A career as a mortgage loan underwriter offers a unique blend of financial analysis, risk assessment, and decision-making that is central to the real estate market. For those with a keen eye for detail and a knack for numbers, it's a stable and rewarding profession. But what is the earning potential? A skilled mortgage underwriter can expect to earn a competitive salary, typically ranging from $60,000 to over $100,000 annually, depending on a variety of critical factors.

This guide will provide a detailed breakdown of a mortgage loan underwriter's salary, the factors that influence it, and the overall career outlook to help you determine if this is the right path for you.

What Does a Mortgage Loan Underwriter Do?

Before diving into the numbers, it’s important to understand the role. A mortgage loan underwriter is the financial detective of the lending industry. They are the individuals who conduct a thorough risk analysis of a loan application and make the final decision: approve, deny, or approve with conditions.

Their core responsibilities include:

- Assessing the "Three C's": Evaluating a borrower's Credit (credit history and score), Capacity (ability to repay the loan, i.e., debt-to-income ratio), and Collateral (the value of the property being purchased).

- Verifying Documentation: Scrutinizing financial documents like pay stubs, W-2s, tax returns, and bank statements.

- Ensuring Compliance: Confirming that the loan file meets all internal company policies and external government regulations (like those from Fannie Mae, Freddie Mac, FHA, or VA).

- Making the Final Loan Decision: Using their analytical judgment to approve or deny the loan, safeguarding the lender from risky investments.

Average Mortgage Loan Underwriter Salary

While salary figures can fluctuate, data from several authoritative sources provides a clear picture of the earning potential for a mortgage loan underwriter in the United States.

According to Salary.com, the median annual salary for a Mortgage Underwriter I (entry-level) is $66,352 as of May 2024, with a typical range falling between $59,286 and $74,792. For a more experienced Mortgage Underwriter III (senior-level), the median salary jumps to $91,257, with a range typically between $80,523 and $103,131.

Data from other reputable sources corroborates this, painting a comprehensive picture:

- Payscale reports an average salary of $73,200 per year, with earnings often including significant bonuses that can add several thousand dollars to the total compensation.

- Glassdoor lists a total pay average of $84,204 per year for mortgage underwriters, factoring in both base salary and additional compensation like cash bonuses and commission sharing.

- The U.S. Bureau of Labor Statistics (BLS) groups underwriters into the broader category of "Loan Officers." For this group, the median pay was $71,150 per year as of May 2023. While this category is wider, it provides a strong government-backed benchmark for the profession.

This data shows a clear path for salary growth, with entry-level professionals starting in the $60k range and senior specialists commanding salaries well over $100,000.

Key Factors That Influence Salary

Your specific salary as a mortgage underwriter is not a single number but a reflection of your unique qualifications and circumstances. Here are the key factors that have the biggest impact on your earnings.

### Level of Education

While a bachelor’s degree is not always a strict requirement, it is highly preferred by most employers and can lead to a higher starting salary. Degrees in Finance, Business, Accounting, or Economics are particularly valuable. More importantly, professional certifications demonstrate a commitment to the craft and can significantly boost earning potential. Prestigious certifications, such as those offered by the National Association of Mortgage Underwriters (NAMU®)—like the Certified Master Mortgage Underwriter (CMMU)—signal a high level of expertise and can open doors to more senior, higher-paying roles.

### Years of Experience

Experience is arguably the most significant factor in determining an underwriter's salary. Lenders pay a premium for underwriters with a proven track record of making sound, compliant decisions. The career path typically follows these stages:

- Entry-Level (0-2 Years): Often starting as a Loan Processor or Junior Underwriter, individuals in this phase learn the fundamentals. Salaries typically range from $55,000 to $65,000.

- Mid-Career (3-8 Years): A fully proficient underwriter with the authority to approve a wide range of conventional loans. Salaries move into the $70,000 to $85,000 range.

- Senior/Lead Underwriter (8+ Years): These experts handle the most complex files (e.g., jumbo loans, self-employed borrowers) and often take on leadership roles, mentoring junior staff or managing an underwriting team. Their salaries frequently exceed $90,000 and can reach $115,000 or more, especially with management responsibilities.

