Introduction

Moving to a new country or starting a new job is a journey filled with both excitement and uncertainty. At the heart of that uncertainty often lies one critical question: "What is the minimum I can expect to earn?" In Spain, a country celebrated for its vibrant culture, stunning landscapes, and high quality of life, this question leads directly to the *Salario Mínimo Interprofesional* (SMI), or the national minimum wage. This isn't just a number; it's a legal standard that forms the bedrock of the country's labor market, a social safety net, and a topic of intense political and economic debate.

Understanding the SMI is crucial not just for those earning it, but for every worker, employer, and prospective resident in Spain. For 2024, the Spanish government has set the gross minimum salary at €1,134 per month paid in 14 installments, totaling €15,876 per year. This figure represents a significant increase in recent years, reflecting a concerted effort to improve living standards and reduce inequality. But what does this number truly mean for your monthly budget in Madrid versus a quiet town in Andalusia? How is it calculated, who is entitled to it, and what are your rights if an employer fails to comply?

As a career analyst who has guided dozens of professionals and expatriates on their journey to work in Spain, I've seen firsthand how a clear understanding of the SMI can empower individuals. I recall a client, a talented graphic designer from abroad, who received a job offer that seemed attractive at first glance. However, by breaking down the contract against the legal SMI, accounting for pro-rated extra payments and tax deductions, we discovered it fell short of the legal minimum. Armed with this knowledge, she successfully renegotiated, securing a fair wage that set her up for a stable and successful start in her new life. This is the power of information.

This guide is designed to be your definitive resource on the minimum salary in Spain. We will delve deep into the official figures, explore the complex factors that influence your take-home pay, analyze the economic impact of the SMI, and provide a practical roadmap for both employees and employers to navigate the system with confidence.

### Table of Contents

- [Understanding Spain's Minimum Wage: What is the SMI?](#understanding-spains-minimum-wage-what-is-the-smi)

- [The Current Minimum Salary in Spain (2024): A Detailed Breakdown](#the-current-minimum-salary-in-spain-2024-a-detailed-breakdown)

- [Who is Covered by the Minimum Salary and How is it Applied?](#who-is-covered-by-the-minimum-salary-and-how-is-it-applied)

- [The Economic and Social Impact of the Minimum Salary](#the-economic-and-social-impact-of-the-minimum-salary)

- [A Practical Guide for Workers and Employers](#a-practical-guide-for-workers-and-employers)

- [Conclusion: Your Rights, Your Value](#conclusion-your-rights-your-value)

Understanding Spain's Minimum Wage: What is the SMI?

The *Salario Mínimo Interprofesional* (SMI) is the legally mandated minimum wage that any employer in Spain must pay their workers for a full-time, 40-hour work week, regardless of the type of contract, age (for those 16 and over), sex, or sector of the economy. It is the absolute floor for compensation.

Legal Foundation and Purpose:

The SMI is established in Article 27 of the Workers' Statute (*Estatuto de los Trabajadores*), the primary legal text governing labor relations in Spain. Its fundamental purpose is to protect workers from unduly low wages and guarantee a basic level of purchasing power to cover essential needs. It acts as a key instrument of social policy, aimed at promoting equitable income distribution and combating in-work poverty.

Who Sets the SMI?

The Spanish government is responsible for setting the SMI annually through a Royal Decree (*Real Decreto*). The process involves consultations with the most representative trade unions (like CCOO and UGT) and business associations (like CEOE and CEPYME). While the government seeks a consensus, it holds the final authority to approve the amount.

The government considers several key factors when determining the annual increase, as outlined in the Workers' Statute:

- The Consumer Price Index (CPI): The national inflation rate is a primary consideration to ensure the SMI maintains its real value.

- Average National Productivity: Increases in productivity are factored in to link wages to economic output.

- The Share of Labor in National Income: This looks at the balance between profits and wages in the economy.

- The General Economic Situation: Broader economic indicators, such as GDP growth and employment figures, play a crucial role.

A Brief History of the SMI's Evolution:

The SMI was first established in Spain in 1963. For decades, it saw modest, inflation-tracking increases. However, the period from 2018 to 2024 has marked a transformative era for the minimum wage. The government has implemented a series of aggressive hikes with the stated goal of raising the SMI to 60% of the average national salary, a benchmark recommended by the European Committee of Social Rights.

