Introduction

Have you ever wondered who the architects are behind a company's most valued perks? Who decides the salary bands, the bonus structures, and the policies—like paid time off for salaried employees—that directly shape workplace culture and employee well-being? These crucial functions are the domain of Compensation and Benefits professionals, the strategic, analytical, and empathetic experts who build the financial and wellness framework of an organization. This is a career path that moves beyond traditional HR to blend data science with human psychology, offering immense impact and significant financial rewards.

For those with a knack for numbers and a passion for people, a career in Compensation and Benefits (C&B) is both challenging and profoundly fulfilling. The professionals in this field are not just administrators; they are strategic partners to leadership, ensuring the company can attract, retain, and motivate top talent in a competitive market. The financial prospects are equally attractive, with seasoned specialists and managers often earning well into the six figures. According to data from Salary.com, the typical range for a Compensation and Benefits Manager in the United States falls between $116,926 and $145,567, with top earners exceeding $165,000.

I remember a time early in my career when I worked with a C&B team that was revamping a company's outdated vacation policy. By introducing a more flexible Paid Time Off (PTO) system and analyzing usage data to encourage employees to actually *take* their breaks, they tangibly reduced burnout and boosted morale across the entire organization. It was a powerful lesson in how a well-designed benefits policy, grounded in data and empathy, isn't just a line item—it's a cornerstone of a thriving company culture.

This comprehensive guide will illuminate the path to becoming a successful Compensation and Benefits professional. We will dissect the role's responsibilities, dive deep into salary data, explore the factors that drive compensation, and provide a clear roadmap for getting started. Whether you are a student, a transitioning professional, or an HR generalist looking to specialize, this article is your ultimate resource.

### Table of Contents

- [What Does a Compensation and Benefits Professional Do?](#what-does-a-compensation-and-benefits-professional-do)

- [Average Compensation and Benefits Salary: A Deep Dive](#average-compensation-and-benefits-salary-a-deep-dive)

- [Key Factors That Influence Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Get Started in This Career](#how-to-get-started-in-this-career)

- [Conclusion](#conclusion)

What Does a Compensation and Benefits Professional Do?

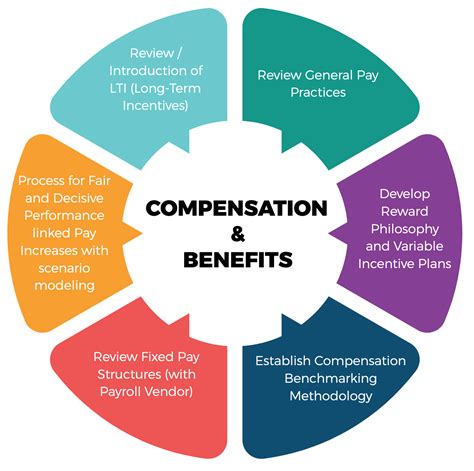

At its core, a Compensation and Benefits professional is responsible for designing, implementing, and managing an organization's entire rewards strategy. This field, often called "Total Rewards," encompasses everything a company offers its employees in exchange for their time and effort. It’s a delicate balance of attracting new talent, retaining existing stars, and maintaining the company’s financial health and legal compliance.

Their work is far more strategic than simple administration. They use market data, financial modeling, and internal analytics to answer critical business questions:

- Are our salaries competitive enough to attract engineers from top tech firms?

- Does our bonus structure actually motivate our sales team to hit their targets?

- How can we design a paid time off for salaried employees policy that promotes work-life balance without disrupting business operations?

- Are our benefits offerings, from health insurance to retirement plans, equitable and compliant with ever-changing laws like the Affordable Care Act (ACA) and the Employee Retirement Income Security Act (ERISA)?

Daily tasks and projects are highly analytical and varied. They include:

- Job Analysis and Evaluation: Systematically assessing roles to determine their relative value to the organization and creating clear job descriptions and leveling guides.

- Salary Benchmarking: Using survey data from vendors like Radford, Mercer, and Willis Towers Watson to compare the company’s pay practices against the market.

- Compensation Structure Design: Building salary ranges, pay grades, and merit increase matrices that are both fair and fiscally responsible.

- Incentive Plan Management: Designing and administering bonus, commission, and long-term incentive (e.g., stock options) plans.

- Benefits Administration: Managing relationships with vendors for health insurance, dental, vision, life insurance, disability, and retirement plans (401k, 403b). This includes annual open enrollment periods.

