Thinking about a career that is essential to every single business? A role that combines meticulous attention to detail with a direct impact on employee morale? Welcome to the world of payroll. A career as a payroll clerk is a stable and rewarding path, offering a competitive salary that can range from a solid entry-level wage of around $42,000 to over $68,000 for experienced professionals.

But what does that salary progression look like, and what factors can you leverage to maximize your earnings? In this detailed guide, we will break down everything you need to know about a payroll clerk's salary, drawing on the latest data from authoritative sources to give you a clear picture of your earning potential.

What Does a Payroll Clerk Do?

Before we dive into the numbers, let's clarify the role. A payroll clerk is the backbone of a company's financial operations, ensuring that every employee is paid accurately and on time. They are guardians of financial data, compliance, and procedural integrity.

Key responsibilities typically include:

- Collecting and verifying timesheets and attendance records.

- Calculating employee wages, overtime, and commissions.

- Processing deductions for taxes, benefits, retirement contributions, and garnishments.

- Preparing and issuing paychecks or initiating direct deposits.

- Maintaining accurate payroll records and ensuring data confidentiality.

- Answering employee questions about pay, deductions, and discrepancies.

- Preparing payroll reports for management and accounting departments.

It's a role that demands precision, reliability, and a strong sense of ethics, making skilled clerks invaluable to any organization.

Average Payroll Clerk Salary

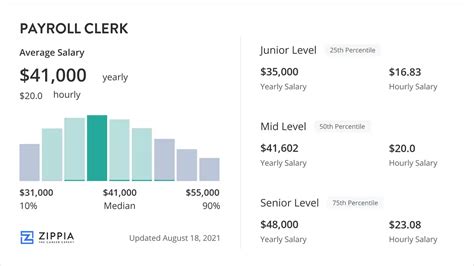

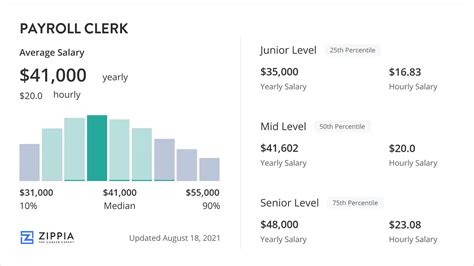

When determining the average salary for a payroll clerk, it's best to consult multiple data sources to get a well-rounded view.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for payroll and timekeeping clerks was $50,560 in May 2023. The "median" wage means that half of the workers in the occupation earned more than that amount, and half earned less.

Other reputable salary aggregators provide a similar outlook, often showing a slightly wider range based on their proprietary data:

- Salary.com reports that the average payroll clerk salary in the United States is around $54,345, with a typical range falling between $48,707 and $60,980.

- Payscale notes an average base salary of approximately $50,100 per year, with a common range spanning from $39,000 to $64,000.

- Glassdoor places the total estimated pay at around $55,613 per year, which includes a base salary and potential additional pay like bonuses.

Based on this data, we can establish a general salary spectrum:

- Entry-Level (Bottom 10%): Starting around $38,000 - $42,000

- Median (50th Percentile): $50,000 - $55,000

- Experienced (Top 10%): Earning $65,000 - $68,000+

Now, let's explore the key factors that determine where you'll fall on this spectrum.

Key Factors That Influence Salary

Your salary isn't just one number; it's a reflection of your unique skills, experience, and circumstances. Here are the five biggest factors that will influence your earning potential as a payroll clerk.

###

Level of Education

While a four-year degree is not always required to enter the field, your educational background plays a significant role in your starting salary and long-term career trajectory.

- High School Diploma or GED: This is the typical minimum requirement. Clerks entering with this level of education will likely start at the lower end of the salary range.

- Associate's or Bachelor's Degree: A degree in Accounting, Finance, or Business Administration can provide a significant advantage. Employers often see this as a sign of commitment and a strong foundational knowledge of financial principles, leading to higher starting offers and a faster path to advancement into roles like Payroll Specialist or Payroll Manager.

- Professional Certifications: This is arguably the most powerful educational tool for boosting your salary. The American Payroll Association (APA) offers two key credentials:

- Fundamental Payroll Certification (FPC): Ideal for entry-level professionals, this certification validates your basic knowledge and can help you stand out from other candidates.

- Certified Payroll Professional (CPP): This is the gold standard for experienced payroll professionals. Earning your CPP demonstrates a high level of expertise in complex payroll topics, compliance, and management. Professionals with a CPP often command significantly higher salaries and are sought after for senior and leadership positions.