- 2018: €735.90 / month (14 payments)

- 2019: €900 / month (A landmark 22.3% increase)

- 2020: €950 / month

- 2021: €965 / month

- 2022: €1,000 / month

- 2023: €1,080 / month

- 2024: €1,134 / month

This rapid ascent has made Spain's minimum wage policy a focal point of international attention and domestic debate, a topic we will explore further in the economic impact section. This history underscores that the SMI is not a static figure but a dynamic policy tool reflecting the social and economic priorities of the government of the day.

The Current Minimum Salary in Spain (2024): A Detailed Breakdown

The most critical piece of information for any worker is the precise, official figure for the minimum salary. For 2024, this was established by Royal Decree 145/2024, of February 6th, published in the Official State Gazette (*Boletín Oficial del Estado*, BOE). It's crucial to understand that the headline figure can be presented in several ways, which can cause confusion. Let's break it down clearly.

The SMI refers to the gross salary, which is the amount before any deductions for social security contributions (*cotizaciones a la Seguridad Social*) and income tax (*Impuesto sobre la Renta de las Personas Físicas*, IRPF).

#### Official SMI Figures for 2024:

- Annual Gross Salary: €15,876

- Monthly Gross Salary (14 Payments): €1,134

- Monthly Gross Salary (12 Payments): €1,323

- Daily Gross Salary (for temporary work): €37.80

Source: *Real Decreto 145/2024, de 6 de febrero, por el que se fija el salario mínimo interprofesional para 2024. Boletín Oficial del Estado (BOE).*

#### Understanding 14 vs. 12 Payments (*Pagas Extras*)

One of the most unique and often confusing aspects of the Spanish salary structure is the concept of *pagas extraordinarias* (extraordinary payments or bonuses). By law and under most collective bargaining agreements (*convenios colectivos*), workers are entitled to at least two extra payments per year, typically paid in July (for summer holidays) and December (for Christmas).

This means the annual salary of €15,876 is commonly paid in 14 installments of €1,134.

However, a company and an employee can agree to have these two extra payments "pro-rated" (*prorrateadas*) and distributed evenly throughout the year. In this case, the annual salary is divided into 12 equal monthly payments.

- 14 Payments: You receive €1,134 per month for 12 months, plus an additional €1,134 payment in the summer and another in the winter.

- 12 Payments: You receive €1,323 every single month (€15,876 / 12).

It is vital to check your work contract to see which payment structure applies to you. Neither structure changes the total annual gross amount you are legally entitled to earn. This is a common point of contention where an employer might offer €1,134 per month over 12 payments, which is illegal as it falls far short of the €15,876 annual minimum.

#### SMI for Different Contract Types

The SMI is a flexible base that adapts to different working arrangements:

1. Part-Time Workers (*Trabajadores a Tiempo Parcial*)

For part-time workers, the SMI is calculated proportionally to the hours worked. For example, if you work 20 hours per week (half of a standard 40-hour week), your minimum gross salary would be 50% of the full-time SMI.

- Calculation: (€15,876 / year) * (Your weekly hours / 40)

- Example (20-hour week): €15,876 * (20 / 40) = €7,938 per year. This could be paid as €567 per month (14 payments) or €661.50 per month (12 payments).

2. Domestic Employees (*Empleados de Hogar*)

Domestic workers who are paid by the hour have a specific minimum wage set. For 2024, this is:

- Minimum Rate per Hour: €8.87

- This hourly rate already includes the proportional part of the extra payments and paid holidays. This ensures that even for very short-term work, the worker receives their full entitlement.

Source: *Disposición adicional primera, Real Decreto 145/2024.*

3. Temporary and Seasonal Workers (*Trabajadores Eventuales y Temporeros*)

For workers on contracts lasting less than 120 days in the same company, the minimum wage can be calculated on a daily basis to simplify payment. The daily minimum cannot be less than:

- Minimum Daily Rate: €53.71

- This figure includes the proportional part of Sundays, holidays, and the two mandatory extra payments. It ensures short-term workers are not disadvantaged.

What is Included in the SMI?

The SMI refers only to the base salary. It does not include in-kind payments (like company housing or a car) unless a collective agreement specifies otherwise and the monetary portion still meets the SMI. It also doesn't include supplements for things like night work, hazardous conditions, or overtime. These must be paid on top of the SMI.