- PTO and Leave Policy Management: This is where the topic of paid time off for salaried employees comes into sharp focus. These professionals design, track, and analyze everything from traditional vacation and sick day policies to modern flexible or "unlimited" PTO, parental leave, and sabbaticals.

- Compliance and Reporting: Ensuring all compensation and benefits practices adhere to federal, state, and local laws (e.g., FLSA, Equal Pay Act).

- Communication: Clearly explaining complex total rewards concepts to managers and employees so they understand the full value of their compensation package.

### A Day in the Life: "Maria," a Compensation & Benefits Manager

To make this tangible, let's imagine a day for Maria, a C&B Manager at a mid-sized tech company.

- 9:00 AM - 10:00 AM: Maria starts her day reviewing a dashboard in the company's Human Resources Information System (HRIS). She’s analyzing a report on PTO usage for the last quarter, specifically looking at trends in paid time off for salaried employees. She notices that one department has a significantly lower usage rate, flagging it as a potential burnout risk. She makes a note to speak with that department's director later.

- 10:00 AM - 12:00 PM: Maria joins a video call with a senior finance director. They are modeling the financial impact of the upcoming annual salary merit cycle. Using advanced Excel skills, Maria presents three different scenarios based on market data, company performance, and budget constraints. They debate the merits of a 3.5% versus a 4% average increase.

- 12:00 PM - 1:00 PM: Lunch break.

- 1:00 PM - 2:30 PM: Maria leads a training session for newly promoted managers. The topic: "Having Effective Compensation Conversations." She walks them through the company's pay philosophy, how salary ranges are determined, and how to explain bonus calculations to their team members.

- 2:30 PM - 4:00 PM: She dives into a project to benchmark the company's parental leave policy. Competitors are starting to offer more generous packages. Maria researches what other firms in their industry and location are offering, pulls together cost estimates, and begins drafting a proposal for the Chief Human Resources Officer (CHRO) to expand their current policy.

- 4:00 PM - 5:00 PM: Maria spends the last hour of her day fielding ad-hoc requests. An HR business partner needs a salary range for a new, unique role. An employee has a complex question about their 401(k) vesting schedule. She resolves these queries, clears her inbox, and plans her priorities for tomorrow.

This example highlights the blend of skills required: deep analytics, strategic thinking, financial acumen, strong communication, and a genuine concern for the employee experience.

Average Compensation and Benefits Salary: A Deep Dive

The salary potential in the Compensation and Benefits field is a significant draw for many professionals. It is a specialized function within HR that commands higher-than-average pay due to the quantitative skills and strategic impact required. Compensation is data-driven, and so is the pay for the people who manage it.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for Compensation, Benefits, and Job Analysis Specialists was $74,530 in May 2023. The BLS notes that the lowest 10 percent earned less than $49,030, while the highest 10 percent earned more than $118,500. However, it's crucial to understand that this BLS category includes entry-level job analysts. For roles with more experience and managerial responsibility, the numbers are substantially higher.

More specialized salary aggregators provide a clearer picture of the entire career ladder. Data from Salary.com (as of late 2023/early 2024) reports the median salary for a Compensation & Benefits Manager in the U.S. is $130,577.

Let's break down the typical salary progression by experience level, pulling from a combination of authoritative sources like Payscale, Glassdoor, and Salary.com.

### Salary by Experience Level (National Averages)

| Experience Level | Typical Job Titles | Typical Salary Range | Key Responsibilities |

| :--- | :--- | :--- | :--- |

| Entry-Level (0-3 years) | Compensation Analyst, Benefits Coordinator, HR Analyst | $60,000 - $85,000 | Data entry, running reports, responding to basic employee queries, supporting surveys, assisting with open enrollment. |

| Mid-Career (3-8 years) | Senior Analyst, Compensation Specialist, Benefits Manager, C&B Manager | $85,000 - $135,000 | Managing projects, conducting complex analysis, designing smaller plans, managing vendor relationships, advising managers. |

| Senior-Level (8+ years) | Senior C&B Manager, Director of Compensation, Director of Total Rewards | $135,000 - $180,000+ | Setting strategy, managing a team, presenting to executives, designing enterprise-wide programs, managing large budgets. |

| Executive-Level (15+ years) | VP of Total Rewards, Chief Human Resources Officer (CHRO) | $180,000 - $300,000+ | Owning the entire people strategy, executive compensation, board-level interaction, long-term organizational design. |

*Sources: Salary data is a synthesized average based on 2023-2024 figures from the U.S. Bureau of Labor Statistics, Payscale.com, Salary.com, and Glassdoor.*

### A Closer Look at Compensation Components

The base salary is only one piece of the puzzle. A "Total Rewards" professional's own package is a testament to the tools of their trade.