### Geographic Location

Where you work matters. Salaries are typically higher in major metropolitan areas and financial hubs where the cost of living is greater and the demand for housing is high. For example, underwriters in cities like San Francisco, New York City, and Boston can expect to earn significantly more than those in smaller, more rural markets. According to Salary.com, a mortgage underwriter in San Francisco, CA earns roughly 25% more than the national average, while one in an area like Springfield, MO may earn below the average.

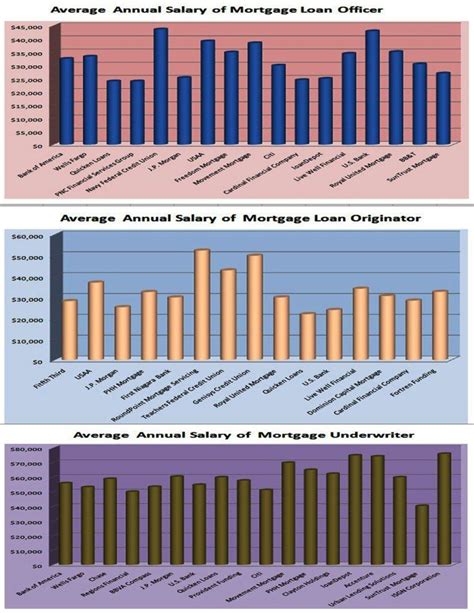

### Company Type

The type of institution you work for also plays a role in your compensation structure.

- Large National Banks (e.g., Bank of America, JPMorgan Chase): These institutions typically offer competitive base salaries, structured career paths, and comprehensive benefits packages.

- Credit Unions: While their base salaries may sometimes be slightly lower than large banks, credit unions are known for excellent benefits, a strong focus on work-life balance, and member-centric cultures.

- Independent Mortgage Lenders (e.g., Rocket Mortgage, loanDepot): These companies often have a more performance-driven compensation model. While the base salary may be in line with the industry average, there is often a higher potential for bonuses tied to the volume and quality of loans underwritten.

### Area of Specialization

Not all underwriting is the same. Developing expertise in a specific niche can make you a more valuable asset and increase your salary. Key specializations include:

- Government-Backed Loans: Underwriters with deep knowledge of FHA, VA, and USDA loan guidelines are always in demand due to the complexity and specific compliance requirements.

- Jumbo Loans: These are large loans that exceed the limits set by Fannie Mae and Freddie Mac. They involve high-net-worth borrowers and complex financial profiles, requiring a high level of analytical skill.

- Non-Qualified Mortgages (Non-QM): This niche involves underwriting loans for borrowers who don't meet traditional lending criteria, such as gig-economy workers or real estate investors. It requires creative problem-solving and a deep understanding of risk.

Job Outlook

The career outlook for underwriters is evolving with technology. The U.S. Bureau of Labor Statistics (BLS) projects a 2% decline in employment for the "Loan Officers" category from 2022 to 2032. This is largely attributed to the automation of simpler, more straightforward loan files through software and AI.

However, this data does not tell the whole story. While technology can handle routine tasks, the need for skilled, experienced human underwriters to assess complex applications, navigate gray areas, and ensure regulatory compliance remains as strong as ever. The most successful underwriters will be those who embrace technology as a tool to enhance their efficiency while focusing on the high-level critical thinking and judgment that a machine cannot replicate. Opportunities will continue to be steady due to professionals retiring or moving to other roles.

Conclusion

A career as a mortgage loan underwriter is an excellent choice for analytical, detail-oriented individuals seeking a professional path with substantial growth potential.

Key Takeaways:

- Solid Earning Potential: With an average salary in the $70,000 to $80,000 range and top earners exceeding $100,000, the profession is financially rewarding.

- Experience is King: Your salary will grow significantly as you gain experience and prove your ability to assess risk effectively.

- Growth Levers: You can actively increase your salary through certifications, specializing in high-demand areas like government or jumbo loans, and targeting roles in high-paying geographic locations.

- Future-Proof Your Career: While automation is changing the field, the need for human expertise in complex and high-stakes loan decisions ensures a stable future for skilled professionals.

For anyone considering this career, the path is clear: build a strong analytical foundation, commit to continuous learning, and you can forge a successful and lucrative career as a gatekeeper of the American dream.