Who is Covered by the Minimum Salary and How is it Applied?

The SMI is a universal floor, but its application can have nuances depending on various factors. Understanding these is key to knowing your precise rights. This section, the most detailed in our guide, will dissect the key factors that determine how the minimum wage applies to you.

### `

`Contract Type and Working Hours`

`As established, the SMI is the reference for a full-time contract, defined in Spain as 40 hours per week. Its most direct application varies based on the nature of your employment agreement.

- Indefinite Full-Time Contracts (*Contrato Indefinido a Jornada Completa*): This is the standard. Workers with this contract are entitled to the full €15,876 gross annual salary. The only variable is whether it's paid in 12 or 14 installments.

- Fixed-Term Full-Time Contracts (*Contrato de Duración Determinada a Jornada Completa*): The same rules apply. The duration of the contract does not affect the monthly or annual minimum salary entitlement. As long as you work 40 hours a week, you are entitled to the full SMI.

- Part-Time Contracts (*Contrato a Tiempo Parcial*): This is where proportionality is crucial. The SMI must be calculated based on the exact percentage of a full-time schedule you work. An employer cannot simply pay a flat, low rate. If your contract is for 30 hours a week (75% of a full-time job), your minimum gross salary must be exactly 75% of the SMI (€11,907 per year). This must be clearly specified in your contract and payslip (*nómina*).

- Training and Apprenticeship Contracts (*Contratos de Formación y Aprendizaje*): This is a key exception. The remuneration for these contracts is set by the relevant collective bargaining agreement. However, it can never be lower than the SMI in proportion to the effective working time. So, if an apprentice's contract stipulates 60% work and 40% training, their salary must be at least 60% of the SMI.

### `

`The Crucial Role of Collective Bargaining Agreements (*Convenios Colectivos*)`

`This is perhaps the most important concept for workers in Spain to understand beyond the national minimum. The SMI is the absolute legal floor, but it is not the effective minimum wage for a majority of workers.

A *Convenio Colectivo* is a binding agreement negotiated between trade unions and employer associations for a specific economic sector (e.g., hospitality, metalworking, consulting, retail) and often a specific geographic area (e.g., provincial, regional, or national).

How do *Convenios* interact with the SMI?

1. They Set Higher Minimums: Almost all *convenios* establish salary tables (*tablas salariales*) with minimum wages that are higher than the national SMI. These tables are broken down by job role, category, and seniority. For example, the minimum salary for a waiter in the hospitality *convenio* for Madrid will be significantly higher than the SMI.

2. They Cannot Go Below the SMI: It is illegal for a *convenio colectivo* to set a salary below the national SMI. If a *convenio* has not been updated and its salary tables fall below a newly approved SMI, the new, higher SMI automatically applies.

3. Absorption and Compensation (*Absorción y Compensación*): This is a critical legal mechanism. If a worker is already earning a salary higher than the new SMI (for example, €18,000 per year) due to their *convenio*, the employer is not legally required to give them a raise when the SMI increases from €15,000 to €15,876. The new SMI is considered "absorbed" by their existing higher salary. However, this only applies if the *convenio* explicitly allows for it. The salary a worker receives according to their *convenio* must always be respected.

How to find your *Convenio Colectivo*: Your work contract or payslip should state which collective agreement applies to your job. You can search for the full text of any *convenio* on the official registry, REGCON (Registro de Convenios y Acuerdos Colectivos de Trabajo). Understanding your specific *convenio* is the only way to know the true minimum salary for your specific job role and sector.

### `

`Geographic Location and Cost of Living`

`A common question from expatriates is whether the minimum wage varies by region. The answer is no. The *Salario Mínimo Interprofesional* is a single, national minimum wage that applies equally in Madrid, Barcelona, Seville, Galicia, and the Canary Islands.

However, the real value and purchasing power of that salary vary enormously across the country due to drastic differences in the cost of living. Earning the SMI of €1,323 gross per month (in 12 payments) provides a very different quality of life in a major city compared to a rural area.

