For ambitious professionals in the accounting, tax, and advisory sectors, reaching the Director level at a "Big Four" firm like KPMG represents a major career milestone. This position signifies deep expertise, significant leadership responsibility, and, consequently, substantial earning potential. But what does that compensation package actually look like?

Navigating the complexities of executive pay can be challenging. This article provides a data-driven analysis of a KPMG Director's salary, breaking down the national averages, key influencing factors, and the overall career outlook to give you a clear picture of what to expect on this prestigious career path. On average, a Director at KPMG can expect a total compensation package ranging from $200,000 to over $360,000 annually, with numerous factors influencing where one might fall within that spectrum.

What Does a KPMG Director Do?

A Director at KPMG is a senior leader who has moved beyond day-to-day task management and is responsible for driving the business forward. While their specific duties vary by service line (Audit, Tax, or Advisory), the core responsibilities are consistent and demand a blend of technical mastery, strategic vision, and interpersonal skill.

Key responsibilities include:

- Leading Client Engagements: Overseeing multiple, often large-scale and complex, client projects from inception to completion.

- Business Development: Cultivating relationships with existing and potential clients, identifying new business opportunities, and playing a crucial role in writing proposals and winning new work.

- Team Leadership and Mentorship: Managing and developing large teams of managers, senior associates, and associates, providing guidance, and fostering their professional growth.

- Subject Matter Expertise: Serving as a go-to expert within their specialized field, contributing to thought leadership, and representing the firm at industry events.

- Practice Management: Overseeing engagement financials, managing budgets, ensuring profitability, and mitigating risks for the firm.

In essence, a Director is a partner-in-training, demonstrating the ability to manage a significant book of business and lead with influence.

Average KPMG Director Salary

Compensation at this level is multifaceted, comprising a competitive base salary and a significant performance-based bonus. It's crucial to look at total compensation to understand the full earning potential.

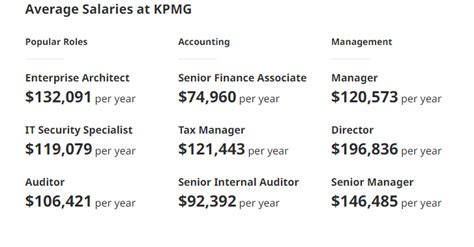

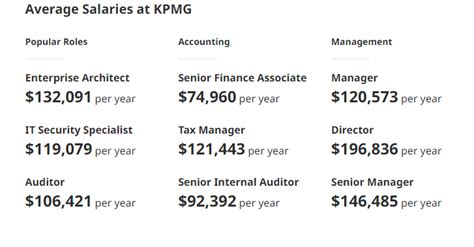

Based on data from reputable salary aggregators, the average salary for a Director at KPMG in the United States shows a consistent and lucrative range.

- Glassdoor reports that the estimated total pay for a Director at KPMG is approximately $254,000 per year, with a likely range between $186,000 and $364,000. This figure includes an estimated base salary of around $211,000 and additional pay (bonuses, profit sharing) of about $43,000.

- Salary.com places the average Director salary at KPMG slightly higher, with a typical range falling between $204,595 and $249,767 for base salary alone. When factoring in bonuses and benefits, the total compensation package aligns with the higher end of Glassdoor's estimates.

It's important to note that these figures are based on user-submitted data and can vary. A newly promoted Director will likely start at the lower end of this range, while a Senior Director with a proven track record of bringing in business will command a salary at the top end.

Key Factors That Influence Salary

Your final compensation package isn't determined by a single number. Several key factors interact to define your specific earnings as a KPMG Director.

### Area of Specialization

This is arguably the most significant factor. KPMG operates across three main service lines, and compensation differs dramatically between them based on market demand and billing rates.

- Advisory (Consulting): This is typically the highest-paying service line. Directors in high-demand advisory practices like Mergers & Acquisitions (M&A), Strategy, Cybersecurity, or Digital Transformation command the highest salaries due to the specialized nature of the work and the high value they deliver to clients.

