A career in private wealth management offers a unique blend of analytical rigor, client relationship building, and strategic financial planning. For those drawn to the world of finance, it presents a path that is not only intellectually challenging but also financially rewarding. The salary potential in this field is substantial, with six-figure incomes being the standard for experienced professionals and top-tier earners reaching well into the seven-figure range.

But what does a private wealth management salary *really* look like? This guide will break down the compensation you can expect, from your first day as an analyst to your peak years as a senior advisor, and explore the key factors that will shape your earning trajectory.

What Does a Private Wealth Manager Do?

Before diving into the numbers, it's essential to understand the role. A private wealth manager, or private wealth advisor, is a specialized financial professional who provides comprehensive financial services to high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals and families. Their goal is to grow and protect their clients' wealth.

Unlike a general financial advisor, their work is holistic and highly customized. Key responsibilities include:

- Investment Management: Crafting and managing sophisticated investment portfolios.

- Financial Planning: Developing long-term strategies for retirement, education funding, and major purchases.

- Estate and Legacy Planning: Working with legal experts to structure trusts, wills, and philanthropic giving.

- Tax Strategy: Minimizing tax liabilities through strategic planning.

- Risk Management: Protecting assets with appropriate insurance and diversification.

Ultimately, a wealth manager is a client's most trusted financial steward, building long-term relationships that can span generations.

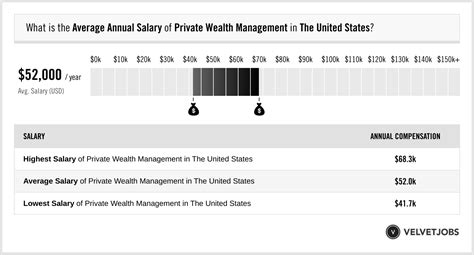

Average Private Wealth Management Salary

Compensation in private wealth management is rarely just a flat salary. It is typically a combination of a base salary, a performance-based bonus, and sometimes, a commission structure tied to the assets under management (AUM).

While figures vary, here is a snapshot based on current data:

- Median Base Salary: Most reputable sources place the median base salary for an experienced Private Wealth Manager in the range of $120,000 to $175,000 per year. For example, Salary.com reports a median salary of approximately $147,698 for a Wealth Management Advisor, while Glassdoor data shows an average base pay of around $130,000.

- Total Compensation: This is the most critical metric. With bonuses and other incentives, total compensation is significantly higher. It's common for experienced advisors to see total annual earnings between $200,000 and $500,000. Top performers at major firms who manage a large book of business can earn well over $1,000,000.

- The Government View: The U.S. Bureau of Labor Statistics (BLS) groups wealth managers under the broader category of "Personal Financial Advisors." The BLS reported a median annual wage of $99,580 in May 2023. This figure is a useful baseline but tends to be lower because it includes all financial advisors, not just those specializing in the high-net-worth market.

Key Factors That Influence Salary

Your personal earning potential is not a single number but a spectrum influenced by several key variables. Understanding these factors is crucial for maximizing your income in this competitive field.

### Level of Education

A bachelor's degree in finance, economics, accounting, or a related field is the standard entry requirement. However, advanced credentials significantly boost credibility and earning power.

- Master of Business Administration (MBA): An MBA, especially from a top-tier business school, can open doors to elite firms and higher starting salaries. It provides an advanced understanding of financial markets and a powerful professional network.

- Professional Certifications: Certifications are a non-negotiable for serious professionals.

- CFP® (Certified Financial Planner): This is the gold standard for financial planning expertise, demonstrating proficiency in investment, retirement, tax, and estate planning.

- CFA (Chartered Financial Analyst): This globally recognized charter is the pinnacle for investment analysis and portfolio management, signaling deep analytical competence. Holding these designations can add a 10-15% premium to your salary and is often a prerequisite for senior roles.

### Years of Experience

Experience is perhaps the single most important factor, as it directly correlates with the size of your client base and assets under management (AUM).

- Entry-Level (Analyst, 0-2 years): In this role, you support senior advisors. Responsibilities include research, preparing reports, and client service. Base salaries typically range from $70,000 to $100,000, with a modest bonus.

- Associate Advisor (3-7 years): Associates begin managing smaller client relationships under supervision and take on more complex tasks. Total compensation, including bonuses, often moves into the $120,000 to $250,000 range.

- Senior Advisor / Vice President (8+ years): At this level, you are responsible for managing a significant book of business (often $100M+ in AUM). Your compensation is heavily tied to performance and AUM, with total earnings frequently exceeding $300,000+.

### Geographic Location

Where you work matters. Salaries are highest in major financial centers where high-net-worth individuals are concentrated.

- Top Tier Cities: New York City, San Francisco, Boston, and Chicago lead the pack with salaries that can be 20-40% higher than the national average to account for both competition and a higher cost of living.

- Other Major Hubs: Cities like Los Angeles, Dallas, and Miami also offer strong compensation due to a growing concentration of wealth.

- Rest of Country: While salaries may be lower in other regions, the cost of living is also reduced, and opportunities are growing in many mid-sized cities.

### Company Type

The type of firm you work for fundamentally shapes your compensation structure and career path.

- Bulge Bracket Banks (e.g., Goldman Sachs, Morgan Stanley): These firms offer high brand recognition, structured training programs, and strong base salaries. They serve a wide range of HNW and UHNW clients and offer access to exclusive products.

- Private Banks (e.g., J.P. Morgan Private Bank, Northern Trust): These institutions focus exclusively on UHNW clients and offer a full suite of bespoke services, including banking and lending. Compensation potential here is among the highest in the industry.

- Registered Investment Advisors (RIAs) and Boutique Firms: These independent firms often offer a more entrepreneurial environment. While the base salary might be lower than at a bulge bracket bank, advisors often retain a higher percentage of the fees generated from their AUM, leading to very high earning potential for those who can build a substantial client book.

### Area of Specialization

While many wealth managers are generalists, developing a niche can make you a sought-after expert and command higher compensation. Specialized knowledge is a key differentiator. Examples include:

- Advising tech executives with complex equity compensation (stock options, RSUs).

- Estate and succession planning for multi-generational family businesses.

- Cross-border wealth management for international clients.

- Sustainable and impact investing for clients focused on ESG (Environmental, Social, and Governance) factors.

Job Outlook

The future for private wealth managers is bright. The U.S. Bureau of Labor Statistics (BLS) projects that employment for personal financial advisors will grow 13% from 2022 to 2032, a rate much faster than the average for all occupations.

This robust growth is driven by two key trends:

1. The Great Wealth Transfer: An unprecedented amount of wealth is set to pass from the Baby Boomer generation to their heirs, creating immense demand for sophisticated estate and investment advice.

2. Market Complexity: As financial products and global markets become more complex, HNW individuals increasingly need expert guidance to navigate their financial lives.

Conclusion

A career in private wealth management is demanding, but the rewards—both personal and financial—are significant. While a six-figure salary is the norm, your ultimate earning potential is not capped. It is a direct result of your commitment to education, the depth of your experience, your ability to build a client book, and the strategic choices you make in your career.

For those with strong analytical skills, a genuine passion for helping people, and the drive to build lasting relationships, private wealth management offers a clear path to a prosperous and fulfilling professional life.