Progressive Claims Adjuster Salary: A Comprehensive 2024 Guide

Considering a career as a claims adjuster is a smart move for individuals who are analytical, empathetic, and excellent problem-solvers. This role offers stability, a clear career path, and the opportunity to help people during challenging times. One of the largest and most respected employers in this field is Progressive. But what can you realistically expect to earn?

A career as a claims adjuster at a leading company like Progressive offers significant financial potential. While entry-level salaries are competitive, experienced and specialized professionals can command earnings well over $90,000 annually. This guide will break down the salary you can expect and the key factors that will shape your long-term earning potential.

What Does a Progressive Claims Adjuster Do?

Before diving into the numbers, it’s important to understand the role. A claims adjuster at Progressive is essentially an investigator and a problem-solver for insurance claims. Whether it's a minor fender-bender or a complex multi-vehicle accident, their job is to determine what happened, assess the damage, and figure out how the insurance policy applies.

Key responsibilities include:

- Investigating Claims: Interviewing claimants and witnesses, collecting police reports, and reviewing photos and videos of the incident.

- Assessing Damage: Evaluating property damage (like vehicles or homes) or reviewing medical reports for bodily injury claims.

- Policy Interpretation: Reading and understanding insurance policies to determine coverage.

- Negotiation and Settlement: Negotiating fair settlements with claimants or their attorneys to resolve the claim.

- Documentation: Maintaining meticulous records of every step of the claims process.

In essence, you are the face of the company after an incident, guiding customers through a process that can often be stressful and confusing.

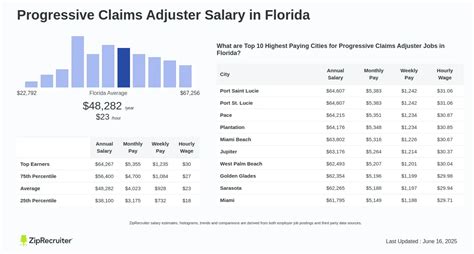

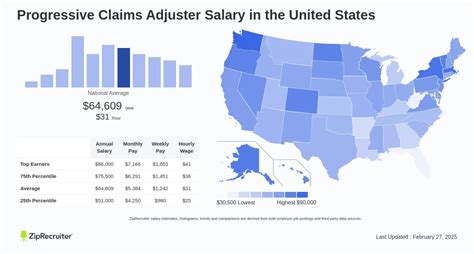

Average Progressive Claims Adjuster Salary

To get a clear picture of compensation, we need to look at both broad industry data and company-specific figures.

According to the U.S. Bureau of Labor Statistics (BLS), the median annual wage for all "Claims Adjusters, Appraisers, Examiners, and Investigators" was $76,170 in May 2023. The lowest 10 percent earned less than $51,190, and the highest 10 percent earned more than $111,860, illustrating a wide range based on experience and specialty.

When we focus specifically on Progressive, data from leading salary aggregators provides a more targeted view:

- Salary.com reports that the typical salary range for a Claims Adjuster at Progressive is between $64,494 and $82,499, with an average base salary around $73,000 as of early 2024.

- Glassdoor shows a similar average base pay, often in the low $70,000s, but highlights that "Total Pay" (which includes cash bonuses, profit sharing, and other incentives) can be significantly higher, often pushing the average closer to $80,000.

A typical salary progression at a company like Progressive might look like this:

- Claims Adjuster Trainee (Entry-Level): $55,000 - $65,000

- Claims Adjuster (Mid-Level): $65,000 - $80,000

- Senior or Specialized Claims Adjuster: $80,000 - $95,000+

These figures are a strong baseline, but your individual salary will be influenced by several critical factors.

Key Factors That Influence Salary

Your base salary is just the starting point. Several variables can significantly increase your earnings throughout your career.

###

Years of Experience

Experience is arguably the most significant factor in determining an adjuster's salary. As you gain expertise, you are trusted with more complex and higher-value claims, which directly translates to higher pay.

