Introduction

While a search for a "Knicks Salary Cap" career might lead you to the exciting world of sports management, the underlying function—strategically managing a complex system of salaries under a defined cap—is a cornerstone of a highly respected and lucrative corporate career: the Compensation and Benefits Manager. These professionals are the architects of an organization's financial relationship with its employees. With a median salary well over six figures and a critical role in attracting and retaining top talent, this career path offers immense potential for those with a flair for data, strategy, and human resources.

What Does a Compensation and Benefits Manager Do?

A Compensation and Benefits Manager is a strategic leader within the Human Resources department responsible for establishing and overseeing an organization's pay and perks. Think of them as the general manager of a company's "salary cap." Their goal is to create a compensation structure that is not only fair and competitive but also aligns with the company's budget, goals, and legal obligations.

Key responsibilities include:

- Designing and Implementing Salary Structures: Creating pay grades and salary bands based on job roles, seniority, and market data.

- Market Analysis: Conducting salary surveys and benchmarking against competitors to ensure the company's pay is attractive.

- Managing Benefits Programs: Administering health insurance, retirement plans (like 401(k)s), paid time off, and other employee perks.

- Ensuring Compliance: Staying up-to-date with federal, state, and local compensation laws and regulations, such as minimum wage and overtime rules.

- Job Evaluation: Analyzing job descriptions to determine their value and place within the company's pay hierarchy.

- Executive and Sales Compensation: Developing specialized and often complex pay plans for top executives and sales teams, including bonuses and stock options.

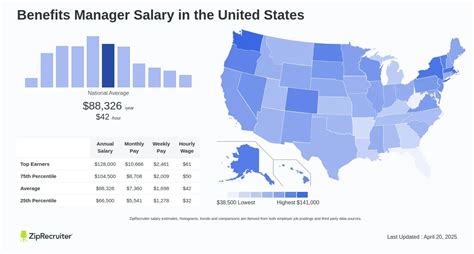

Average Compensation and Benefits Manager Salary

The earning potential for a Compensation and Benefits Manager is significant, reflecting the strategic importance of the role.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Compensation and Benefits Managers was $136,380 as of May 2023. This is a strong starting point, but actual salaries can vary widely based on several factors.

A typical salary range looks like this:

- Entry-Level/Analyst: $75,000 - $95,000

- Mid-Career Manager: $100,000 - $150,000

- Senior/Director Level: $160,000 - $220,000+

Data from salary aggregators supports this. Salary.com places the average salary for a Compensation Manager in the U.S. at around $127,510, with a common range falling between $113,018 and $143,156.

Key Factors That Influence Salary

Just like in professional sports, where a star player earns more than a rookie, several key variables determine a Compensation and Benefits Manager's salary.

### Level of Education

A bachelor's degree is typically the minimum requirement for this field. Common majors include Human Resources, Finance, Business Administration, or a related discipline. However, advanced education can significantly boost earning potential and career advancement. Professionals with a Master of Business Administration (MBA) or a master's degree in Human Resources often qualify for senior leadership positions and, consequently, higher salaries. Certifications like the Certified Compensation Professional (CCP) also signal expertise and can lead to increased pay.

### Years of Experience

Experience is one of the most critical factors. A professional's journey often begins in an analyst role, focusing on data collection and reporting.

- Entry-Level (0-3 years): Professionals start as Compensation Analysts, learning the fundamentals of market analysis and job evaluation. Their salaries are at the lower end of the spectrum.

- Mid-Career (4-10 years): With experience, they advance to manager roles, taking on responsibility for entire programs and strategic planning. This is where salaries cross the six-figure mark.

- Senior/Executive Level (10+ years): Directors and Vice Presidents of Compensation & Benefits oversee the entire function for a large corporation, often on a global scale. These roles command the highest salaries, often supplemented with significant bonuses and equity.

### Geographic Location

Where you work matters immensely. Metropolitan areas with a high cost of living and a high concentration of corporate headquarters offer the most lucrative salaries. The demand for skilled managers to navigate competitive hiring landscapes drives wages up. For example, a Compensation Manager in New York City or San Francisco can expect to earn 20-30% more than the national average to compensate for the higher cost of living and intense competition for talent.

### Company Type

The size and industry of the employer are major determinants of pay. A large, multinational corporation in a high-revenue sector like technology, finance, or pharmaceuticals will have a much larger and more complex compensation structure than a small non-profit or a local government agency. Consequently, the managers overseeing these multi-billion dollar payrolls are compensated at a premium. Working for a specialized HR or compensation consulting firm can also be very lucrative.

### Area of Specialization

Within the broader field, certain specializations are in higher demand and command higher pay.

- Executive Compensation: This niche focuses on designing complex pay packages for C-suite executives, involving base salary, bonuses, long-term incentives, and stock options. It requires deep financial and legal knowledge.

- Sales Compensation: Crafting incentive plans that motivate sales teams and drive revenue is a highly strategic function that directly impacts the company's bottom line.

- Global Compensation: For multinational corporations, managing pay and benefits across different countries, currencies, and legal systems is a highly complex and valuable skill.

Job Outlook

The future is bright for this profession. The U.S. Bureau of Labor Statistics projects that employment for Compensation and Benefits Managers will grow by 5 percent from 2022 to 2032, which is faster than the average for all occupations.

This growth is fueled by several trends. As healthcare coverage options and retirement plans become more complex, businesses need experts to help them navigate these choices. Furthermore, in a competitive job market, companies are increasingly relying on data-driven compensation strategies to attract and retain the best employees, making the role more critical than ever.

Conclusion

While you can't have a career *as* a "Knicks Salary Cap," you can absolutely build a successful and rewarding career as the strategic mind behind a company's pay structure. The role of a Compensation and Benefits Manager is a perfect fit for analytical, data-driven individuals who want to play a pivotal role in an organization's success. With a strong salary, positive job growth, and the opportunity to make a tangible impact on both employees and the bottom line, it's a career path that offers a clear road to professional and financial achievement.