- Base Salary: This is the fixed, predictable portion of pay and forms the largest component, especially at junior levels. It's determined by the factors we'll explore in the next section (experience, location, etc.).

- Annual Bonus / Short-Term Incentive (STI): This is a variable payment, typically tied to both individual and company performance over a one-year period.

- Analysts: Might receive a bonus of 5-10% of their base salary.

- Managers: Often have a target bonus of 10-20%.

- Directors and VPs: Can have target bonuses of 25-50% or more.

- Profit Sharing: Some companies, particularly in manufacturing or professional services, distribute a portion of their profits to employees. This is often contributed directly to retirement accounts.

- Long-Term Incentives (LTI): Especially common in publicly traded companies or high-growth startups, LTIs are designed to retain key talent and align their interests with long-term company success.

- Restricted Stock Units (RSUs): A grant of company stock that vests (becomes fully owned by the employee) over a period, typically 3-4 years.

- Stock Options: The right to buy company stock at a predetermined price in the future. Their value depends on the stock price increasing.

- LTI is typically reserved for senior-level roles (Manager and above), but some tech companies offer it to nearly all employees.

- Benefits: C&B professionals enjoy the very benefits they help design. This includes high-quality health, dental, and vision insurance; generous 401(k) matching contributions; and, of course, well-structured paid time off for salaried employees, parental leave, and other wellness perks. The value of a robust benefits package can easily add another 20-30% on top of base salary.

Understanding this complete picture is essential. A $120,000 base salary offer with a 20% bonus target and an annual RSU grant of $30,000 is far more lucrative than a flat $140,000 salary with no variable pay.

Key Factors That Influence Salary

While national averages provide a useful benchmark, your individual earning potential as a Compensation and Benefits professional is determined by a combination of critical factors. Mastering these levers is the key to maximizing your career-long compensation. This is the most detailed and important section for understanding your true market value.

### ### Level of Education

Education forms the foundation of your career and directly impacts your starting salary and long-term trajectory.

- Bachelor's Degree: This is the standard entry requirement. Degrees in Human Resources, Business Administration, Finance, Economics, or Statistics are most common and highly valued. A graduate with a quantitative-heavy degree (like Finance or Statistics) may command a slightly higher starting salary as an Analyst, as the role is heavily data-dependent.

- Master's Degree: An advanced degree can significantly accelerate your career.

- Master's in Human Resources (MHRM) or Industrial-Organizational Psychology (MS): These programs provide specialized, deep knowledge of HR theory, labor law, and organizational behavior, making graduates strong candidates for leadership-track roles. This can lead to a 10-15% salary premium over a Bachelor's degree alone.

- Master of Business Administration (MBA): An MBA is particularly powerful for those aiming for Director, VP, or CHRO roles. It equips professionals with a broader business and strategic acumen, allowing them to connect C&B strategy directly to the company's P&L and corporate goals. An MBA from a top-tier school can easily command a 20-30% salary increase and open doors to the most lucrative C&B leadership positions.

- Professional Certifications: In the C&B world, certifications are not just resume-boosters; they are widely recognized credentials that validate specific expertise and can lead directly to higher pay. The most respected are:

- Certified Compensation Professional (CCP®): Offered by WorldatWork, this is the gold standard for compensation specialists. It demonstrates mastery of job analysis, base and variable pay design, and market pricing. Earning a CCP can result in a salary bump of 5-10% and is often a prerequisite for manager-level roles.

- Certified Benefits Professional (CBP®): Also from WorldatWork, this is the parallel certification for benefits experts, covering health and welfare plans, retirement plans, and benefits compliance.

- Certified Employee Benefit Specialist (CEBS®): A highly respected and rigorous designation focused exclusively on benefits, co-sponsored by the International Foundation of Employee Benefit Plans and the Wharton School of the University of Pennsylvania. It's particularly valued in large corporations with complex benefits needs.

- SHRM-CP or SHRM-SCP: While more generalist HR certifications, they are valuable for C&B professionals to demonstrate a broad understanding of the HR function.

