Reaching the rank of Partner at Boston Consulting Group (BCG) is akin to summiting Mount Everest in the world of business. It represents the pinnacle of a demanding, intellectually rigorous, and profoundly influential career in management consulting. For those with the ambition, intellect, and resilience to embark on this journey, the rewards—both financial and professional—are extraordinary. The query "partner at bcg salary" opens the door to a world of seven-figure compensation packages, but the true value of the role extends far beyond the paycheck. It’s about shaping the future of global industries, advising C-suite executives of Fortune 500 companies, and building a legacy of impactful change.

The path is not for the faint of heart. It demands a rare blend of analytical prowess, strategic insight, client management artistry, and relentless drive. The average total compensation for a BCG Partner regularly ventures into the multi-million dollar range, a figure that reflects the immense value they are expected to create for their clients and the firm. In my years as a career analyst specializing in elite professional services, I once coached a senior manager on their final, grueling push to make Partner. The process was a crucible, testing not just their case-solving skills but their commercial instincts and leadership mettle. Seeing them succeed underscored for me that reaching this level is less a promotion and more a fundamental transformation into a titan of industry.

This guide will demystify the journey. We will dissect the role of a BCG Partner, provide a granular breakdown of their compensation structure, explore the factors that dictate their earnings, and lay out the demanding but decipherable path to getting there. Whether you are an undergraduate dreaming of a career in consulting or a seasoned professional considering your next big move, this article will serve as your comprehensive roadmap to understanding one of the most coveted positions in the corporate world.

### Table of Contents

- [What Does a Partner at BCG Do?](#what-does-a-partner-at-bcg-do)

- [Average Partner at BCG Salary: A Deep Dive](#average-partner-at-bcg-salary-a-deep-dive)

- [Key Factors That Influence a Partner's Salary](#key-factors-that-influence-salary)

- [Job Outlook and Career Growth](#job-outlook-and-career-growth)

- [How to Begin the Journey to Partner at BCG](#how-to-get-started-in-this-career)

- [Conclusion: Is the Climb Worth the View?](#conclusion)

What Does a Partner at BCG Do?

While a junior consultant at BCG is focused on analysis—building models, conducting research, and creating slide decks—a Partner operates on an entirely different plane. The role fundamentally pivots from *doing* the analytical work to *shaping and selling* the work, managing senior client relationships, and building the firm's future. A Partner is simultaneously a master strategist, a rainmaker, a C-suite confidant, and a firm leader.

Their responsibilities can be broken down into four core pillars:

1. Business Development & Sales: This is arguably the most critical function. Partners are responsible for generating revenue for the firm. They spend a significant portion of their time identifying potential client problems, building relationships with senior executives (CEOs, CFOs, COOs), and crafting compelling proposals for multi-million dollar consulting projects. They are the face of BCG to the market, and their ability to sell work directly impacts their own compensation and the firm's health.

2. Client Relationship Management & Project Oversight: Once a project is sold, the Partner serves as the ultimate point of accountability. While a Project Leader or Principal manages the day-to-day execution, the Partner manages the senior client relationship, ensuring the project delivers on its promises and aligns with the client's strategic objectives. They steer the project from a 30,000-foot view, providing critical insights, managing political sensitivities within the client organization, and ensuring the final recommendations are impactful and actionable.

3. Thought Leadership & Intellectual Property (IP) Creation: BCG built its reputation on groundbreaking business concepts like the "experience curve" and the "growth-share matrix." Partners are the modern-day custodians of this legacy. They are expected to be leading experts in their respective industries or functional practices (e.g., digital transformation, sustainability, private equity). This involves publishing articles in top-tier publications like Harvard Business Review, speaking at major industry conferences, and developing new frameworks and intellectual capital that enhance BCG's brand and competitive edge.

4. Firm Building: Partners are the owners of the firm, and with that comes the responsibility of stewardship. This includes mentoring and developing the next generation of consultants, leading internal committees (e.g., recruiting, training, diversity and inclusion), defining the strategic direction of their local office or practice area, and embodying the firm's values.

### A Day in the Life of a BCG Partner

To make this concrete, here is a fictional but highly realistic glimpse into a Partner's day:

- 7:00 AM - 8:30 AM: Early morning video conference with the CEO of a key client in Europe to discuss progress on a major corporate restructuring project. The Partner provides high-level assurance and addresses a sensitive concern raised by a board member.

- 8:30 AM - 9:00 AM: Quick check-in call with the Project Leader running the aforementioned restructuring. They align on the key messages for the upcoming steering committee meeting and troubleshoot a data-gathering challenge.

