For ambitious professionals aiming to climb the corporate ladder, lead impactful organizations, and achieve significant financial success, the Master of Business Administration (MBA) has long been considered the gold standard. It’s more than a degree; it’s a powerful career accelerator, a gateway to elite networks, and a transformative personal journey. But beyond the prestige and the leadership training, a crucial question drives many prospective students: What is the real return on this substantial investment? What does a master in business administration salary actually look like?

The answer is both complex and incredibly promising. While headlines often tout staggering six-figure starting salaries, the reality is a nuanced landscape shaped by your school, specialization, experience, and industry choice. The median base starting salary for graduates of top-ranked U.S. business schools consistently surpasses $175,000, with top earners in fields like investment banking and private equity receiving signing and performance bonuses that can push their first-year total compensation well over a quarter-million dollars.

I remember mentoring a sharp, mid-career marketing professional a few years ago who felt she had hit a ceiling. She was brilliant and hardworking but lacked the broad strategic and financial acumen to move into senior leadership. After two years in a rigorous MBA program, she re-entered the workforce not just as a marketer, but as a business leader, landing a Director of Strategy role at a major tech firm with a salary that nearly tripled her pre-MBA earnings. Her story isn't an outlier; it's a testament to the profound financial and professional transformation an MBA can catalyze.

This guide will demystify the MBA salary landscape. We will move beyond the sensational numbers to provide a comprehensive, data-driven analysis of what you can realistically expect to earn with a Master in Business Administration. We will explore the roles MBA graduates fill, dissect the average compensation packages, and delve into the critical factors that will ultimately determine your earning potential. Consider this your definitive resource for understanding the true value of an MBA.

### Table of Contents

- [What Kind of Jobs Do MBA Graduates Do?](#what-kind-of-jobs-do-mba-graduates-do)

- [Average Master in Business Administration Salary: A Deep Dive](#average-master-in-business-administration-salary-a-deep-dive)

- [Key Factors That Influence Your MBA Salary](#key-factors-that-influence-your-mba-salary)

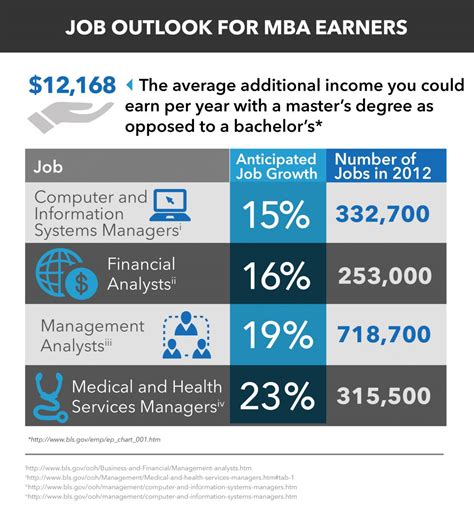

- [Job Outlook and Career Growth for MBA Graduates](#job-outlook-and-career-growth-for-mba-graduates)

- [How to Launch Your High-Earning MBA Career](#how-to-launch-your-high-earning-mba-career)

- [The Final Verdict: Is an MBA Worth It?](#the-final-verdict-is-an-mba-worth-it)

What Kind of Jobs Do MBA Graduates Do?

It's a common misconception to think of "MBA" as a job title. It's not. A Master in Business Administration is a graduate-level degree that equips individuals with a broad toolkit of skills in finance, marketing, operations, strategy, and leadership. This versatile qualification doesn't funnel graduates into a single profession; instead, it opens doors to a wide array of high-level roles across virtually every industry. An MBA signals to employers that you possess the analytical rigor and strategic mindset necessary to solve complex business problems and lead teams effectively.

The core function of most MBA-level jobs is to drive value for an organization. This can manifest in numerous ways: identifying new market opportunities, optimizing financial performance, streamlining complex operations, managing large-scale projects, or crafting long-term corporate strategy. Graduates are expected to move beyond tactical, day-to-day execution and engage in strategic thinking that shapes the future of the business.

Here are some of the most common and lucrative career paths for MBA graduates:

- Management Consulting: Consultants are professional problem-solvers hired by companies to tackle their biggest challenges. They might develop a market-entry strategy for a new product, restructure a company's organization to improve efficiency, or conduct due diligence for a major acquisition. This field is renowned for its fast pace, intellectual rigor, and excellent compensation.