- Tax: Tax Directors also earn a premium, especially those specializing in complex areas like International Tax, Transfer Pricing, or M&A Tax.

- Audit (Assurance): While still highly compensated, Audit Directors generally fall on the lower end of the Director salary spectrum compared to their Advisory and Tax counterparts. The work is often viewed as more commoditized, leading to more competitive fee pressure.

### Years of Experience

Experience directly correlates with salary. A professional who has just been promoted to Director after 8-10 years with the firm will earn less than a Senior Director with 15+ years of experience. Senior Directors have deeper client relationships, a more extensive professional network, and a proven ability to generate revenue, which is directly rewarded in their compensation.

### Geographic Location

Where you work matters. KPMG, like other major corporations, adjusts salaries based on the cost of living and market rates in different metropolitan areas.

- High-Cost-of-Living (HCOL) Areas: Directors in cities like New York, San Francisco, Los Angeles, and Boston can expect to see their base salaries be 15-25% higher than the national average.

- Medium to Low-Cost-of-Living (MCOL/LCOL) Areas: Conversely, Directors in smaller markets like St. Louis, Kansas City, or Charlotte will have salaries closer to, or slightly below, the national average, though their purchasing power may be comparable.

### Company Type

While this article focuses on KPMG, it's helpful to understand how its "Big Four" status impacts pay. Directors at KPMG, Deloitte, PwC, and EY consistently earn more than their counterparts at mid-tier firms (e.g., Grant Thornton, BDO) or smaller, regional accounting firms. This premium is due to the scale of clients, the complexity of the work, and the global revenue of the Big Four, which allows for more competitive compensation packages to attract and retain top talent.

### Level of Education

By the time a professional reaches the Director level, their on-the-job performance and specialization far outweigh their initial education. However, educational background and certifications remain important. A bachelor's degree in accounting, finance, or a related field is a prerequisite. Many Directors also hold a master's degree, such as a Master of Accountancy (MAcc) or an MBA from a top-tier university, which can provide an edge.

Furthermore, professional certifications are often essential for advancement.

- CPA (Certified Public Accountant): Virtually mandatory for Directors in Audit and Tax.

- CFA (Chartered Financial Analyst): Highly valued in M&A and financial advisory roles.

- PMP (Project Management Professional): Beneficial for those leading large, complex implementations.

Job Outlook

The career outlook for senior leaders in accounting and consulting is exceptionally strong. The U.S. Bureau of Labor Statistics (BLS) does not track "KPMG Director" as a specific role, but we can look at related professions for a reliable forecast.

For Management Analysts (a category that includes many advisory roles), the BLS projects a 10% job growth from 2022 to 2032, which is much faster than the average for all occupations. The BLS attributes this growth to the increasing need for organizations to improve efficiency and control costs.

Similarly, the outlook for Financial Managers is projected to grow by 16% in the same period. The increasing complexity of the global economy, changing regulations, and the drive for digital transformation mean that the expertise provided by KPMG Directors will remain in high demand for the foreseeable future.

Conclusion

A Director position at KPMG is the culmination of years of hard work, strategic focus, and dedicated leadership. The role offers a challenging and rewarding career path with a compensation package to match.

Key Takeaways:

- Significant Earning Potential: Total compensation for a KPMG Director typically falls between $200,000 and $360,000+, including a strong base salary and performance-driven bonuses.

- Specialization is Key: Your service line and area of expertise, particularly in high-growth advisory fields, will be the biggest determinant of your salary.

- Compensation is a Package: Your earnings are a function of your specialization, experience, geographic location, and ability to drive business for the firm.

- Strong Future Outlook: The demand for the high-level expertise offered by Big Four Directors is projected to grow significantly, ensuring career stability and opportunity.

For those aspiring to this level, the path is clear: develop deep technical expertise in a high-demand area, cultivate strong leadership and relationship-building skills, and consistently demonstrate your value to both clients and the firm. The rewards, both professional and financial, are well worth the effort.