A career as a bank manager offers a compelling blend of leadership, financial acumen, and direct community impact. It's a role that commands respect and provides a stable, rewarding career path. But what does that translate to in terms of salary? If you're considering this profession, understanding the earning potential is a critical step.

This guide breaks down the salary you can expect as a bank manager, the key factors that drive your earnings, and the promising future of the profession. On average, bank managers in the United States can expect to earn a competitive salary, often ranging from $80,000 to over $150,000 annually, with significant potential for growth based on experience, location, and specialization.

What Does a Bank Manager Do?

Before diving into the numbers, it’s essential to understand the scope of the role. A bank manager is the leader of a bank branch or a specific department. They are responsible for the institution's smooth operation, profitability, and compliance with regulations.

Key responsibilities typically include:

- Team Leadership: Hiring, training, and managing tellers, personal bankers, and loan officers.

- Operational Oversight: Ensuring the branch runs efficiently, securely, and in compliance with all banking laws.

- Customer Relationship Management: Building and maintaining strong relationships with clients and addressing their needs and concerns.

- Sales and Growth: Driving branch performance by meeting goals for loans, deposits, and other financial products.

- Financial Reporting: Analyzing financial data, preparing reports for senior management, and managing the branch's budget.

Average Bank Manager Salary

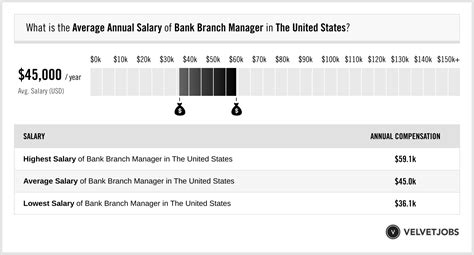

Salary data for bank managers can vary depending on the source and the specific title being analyzed. It's helpful to look at both the broad category of "Financial Managers" and the more specific role of a "Bank Branch Manager."

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Financial Managers was $156,100 as of May 2023. This is a broad category that includes high-level corporate finance roles alongside bank managers. The lowest 10 percent earned less than $82,540, while the highest 10 percent earned more than $239,200.

For a more targeted look, salary aggregators provide specific data for branch-level roles:

- Salary.com reports that the median salary for a Bank Branch Manager in the U.S. is approximately $99,500 as of early 2024, with a typical range falling between $88,600 and $113,300.

- Glassdoor indicates an average base pay of around $84,000 per year, but a total average pay (including bonuses, commission, and profit sharing) of nearly $97,000.

This data highlights a crucial point: a bank manager's total compensation often includes significant performance-based bonuses, which can substantially increase their overall earnings.

Key Factors That Influence Salary

Your salary as a bank manager isn't a single, fixed number. It's a dynamic figure influenced by several critical factors.

###

Level of Education

A bachelor's degree in finance, business administration, economics, or a related field is the standard entry requirement for a management track in banking. However, advanced credentials can unlock higher pay and more senior positions. An MBA (Master of Business Administration), particularly with a finance concentration, can make a candidate more competitive for roles in larger banks or corporate banking divisions, leading to a significant salary premium. Professional certifications like the Certified Financial Planner (CFP) or Certified Financial Analyst (CFA) can also boost earning potential, especially in wealth management roles.

###

Years of Experience

Experience is one of the most significant drivers of salary growth in banking. A clear progression exists as you build your career.

- Entry-Level (0-4 years): An assistant branch manager or a manager of a smaller branch might start in the $65,000 to $85,000 range.

- Mid-Career (5-9 years): With a proven track record of meeting sales goals and managing a team effectively, a bank manager can expect to earn in the $90,000 to $120,000 range.

- Senior/Experienced (10+ years): Senior branch managers, regional managers, or managers at large, high-volume branches can command salaries well over $125,000, with top earners exceeding $150,000 with bonuses. Payscale data confirms this trend, showing a sharp increase in salary for those with over a decade of experience.

###

Geographic Location

Where you work matters immensely. Salaries are adjusted for the local cost of living and the concentration of financial activity. Managers in major metropolitan areas and financial hubs will earn significantly more than those in rural or smaller urban areas. For example, a bank manager in New York City, San Francisco, or Boston will likely see a salary that is 20-30% higher than the national average. Conversely, salaries in states with a lower cost of living will trend closer to or slightly below the national median.

###

Company Type

The type and size of the banking institution have a direct impact on compensation structures.

- Large National Banks (e.g., JPMorgan Chase, Bank of America): These institutions typically offer higher base salaries and more lucrative bonus structures due to their vast resources and the complexity of their operations.

- Regional and Community Banks: While base salaries may be slightly lower than at national giants, these banks often offer a strong sense of community, better work-life balance, and competitive benefits packages.

- Credit Unions: As non-profit, member-owned institutions, credit unions offer competitive salaries but may have different bonus and incentive structures compared to for-profit banks.

- Investment Banks: A management role within an investment bank is a different career path entirely, with compensation packages (including bonuses) that are substantially higher than in commercial or retail banking.

###

Area of Specialization

Not all bank manager roles are the same. Specializing in a high-growth or high-value area can dramatically increase your earning potential.

- Retail Branch Manager: The most common role, focused on consumer banking.

- Commercial Bank Manager: Works with business clients on loans, deposits, and treasury services. These roles often come with higher earning potential tied to the size of the loan portfolio managed.

- Wealth Management Manager: Oversees advisors who work with high-net-worth individuals. Compensation is heavily tied to assets under management (AUM) and can be extremely lucrative.

- Operations Manager: A back-office role focused on ensuring compliance, efficiency, and security. Salary is typically stable and less reliant on sales-based bonuses.

Job Outlook

The future for financial management roles is bright. According to the BLS, employment of financial managers is projected to grow 16 percent from 2022 to 2032, which is much faster than the average for all occupations.

This strong growth is driven by the increasing complexity of financial products and services, the need for sound risk management, and the demands of a growing global economy. While technology and digital banking are changing the nature of branch operations, they are also elevating the role of the modern bank manager. The focus is shifting from transactional oversight to high-level advisory services, strategic relationship building, and complex problem-solving—skills that are in high demand.

Conclusion

Choosing a career as a bank manager is a move toward a stable, challenging, and financially rewarding profession. While a national average salary provides a useful benchmark, your true earning potential is in your hands.

Here are the key takeaways:

- Strong Earning Potential: Base salaries typically range from $80,000 to $115,000, with total compensation often exceeding this due to bonuses.

- Experience is Key: Your salary will grow significantly as you gain experience and take on more responsibility.

- Location and Specialization Matter: Working in a major financial hub or specializing in a high-value area like commercial or wealth management can substantially increase your pay.

- The Future is Bright: With a job outlook that is much faster than average, the demand for skilled and adaptable financial leaders is set to grow.

For those with a knack for leadership, a strong understanding of finance, and a commitment to serving clients, a career as a bank manager is not only a viable path but a gateway to a prosperous and impactful professional journey.