Understanding the 2024 Overtime Rule: A Game-Changer for Salaried Employees

For millions of salaried American workers, 2024 marks a pivotal shift in how they are compensated. A new final rule from the U.S. Department of Labor is set to dramatically expand eligibility for overtime pay, potentially adding thousands of dollars to the annual income of employees across various industries. This landmark change updates the regulations under the Fair Labor Standards Act (FLSA) and creates new salary thresholds that employers must meet to classify an employee as "exempt" from overtime. Understanding this change is critical for both employees seeking fair compensation and professionals charting their career path.

What is the New Overtime Rule for Salaried Employees?

At its core, the new DOL rule addresses the "white-collar" exemption for overtime pay. Under the FLSA, most employees are entitled to be paid at least one-and-a-half times their regular rate of pay for any hours worked over 40 in a workweek. However, certain executive, administrative, and professional (EAP) employees can be classified as "exempt" from this requirement if they meet two primary criteria:

1. Duties Test: They must primarily perform high-level, exempt job duties.

2. Salary Threshold Test: They must be paid a fixed salary that meets a certain minimum dollar amount.

The 2024 rule significantly raises this minimum salary threshold. The primary function of this new law is to reclassify millions of lower-salaried employees from "exempt" to "non-exempt" status, making them legally eligible for overtime pay. This means that if a salaried employee works 45 hours in a week, their employer must now either give them a substantial raise to meet the new threshold or pay them for those five extra hours at a time-and-a-half rate.

The New Salary Thresholds: How Much Do You Need to Earn?

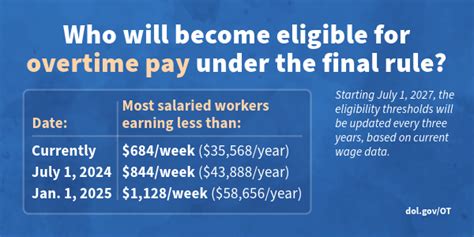

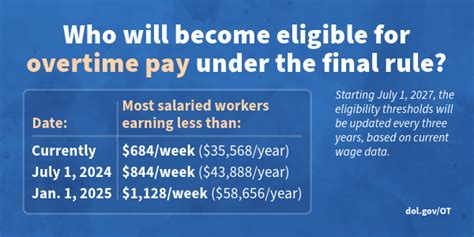

This is the most critical component of the new rule. The salary threshold, which has not been significantly updated in years, is increasing in two distinct phases. It's important to note that these are federally mandated minimums; some states may have even higher thresholds.

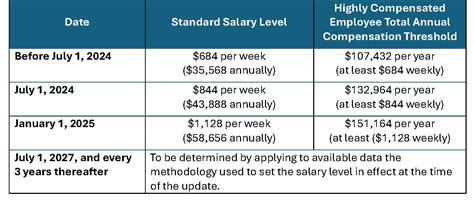

According to the U.S. Department of Labor's Final Rule, "Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees," the new thresholds are:

- Effective July 1, 2024: The salary threshold for EAP exemption will increase to $844 per week, which is equivalent to an annual salary of $43,888.

- Effective January 1, 2025: The threshold will increase again to $1,128 per week, which is equivalent to an annual salary of $58,656.

Additionally, the total annual compensation requirement for "highly compensated employees" (HCEs) will also increase:

- Effective July 1, 2024: The HCE threshold rises to $132,964 per year.

- Effective January 1, 2025: The HCE threshold rises to $151,164 per year.

Finally, the rule establishes a mechanism for these thresholds to be automatically updated every three years to reflect current wage data, ensuring they do not become outdated again.

Key Factors and Impacts of the New Rule

This regulation will not affect all professionals equally. Its impact will vary significantly based on your current salary, industry, location, and employer's response.

### Impact on Your Pay and Work Life

If your current salary is below the new thresholds, your employer has two primary options:

1. Increase Your Salary: They can raise your salary to meet or exceed the new threshold (e.g., to at least $58,656 by January 1, 2025) to maintain your exempt status. This often preserves flexibility but may come with higher performance expectations.

