In the sprawling, high-stakes metropolis of New York City, few professions capture the imagination quite like a real estate broker. It's a career synonymous with ambition, million-dollar deals, and the thrilling pulse of the world's most dynamic property market. For many, the question isn't just about the lifestyle; it's about the bottom line: *What is a realistic New York real estate broker salary?* The answer is as complex and layered as the city itself, a figure not defined by a simple annual number but by a potent mix of skill, hustle, network, and specialization.

The allure is undeniable. The median sale price for a Manhattan apartment frequently hovers around $1.2 million, and in the luxury sector, figures soar into the tens of millions. The commissions tied to these transactions suggest a path to significant wealth. While top-tier brokers can indeed earn seven-figure incomes, the journey to that level is a marathon of relentless effort and strategic career-building. The average New York real estate broker earns a highly competitive income, with salary aggregators like Salary.com reporting a median of around $105,801 as of late 2023, but with a typical range that can stretch from $85,000 to over $140,000 and beyond. However, this is a commission-based role, meaning your income is a direct reflection of your success.

I once mentored a young agent who was struggling after her first year, feeling overwhelmed by the competition. We reframed her approach, focusing not on "making sales" but on becoming a hyper-specialized neighborhood expert for a small, five-block radius in the West Village. Within two years, she became the go-to broker for that niche, her income tripled, and more importantly, she found deep satisfaction in her expertise. Her story is a testament to the fact that in New York real estate, success—and salary—isn't about covering the most ground, but about owning your ground.

This guide is designed to be your definitive resource, cutting through the glamour to provide a data-driven, comprehensive analysis of what it truly takes to earn a top-tier living as a New York real estate broker. We will dissect every factor that influences your paycheck, from your specialization and brokerage choice to the very street you choose to work on.

### Table of Contents

- [What Does a New York Real Estate Broker Do?](#what-does-a-new-york-real-estate-broker-do)

- [Average New York Real Estate Broker Salary: A Deep Dive](#average-new-york-real-estate-broker-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a New York Real Estate Broker Do?

Before we dive into the numbers, it's crucial to understand the distinction between a real estate *agent* (or salesperson) and a real estate *broker*. In New York, an agent must work under the supervision of a licensed broker. A broker, having met higher experience and education requirements, can work independently, open their own firm, and employ other agents. While their day-to-day tasks can be similar, the broker carries ultimate legal responsibility for the transactions handled by their firm. For the purpose of this guide, "broker" will refer to an experienced professional actively transacting in the market, whether independently or as an associate broker within a larger firm.

A New York real estate broker is far more than a salesperson; they are a project manager, a market analyst, a fierce negotiator, a legal guide, and often, a part-time therapist for clients navigating one of life's most stressful decisions. Their core responsibility is to act as a fiduciary—a person legally and ethically bound to act in their client's best interest.

Core Responsibilities and Daily Tasks:

- Client Representation: Sourcing and representing either buyers or sellers (and sometimes landlords or renters). This involves initial consultations to understand their needs, financial position, and goals.

- Market Analysis: Performing a Comparative Market Analysis (CMA) to accurately price a seller's property or to advise a buyer on a fair offer. This requires an encyclopedic knowledge of recent sales, current inventory, and neighborhood trends.

- Marketing and Prospecting: For sellers, this involves creating a comprehensive marketing plan: professional photography, virtual tours, compelling property descriptions, online listings (on platforms like StreetEasy, Zillow, and the MLS via REBNY's RLS), email campaigns, and networking with other brokers.

- Property Showings: Coordinating and conducting property viewings, open houses, and private tours. This requires impeccable time management and the ability to highlight a property's best features.

- Negotiation: Acting as the intermediary to negotiate price, terms, contingencies (like financing and inspections), and closing dates. This is where a top broker truly earns their commission.

- Transaction Management: Once an offer is accepted, the broker manages the entire process. This includes liaising with real estate attorneys, mortgage brokers, managing agents (for co-ops and condos), and title companies to ensure a smooth path to closing. For notoriously complex NYC co-op deals, this includes helping the buyer prepare an exhaustive board package.