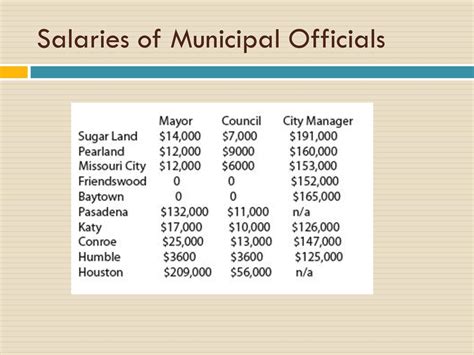

Let's look at a comparative analysis using data from cost-of-living aggregator Numbeo and property portal Idealista (as of early 2024), which provide user-contributed but widely cited estimates.

| Expense Category | Madrid / Barcelona (Avg.) | Medium City (e.g., Valencia, Malaga) | Smaller City/Rural (e.g., Badajoz, Lugo) |

| ------------------------- | ------------------------- | ------------------------------------ | --------------------------------------- |

| Studio Apt. Rent (City Center) | €900 - €1,200 | €700 - €900 | €400 - €550 |

| 1-Bedroom Apt. Rent (Outside Center) | €750 - €950 | €550 - €700 | €350 - €450 |

| Basic Utilities (Monthly) | €120 - €180 | €100 - €150 | €90 - €130 |

| Monthly Transport Pass| €40 - €55 | €30 - €40 | €20 - €30 |

| Meal at Inexpensive Restaurant | €13 - €18 | €11 - €15 | €10 - €12 |

Analysis:

A worker earning the net SMI (approx. €1,200/month after deductions) in Madrid or Barcelona would find that a modest studio apartment alone could consume 75-100% of their income, making it functionally impossible to live alone. They would be forced into flat-sharing arrangements or long commutes. In contrast, the same worker in a city like Badajoz (Extremadura) could rent a small apartment for around €400, leaving a much larger portion of their salary for other expenses.

This disparity is a major topic of political debate. Some regions, particularly the Basque Country and Catalonia, have pushed for the ability to set their own, higher regional minimum wages to reflect their higher cost of living, though this is not currently permitted under Spanish law.

### `

`From Gross to Net: Deductions from the SMI`

`The headline figure of €1,134 (14 payments) is the gross salary. To understand your actual take-home pay (*salario neto*), you must account for two main deductions.

1. Social Security Contributions (*Cotizaciones a la Seguridad Social*)

These are mandatory contributions that fund Spain's public pension system, unemployment benefits, sick leave, and healthcare. For the employee, the total deduction is 6.47% of their gross salary (for a standard contract).

- Calculation: €1,323 (monthly SMI in 12 payments) * 6.47% = €85.60 per month

- Note: The employer also pays a much larger social security contribution (around 30-32%) on top of the worker's gross salary. This is the employer's cost, not the worker's.

2. Income Tax (IRPF - *Impuesto sobre la Renta de las Personas Físicas*)

This is the personal income tax. Due to recent changes, workers earning the annual SMI of €15,876 are now effectively exempt from paying IRPF. The government has raised the minimum income threshold for IRPF to align with the new SMI, ensuring that minimum wage earners are not taxed on their income.

However, the withholding rate can be affected by personal circumstances (e.g., marital status, number of children), and it's calculated on an annual basis. If a worker has other sources of income, their overall tax burden might change.

Estimated Net SMI in 2024:

- Gross Monthly Salary (12 payments): €1,323.00

- Social Security Deduction (~6.47%): - €85.60

- IRPF Deduction: - €0 (in most standard cases)

- Estimated Net Monthly Salary: ~€1,237.40

This net figure is the approximate amount you can expect to see in your bank account each month if you are earning the SMI on a full-time contract with pro-rated extra payments.

The Economic and Social Impact of the Minimum Salary

The substantial increases in Spain's SMI since 2018 have not occurred in a vacuum. They are part of a deliberate policy shift that has ignited a fierce debate among economists, politicians, and business leaders. Analyzing this impact is crucial to understanding the future trajectory of wages and employment in Spain.

### `

`Recent Trends and Future Outlook`

`The guiding policy of the current government has been to align the SMI with 60% of the average Spanish salary. According to government reports and analysis by trade unions, the 2024 figure of €15,876 per year has largely achieved this objective.

Future Outlook:

What comes next is a matter of speculation and political negotiation.

- Trade Unions (CCOO, UGT): Continue to advocate for annual increases that are, at a minimum, tied to inflation (CPI) to prevent any loss of purchasing power. They argue that a strong SMI is the best tool against poverty and for stimulating domestic demand.