- Finance: This broad category includes several high-stakes roles.

- Investment Banking: Associates advise companies on mergers and acquisitions (M&A), and help them raise capital through stock or bond offerings. The hours are famously long, but it is one of the highest-paying post-MBA careers.

- Private Equity: Professionals in this field raise capital to buy entire companies, work to improve their operations and profitability over several years, and then sell them for a profit.

- Corporate Finance: Within a large corporation, MBA graduates often work in roles like financial planning and analysis (FP&A), treasury, or corporate development, managing the company's financial health and strategy from the inside.

- Technology: The tech industry is a major recruiter of MBA talent for non-engineering roles.

- Product Management: A Product Manager (PM) acts as the "CEO" of a product, sitting at the intersection of business, technology, and user experience to guide a product from conception to launch and beyond.

- Business Development & Strategy: These roles focus on forging strategic partnerships, exploring new revenue streams, and analyzing the competitive landscape to guide the company's long-term growth.

- Marketing & Brand Management: MBA graduates in marketing move beyond advertising campaigns to take on strategic roles. A Brand Manager oversees the entire business of a specific brand or product line, including its P&L (profit and loss), long-term strategy, and market positioning.

### A Day in the Life of a Post-MBA Management Consultant

To make this more tangible, let's imagine a day for "Anna," a newly-minted MBA working as a consultant for a top-tier firm.

- 8:00 AM: Anna arrives at the client's headquarters. Her team is in the middle of a 3-month project to help a major retail company develop a new e-commerce strategy. She grabs coffee and huddles with her team to align on the day's priorities. Today's focus: finalizing the financial model for the proposed strategy.

- 9:00 AM - 12:00 PM: Anna is "in the model." She's deep in an Excel spreadsheet with thousands of rows, projecting future revenue, costs, and profitability based on different scenarios for the e-commerce launch. She uses the financial modeling skills she honed in her MBA finance classes to pressure-test assumptions and ensure the numbers are rock-solid.

- 12:00 PM - 1:00 PM: Lunch is a working session with her Engagement Manager and a client-side Vice President. They discuss the preliminary findings from the model and debate the strategic trade-offs of different approaches. Anna is expected to contribute intelligently, defending her analysis and asking insightful questions.

- 1:00 PM - 4:00 PM: The afternoon is dedicated to "deck building." The primary way consultants communicate their recommendations is through PowerPoint slide decks. Anna translates her complex financial model into a series of clear, compelling charts and executive-level summaries. This requires not just analytical skill, but a strong sense of storytelling and visual communication.

- 4:00 PM - 6:00 PM: Anna joins a brainstorming session with her team and a few key clients to think through the operational challenges of the new strategy. How will the supply chain need to adapt? What new customer service capabilities are required? Her broad MBA curriculum, which covered operations and marketing, allows her to contribute meaningfully to a wide-ranging business discussion.

- 6:00 PM onwards: Work often continues back at the hotel. Anna might spend another hour or two refining the slide deck, responding to emails, and preparing for the next day's client meetings. The days are long and demanding, but she's operating at the highest levels of business strategy, solving a multi-million dollar problem for her client just one year out of business school.

This example illustrates the blend of hard analytical skills, strategic thinking, and high-level communication that defines many post-MBA roles.

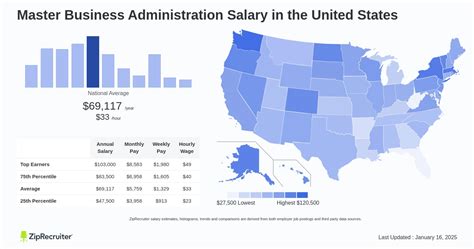

Average Master in Business Administration Salary: A Deep Dive

The salary potential is, without a doubt, a primary motivator for pursuing an MBA. The financial return is often substantial and immediate, catapulting graduates into a new income bracket. However, the "average" salary can be misleading, as it's an amalgamation of different industries, locations, and school tiers. To truly understand the numbers, we must break them down.

According to the Graduate Management Admission Council (GMAC), a leading authority on business education, the landscape for MBA graduates remains exceptionally strong. Their 2023 Corporate Recruiters Survey highlights that the median starting base salary for U.S. MBA graduates was projected to be $125,000. It's crucial to note this figure includes graduates from a wide spectrum of business schools.