2. Reclassify You as Non-Exempt: They can keep your salary the same (or change you to an hourly rate) and reclassify you as non-exempt. In this scenario, you will be legally entitled to overtime pay for any hours worked beyond 40 per week. While this provides direct compensation for extra work, it will also mean you must meticulously track your hours.

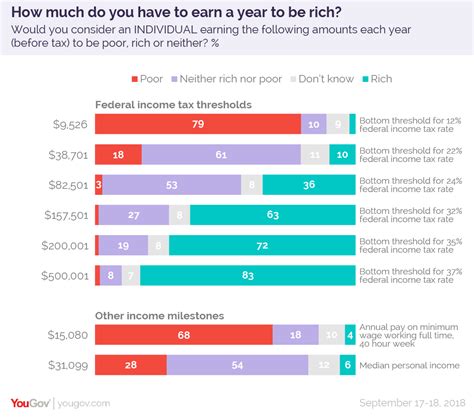

### Impact Based on Geographic Location

The rule's effect will be most pronounced in regions with a lower cost of living and correspondingly lower average salaries. For example, a role like an Assistant Store Manager in a rural area of the Midwest or South is more likely to fall below the new $58,656 threshold than the same role in a major metropolitan area like New York City or San Francisco. Data from Payscale shows that the median salary for an Assistant Store Manager in the U.S. is around $51,000, placing many of these professionals directly in the category to be affected by this new rule.

### Impact Based on Company Type and Industry

Industries with traditionally lower pay scales for managerial or professional roles will be heavily impacted. These include:

- Retail and Hospitality: Roles like store managers, restaurant managers, and department supervisors often have salaries in the $45,000 to $60,000 range.

- Non-Profits: Program coordinators and junior development officers frequently earn salaries that will fall below the new threshold.

- Startups: Early-stage companies that rely on "sweat equity" and lower base salaries for professional staff will need to adjust their compensation strategies significantly.

### Impact Based on Experience Level

This rule primarily benefits early-career and junior-level professionals. Entry-level salaried roles like "Management Trainee," "Junior Accountant," or "HR Coordinator" often start in the $40,000 to $55,000 range. According to Salary.com, the average salary for an HR Coordinator in the U.S. is approximately $55,500, meaning many in this role will now become eligible for overtime pay unless they receive a raise. Senior-level professionals earning well above the $60,000 mark are unlikely to be directly affected.

Potential Effects on the Job Market and Career Paths

The long-term impact on the job market is expected to be significant. The U.S. Bureau of Labor Statistics (BLS) projects steady growth in many professional and management occupations, and this rule will reshape the compensation structure within those fields.

Potential effects include:

- Salary Compression: Employers may raise the salaries of their lowest-paid exempt workers to meet the threshold, shrinking the pay gap between junior and mid-level employees.

- Rethinking Workloads: Companies may become stricter about employees working more than 40 hours to avoid paying overtime. This could lead to better work-life balance for some, but also potentially more rigid schedules and less flexibility.

- Increased Value on Efficiency: With overtime now a direct cost for more employees, companies will place a higher premium on productivity and efficiency within a 40-hour workweek.

Conclusion: Navigating the New Salary Landscape

The 2024 DOL overtime rule is more than a legal update; it's a fundamental shift in the American workplace that empowers millions of salaried workers. For professionals whose earnings fall near the new thresholds, this is a moment of significant opportunity.

Key Takeaways:

- Know Your Number: Understand the new salary thresholds: $43,888 by July 1, 2024, and $58,656 by January 1, 2025.

- Understand Your Classification: Determine if you are currently classified as exempt or non-exempt and whether your salary falls below the new minimums.

- Prepare for a Conversation: If you are affected, be prepared to discuss the changes with your employer. Understand their plan to either raise your salary or reclassify you and pay overtime.

- Leverage This for Growth: Whether you receive a raise or become eligible for overtime, this change provides a new baseline for your earning potential and a powerful tool for ensuring you are paid fairly for every hour you work.