- 9:30 AM - 11:00 AM: Internal review of a final proposal for a new digital transformation project for a potential client in the consumer goods sector. The Partner pushes the team to sharpen the value proposition and fine-tune the pricing model.

- 11:30 AM - 1:00 PM: "Prospecting lunch" with a Managing Director at a major private equity firm. The conversation is entirely relationship-focused, exploring market trends and potential areas where BCG could help their portfolio companies. No slides, no formal pitch—just building trust.

- 1:30 PM - 3:00 PM: Lead a brainstorming session for a thought leadership article on the implications of generative AI for the healthcare industry. The Partner contributes the core framework and assigns research tasks to a team of consultants.

- 3:00 PM - 4:30 PM: Back-to-back mentoring sessions with a high-potential Principal being groomed for the Partner track and a new Consultant just starting at the firm.

- 5:00 PM - 6:30 PM: Fly from New York to Chicago for a critical client workshop the next day. They use the flight time to review the pre-read materials and draft an email to the client CEO to set the stage for the meeting.

- 7:30 PM - 9:00 PM: Team dinner in Chicago with the project team on the ground. This is a crucial time for building morale, understanding team dynamics, and providing informal guidance and coaching.

This schedule highlights the intense multitasking, strategic thinking, and people-centric nature of the role. It is less about spreadsheets and more about strategy, sales, and stewardship.

Average Partner at BCG Salary: A Deep Dive

Discussions about Partner compensation at elite firms like BCG are often shrouded in secrecy. These are private partnerships, not public companies, so they have no obligation to disclose executive pay. The figures presented here are therefore compiled from highly reputable industry sources, including reports from consulting-focused platforms like Management Consulted and Wall Street Oasis, as well as anonymized, self-reported data from salary aggregators like Glassdoor and Levels.fyi. It's crucial to understand that these are expert estimates and can vary significantly based on the factors we'll discuss in the next section.

The key takeaway is that total compensation for a BCG Partner is composed of several layers, and the base salary is only the starting point. The real wealth generation comes from performance bonuses and, most importantly, profit sharing.

A newly elected Partner (often called a Junior Partner) at BCG in a major market like the United States can expect their total compensation to start around $1,000,000. More senior Partners can easily earn $3,000,000 to $5,000,000+ per year.

Let's break down the typical components:

### Compensation Components for a BCG Partner

1. Base Salary: This is the fixed, guaranteed portion of the salary. For a Partner, this component is substantial but represents a smaller percentage of their total take-home pay compared to more junior roles.

- Typical Range: $450,000 to $650,000 per year.

- *Source:* This range is a synthesis of data from Management Consulted's 2023-2024 reports and senior-level data points on Glassdoor for "Managing Director & Partner" roles.

2. Performance Bonus: This is a variable cash bonus tied to performance. The evaluation is holistic and is based on a combination of factors:

- Individual Performance: Primarily measured by the amount of business sold (revenue generation).

- Project Success: Client satisfaction scores and the measured impact of their projects.

- Firm Contribution: Leadership in thought leadership, mentoring, recruiting, and other internal initiatives.

- Typical Range: Can range from 50% to over 100% of the base salary. A strong performing Partner might receive a bonus of $300,000 to $700,000+.

3. Profit Sharing / Equity Distribution: This is the most significant and differentiating component of Partner compensation. As owners of the firm, Partners receive a share of BCG's global profits. This share is allocated based on a Partner's seniority and sustained contribution to the firm over many years. This is what separates Partner earnings from even the most senior corporate executive roles.

- Typical Range: This can add another $500,000 to several million dollars to a Partner's annual compensation. For a new Partner, it might be in the low-to-mid six figures, but for a Senior Partner who has been with the firm for over a decade, this component alone can be well over $2,000,000.

4. Retirement & Other Benefits: BCG offers extremely generous retirement packages, often seen as a form of deferred compensation. This typically includes a significant 401(k) match and a separate, firm-funded profit-sharing retirement plan.

- Typical Value: It's not uncommon for the firm's annual retirement contribution to exceed $100,000, building a multi-million dollar nest egg for the Partner over their tenure.