When we focus on the top-tier programs (often referred to as the "M7" or "T15"), the numbers climb dramatically. For the class of 2023, many top schools reported median base salaries of $175,000, with some, like the Wharton School and Stanford Graduate School of Business, reporting median total compensation (including bonuses) exceeding $200,000.

### Salary by Experience Level

An MBA is a career accelerator, and the salary trajectory reflects this. The initial post-MBA salary is just the starting point for a steep curve of income growth. Here’s a breakdown of typical salary ranges by post-MBA experience, according to data synthesized from sources like Payscale and Glassdoor for corporate roles (excluding outliers in finance and entrepreneurship).

| Experience Level | Typical Base Salary Range | Typical Total Compensation Range (with Bonus) | Description |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-2 years post-MBA) | $120,000 - $175,000 | $140,000 - $220,000+ | Graduates entering roles like Consultant, Associate Brand Manager, or Senior Financial Analyst. Signing bonuses are common. |

| Mid-Career (3-8 years post-MBA) | $160,000 - $225,000 | $190,000 - $300,000+ | Professionals promoted to roles like Engagement Manager, Director, or Senior Product Manager. Performance bonuses become a larger part of compensation. |

| Senior-Level (8-15+ years post-MBA) | $220,000 - $350,000+ | $300,000 - $750,000+ | Executives in Vice President, Senior Vice President, or C-suite roles. Equity (stock options, RSUs) becomes a significant, often primary, component of total compensation. |

| Executive/C-Suite (15+ years) | $350,000+ | $1,000,000+ | CEO, CFO, COO, etc. Compensation is heavily weighted towards long-term incentives and company performance. |

*(Note: These figures are representative for 2023-2024 and can vary significantly based on the factors discussed in the next section. Sourced from a combination of GMAC reports, university career reports, Payscale, and Glassdoor data.)*

### Deconstructing the Compensation Package

The base salary is only one piece of the puzzle. For MBA graduates, total compensation is a much more important metric. Here are the key components you'll encounter:

- Base Salary: This is your guaranteed annual pay. It's the most stable part of your compensation. While high, it often represents only 60-80% of your total first-year earnings in high-paying industries.

- Signing Bonus: A one-time bonus paid upon signing an employment offer. This is extremely common for post-MBA hires, especially in consulting and finance. It's designed to offset the cost of relocation and the loss of income during the two years of study. According to career reports from top MBA programs like Harvard Business School and Chicago Booth, median signing bonuses for the class of 2023 were frequently in the $30,000 - $50,000 range.

- Performance Bonus: An annual bonus tied to your individual performance, your team's performance, and the company's overall profitability. In the first few years, this might be 15-30% of your base salary. In finance, this bonus can be much larger, often 50-100% (or more) of the base salary, even in the first year. As you become more senior, this component grows significantly.

- Profit Sharing: Some companies distribute a portion of their profits to employees. This is typically a percentage of your salary and depends entirely on the company's success in a given year.

- Stock Options & Restricted Stock Units (RSUs): Particularly common in the tech industry and for senior-level roles everywhere, equity gives you a stake in the company's future success. RSUs are grants of company stock that vest over a period of time (e.g., 4 years). Stock options give you the right to buy company stock at a predetermined price. If the company's stock price rises, this can lead to substantial financial gains, often dwarfing your salary and bonus.

When evaluating a post-MBA job offer, it's critical to look at the entire package. A role with a slightly lower base salary but a generous equity grant at a high-growth startup could ultimately be far more lucrative than a role with a higher base salary at a slow-growing incumbent.

Key Factors That Influence Your MBA Salary

While the average salaries are impressive, your individual master in business administration salary will be determined by a confluence of specific factors. Understanding these levers is crucial for maximizing your return on investment. Some factors are within your control (like the skills you build and the jobs you target), while others are decisions you make early on (like the school you attend).

###

1. Level of Education & Prestige of the Institution

This is arguably the single most significant factor in determining your initial post-MBA salary. The business world, for better or worse, operates on a signaling system, and the brand name of your business school is a powerful signal of quality, rigor, and talent.

- Tier 1: M7 and Top 15 Schools: The elite group of schools often referred to as the "M7" (Harvard, Stanford, Wharton, Kellogg, Booth, Columbia, MIT Sloan) and the broader "Top 15" (including schools like Tuck, Darden, Stern, Ross) are the primary recruiting grounds for the most sought-after and highest-paying employers in consulting, finance, and tech. As mentioned, graduates from these schools routinely command median starting base salaries of $175,000 and total compensation packages exceeding $200,000. These schools provide unparalleled access to recruiters, powerful alumni networks, and a curriculum that is highly respected.