- Lead Generation and Networking: The lifeblood of the business. Successful brokers spend a significant portion of their time cultivating their Sphere of Influence (SOI), attending industry events, building relationships with other professionals, and leveraging digital marketing to attract new clients.

### A Day in the Life of a Manhattan Broker

To make this tangible, let's follow a day in the life of "Isabella," a successful associate broker at a major Manhattan firm specializing in downtown luxury condos.

- 7:30 AM: Isabella starts her day not in the office, but at her laptop at home. She reviews overnight market activity, new listings in her target neighborhoods (SoHo, Tribeca), and checks for updates on her active deals. She flags a newly listed two-bedroom loft that's perfect for a buyer client.

- 8:30 AM: She sends a personalized market update email to her "A-list" clients, highlighting the new loft and another recent price reduction. This positions her as a proactive expert.

- 9:00 AM: Arrives at the office. She spends an hour making calls: first to her buyer about the loft, scheduling a showing for that afternoon. Then, she follows up with the attorney on a deal nearing its closing date and checks in with a seller to provide feedback from yesterday's showings.

- 11:00 AM: Meets a new seller client at their Flatiron apartment for a listing presentation. She comes prepared with a stunningly detailed CMA, a proposed marketing strategy, and a clear explanation of her commission structure and value proposition.

- 1:00 PM: Grabs a quick lunch while preparing for her afternoon showings. She reviews the details of three different properties she'll be showing to her buyer client.

- 2:00 PM - 4:00 PM: Isabella meets her buyer and they tour the three properties. She doesn't just open doors; she points out the quality of the building's financials, discusses the pros and cons of the layout, and provides context on recent sales in each building. The new loft is a huge hit.

- 4:30 PM: Back at the office, she debriefs with her buyer. They decide to make an offer on the loft. Isabella immediately calls the listing broker to build rapport and gather intelligence before drafting the formal offer.

- 5:30 PM: Isabella spends an hour working on the co-op board package for another client. It's a meticulous, detail-oriented task that can make or break a deal.

- 7:00 PM: She attends a networking event hosted by a mortgage bank. This isn't just a social hour; it's a strategic opportunity to strengthen relationships with industry partners who can provide referrals and support her clients.

- 9:00 PM: Finally home, she does one last check of her emails and drafts a to-do list for tomorrow before shutting down.

This snapshot reveals the reality: a career as a New York real estate broker is an entrepreneurial pursuit demanding long hours, diverse skills, and an "always-on" mentality. The financial rewards are a direct result of this disciplined, client-focused effort.

Average New York Real Estate Broker Salary: A Deep Dive

The term "salary" is somewhat of a misnomer in the world of real estate. The vast majority of real estate brokers are independent contractors who earn income through commissions. Their earnings are not a fixed annual figure but Gross Commission Income (GCI)—the total amount of commission they generate before deducting business expenses and brokerage splits.

A small fraction of brokers, typically those in management roles (like a Managing Broker or Office Manager), may receive a base salary plus bonuses, but the active, transacting broker's income is tied directly to performance.

When salary aggregators report an "average salary," they are typically calculating an earnings estimate based on data submitted by professionals in that role. This provides a useful benchmark, but it's essential to understand the underlying commission-based structure.

National vs. New York Averages

Nationally, the U.S. Bureau of Labor Statistics (BLS) groups real estate brokers and sales agents together. As of May 2022 (the most recent comprehensive data), the median annual wage for this group was $52,030. The top 10 percent earned more than $160,860. This national figure, however, is heavily skewed by lower-cost markets and part-time agents. It pales in comparison to the potential in a high-cost, high-volume market like New York City.