- Employer Associations (CEOE, CEPYME): Have voiced significant concerns, especially on behalf of small and medium-sized enterprises (SMEs). They argue that the rapid pace of increases has raised labor costs to unsustainable levels, particularly in less productive sectors and rural areas. They advocate for more moderate, predictable increases tied to productivity gains.

- The Government: The future path will likely depend on the economic climate. In times of high inflation, pressure will mount to raise the SMI to protect workers. In times of economic slowdown or rising unemployment, there may be calls for moderation. The political consensus is fragile, but the principle of an SMI pegged to 60% of the average wage now appears to be an established benchmark.

### `

`Impact on Employment, Poverty, and the Economy`

`The central economic question is: Do large minimum wage hikes kill jobs? The evidence in Spain is complex and contested.

Arguments in Favor and Positive Impacts:

- Poverty Reduction: The primary goal. Studies from organizations like Oxfam Intermón and the unions show a direct correlation between SMI hikes and a reduction in in-work poverty and gender inequality, as women are disproportionately represented in low-wage sectors. The Ministry of Labour estimates the recent increases have directly benefited over 2.5 million of Spain's lowest-paid workers.

- Increased Domestic Demand: Lower-income households have a higher propensity to consume. Putting more money in their pockets directly fuels the local economy, as the money is spent on goods and services rather than saved or invested.

- Formalization of the Economy: A higher SMI can incentivize workers in the "black economy" (*economía sumergida*) to demand formal contracts, increasing tax and social security revenue.

Arguments Against and Negative Impacts:

- Job Destruction/Slower Job Creation: This is the main concern of business groups. A landmark 2021 report from the Bank of Spain (Banco de España) on the 2019 hike estimated that the measure resulted in a net destruction of between 0.6% and 1.1% of jobs for the affected population. They argue that for some low-margin businesses, the only way to absorb the higher labor cost is to reduce staff or halt new hiring. The impact is most pronounced among younger workers, those with lower qualifications, and in sectors like agriculture.

- Inflationary Pressure: In theory, businesses might pass on higher labor costs to consumers in the form of higher prices, contributing to inflation. While some micro-level price increases have been observed, most macroeconomic studies have not found the SMI hikes to be a primary driver of Spain's recent inflation, which has been largely linked to energy costs and global supply chain issues.

- Reduced Competitiveness: Particularly in the agricultural sector, which competes with produce from countries with much lower labor costs (like Morocco), business associations argue that the high SMI makes Spanish goods less competitive on the international market.

The consensus among most economists is that the effect is not binary. The SMI hikes have likely had a modest negative effect on employment levels for specific, vulnerable groups but have also had a significant positive effect on reducing inequality and poverty for a much larger population.

### `

`Spain's SMI in an International Context`

`To truly appreciate Spain's position, it's helpful to compare its minimum wage to that of its European neighbors. Eurostat, the statistical office of the European Union, provides harmonized data for comparison.

Monthly Minimum Wage in Select EU Countries (Gross, Early 2024 - Approx. Values)

| Country | Monthly Minimum Wage (12 payments) |

| ------------- | ---------------------------------- |

| Luxembourg | ~€2,571 |

| Germany | ~€2,054 |

| Belgium | ~€1,994 |

| Netherlands | ~€1,995 |

| Ireland | ~€1,910 |

| France | ~€1,767 |

| Spain | ~€1,323 |

| Slovenia | ~€1,254 |

| Portugal | ~€887 |

| Greece | ~€910 |

| Poland | ~€978 |

Source: *Eurostat, 2024 data, figures rounded and converted to a 12-payment structure for comparability.*

This data reveals that Spain sits comfortably in a middle group of EU countries. Its minimum wage is substantially higher than that of its neighbor Portugal and many Eastern European nations. However, it remains significantly below the top tier of countries like Germany, France, and the Benelux nations. The recent increases have successfully moved Spain out of the "low-wage" EU bloc and into a more central position, aligning its labor standards more closely with those of its major European peers.

A Practical Guide for Workers and Employers

Knowledge is only powerful when it's actionable. This section provides a practical checklist and guide for both employees and employers to ensure compliance and protect their rights and obligations concerning the SMI.

### `

`For Workers: Know Your Rights and What to Do`

`Your salary is your livelihood. It's essential to be proactive and informed.

1. How to Check Your Payslip (*Nómina*)

Your monthly payslip is a legal document that must contain a detailed breakdown of