- Tier 2: Top 20-50 Schools: Graduates from well-regarded public and private universities in the Top 50 still see a significant salary bump and excellent career opportunities, particularly within their specific region or for specific industry strengths (e.g., a school known for its supply chain management program). Median starting salaries might be in the $110,000 - $140,000 range, which is still a fantastic return. The key difference is that access to the most elite "bulge bracket" investment banks or "MBB" (McKinsey, Bain, BCG) consulting firms may be more limited.

- Other Accredited Programs: An MBA from a regionally accredited but less-nationally-ranked program can still provide immense value, especially for professionals looking to advance within their current company or region. The salary increase may be more modest, perhaps from $70,000 to $100,000, but the ROI can still be very high given the potentially lower tuition costs.

- Executive MBA (EMBA) vs. Full-Time vs. Part-Time/Online:

- EMBA: Designed for seasoned professionals (typically 10-15+ years of experience), EMBA programs are for those who want to continue working while studying. Salary impact is measured differently, as students are already high earners. The goal is often a promotion to a VP or C-suite role, with salary increases often realized *during* or immediately after the program.

- Part-Time/Online MBA: These offer flexibility and are excellent for "career enhancers" looking to move up within their current field. The immediate salary jump might be less dramatic than for full-time graduates who go through formal on-campus recruiting, but the long-term earnings potential is still significantly boosted.

###

2. Years of Experience (Pre- and Post-MBA)

Your professional background *before* business school plays a vital role. MBA programs are not for recent college graduates; the average amount of pre-MBA work experience at top programs is around 4-6 years.

- Pre-MBA Experience: Recruiters don't just look at the MBA; they look at the whole package. A candidate with 5 years of experience at a respected company like Google or Goldman Sachs before attending a top MBA program is seen as a lower-risk, higher-potential hire than someone with less-defined experience. This "blue-chip" pre-MBA background can lead to more competitive offers.

- Post-MBA Trajectory: As detailed in the table above, salary growth is rapid in the years immediately following graduation. A promotion from Consultant to Engagement Manager in consulting, or from Associate to Vice President in banking, comes with a substantial pay increase. An analysis by Payscale.com shows that the mid-career salary for an MBA graduate is, on average, significantly higher than for those with only a bachelor's degree, demonstrating the long-term value and accelerated growth track. The gap widens considerably at the senior and executive levels. For example, a senior manager with just a bachelor's might earn $140,000, while their counterpart with an MBA could be earning closer to $200,000 or more in the same role.

###

3. Geographic Location

Where you work has a massive impact on your salary, primarily due to cost of living and the concentration of high-paying industries. Major metropolitan hubs offer the highest nominal salaries but also come with the highest expenses.

Here's a look at how salaries can vary by location, citing data from Salary.com and university career reports which consistently highlight these metropolitan areas as top-paying destinations.

| Metropolitan Area | Why It Pays Well | Representative Median Base Salary (Top MBA Grads) |

| :--- | :--- | :--- |

| New York, NY | The undisputed global center for finance (investment banking, private equity). High concentration of consulting and corporate headquarters. | $175,000+ |

| San Francisco Bay Area, CA | The heart of the global tech industry (Big Tech, startups) and venture capital. | $175,000+ |

| Boston, MA | A major hub for management consulting, biotech, and asset management. | $175,000+ |

| Chicago, IL | Strong in consulting, corporate finance (home to many Fortune 500 companies), and a significant finance scene. | $165,000 - $175,000 |

| Seattle, WA | Dominated by major tech players like Amazon and Microsoft, with a booming startup ecosystem. | $160,000 - $170,000 |

| Houston/Dallas, TX | Powerhouses for the energy industry, with growing consulting and corporate sectors. Lower cost of living means salaries go further. | $150,000 - $165,000 |

Conversely, working in a smaller city or a region with a lower cost of living will likely mean a lower base salary, perhaps in the $110,000 - $130,000 range. However, the *real* value might be comparable or even higher once you factor in housing, taxes, and other expenses.

