A career in Mergers and Acquisitions (M&A) represents one of the most dynamic, challenging, and financially rewarding paths in the world of finance. It's a field where strategic decisions worth billions of dollars are made, and the professionals guiding these deals are compensated accordingly. For ambitious individuals with a sharp analytical mind and a tolerance for high-pressure environments, the allure is undeniable. But what does that translate to in actual earnings? While entry-level total compensation can quickly reach $150,000 to $200,000, senior professionals can command salaries well into the seven figures, making it a pinnacle of corporate finance careers.

This guide will break down the components of an M&A salary, the factors that drive your earning potential, and the long-term outlook for this prestigious profession.

What Does a Mergers and Acquisitions Professional Do?

At its core, an M&A professional is a strategic advisor who guides companies through the complex process of buying, selling, or combining with other businesses. This is not just a single job title but a field of practice primarily found within investment banks, private equity firms, and the corporate development departments of large corporations.

Key responsibilities include:

- Valuation: Determining the financial worth of a company using methods like Discounted Cash Flow (DCF), comparable company analysis, and precedent transactions.

- Financial Modeling: Building intricate spreadsheets to project a company's future performance and model the financial impact of a potential transaction.

- Due Diligence: Acting as a detective to investigate every aspect of a target company—from its financial statements and legal contracts to its operational strengths and weaknesses—to uncover any potential risks.

- Deal Structuring and Negotiation: Assisting senior bankers and clients in structuring the terms of the deal and negotiating the purchase price and other key conditions.

- Process Management: Coordinating with lawyers, accountants, and executives to ensure the deal progresses smoothly from the initial pitch to the final closing.

Average Mergers and Acquisitions Salary

Discussing M&A salaries requires a critical distinction: compensation is almost always a combination of a base salary and a significant performance-based bonus. The bonus is a substantial part of the total take-home pay and is tied to both individual and firm performance.

According to data compiled from leading sources like Salary.com, Glassdoor, and industry reports, here is a typical breakdown of M&A compensation by experience level in the United States.

- Analyst (Entry-Level, 0-3 years):

- Base Salary: $100,000 - $130,000

- All-In Compensation (with bonus): $160,000 - $250,000+

- Analysts are typically recent university graduates who handle the bulk of the financial modeling and presentation work.

- Associate (Post-MBA or Promoted Analyst, 3-6 years):

- Base Salary: $175,000 - $225,000

- All-In Compensation (with bonus): $275,000 - $450,000+

- Associates take on more project management responsibilities and begin interacting with clients.

- Vice President (VP) (6-10 years):

- Base Salary: $250,000 - $300,000

- All-In Compensation (with bonus): $450,000 - $700,000+

- VPs are the primary managers of deal execution and lead client relationships.

- Director / Managing Director (MD) (10+ years):

- Base Salary: $350,000 - $600,000+

- All-In Compensation (with bonus): $750,000 - $2,000,000+

- These senior leaders are responsible for originating deals (business development) and managing the firm's most important client relationships. Their compensation is heavily tied to the revenue they generate.

*Source Note: These figures are composites based on publicly available data from Salary.com, Glassdoor, and professional finance forums as of late 2023. Bonuses can vary dramatically based on market conditions and firm performance.*

Key Factors That Influence Salary

Your specific salary within these wide ranges will be determined by several critical factors.

### Level of Education

A bachelor's degree in finance, economics, or accounting from a top-tier university is the standard entry requirement for an Analyst role. However, the Master of Business Administration (MBA) is a major inflection point. Graduating with an MBA from a top business school is the primary pathway to entering an investment bank at the Associate level, which comes with a significant jump in both base salary and overall responsibility.

### Years of Experience

As illustrated in the salary breakdown above, experience is the single most powerful driver of compensation in M&A. The career path is highly structured, with promotions (from Analyst to Associate, to VP, to MD) directly tied to years of service and proven ability. With each promotion, both the base salary and the bonus potential increase exponentially.