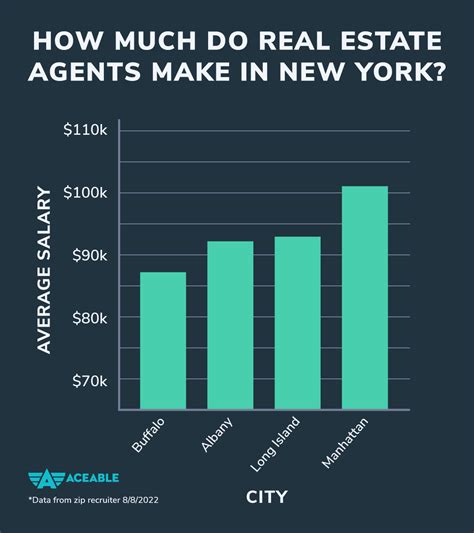

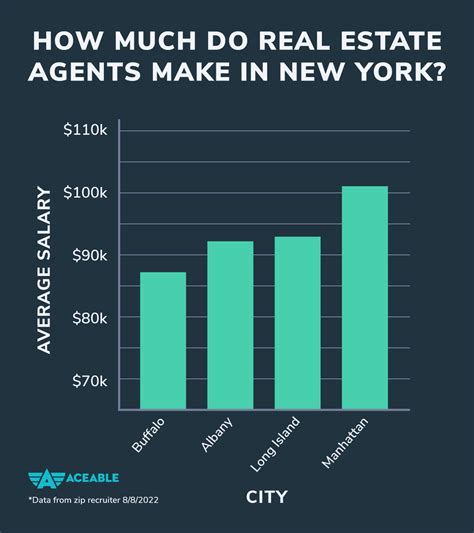

Here’s a look at more specific data for New York City:

- Salary.com (as of November 2023): Reports the median salary for a Real Estate Broker in New York, NY, as $105,801. The range typically falls between $85,739 and $141,811. Crucially, they note this does *not* include commission, which can significantly increase total earnings.

- Glassdoor (as of December 2023): Estimates the total pay for a Real Estate Broker in the New York City area to be $170,234 per year, with a median "likely range" of $111,000 to $263,000. This figure combines an estimated base salary with additional pay like commission and bonuses.

- Indeed (as of December 2023): Reports an average salary for a Real Estate Broker in New York, NY, as $111,189 per year.

The key takeaway is that an experienced, full-time broker in New York City can realistically expect to earn a six-figure income. The variance between $85,000 and $260,000+ highlights the immense impact of the factors we will explore next.

### Earnings by Experience Level

A broker's income follows a steep growth curve, directly correlated with their experience, network, and track record.

| Experience Level | Typical GCI Range (Pre-Split/Expenses) | Estimated Net Annual Earnings | Notes |

| :----------------------------------------------- | :------------------------------------- | :---------------------------- | :------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- |

| New Broker (0-3 Years) | $80,000 - $150,000 | $40,000 - $90,000 | Still building a client base. Likely on a less favorable commission split (e.g., 50/50). Heavily reliant on prospecting, open houses, and brokerage-provided leads. High business expenses relative to income. |

| Mid-Career Broker (4-9 Years) | $200,000 - $500,000 | $120,000 - $300,000 | Has a solid track record and a growing referral network. May have a better commission split (60/40 or 70/30). Able to handle more complex and higher-priced transactions. |

| Senior / Top Producer Broker (10+ Years) | $600,000 - $2,000,000+ | $350,000 - $1,200,000+ | Business is primarily referral-based. Commands a high level of trust and authority. Often specializes in the luxury market. May lead a team or have their own brokerage with the best splits. |

*Disclaimer: These are illustrative estimates. Actual earnings can vary significantly based on individual performance, market conditions, and business model.*

### Deconstructing Compensation: It's All About the Commission

Understanding how a commission is calculated and distributed is fundamental to understanding a broker's salary.

Let's use a hypothetical $1,500,000 condo sale in Brooklyn.

1. Total Commission: The typical commission in NYC is 5-6%, paid by the seller. Let's assume it's 6%, which equals $90,000.

2. The Co-Broke Split: This total commission is almost always split between the seller's broker and the buyer's broker. The standard split is 50/50.