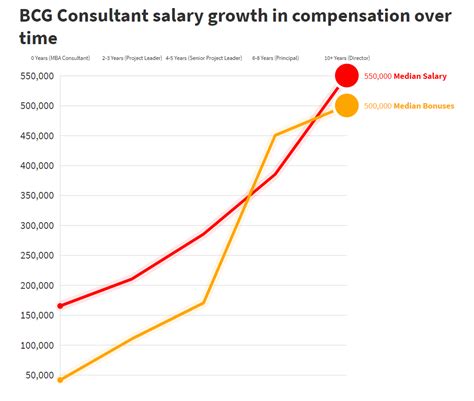

### Salary Progression by Experience Level (Illustrative)

To visualize the growth, let's look at illustrative compensation brackets for different stages of a Partner's career at BCG in the US.

| Partner Level | Years as Partner | Typical Base Salary | Typical Bonus + Profit Sharing | Estimated Total Compensation |

| :--- | :--- | :--- | :--- | :--- |

| Junior Partner | 1-3 | $450k - $550k | $400k - $700k | $850,000 - $1,250,000 |

| Mid-Tenure Partner| 4-8 | $550k - $600k | $700k - $1,500,000 | $1,250,000 - $2,100,000 |

| Senior Partner / Managing Director | 8+ | $600k - $750k+ | $1,500,000 - $4,000,000+ | $2,100,000 - $5,000,000+|

*Disclaimer: These are synthesized estimates based on industry reports and should be considered illustrative. Actual compensation can vary widely.*

As the table shows, the initial jump to Partner is financially significant, but the real wealth creation occurs over the following decade as a Partner's influence, client portfolio, and, consequently, their share of the firm's profits grow exponentially.

Key Factors That Influence a Partner's Salary

While the average compensation for a BCG Partner is staggeringly high, the actual figure is not a monolith. It is a highly variable number influenced by a confluence of factors. At this echelon of the professional world, compensation is a direct reflection of the value—both tangible and intangible—that a Partner brings to the firm. Understanding these levers is key to comprehending the nuances of their earnings potential.

`Level of Education`

`By the time an individual is being considered for Partner, their raw academic credentials from a decade or more prior are less important than their proven track record. However, the *type* of educational background can shape their career trajectory and area of expertise, which in turn influences compensation.

- The MBA Advantage: The most traditional path to a BCG partnership is through a top-tier MBA program (e.g., Harvard Business School, Stanford GSB, Wharton, INSEAD). These programs not only provide a rigorous business education but, more importantly, a powerful and enduring alumni network. This network becomes an invaluable source of client leads and relationships throughout a Partner's career. While there's no direct "MBA bonus" at the Partner level, those with elite MBA degrees often have a head start in building the client portfolio necessary for top-tier compensation.

- Advanced Degrees (PhD, MD, JD): BCG actively recruits candidates with advanced degrees for its "expert track" and generalist consulting roles. A Partner with a PhD in a specific scientific field, an MD in healthcare, or a JD in law can command immense authority (and therefore, sell more specialized, high-margin work) in their respective practice areas. For example, an MD Partner leading a project for a major pharmaceutical company can engage with the client's R&D leadership on a peer-to-peer level, a dynamic that is incredibly valuable and can lead to larger, more strategic projects. This specialized expertise often translates to higher revenue generation and, consequently, a larger performance bonus.

- Certifications: Traditional certifications (like PMP or Six Sigma) are largely irrelevant at the Partner level. The "certification" that matters is the Partner's published work, their reputation in the industry, and their track record of success. Their expertise *is* their certification.

`Years of Experience and Seniority`

`This is perhaps the most significant factor in determining a Partner's compensation. There is a vast difference between the earnings of a newly elected Partner and a Senior Partner who has been with the firm for 15 years.

- Year 1-3 (Junior Partner): In the first few years, a new Partner is focused on proving their ability to consistently sell work and lead large-scale client engagements. Their base salary is high, but their bonus and profit-sharing components are at the lower end of the Partner scale. Total compensation typically falls in the $850,000 to $1,250,000 range. The pressure is immense to transition from delivering work to selling it.

- Year 4-8 (Established Partner): By this stage, a successful Partner has built a reliable book of business and a strong network of C-suite clients who trust them implicitly. They are leading multiple project teams and likely taking on more significant firm-building roles. Their profit-sharing allocation increases significantly as they demonstrate sustained performance. Total compensation can be expected to climb into the $1,250,000 to $2,100,000 range.

- Year 8+ (Senior Partner / Managing Director): These are the titans of the firm. Senior Partners often manage relationships with BCG's largest global clients, lead entire practice areas (e.g., Global Head of Private Equity), or run major geographic offices. Their compensation is heavily weighted towards profit sharing, reflecting their immense contribution to the firm's overall success. Their earnings can soar past $2,100,000 and, for the very top performers, exceed $5,000,000 annually. According to reports from industry insiders on platforms like Wall Street Oasis, the compensation for these top-level leaders can reach even higher, into the $7M-$10M range in exceptionally good years for the firm.

`Geographic Location`

`While BCG operates as a global partnership, geography still plays a crucial role in compensation, driven by both cost of living and, more importantly, market opportunity.

