Thinking about advancing your career in finance with a master's degree in accounting? It’s a strategic move that can significantly enhance your skills, open doors to leadership roles, and substantially increase your earning potential. But what exactly does that look like in terms of dollars and cents?

A master's degree in accounting is more than just an academic achievement; it's a direct investment in a career path known for its stability, demand, and impressive financial rewards. Professionals holding this advanced degree can expect to earn a competitive salary, with averages often starting near $75,000 for entry-level roles and climbing well into the six-figure range, frequently exceeding $150,000 for experienced specialists and managers.

This article breaks down the salary you can expect with a master's degree in accounting, the key factors that influence your pay, and the robust career outlook for this profession.

What Do Professionals with a Master's in Accounting Do?

While a bachelor's degree provides a solid foundation in accounting principles, a master's program is designed to cultivate experts and leaders. Graduates are equipped to move beyond routine bookkeeping and into strategic financial roles. Their responsibilities often involve high-level analysis, decision-making, and specialized knowledge.

Key responsibilities include:

- Advanced Financial Reporting & Analysis: Preparing and interpreting complex financial statements for stakeholders, investors, and regulatory bodies.

- Auditing and Assurance: Leading internal or external audits to ensure financial accuracy, assess internal controls, and mitigate risk.

- Strategic Tax Planning: Developing sophisticated tax strategies for corporations or high-net-worth individuals to ensure compliance and optimize financial outcomes.

- Forensic Accounting: Investigating financial discrepancies, fraud, and white-collar crime.

- Managerial & Cost Accounting: Analyzing internal company data to improve operational efficiency, guide pricing decisions, and manage budgets.

- Advisory & Consulting: Providing expert financial advice on mergers and acquisitions, business valuation, and risk management.

Average Master's in Accounting Salary

While salary figures can vary, data from authoritative sources consistently shows a significant financial advantage for those with a master's degree.

According to Salary.com, the average salary for an accountant with a master's degree or MBA falls in the range of $91,015 to $112,663, with a strong median figure. Similarly, Payscale reports that the average salary for someone holding a Master of Accountancy (MAcc) is approximately $81,000 per year, but this figure includes a wide range of experience levels.

A realistic salary trajectory looks something like this:

- Entry-Level (0-2 years): $70,000 - $85,000

- Mid-Career (3-9 years): $85,000 - $120,000

- Senior/Experienced (10+ years): $120,000 - $175,000+

It's important to note that these senior-level salaries often belong to those in management roles like Controller, Director of Finance, or Partner at an accounting firm.

Key Factors That Influence Salary

Your base salary is just the starting point. Several key factors can dramatically impact your total compensation. Understanding these variables will help you maximize your earning potential throughout your career.

### Level of Education and Certification

While a master's degree itself provides a salary bump, its greatest financial impact is often realized when combined with the Certified Public Accountant (CPA) license. Most states require 150 semester hours of education to sit for the CPA exam, a requirement that a master's degree program helps fulfill.

The CPA designation is the gold standard in the accounting industry and comes with a significant pay premium. A report from the American Institute of Certified Public Accountants (AICPA) and other industry surveys consistently show that CPAs earn 5% to 15% more than their non-certified peers. This "CPA bonus" grows with experience, making the combination of a master's degree and a CPA license the most powerful driver of high income.

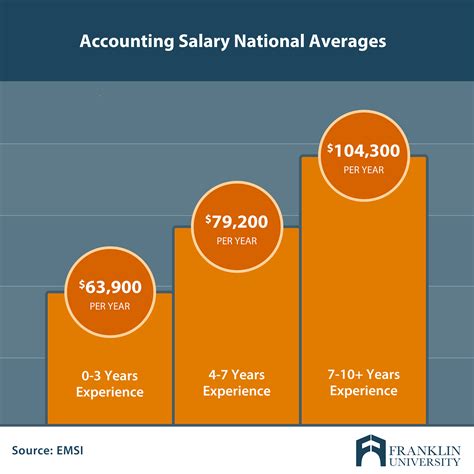

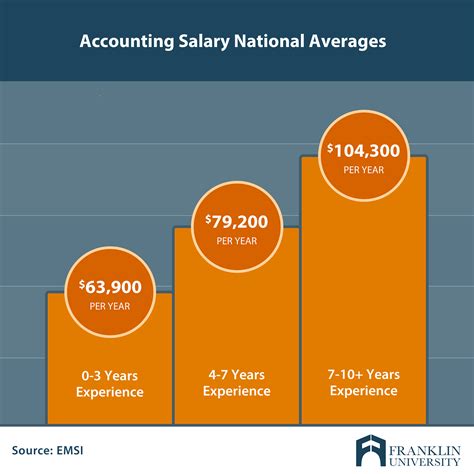

### Years of Experience

Experience is a critical factor in determining salary. As you gain practical skills, take on more complex projects, and demonstrate a track record of success, your value to employers increases significantly.

