For individuals who are meticulous, organized, and thrive on guiding people through major life decisions, a career as a mortgage loan processor can be both rewarding and financially stable. This role is the operational backbone of the mortgage industry, ensuring every detail is perfect before a loan is approved. But what does that responsibility translate to in terms of salary?

This guide provides a data-driven look at the earning potential for a mortgage loan processor. On average, you can expect a salary ranging from $45,000 to over $70,000 per year, with top earners and those in high-demand markets exceeding this range significantly, especially when bonuses are considered.

Let's break down the numbers, the factors that drive them, and the future outlook for this essential profession.

What Does a Mortgage Loan Processor Do?

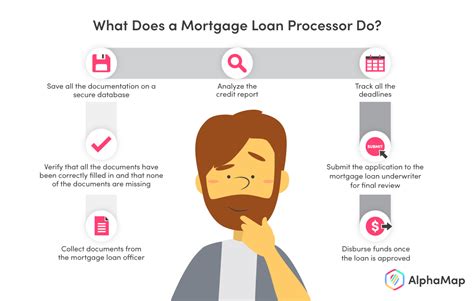

Before diving into the salary figures, it's important to understand the role. A mortgage loan processor acts as the critical link between the loan originator (who sells the loan) and the underwriter (who approves it). They are the project managers of the mortgage application, responsible for gathering, verifying, and preparing all the necessary documentation for a loan file.

Key responsibilities include:

- Collecting and verifying borrower documentation (pay stubs, tax returns, bank statements).

- Ordering third-party reports like appraisals, title searches, and flood certifications.

- Communicating with borrowers, real estate agents, and underwriters to resolve issues and request information.

- Ensuring the loan file is complete and compliant with all state and federal regulations.

- Preparing the finalized loan package for submission to the underwriting department.

In short, their attention to detail prevents delays and ensures a smooth journey from application to closing day.

Average Mortgage Loan Processor Salary

The compensation for a mortgage loan processor is competitive and often includes a base salary plus performance-based bonuses.

According to leading salary aggregators, the average base salary for a mortgage loan processor in the United States falls into a consistent range.

- Salary.com reports that the median salary for a Loan Processor is $48,932 as of early 2024, with a typical range falling between $43,027 and $55,604.

- Payscale provides a similar view, with an average base salary of around $48,500 per year. Their data shows that salaries can start near $38,000 for entry-level positions and rise to over $65,000 for experienced professionals.

- Glassdoor estimates the total pay (including base and additional compensation like bonuses) for a Mortgage Processor to be around $66,549 per year on average, highlighting the significant impact of variable pay in this role.

It's crucial to note that many processors earn per-file bonuses, which can add several hundred to several thousand dollars to their monthly income, especially during busy housing market cycles.

Key Factors That Influence Salary

Your specific salary will be influenced by several key factors. Understanding these can help you strategize your career path and maximize your earning potential.

###

Level of Education

While a bachelor's degree is not a strict requirement for most loan processor positions, it can give you a competitive edge. A degree in finance, business, or a related field can lead to a higher starting salary and open doors to management or underwriting roles more quickly. However, the majority of processors enter the field with a high school diploma or an associate's degree, relying on on-the-job training and certifications to advance.

###

Years of Experience

Experience is arguably the most significant factor in determining a loan processor's salary. As you gain expertise in handling complex files and navigating regulations, your value to an employer skyrockets.

- Entry-Level (0-2 years): Processors at this stage are typically learning the fundamentals. They handle more straightforward loan files (like conventional refinances) under close supervision. Salaries often start in the $40,000 to $48,000 range.

- Mid-Career (3-5 years): With a few years of experience, processors can manage a larger pipeline of more complex loans (e.g., FHA, VA) with greater autonomy. Their base salary often moves into the $48,000 to $60,000 range, with more substantial bonus opportunities.

- Senior / Lead Processor (5+ years): Senior processors are experts who can handle any file type, including challenging jumbo, construction, or self-employed borrower loans. They often train junior staff and act as a resource for the entire team. Their base salaries can exceed $65,000 or $70,000, with total compensation often pushing well beyond that.

###

Geographic Location

Where you work matters. Salaries are adjusted based on the local cost of living and the demand for housing in a particular region. Major metropolitan areas and states with hot real estate markets tend to offer higher compensation.

For example, processors working in cities like San Francisco, New York City, Boston, and Washington, D.C., can expect to earn significantly more than the national average. Conversely, salaries in smaller cities in the Midwest or Southeast may be closer to the lower end of the national range, though this is often balanced by a lower cost of living.

###

Company Type

The type of company you work for also plays a role in your compensation structure.

- Large Banks and Financial Institutions: These companies often offer very structured salary bands, excellent benefits, and stability. While the bonus potential might be more modest, the overall package is typically strong and predictable.

- Independent Mortgage Lenders: These firms, which specialize solely in mortgages, are often more aggressive with performance-based pay. Base salaries may be in line with the market average, but high-performing processors can earn significant bonuses, leading to higher overall compensation in busy years.

- Credit Unions: Focused on member service, credit unions provide a stable work environment and competitive pay. Compensation may not reach the highest peaks seen at some independent lenders, but they are known for good work-life balance and solid benefits.

###

Area of Specialization

Developing expertise in specific loan types can make you a more valuable asset. Processors who are proficient in niche areas are in high demand.

- Government-Backed Loans (FHA, VA, USDA): These loans have unique and strict guidelines. A processor who is an expert in navigating these requirements is highly sought after.

- Jumbo and Super Jumbo Loans: These large, non-conforming loans carry more risk and complexity, and experienced processors who can handle them confidently can command higher pay.

- Renovation or Construction Loans: These are some of the most complex files, involving draws, inspections, and contractor coordination. Specializing in this area can lead to top-tier earnings.

Furthermore, while not always required for a pure processing role, obtaining a Mortgage Loan Originator (MLO) license via the NMLS can increase your versatility and pay, potentially allowing you to work in hybrid processor/originator roles.

Job Outlook

The U.S. Bureau of Labor Statistics (BLS) projects the employment of "Loan Interviewers and Clerks," the category that includes loan processors, to show a slight decline of 4% from 2022 to 2032.

However, this statistic should be viewed with context. The decline is largely attributed to automation of routine data entry and verification tasks. The demand for skilled, analytical processors who can manage complex files, solve problems, and provide a human touch is expected to remain steady. The cyclical nature of the mortgage industry and natural employee turnover will continue to create consistent job openings for qualified candidates.

Conclusion

A career as a mortgage loan processor offers a clear path for professional and financial growth. While an entry-level position may start with a modest salary, your earning potential is directly tied to factors within your control.

Key Takeaways:

- Expect a solid base salary with a national median around $48,000, but remember that total compensation is often much higher due to bonuses.

- Experience is your greatest asset. Focus on mastering your craft, as each year of experience significantly increases your earning power.

- Specialize to stand out. Becoming an expert in government, jumbo, or other complex loans can make you indispensable.

- Location and company choice matter. Strategically choosing where you work can have a major impact on your paycheck.

For the detail-oriented individual looking for a stable and engaging career in the finance world, becoming a mortgage loan processor is a pathway to success, with tangible rewards for expertise and hard work.