As a professional working or hiring in New York, understanding your compensation structure is about more than just your market value—it's also about legal compliance. One of the most critical, and often misunderstood, components of this is the "exempt salary threshold." This figure dictates the minimum salary an employee must earn to be classified as exempt from overtime pay. For 2025, employers and employees across the state must prepare for updated figures that will impact budgets, job classifications, and take-home pay.

Navigating these regulations is essential for career planning and effective management. This guide breaks down what the New York State exempt salary threshold is, what the anticipated 2025 figures are, and how it affects you.

What is the NYS Exempt Salary Threshold?

In simple terms, the exempt salary threshold is a minimum weekly and annual salary set by the New York State Department of Labor (NYSDOL). To classify an employee as "exempt" from overtime, an employer must pay them at least this salary amount *and* the employee's primary job duties must fit into specific "exempt" categories (Executive, Administrative, or Professional).

- Exempt Employees: Are paid a fixed salary, regardless of the hours worked, and are not eligible for overtime pay (typically time-and-a-half) for working more than 40 hours a week.

- Non-Exempt Employees: Must be paid at least the minimum wage and are entitled to overtime pay for all hours worked over 40 in a workweek.

Failing to meet both the salary basis test (paying above the threshold) and the duties test (having qualifying job responsibilities) means the employee is, by law, non-exempt and must be paid for overtime.

New York State Exempt Salary Thresholds for 2025

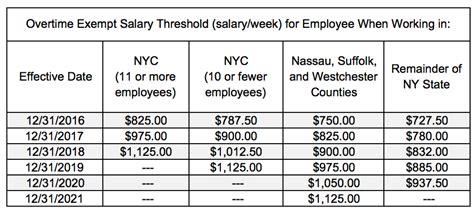

New York State has a tiered system for its salary threshold, with different rates for New York City and its surrounding suburban counties compared to the rest of the state. These rates have been increasing annually on a set schedule.

As of the latest guidance from the New York State Department of Labor, the thresholds are scheduled to continue increasing. While the final, officially published rates for 2025 are typically confirmed by the NYSDOL around October 1st of the preceding year, the planned increases provide a clear benchmark for what to expect.

Based on the established schedule, here are the minimum salary thresholds for 2024, which serve as the foundation for the upcoming 2025 increase:

| Geographic Area | 2024 Weekly Minimum | 2024 Annual Minimum | Expected 2025 Increase |

| :--- | :--- | :--- | :--- |

| NYC, Nassau, Suffolk, & Westchester Counties | $1,200.00 | $62,400.00 | An increase is scheduled for 1/1/2025. |

| Rest of New York State | $1,124.20 | $58,458.40 | An increase is scheduled for 1/1/2025. |

*Source:* *New York State Department of Labor, "Minimum Wage."*

Professionals and employers should budget for a continued increase in 2025 and 2026. It is crucial to monitor the official NYSDOL website for the final published rates in late 2024.

Key Factors and Implications of the Threshold

The exempt salary threshold isn't just a number; it's a critical factor that interacts with experience, location, and job function to determine an employee's legal pay status.

### Geographic Location

This is the most direct factor influencing the threshold. As shown above, New York State has a two-tiered system. The higher cost of living and prevailing wages in the downstate region (NYC, Long Island, and Westchester) necessitate a higher salary threshold.

- Impact: A manager earning $60,000 annually could be classified as exempt in an upstate county like Albany or Erie, but would be considered non-exempt (and eligible for overtime) if they held the same job in Brooklyn or Nassau County. Companies with offices in both regions must manage two different sets of payroll rules.

### Area of Specialization (The "Duties Test")

Salary is only half of the equation. To be exempt, an employee's primary duties must fall under one of the EAP (Executive, Administrative, or Professional) exemptions.

- Executive Exemption: Primary duty is managing the enterprise or a department. Must customarily direct the work of two or more other employees and have the authority to hire or fire. *Example: A retail store manager or a director of operations.*

- Administrative Exemption: Primary duty is performing office or non-manual work directly related to the management or general business operations. Must include the exercise of discretion and independent judgment. *Example: An HR Manager, a Senior Project Manager, or a Financial Analyst.*

- Professional Exemption: Primary duty is work requiring advanced knowledge in a field of science or learning (a "Learned Professional," like a doctor or lawyer) or work requiring invention, imagination, or talent (a "Creative Professional," like a graphic designer or writer).

### Years of Experience

Experience does not change the legal salary threshold, but it heavily influences whether an employee's salary will surpass it.

- Entry-Level: Professionals at the start of their careers, such as an "Associate Project Coordinator" or a "Junior Analyst," often have salaries near or below the threshold. Many of these roles in New York are correctly classified as non-exempt. As the threshold rises, more junior-to-mid-level roles may be reclassified from exempt to non-exempt.

- Senior-Level: Highly experienced professionals in roles like "Senior Director" or "Lead Engineer" will almost always have salaries well above the threshold. Their classification is more dependent on meeting the strict duties test for their role.

### Company Type

How a company responds to the rising threshold often depends on its size and financial health.

- Startups and Small Businesses: May face budgetary pressure. They might need to reclassify salaried employees to hourly, carefully track their hours to limit overtime, or find the budget to raise salaries above the new threshold to maintain an exempt status.

- Large Corporations: Typically have dedicated HR and legal teams to manage these changes. They are more likely to raise salaries for affected employees to keep them exempt, as this simplifies payroll and avoids the administrative burden of tracking hours for thousands of employees. According to Salary.com, larger companies often pay a premium over smaller ones, which helps them stay ahead of these regulatory changes.

Job Outlook and Its Connection to the Threshold

The job outlook for professional and management occupations remains strong. The U.S. Bureau of Labor Statistics (BLS) projects that management occupations will grow by 8% from 2022 to 2032, faster than the average for all occupations. This growth will create approximately 832,000 new jobs.

This positive outlook means that competition for skilled administrative, professional, and executive talent will remain high in New York. As the salary threshold rises, companies will be under pressure to offer competitive compensation not just to attract new talent, but also to comply with the law. This creates upward pressure on salaries for roles hovering near the threshold, which can be beneficial for employees.

Conclusion: Key Takeaways for 2025

The rising New York State exempt salary threshold is a critical piece of information for any professional in the state. As we look toward 2025, here are the essential takeaways:

1. Know the Numbers: Be aware of the two-tiered system and anticipate that the current 2024 thresholds of $62,400 (downstate) and $58,458.40 (upstate) will increase.

2. It’s Not Just About Salary: Remember that exemption depends on both meeting the salary threshold *and* satisfying the duties test for an executive, administrative, or professional role.

3. Location Matters: Your legal pay classification can change based on whether you work in Westchester County or an upstate county.

4. Stay Informed: Both employees and employers should monitor the NYS Department of Labor website in late 2024 for the officially published 2025 rates.

5. Be Proactive: Employees should understand their rights and classifications. Employers must audit their payroll, budget for potential salary increases or overtime costs, and communicate clearly with their teams.

By understanding these regulations, you can better navigate your career path, negotiate your salary with confidence, and ensure you are being compensated fairly and legally in the dynamic New York market.