###

4. Industry, Company Type & Size

The industry you choose to enter post-MBA is a critical determinant of your compensation. The financial rewards are not distributed equally across all sectors.

- Top Paying Industries:

- Financial Services: Consistently the highest-paying sector. Investment banking, private equity, and venture capital offer staggering compensation packages, driven by massive performance bonuses.

- Management Consulting: Close behind finance, the top consulting firms (MBB) offer very high and standardized starting packages to attract the best talent.

- Technology: Big Tech firms (Google, Meta, Amazon, Apple) offer competitive base salaries and, most importantly, lucrative RSU packages that can add $50,000 - $100,000+ per year to total compensation as they vest.

- Mid-to-High Paying Industries:

- Healthcare/Biotech: Roles in strategy, business development, and marketing at large pharmaceutical and medical device companies are well-compensated.

- Consumer Packaged Goods (CPG): Brand management roles at companies like Procter & Gamble or PepsiCo offer strong salaries and excellent training, though typically less than the top three industries.

- Energy: Strategy and finance roles in the oil and gas or renewable energy sectors can be very lucrative.

- Lower Paying Industries:

- Non-Profit: While incredibly rewarding, salaries in the non-profit sector are significantly lower. MBAs enter this field driven by mission rather than money.

- Government: Public sector roles offer excellent stability and benefits but cannot compete with private sector salaries.

Company Size: Large, established corporations (Fortune 500) and elite professional services firms typically offer the highest and most structured starting salaries. Startups, on the other hand, may offer a lower base salary but compensate with a significant equity stake. This is a high-risk, high-reward proposition: if the startup succeeds and goes public or is acquired, that equity could be worth millions. If it fails, it's worth nothing.

###

5. Area of Specialization

During your MBA, you can choose to specialize in certain areas. This choice often aligns directly with your target industry and can enhance your appeal to specific recruiters.

- Finance: A specialization in finance, with deep coursework in corporate finance, valuation, and financial modeling, is almost a prerequisite for high-finance careers.

- Strategy: This is a versatile specialization that is highly valued by management consulting firms and for corporate strategy roles.

- Business Analytics/Data Science: A newer but increasingly valuable specialization. The ability to understand and interpret large datasets is a skill that commands a premium in tech, marketing, and operations. Graduates with a strong quantitative and analytical background are in high demand.

- Marketing: A specialization in marketing is key for those targeting Brand Management or other strategic marketing roles in CPG, tech, or retail.

- Entrepreneurship: While it doesn't lead to a traditional "salary," this specialization equips founders with the skills to launch and scale their own ventures.

###

6. In-Demand Skills

Beyond your degree and specialization, a specific set of skills will make you a more valuable and thus higher-paid candidate. These are the abilities you should focus on developing before, during, and after your MBA.

- Hard Skills:

- Financial Modeling: The ability to build complex, dynamic financial models in Excel is non-negotiable for finance and highly valued in consulting and corporate strategy.

- Data Analysis & Visualization: Proficiency with tools like SQL, Python, R, and data visualization software like Tableau or Power BI is a major differentiator in the modern business world.

- Quantitative Analysis: A strong grasp of statistics and the ability to interpret quantitative data to make business decisions.

- Soft Skills (or "Core Skills"):

- Strategic Thinking: The ability to see the big picture, understand competitive dynamics, and formulate long-term plans.

- Leadership & Influence: The capacity to lead teams, manage stakeholders, and persuade others, even without direct authority.

- Structured Communication: The skill, honed in consulting, of presenting complex information in a clear, concise, and compelling manner (both verbally and in writing).

- Problem-Solving: A structured, hypothesis-driven approach to breaking down ambiguous problems into manageable components and driving towards a solution.

Mastering these skills and effectively demonstrating them in your resume and interviews will directly translate into better job offers and a higher starting salary.

Job Outlook and Career Growth for MBA Graduates

The substantial salary is compelling, but a prudent career analyst also examines the long-term prospects. For MBA graduates, the outlook is exceptionally robust, characterized by steady demand, ample growth opportunities, and a clear path to leadership.

The U.S. Bureau of Labor Statistics (BLS) provides a strong proxy for the health of the MBA job market through its data on "Management Occupations." This broad category encompasses many of the roles that MBAs fill, from Financial Managers to Management Analysts (Consultants) to Marketing Managers. According to the BLS's 2022-2032 projections, employment in management occupations is projected to grow **