- Entry-Level (0-2 years): In a trainee role, your focus is on learning the fundamentals of investigation, policy, and claims software. Your compensation is lower as the company invests heavily in your training.

- Mid-Level (3-7 years): You are now a proficient adjuster, working independently on a full caseload. Your salary sees a substantial jump as you prove your ability to efficiently and fairly settle claims.

- Senior Level (8+ years): Senior adjusters often mentor junior staff, handle complex litigation files, or move into specialized roles. Their deep expertise makes them highly valuable, and their compensation reflects this.

###

Area of Specialization

Not all claims are created equal. The type of claims you handle has a major impact on your salary.

- Property & Auto Physical Damage: This is the most common entry point. These roles involve assessing damage to cars and property and have a standard pay scale.

- Bodily Injury (BI): These adjusters handle the medical aspect of claims. The work is more complex, involving medical records, long-term injuries, and legal negotiations. BI adjusters typically earn more than property adjusters.

- Catastrophe (CAT): CAT adjusters are deployed to areas hit by natural disasters like hurricanes, wildfires, or tornadoes. The work is intense and requires extensive travel, but the earning potential is very high due to overtime and high demand.

- Commercial Lines: Adjusters who handle claims for businesses deal with complex policies and high-value losses. This specialization requires significant experience and commands a higher salary.

###

Geographic Location

Where you live and work plays a crucial role. Large national companies like Progressive adjust salaries based on the local cost of living and market demand. An adjuster in a high-cost metropolitan area like New York City, San Francisco, or Boston will earn a higher base salary than an adjuster in a lower-cost rural area to offset living expenses. The BLS confirms this, showing top-paying states for adjusters include Massachusetts, Connecticut, and New Jersey.

###

Level of Education

While a bachelor’s degree is not always a strict requirement, it is highly preferred by major employers like Progressive and can give you a competitive edge. A degree in business, finance, or criminal justice is particularly relevant. Possessing a degree can lead to a higher starting salary and open up more opportunities for advancement into management or senior technical roles later in your career. Additionally, holding professional certifications, such as the Associate in Claims (AIC) or Chartered Property Casualty Underwriter (CPCU), can further boost your earning potential.

###

Company Type

Working for a large national carrier like Progressive offers a different compensation structure than other roles in the industry.

- Staff Adjuster (Progressive, Allstate, etc.): You receive a stable salary, comprehensive benefits, a company car (for field roles), and access to structured training and career development.

- Independent Adjuster: These professionals work for themselves or for an independent firm, handling claims for multiple insurance companies. Their earning potential can be very high as they are often paid a percentage of the claim's value, but their income is less stable and they are responsible for their own benefits, licensing, and expenses.

Job Outlook

The career outlook for claims adjusters is nuanced. The U.S. Bureau of Labor Statistics projects a slight decline of 4% in employment for claims adjusters from 2022 to 2032.

However, this statistic requires context. The decline is largely expected due to automation and AI, which can now handle simple, low-complexity property claims with minimal human intervention. On the other hand, the demand for skilled, experienced human adjusters to manage complex, high-stakes claims—such as bodily injury, litigated cases, commercial losses, and catastrophe claims—is expected to remain strong. These are areas where human judgment, negotiation, and empathy are irreplaceable.

Therefore, for those willing to specialize and continuously develop their skills, the long-term career outlook remains very positive.

Conclusion

A career as a claims adjuster at Progressive offers a financially rewarding path for the right candidate. With competitive starting salaries and total compensation packages often exceeding $75,000, the role provides a stable foundation for professional growth.

Your long-term success and earning potential will be directly tied to your commitment to growth. By gaining experience, pursuing valuable specializations like Bodily Injury or Catastrophe claims, and obtaining industry certifications, you can build a career that is not only financially lucrative but also professionally fulfilling. If you are a dedicated problem-solver with a desire to help others, this is a career path well worth considering.