### ### Years of Experience

Experience is arguably the single most significant driver of salary growth in this field. The progression is logical and tied to increasing levels of responsibility, strategic impact, and team leadership.

- Entry-Level (0-3 years) - Analyst/Coordinator: ($60,000 - $85,000). At this stage, you are learning the ropes. Your focus is on execution, data integrity, and supporting senior team members. Your value is in your accuracy, work ethic, and ability to learn quickly.

- Mid-Career (3-8 years) - Senior Analyst/Manager: ($85,000 - $135,000). You've moved from just running reports to interpreting them. You own significant processes like the annual merit cycle or open enrollment. You begin designing smaller plans, managing vendor relationships independently, and providing counsel to business leaders. This is where you might begin to manage one or two junior analysts. The leap from individual contributor to manager is often where the first six-figure salaries are achieved.

- Senior-Level (8+ years) - Senior Manager/Director: ($135,000 - $180,000+). You are no longer just managing processes; you are setting strategy. You manage a team of C&B professionals, control a significant budget, and are the primary advisor to senior leadership on all things Total Rewards. Your work involves long-range planning, such as redesigning the entire company's career-leveling framework or introducing new LTI plans. Payscale.com data shows that a Director of Compensation, for example, has a median salary of approximately $155,000.

- Executive-Level (15+ years) - VP/CHRO: ($180,000 - $300,000+). At this level, you are part of the executive leadership team. Your scope extends to executive compensation, which is a highly specialized and lucrative niche. You present to the Board of Directors' Compensation Committee and are responsible for the entire people strategy of the organization. Total compensation at this level is heavily weighted toward long-term incentives and can reach well into the high six figures.

### ### Geographic Location

Where you work has a massive impact on your paycheck. Salaries are adjusted for the local cost of labor and cost of living. Major metropolitan areas with high concentrations of large corporate headquarters, tech companies, and financial services firms pay a significant premium.

Here's a comparative look at median salaries for a Compensation and Benefits Manager in different U.S. cities, based on data from Salary.com (2024):

- High-Cost Metropolitan Areas:

- San Francisco, CA: ~$161,900

- New York, NY: ~$157,200

- Boston, MA: ~$147,700

- Washington, D.C.: ~$145,500

- Mid-Range Metropolitan Areas:

- Chicago, IL: ~$137,300

- Dallas, TX: ~$131,200

- Atlanta, GA: ~$127,700

- Lower-Cost Metropolitan Areas:

- Tampa, FL: ~$125,500

- St. Louis, MO: ~$124,500

This data clearly shows that a C&B professional in San Francisco could earn nearly $40,000 more per year than one in St. Louis for performing a similar role. The rise of remote work has complicated this slightly, with some companies adopting location-agnostic pay while others use geographic pay zones to adjust salaries for remote employees based on where they live.

### ### Company Type & Size

The type and size of your employer create different opportunities and compensation structures.

- Large Corporations (e.g., Fortune 500): These companies typically offer the highest base salaries and most structured compensation packages. They have large, specialized C&B teams and clear career paths. They also offer robust benefits, generous 401(k) matches, and often, LTI plans like RSUs. The work can be more bureaucratic but provides stability and deep specialization.

- Tech Companies / Startups: Compensation in the tech world, particularly at pre-IPO or high-growth startups, can be a mix.

- Base salaries may be slightly below large-corporation levels.

- However, the potential upside from stock options or RSUs can be enormous if the company is successful. This makes total compensation highly variable and risk-oriented. C&B professionals in this space need to be adept at designing equity plans.

- Non-Profits / Higher Education: These organizations are mission-driven, but this often comes with lower pay. Salaries can be 15-25% lower than in the for-profit sector. However, they often compensate with excellent benefits, such as very generous paid time off policies, tuition remission for employees and their families, and strong retirement contribution plans (like 403b plans).

- Government (Federal, State, Local): Government roles offer unparalleled job security and exceptional benefits, particularly pensions and healthcare. Pay is determined by rigid pay scales (like the GS scale for federal employees). While the base salary may not reach the peaks of the private sector, the total value proposition, including work-life balance and benefits, is very strong.

- Consulting Firms: Working for a compensation consulting firm (e.g., Mercer, Willis Towers Watson, Korn Ferry) is another path. These roles are client-facing, highly analytical, and project-based. The pay is very competitive, often rivaling large corporations, and the work provides exposure to a wide variety of industries. However, the work-life balance can be more demanding.

### ### Area of Specialization

Within the C&B field, certain specializations are more complex and command higher salaries.