- Entry-Level (0-2 years): You are applying advanced theoretical knowledge. Employers are investing in your potential.

- Mid-Career (3-9 years): You have proven your abilities, can work independently, and may begin managing small teams or complex projects. This is where salaries see substantial growth.

- Senior-Level (10+ years): You are now a strategic leader. Roles like Controller, CFO, or Firm Partner are common at this stage, commanding top-tier salaries, bonuses, and equity potential.

### Geographic Location

Where you work matters. Major metropolitan areas with a high concentration of large corporations and financial institutions typically offer the highest salaries to compensate for a higher cost of living.

According to data from the U.S. Bureau of Labor Statistics (BLS), the top-paying metropolitan areas for accountants and auditors include:

1. New York-Newark-Jersey City, NY-NJ-PA

2. San Jose-Sunnyvale-Santa Clara, CA

3. San Francisco-Oakland-Hayward, CA

4. Washington-Arlington-Alexandria, DC-VA-MD-WV

5. Boston-Cambridge-Nashua, MA-NH

Working in these regions can result in a salary that is 20-40% higher than the national average.

### Company Type

The type of organization you work for has a profound effect on your compensation package.

- Public Accounting (The "Big Four"): The four largest global accounting firms (Deloitte, PwC, EY, and KPMG) are known for offering the most competitive starting salaries and robust benefits packages to attract top talent. The work is demanding but provides unparalleled experience.

- Corporate/Industry Accounting: Working in the finance department of a large, publicly-traded company (e.g., a Fortune 500 firm) also offers high salaries, especially in senior roles like Financial Controller or Internal Audit Director.

- Government: Federal agencies like the FBI, IRS, and Government Accountability Office (GAO) offer competitive salaries, excellent benefits, and strong job security, though the absolute pay may be slightly lower than in top-tier public or corporate roles.

- Non-Profit & Small Business: These organizations typically offer lower salaries due to budget constraints, but they can provide a better work-life balance and a strong sense of mission.

### Area of Specialization

A master's degree allows you to develop deep expertise in a high-demand niche. Specializing can make you a more valuable asset and significantly boost your salary. Some of the most lucrative specializations include:

- Forensic Accounting: Investigating financial crimes. These specialists are in high demand and command premium salaries.

- Information Technology (IT) Audit: Combining accounting and tech skills to audit complex IT systems and cybersecurity controls.

- International Tax: Navigating the complex tax laws of multiple countries for multinational corporations.

- Mergers & Acquisitions (M&A) / Transaction Advisory: Providing financial due diligence and valuation services for corporate takeovers.

Job Outlook

The future for accounting professionals is bright and stable. According to the U.S. Bureau of Labor Statistics (BLS), employment for accountants and auditors is projected to grow 4 percent from 2022 to 2032, which is as fast as the average for all occupations.

This growth translates to about 126,500 openings for accountants and auditors each year, on average, over the decade. This consistent demand is driven by economic growth, changing financial regulations, increased globalization, and the constant need for organizations to maintain tight financial controls.

Conclusion: A Smart Investment in Your Future

Pursuing a master's degree in accounting is a proven strategy for accelerating your career and maximizing your lifetime earning potential. While the national average salary provides a strong baseline, your ultimate income will be shaped by a powerful combination of factors.

The key takeaways are clear:

- Combine Education with Certification: Use your master's degree as a stepping stone to earning your CPA license to unlock the highest salary premiums.

- Be Strategic About Location and Industry: Target high-growth metropolitan areas and industries known for top compensation, such as public accounting or large corporations.

- Specialize and Become an Expert: Develop expertise in a high-demand niche like forensic accounting or IT audit to become an indispensable asset.

By leveraging your advanced degree, gaining valuable experience, and making strategic career choices, you can build a rewarding and highly lucrative career in the world of accounting.