###

Years of Experience

Experience is a primary driver of salary growth in the payroll profession. As you gain more experience, you move from routine data entry to complex problem-solving and strategic oversight.

- Entry-Level (0-2 Years): You'll focus on core tasks like data verification, basic calculations, and answering simple employee queries. Your salary will be in the initial range.

- Mid-Level (3-5 Years): You're now comfortable handling the entire payroll cycle, managing more complex issues like multi-state taxes or wage garnishments, and generating standard reports. You can expect a steady increase in salary.

- Senior-Level (5+ Years): With extensive experience, you may take on a lead or senior clerk role. This involves training junior staff, troubleshooting complex system errors, ensuring regulatory compliance, and contributing to process improvements. This level of experience commands a salary at the top end of the range for a clerk.

###

Geographic Location

Where you work matters. Salaries for payroll clerks vary significantly across the country, largely driven by the cost of living and demand for skilled professionals in a given metropolitan area.

According to BLS data, some of the top-paying states for payroll clerks include:

- District of Columbia

- Washington

- California

- Massachusetts

- New York

Conversely, salaries tend to be lower in states with a lower cost of living, particularly in the Southeast and rural Midwest. A payroll clerk in a major city like San Jose, CA, or Seattle, WA, can expect to earn substantially more than a clerk in a smaller town to compensate for higher living expenses.

###

Company Type

The size and industry of your employer have a direct impact on your paycheck.

- Large Corporations: These companies often have thousands of employees across multiple states or even countries. The complexity of their payroll systems demands a high level of skill, and they typically offer more competitive salaries and robust benefits packages.

- Small to Medium-Sized Businesses (SMBs): In a smaller company, a payroll clerk might also handle some HR or bookkeeping duties. While the base salary may be slightly lower than at a large corporation, the breadth of experience gained can be invaluable for future career growth.

- Payroll Service Providers (e.g., ADP, Paychex): Working for a company whose core business is payroll can be an excellent career move. These organizations are experts in the field, provide outstanding training, and offer competitive pay with clear career progression paths.

- Government and Non-Profit: Public sector and non-profit roles may offer a slightly lower base salary but often compensate with exceptional job security, generous retirement plans, and a better work-life balance.

###

Area of Specialization

As you advance in your career, developing a specialization can make you a more valuable—and higher-paid—asset. While many clerks are generalists, those who cultivate expertise in niche areas are in high demand.

Specializations that can boost your salary include:

- Payroll Tax and Compliance: Deep knowledge of federal, state, and local tax laws.

- International Payroll: Handling the complexities of paying employees in different countries.

- Systems Implementation: Expertise in setting up and managing payroll software like Workday, ADP, or UKG.

- Garnishments and Levies: Becoming an expert in processing legally mandated wage deductions.

Job Outlook

The U.S. Bureau of Labor Statistics projects a decline of 10 percent in employment for payroll and timekeeping clerks from 2022 to 2032. However, it's critical to understand the context behind this number.

This projection is largely due to the increasing automation of routine payroll calculations and data entry. Software can now handle many of the basic tasks once performed manually.

However, this does not mean the profession is disappearing. Instead, it is evolving. The demand is shifting away from simple data entry and toward professionals who can:

- Manage and audit complex payroll systems.

- Ensure ever-changing tax and labor law compliance.

- Analyze payroll data to provide strategic insights.

- Solve complex problems that automation cannot handle.

The takeaway is clear: for those willing to adapt, upskill, and pursue certifications like the CPP, the future remains bright. The need for skilled, analytical payroll experts who can oversee sophisticated systems is stronger than ever.

Conclusion

A career as a payroll clerk offers a stable and rewarding path with a solid financial foundation. While the national median salary hovers around $50,000 - $55,000, your individual earning potential is firmly in your control.

To maximize your salary, focus on these key takeaways:

1. Invest in Education: Pursue professional certifications like the FPC and CPP to validate your skills and command a higher salary.

2. Gain Experience: The longer you stay in the field, the more valuable you become. Seek roles with increasing responsibility.

3. Be Strategic About Location & Industry: Consider high-paying metropolitan areas and industries known for competitive compensation.

4. Embrace Specialization and Technology: Don't fear automation—master it. Become an expert in payroll systems and complex compliance issues to future-proof your career.

By being proactive about your professional development, you can build a successful and lucrative career ensuring that the most critical asset of any company—its people—are paid perfectly, every time.