- Major Global Hubs (New York, London, San Francisco, Hong Kong): Partners in these top-tier markets typically earn the most. This is not just due to the higher cost of living. These cities are epicenters of global finance, technology, and corporate headquarters, meaning there is a higher concentration of potential clients and larger, more complex (and thus more lucrative) projects. A Partner in New York focused on financial services or one in San Francisco focused on tech will have access to a larger revenue pool, directly impacting their sales figures and bonus potential.

- Secondary Markets (e.g., Chicago, Dallas, Atlanta): Compensation in these cities is still exceptionally high but may be slightly lower than in the primary hubs. The base salaries and bonus structures are broadly similar, but the absolute size of the deals and the volume of available work might be smaller, which can affect the upper limits of the performance-based components.

- Emerging Markets: Partners leading offices in high-growth emerging markets may have compensation packages with unique structures designed to incentivize market development. While the absolute numbers might be lower initially, the potential for growth can be enormous.

Salary aggregator Glassdoor reflects these variations, with self-reported salaries for similar senior consulting roles showing a premium of 10-20% in cities like New York and San Francisco compared to other major US cities.

`Performance, Practice Area, and Firm Contribution`

`Since we are focused on a single firm, BCG, the "Company Type & Size" factor translates into a Partner's specific role and performance *within* the firm. This is where individual differentiation has the greatest impact.

- Practice Area Specialization: Partners in high-growth, high-margin practice areas tend to earn more. Today, these include:

- Digital, Tech & AI (BCG X): Advising on digital transformation, data analytics, and AI strategy is a massive growth engine for consulting firms. Partners who can lead these complex, technology-intensive projects are in high demand and can command premium fees.

- Private Equity (PE): The Private Equity Group (PEG) is often considered one of the most lucrative areas. Partners in this practice advise PE firms on due diligence for multi-billion dollar buyouts and help portfolio companies improve performance. The work is fast-paced, high-stakes, and highly profitable for BCG.

- Sustainability & ESG: As environmental, social, and governance (ESG) issues become central to corporate strategy, Partners who can provide expert advice in this domain are becoming increasingly valuable.

- Business Development Success (Rainmaking): This is the ultimate metric. A Partner who consistently brings in $10 million in revenue per year will earn substantially more than a Partner who brings in $5 million, even if they have the same title and tenure. The bonus and profit-sharing system is designed to directly reward those who grow the firm's top line.

- Firm Contribution: While harder to quantify, contribution to the firm's health and culture is also a factor. A Partner who is a world-renowned thought leader, who develops a revolutionary new piece of intellectual property, or who is an exceptional mentor and developer of future leaders will see that contribution reflected in their performance review and, ultimately, their bonus.

`In-Demand Skills for Top Compensation`

`At the Partner level, technical skills are table stakes. The skills that differentiate the highest earners are more strategic and relational.

1. C-Suite Relationship Scaffolding: The ability to move beyond a transactional "consultant-client" relationship to become a trusted, long-term advisor to CEOs and board members. This involves deep empathy, political savvy, and the ability to discuss complex business issues with credibility and gravitas.

2. Mega-Deal Sales & Negotiation: The skill of architecting and selling large, complex, multi-year transformation programs worth tens of millions of dollars. This requires sophisticated value proposition design, objection handling, and negotiation skills.

3. Intellectual "Spike" and Brand Building: Developing a deep, recognized "spike" or area of expertise that makes them the go-to person in the industry for a specific topic (e.g., post-merger integration in the pharma sector, or supply chain resilience using AI).

4. Team Inspiration and Leadership: The highest-paid Partners are not just managers; they are leaders who can inspire and motivate teams of brilliant, ambitious consultants to deliver exceptional results under intense pressure.

5. Amphibious Thinking: The ability to operate at both the 50,000-foot strategic level with a board of directors and dive deep into the weeds of a specific analytical problem with their team when necessary.

In summary, a BCG Partner's salary is a complex equation. It's a function of their tenure, their location, their area of expertise, and, above all, their demonstrated ability to create immense value for clients and the firm.

Job Outlook and Career Growth

While the path to Partner at BCG is exceptionally narrow, the outlook for the management consulting industry as a whole remains robust, providing a strong foundation for the firm's continued growth and the need for future leaders.

### Industry-Wide Job Outlook

The U.S. Bureau of Labor Statistics (BLS) provides outlook data for "Management Analysts," which is the closest proxy for management consultants. According to the BLS's Occupational Outlook Handbook, employment for management analysts is projected to grow 10 percent from 2022 to 2032, which is much faster than the average for all occupations.

The BLS projects about 103,500 openings for management analysts each year, on average,