- Seller's Brokerage gets: $45,000

- Buyer's Brokerage gets: $45,000

3. The Brokerage Split: Neither the seller's broker nor the buyer's broker gets to keep the full $45,000. They must split it with their sponsoring brokerage. This split varies dramatically.

- Scenario A (Newer Broker): A 50/50 split is common. The broker takes home $22,500 ($45,000 * 50%).

- Scenario B (Experienced Broker): A 70/30 split in their favor. The broker takes home $31,500 ($45,000 * 70%).

- Scenario C (Top Producer on a Cap): Some firms have a "cap" model. A broker might be on a 80/20 split until they've paid a certain amount (e.g., $40,000) to the brokerage that year. After that, they keep 100% of their commission.

4. The Final Tally: From that single $1.5M sale, our broker's take-home pay (before taxes and business expenses) could be anywhere from $22,500 to over $40,000.

Now, consider the expenses. A New York broker is running a small business. They are personally responsible for:

- Marketing Costs: Professional photography, floor plans, advertising, printing.

- REBNY & MLS Dues: Required for listing access.

- Licensing & Education Fees: Continuing education is mandatory.

- Technology: CRM software, personal website, social media tools.

- Insurance: Errors & Omissions (E&O) insurance, health insurance.

- Taxes: As independent contractors, they must pay self-employment tax (Social Security and Medicare) on top of federal, state, and city income taxes, and often make quarterly estimated payments.

This is why a broker who generates $200,000 in GCI doesn't take home $200,000. After brokerage splits and business expenses (which can easily account for 30-50% of GCI for a new broker), the net income is substantially lower.

Key Factors That Influence Salary

The vast income range for a New York real estate broker is a direct result of several powerful variables. Mastering these factors is the key to moving from an average earner to a top producer.

### ### Geographic Location: The Power of Place

In real estate, the mantra is "location, location, location," and this applies as much to a broker's income as it does to property value. A broker's earnings are inextricably linked to the median home prices of the areas they specialize in. A 3% commission in a neighborhood with a $500,000 average sale price yields $15,000, while the same percentage in a neighborhood averaging $3,000,000 yields $90,000.

A Tale of Five Boroughs (and Beyond):

- Manhattan: The epicenter of high-value real estate. Brokers specializing in luxury co-ops on the Upper East Side, sprawling lofts in SoHo and Tribeca, or new development penthouses in Hudson Yards operate at the highest price points. The barrier to entry is immense, requiring deep connections and a sophisticated understanding of a discerning clientele. Earning potential is virtually unlimited but competition is the fiercest on the planet.

- Brooklyn: No longer just a more affordable alternative, Brooklyn is a prime market in its own right. Neighborhoods like Brooklyn Heights, Park Slope, and Cobble Hill boast historic brownstones that command millions. Williamsburg and Bushwick attract a trendy, affluent crowd, while areas like Bedford-Stuyvesant and Crown Heights have seen explosive appreciation. A successful Brooklyn broker can earn a high six-figure income by mastering this diverse landscape.

- Queens: A borough of incredible diversity in both culture and housing stock. Long Island City's glass towers offer Manhattan-style living with stunning views. Forest Hills Gardens has stately Tudor homes, while Astoria and Sunnyside feature a mix of pre-war co-ops and multi-family homes. While the average price point is lower than Manhattan or prime Brooklyn, the volume of transactions and opportunities in investment properties can lead to a very successful career.

- The Bronx & Staten Island: These boroughs offer more accessible price points, providing opportunities for brokers to work with first-time homebuyers and local communities. While individual commission checks may be smaller, a high volume of deals can result in a solid income. The potential for growth in areas like the South Bronx is also a major draw for forward-thinking brokers.

- The Hamptons & Westchester: Many top NYC brokers also serve the lucrative second-home and suburban markets. The Hamptons, in particular, is a world of its own, with summer rentals commanding six-figure prices and estates selling for tens of millions. A broker who can bridge the city and these affluent suburbs has a massive competitive advantage.

