Considering a career as a Notary Signing Agent (NSA)? You're likely drawn to the promise of flexibility, entrepreneurship, and a vital role in significant financial transactions. But what is the realistic earning potential? While a six-figure income is possible for top performers, the typical notary signing agent salary is a nuanced topic.

This in-depth guide will break down what you can expect to earn, the key factors that dictate your income, and the overall outlook for this dynamic profession. With potential earnings ranging from $45,000 to over $70,000 annually, and top agents earning even more, it's a career path worth exploring.

What Does a Notary Signing Agent Do?

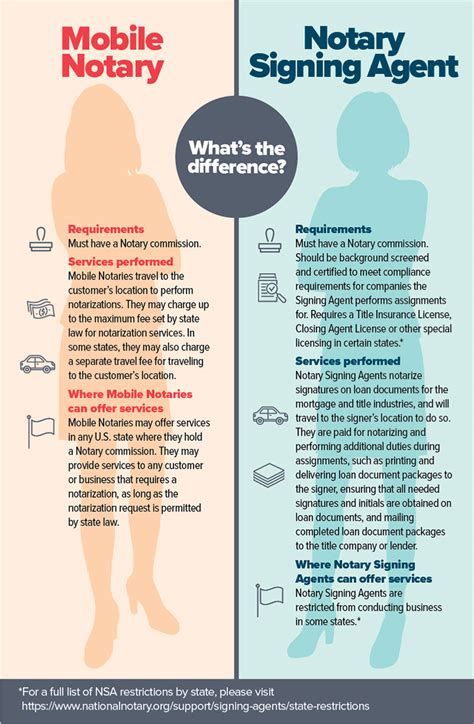

Before diving into the numbers, let's clarify the role. A Notary Signing Agent is a specially trained Notary Public who guides borrowers through the process of signing loan documents. In the final stage of a real estate or mortgage transaction, the NSA acts as the trusted, impartial third party.

Their core responsibilities include:

- Receiving and preparing loan document packages.

- Traveling to the signers' location (home, office, etc.).

- Verifying the identity of all parties involved.

- Ensuring all documents are signed, dated, and initialed correctly.

- Notarizing the required signatures.

- Returning the completed and error-free package to the title company or lender promptly.

They are the crucial last link in the chain, ensuring the integrity and legality of the closing process.

Average Notary Signing Agent Salary

Unlike traditional jobs, most Notary Signing Agents are independent contractors. This means their "salary" is actually business revenue, earned on a per-signing basis. The fee for a single loan signing appointment typically ranges from $75 to $200, depending on the complexity of the loan, the number of documents, and the distance traveled.

To understand this as an annual salary, consider these scenarios:

- Part-Time: Completing just five signings a week at an average of $125 per signing equates to $32,500 per year.

- Full-Time: Completing ten signings a week at the same rate equates to $65,000 per year.

For a more traditional salary benchmark, we can look at data from leading aggregators:

- Salary.com reports that the average salary for a Notary Signing Agent in the United States is $58,245 as of May 2024, with a typical range falling between $48,901 and $68,701.

- Glassdoor estimates the total pay for a Notary Signing Agent to be around $54,581 per year on average, combining a base salary and additional pay like tips and bonuses.

It's important to note the wide range in these figures. This is because an NSA's income is not fixed; it is directly influenced by several critical factors.

Key Factors That Influence Salary

Your earning potential as an NSA is not left to chance. It's shaped by your skills, strategy, and business environment. Here are the five most significant factors that will determine your income.

###

Level of Education and Certification

While a college degree is not required to become an NSA, your investment in specialized training is paramount. Simply being a Notary Public is not enough. Lenders and title companies require agents who have completed specific Notary Signing Agent training and certification programs, like those offered by the National Notary Association (NNA).

Holding an updated certification and passing an annual background check shows that you are a serious, knowledgeable professional. This builds trust, which leads to more—and higher-paying—signing opportunities. Continuous education on new laws and loan types further solidifies your reputation and earning power.

###

Years of Experience

Experience is a powerful driver of income.

- Entry-Level (0-2 Years): New agents focus on building relationships with signing services. They may need to accept lower fees initially to build a track record of reliability and accuracy.

- Mid-Career (2-5 Years): With a portfolio of successful signings, agents become more efficient and can command higher fees. They often begin receiving direct work from title companies, which typically pays more than assignments from signing services.

- Experienced (5+ Years): Seasoned NSAs have a robust network of direct clients. Their reputation for being error-free and dependable makes them the first choice for complex or high-value closings. They have the leverage to set their own fees and can earn a premium for their expertise.

###

Geographic Location

Where you work matters—a lot. Demand for NSAs is directly tied to the activity of local real estate markets.

- High-Demand Areas: Metropolitan areas with hot real estate markets (e.g., major cities in California, Texas, Florida, and New York) have a higher volume of transactions. This constant demand allows agents to complete more signings and charge higher fees, partly to offset a higher cost of living.

- Low-Demand Areas: In rural or less populated areas, there may be fewer signings available. However, a local agent may be able to charge more for travel and become the go-to professional in their region with less competition.

###

Company Type (Work Arrangement)

The way you structure your work has a profound impact on your salary and responsibilities.

- Independent Contractor (Most Common): As a freelancer, you have the highest earning potential. You set your own hours and fees. However, you are also a small business owner responsible for your own marketing, supplies (printer, paper, toner), insurance (Errors & Omissions), and self-employment taxes. Your income is a direct result of your hustle.

- Salaried Employee: Some larger title companies, law firms, or banks hire in-house NSAs. In this model, you receive a steady paycheck and benefits like health insurance and a 401(k). Your earning potential has a lower ceiling, but you gain stability and are not responsible for business overhead.

###

Area of Specialization

Not all loan signings are created equal. Specializing in more complex and less common types of signings can significantly boost your per-appointment fee.

- Standard Signings (Refinance, HELOC): These are the most common and form the foundation of an NSA's work.

- Purchase & Seller Packages: These closings involve more documents and are often more time-sensitive, commanding a higher fee.

- Reverse Mortgages: These are highly complex and require specialized knowledge. Agents who are proficient in handling reverse mortgages can charge premium rates, often $150 to $250 or more per signing.

Developing expertise in niche areas makes you a more valuable and in-demand professional.

Job Outlook

While the U.S. Bureau of Labor Statistics (BLS) does not track Notary Signing Agents as a distinct profession, the outlook for the role is intrinsically linked to the health of the real estate, mortgage, and financial industries.

As long as people are buying, selling, and refinancing homes, there will be a strong and consistent need for qualified NSAs to facilitate these transactions. Furthermore, the rise of Remote Online Notarization (RON) is not replacing the profession but evolving it. Agents who become certified to perform electronic closings can expand their services, work more efficiently, and cater to a tech-savvy client base, positioning themselves for future success.

Conclusion

A career as a Notary Signing Agent offers a unique blend of autonomy and financial opportunity. While aggregator sites suggest an average salary in the $50,000s to $60,000s, your true earning potential is in your hands.

Your income will be a direct reflection of your:

- Professionalism and Training: Invest in quality certification and continuous learning.

- Experience and Reputation: Build a track record of being accurate, reliable, and pleasant to work with.

- Business Acumen: Market yourself effectively, manage your finances, and seek out high-value work.

- Location and Specialization: Capitalize on your local market and develop expertise in complex signings.

For the diligent and entrepreneurial professional, a career as a Notary Signing Agent is not just a job—it's an opportunity to build a flexible and financially rewarding business.