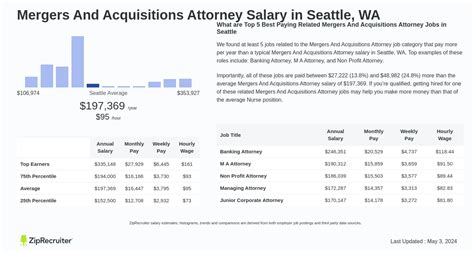

### Geographic Location

Finance is a geographically concentrated industry, and M&A is no exception. Salaries are highest in major financial hubs where the deal flow is concentrated.

- New York City: The undisputed center of the M&A world, offering the highest compensation packages to attract top talent.

- San Francisco / Bay Area: A close second, driven by the massive volume of technology-focused M&A.

- Other Major Hubs: Cities like Chicago, Los Angeles, Boston, and Houston (for energy-related M&A) also host significant M&A activity and offer very competitive salaries, though often slightly below New York levels.

According to Payscale, a financial professional in New York can expect to earn significantly above the national average, reflecting both the high cost of living and the concentration of high-value deals.

### Company Type

Where you work has a massive impact on your paycheck.

- Bulge Bracket Banks (e.g., Goldman Sachs, J.P. Morgan): These global giants handle the largest and most complex deals. They are known for setting the top-tier compensation benchmarks.

- Elite Boutique Banks (e.g., Evercore, Lazard, Centerview Partners): These firms specialize exclusively in advisory services like M&A. They often compete directly with bulge brackets for talent and, in many cases, offer even higher compensation due to their lower overhead.

- Middle-Market Banks (e.g., Baird, Houlihan Lokey): These firms focus on deals for mid-sized companies. While compensation is still extremely lucrative, it may be slightly lower than at bulge bracket or elite boutique firms.

- Corporate Development: This involves working "in-house" for a large company (like Google, Disney, or a Fortune 500 industrial) on its acquisition strategy. Base salaries are often competitive with or even higher than banks, but bonuses are significantly lower. This path is often chosen by former bankers seeking a better work-life balance.

### Area of Specialization

Within a bank, analysts are often aligned with industry groups (e.g., Technology, Media & Telecom (TMT), Healthcare, Industrials, Financial Institutions Group (FIG)). During boom years for a particular sector, like tech or healthcare, bankers specializing in that area may see larger bonuses due to higher deal volume and firm profitability.

Job Outlook

The career outlook for M&A professionals is intrinsically linked to the health of the global economy. While the U.S. Bureau of Labor Statistics (BLS) does not track "M&A Analyst" as a distinct profession, the closest proxy is "Financial Analysts." The BLS projects employment for Financial Analysts to grow 8% from 2022 to 2032, which is much faster than the average for all occupations.

M&A activity is cyclical. It thrives in periods of economic growth, low-interest rates, and high corporate confidence. During economic downturns, deal flow may slow, but this is often counterbalanced by an increase in restructuring and bankruptcy advisory work. Competition for M&A roles is always fierce, but skilled professionals who can navigate both bull and bear markets will remain in high demand.

Conclusion

A career in mergers and acquisitions is not for the faint of heart. It demands long hours, intense pressure, and an unwavering commitment to excellence. However, the rewards are commensurate with the challenges. The profession offers:

- Exceptional Earning Potential: Total compensation can reach six figures straight out of university and has a clear path to seven figures for top performers.

- Unparalleled Experience: You will operate at the highest levels of business, helping to shape industries and guide companies through their most transformative moments.

- Accelerated Career Growth: The skills learned in M&A—financial modeling, valuation, strategic thinking, and negotiation—are highly transferable and open doors to careers in private equity, venture capital, and executive leadership.

For those with the ambition, analytical prowess, and resilience to succeed, a career in M&A offers a front-row seat to the world of corporate strategy and a pathway to significant financial and professional achievement.