adopt remote and hybrid work models, these geographic distinctions may begin to blur slightly, though the gravitational pull of major corporate centers remains strong.

Example: Chief Financial Officer (CFO) Median Base Salary by City (2024 data from Salary.com):

- San Jose, CA: $308,198

- New York, NY: $286,767

- Boston, MA: $278,574

- Chicago, IL: $263,491

- Dallas, TX: $252,696

- Atlanta, GA: $248,300

This data clearly illustrates the premium placed on executives operating in high-cost, high-competition markets.

###

Company Type & Size

The size, ownership structure, and profitability of a company are massive drivers of executive pay.

- Startups: A CEO of an early-stage, venture-backed startup might have a relatively modest cash salary (e.g., $150,000 - $250,000) but will hold a significant equity stake (e.g., 5-15%). The compensation is a high-risk, high-reward bet on a future acquisition or IPO.

- Small and Mid-Sized Businesses (SMBs): For privately held companies with revenues between $10 million and $500 million, CEO pay is more conventional. It consists of a solid six-figure base salary and a bonus tied directly to profitability. Total cash compensation might range from $300,000 to $1 million, with potential for profit-sharing or synthetic equity.

- Large Private Corporations: At large, privately held companies (like Koch Industries or Cargill), executive compensation can be very high, often rivaling public companies. However, it's typically more cash and bonus-focused, as there is no publicly traded stock to grant.

- Publicly Traded Corporations: This is where pay scales reach their apex. The scale and complexity of managing a global public company, the intense public scrutiny, and the direct link to shareholder value creation justify the multi-million dollar packages. A CEO's pay is directly correlated with the company's market capitalization; the larger the company, the higher the median pay.

###

Area of Specialization and Industry

The industry in which a company operates heavily influences its ability and willingness to pay top dollar for leadership.

- High-Paying Industries: Technology, Financial Services (Private Equity, Hedge Funds, Investment Banking), and Biopharmaceuticals consistently lead the pack in executive compensation. These industries are characterized by high growth, high margins, and intense competition for talent that can drive innovation and capture market share. Leaders with deep expertise in areas like SaaS, AI, drug development, or complex financial instruments are in extremely high demand.

- Moderate-Paying Industries: Sectors like Manufacturing, Consumer Packaged Goods (CPG), and Retail offer very respectable executive compensation, but it generally falls below the levels of tech and finance.

- Lower-Paying Sectors: Non-profit and Government leadership roles, while incredibly important, operate under different constraints. A CEO of a large national non-profit might earn between $300,000 and $800,000, a handsome sum but a fraction of their for-profit counterparts. These roles are often pursued by individuals driven as much by mission as by monetary reward.

###

In-Demand Skills

Beyond a resume, certain skills and competencies dramatically increase an executive's value and, therefore, their compensation.

- Transformational Leadership: The ability to lead an organization through massive change (e.g., a digital transformation, a post-merger integration, or a business model pivot) is perhaps the most valuable skill.

- Financial Acumen: Deep understanding of capital markets, M&A, and value creation is non-negotiable. Executives who can speak the language of Wall Street and create shareholder value are rewarded handsomely.

- Digital and AI Fluency: In today's economy, every company is a technology company. Leaders who understand how to leverage data, analytics, and artificial intelligence for competitive advantage are at a premium.

- Global Experience: Proven success in managing international operations, navigating different cultures, and understanding global supply chains is critical for multinational corporations.

- ESG Expertise: A growing area of focus for boards and investors is Environmental, Social, and Governance (ESG). Leaders who can craft and execute a credible ESG strategy that mitigates risk and enhances brand reputation are increasingly sought after.

Job Outlook and Career Growth for Executives

The path to the C-suite is less about an expanding job market and more about rising to the top of an intensely competitive pyramid. While the number of top executive positions is not projected to grow rapidly, the roles themselves are evolving, presenting new challenges and opportunities for aspiring leaders.

### BLS Job Outlook Analysis

The U.S. Bureau of Labor Statistics (BLS) provides a sober and realistic outlook for the "Top Executives" category. According to their 2022-2032 projections:

- Job Growth: Employment of top executives is projected to grow by 3 percent from 2022 to 2032,