- Executive Compensation: This is the most lucrative niche. These professionals design the complex pay packages (base, bonus, LTIs, perks, severance) for C-suite executives. It requires deep knowledge of finance, tax law, and SEC regulations. Directors of Executive Compensation can easily earn $200,000 - $250,000+.

- Sales Compensation: Designing incentive plans for sales teams is a highly specialized skill. A good plan can directly drive revenue, making these professionals incredibly valuable. It requires a blend of data modeling and understanding sales psychology.

- International Compensation & Benefits: For global companies, managing pay and benefits across different countries, currencies, laws, and cultural norms is a major challenge. Experts in global mobility and international C&B are in high demand.

- Compensation Analytics / Data Science: As HR becomes more data-driven, roles are emerging that focus purely on the quantitative side: statistical modeling of pay equity, predictive analytics for turnover based on compensation, and building complex dashboards. These roles require skills in SQL, Python, R, and data visualization tools like Tableau.

### ### In-Demand Skills

Beyond your formal credentials, specific skills will make you a more effective and higher-paid C&B professional.

- Advanced Data Analysis & Excel: This is non-negotiable. You must be an Excel power user, comfortable with VLOOKUP/XLOOKUP, pivot tables, and complex formulas. Building financial models to forecast the cost of a new benefits program or a merit cycle is a core competency.

- HRIS & Compensation Software Proficiency: Experience with major HR Information Systems (like Workday, SAP SuccessFactors, Oracle) and specialized compensation software (like Payscale or Salary.com's platforms) is essential.

- Financial Acumen: You need to speak the language of the CFO. Understanding concepts like P&L statements, budget forecasting, and stock dilution is critical for gaining credibility and making a strategic impact.

- Legal & Regulatory Compliance: A deep and up-to-date knowledge of laws like the Fair Labor Standards Act (FLSA), Equal Pay Act, ACA, ERISA, and new pay transparency legislation is mandatory to protect the company from risk.

- Communication & Influence: You can have the best data in the world, but it's useless if you can't explain it clearly and persuasively to different audiences—from a nervous employee asking about their paycheck to a skeptical executive reviewing your multi-million dollar budget proposal.

- Negotiation & Vendor Management: A significant part of the benefits role involves negotiating contracts and managing relationships with insurance brokers, retirement plan administrators, and data survey providers. Strong negotiation skills can save the company millions of dollars.

Job Outlook and Career Growth

For those considering a career in Compensation and Benefits, the future is bright. The demand for professionals who can strategically manage a company's largest expense—its people—is robust and growing.

The U.S. Bureau of Labor Statistics (BLS) projects that employment of Compensation, Benefits, and Job Analysis Specialists will grow 7 percent from 2022 to 2032, which is faster than the average for all occupations. The BLS anticipates about 9,500 openings for these specialists each year, on average, over the decade. This steady demand is driven by several key factors and emerging trends.

### Emerging Trends Shaping the Future

The world of work is in constant flux, and C&B professionals are at the epicenter of this transformation. Staying ahead of these trends is key to long-term career success.

1. The Rise of Pay Transparency: A wave of new state and local laws (in places like Colorado, New York City, and California) now require companies to disclose salary ranges in job postings. This is a monumental shift. C&B professionals are on the front lines, tasked with ensuring their organizations have internally equitable and externally competitive pay structures that can withstand public scrutiny. This requires more rigor, better data, and stronger communication than ever before.

2. The Analytics Revolution (HR Tech & AI): Gut-feel decisions are a thing of the past. Modern C&B is driven by data. The ability to use sophisticated HRIS platforms and data visualization tools (like Tableau or Power BI) to analyze pay equity, model compensation scenarios, and predict turnover is becoming a core competency. Professionals who embrace these technologies and build their data science skills will be the most sought-after. AI is beginning to help with tasks like writing job descriptions and benchmarking initial salary data, freeing up professionals to focus on higher-level strategy.

3. The Focus on Holistic Well-being: The pandemic accelerated a shift in employee expectations. Benefits are no longer just about health insurance and a 401(k). Companies are now competing on "holistic well-being," which includes mental health support (therapy apps, EAPs), financial wellness programs (student loan repayment, financial coaching), family-forming benefits (fertility treatments, adoption assistance), and flexible work arrangements. C&B experts are tasked with designing and managing these complex and diverse benefit ecosystems.

4. **Flexibility and Remote