### ### Area of Specialization: Your Niche is Your Strength

Generalists rarely reach the top of the New York market. Specialization allows a broker to develop profound expertise, build a targeted network, and become the go-to authority for a specific type of property or client.

Residential vs. Commercial: This is the most fundamental split.

- Residential Real Estate: Focuses on properties where people live (condos, co-ops, townhouses, single/multi-family homes). It's more emotionally driven, with shorter transaction cycles (typically 3-6 months).

- *Sub-Niches:*

- Luxury Resale: Working with properties over $5 million. Requires discretion, a global network, and an understanding of the UHNW (Ultra-High-Net-Worth) client.

- New Development: Working for a developer to sell units in a brand-new building. This can be highly lucrative but is more akin to a sales role within a large project.

- Co-op Specialist: Mastering the labyrinthine process of co-op board applications is a highly valuable skill in a city where co-ops make up a huge portion of the housing stock.

- Townhouse Expert: Understanding the unique structural, historical, and zoning issues of townhouses in neighborhoods like the West Village or Park Slope.

- Commercial Real Estate (CRE): Focuses on properties used for business purposes. Transactions are based on financial analysis and investment returns (cap rates, ROI, IRR). Deal cycles are much longer (6 months to over a year), but the commissions are substantially larger.

- *Sub-Niches:*

- Office Leasing: Representing either landlords trying to fill vacant space or tenants looking for a new office. Income is often generated over the life of the lease.

- Retail Brokerage: Working with storefronts, from major brands on Fifth Avenue to local cafes in Brooklyn. Requires an understanding of foot traffic, consumer trends, and zoning.

- Industrial Properties: Warehouses, logistics centers, and manufacturing spaces, a booming sector thanks to e-commerce.

- Multi-family Investment Sales: Brokering the sale of apartment buildings. This is a highly analytical field requiring deep knowledge of rent rolls, operating expenses, and real estate finance.

A top commercial broker in Manhattan can easily earn a seven-figure income, but the learning curve is steep and the required financial acumen is significant.

### ### Years of Experience & Reputation: The Compounding Power of Trust

In a commission-only career, there is no substitute for time and track record. Experience doesn't just mean you've seen more deals; it means you've built the two assets that drive a seven-figure income: a referral network and a powerful reputation.

- The Early Years (1-3): Income is a direct result of active, outbound prospecting. You are "hunting" for every deal. Your network is small, and your reputation is unproven. This is the period of highest attrition.

- The Growth Years (4-9): A shift begins. Past clients start referring friends and family. Other brokers recognize your name and are more eager to work with you. You have a portfolio of successful deals to showcase. Income becomes a mix of "hunting" and "farming" (nurturing existing relationships).

- The Veteran Years (10+): The business model inverts. The majority of your clients come to you through referrals and your established brand. You are a recognized expert in your niche. You have the leverage to negotiate more favorable commission splits or run your own successful team/brokerage. Your income is a reflection of a decade or more of cultivated trust.

### ### The Brokerage You Join: A Strategic Partnership

The choice of brokerage is one of the most critical decisions a broker makes. It's not just a place to hang your license; it's your business partner. The brand, resources, training, and commission structure will all directly impact your bottom line.

- National & International Powerhouses (e.g., Compass, Douglas Elliman, The Corcoran Group, Sotheby's International Realty):

- Pros: Instant brand recognition and credibility. Access to powerful marketing tools, technology platforms, extensive training programs, and a vast internal network of agents for referrals.

- Cons: Commission splits are often less favorable, especially for newer agents (can start at 50/50). There can be more bureaucracy and less flexibility.

- Boutique & Local Firms (e.g., Warburg Realty, many smaller neighborhood-focused shops):

- Pros: Often offer more competitive commission splits. A more intimate, collaborative culture. The ability to be a bigger fish in a smaller pond and build a personal brand more easily.

- Cons: Less brand recognition outside of their specific niche. Fewer built-in tools and marketing resources